Nuclear Power in China

- The impetus for nuclear power in China is due to air pollution from coal-fired plants, as well as climate commitments and energy security.

- China’s policy is to have a closed nuclear fuel cycle.

- China has become largely self-sufficient in reactor design and construction, but is making full use of Western technology while adapting it.

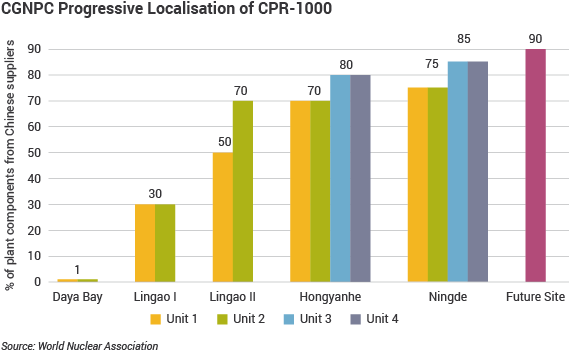

- Relative to the rest of the world, a major strength is the nuclear supply chain.

- China’s policy is to ‘go global’ with exporting nuclear technology including heavy components in the supply chain.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2023): 9548 TWh

Generation mix: coal 5857 TWh (61%); hydro 1286 TWh (13%); wind 886 TWh (9%); solar 584 TWh (6%); nuclear 435 TWh (5%); natural gas 283 TWh (3%); biofuels & waste 206 TWh (2%).

Import/export balance: 17.1 TWh net export (5.0 TWh imports; 22.1 TWh exports)

Total consumption: 8013 TWh

Per capita consumption: c. 5700 kWh in 2023

Source: International Energy Agency and The World Bank. Data for year 2023.

Rapid growth in demand has given rise to power shortages, and the reliance on fossil fuels has led to much air pollution. The economic loss due to pollution is put by the World Bank at almost 6% of GDP,1 and the new leadership from March 2013 prioritized this.* Chronic and widespread smog in the east of the country is attributed to coal burning.

* Official measurements of fine particles in the air measuring less than 2.5 micrometres, which pose the greatest health risk, rose to a record 993 micrograms per cubic metre in Beijing on 12 January 2013, compared with World Health Organization guidelines of no higher than 25.

In August 2013 the State Council said that China should reduce its carbon emissions by 40-45% by 2020 from 2005 levels, and would aim to boost renewable energy to 15% of its total primary energy consumption by 2020. In 2012 China was the world’s largest source of carbon emissions – 2626 MtC (9.64 Gt CO2), and its increment that year comprised about 70% of the world total increase. In March 2014 the Premier said that the government was declaring “war on pollution” and would accelerate closing coal-fired power stations.

In November 2014 the Premier announced that China intended about 20% of its primary energy consumption to be from non-fossil fuels by 2030, at which time it intended its peak of CO2 emissions to occur. This 20% target is part of the 13th Five-Year Plan and was reiterated at the Paris climate change conference in December 2015, along with reducing CO2 emissions by 60-65% from 2005 levels by 2030. In September 2020, the Premier stated that the country now intends to reach peak emissions before 2030, and to become carbon neutral before 2060.

In the 13th Five-Year Plan (2016-2020) for power production announced by the National Energy Administration (NEA) in November 2016, coal capacity was to be limited to 1100 GWe by 2020 by cancelling and postponing about 150 GWe of projects. Gas in 2020 was projected at 110 GWe, hydro 340 GWe, wind 210 GWe, and solar 110 GWe, of which distributed PV was to be 60 GWe. Nuclear 58 GWe was reiterated for 2020.

China's 14th Five-Year Plan (2021-2025) set a target to reach 70 GWe gross of nuclear capacity by the end of 2025. By the end of 2025, operating capacity reached about 62 GWe, with a further 43 GWe under construction.

The grid system run by the State Grid Corporation of China (SGCC) and China Southern Power Grid Co (CSG) is sophisticated and rapidly growing, utilizing ultra high voltage (1000 kV AC and 800 kV DC) transmission. In 2024, SGCC invested about CNY 600 billion on the grid system.

The main nuclear operators are China National Nuclear Corporation (CNNC) and China General Nuclear Power Group (CGN), with SPIC (via its nuclear power business State Nuclear Power Technology Corporation – SNPTC) a third one.

Energy policy and clean air

While coal is the main energy source, most reserves are in the north or northwest and present an enormous logistical problem – nearly half the country's rail capacity is used in transporting coal. Because of the heavy reliance on old coal-fired plant, electricity generation accounts for much of the country's air pollution, which is a strong reason to increase nuclear share. China is by far the world’s largest contributor of carbon dioxide emissions. Gas consumption in 2025 is expected to exceed 450 billion cubic metres according to China National Petroleum Corp. Of that, just over half will be produced domestically. The Power of Siberia pipeline connects Russia to China’s south and east and has export capacity of 38 billion cubic metres per year.

Water is also a constraint on coal-fired power generation, much of which is in water-deficient regions. Retrofit to air cooling decreases efficiency by 3-10% and is reported to cost about $200 million per GWe in China.

Desalination is an important part of China’s long-term water strategy. The country’s lack of fresh water, and overuse of underground water resources, poses significant health problems for a minority of its population. China produces about 10 million m3/day of desalinated water at present, about 10% of the world’s total, and is building further capacity.

In September 2014 a national climate change plan prepared by the NDRC was approved by the State Council. This set emissions and clean energy targets for 2020. The carbon emissions intensity target was set at 40-45% reduction from 2005 to 2020. It aims to increase the shares of non-fossil fuels in primary energy consumption to about 15% by 2020 – at the end of 2018 it was 12%. The plan also set the target for China to increase forest coverage by 40 million hectares by the end of 2019. The government said it would speed up efforts to establish a carbon emissions permit market, as well as deepening international cooperation under the principles of "common but differentiated responsibilities", equity, and respective capability.

The State Council published the Energy Development Strategy Action Plan, 2014-2020 in November 2014. The plan aimed to cut China's reliance on coal and promote the use of clean energy, confirming the 2012 target of 58 GWe nuclear in 2020, with 30 GWe more under construction. The plan called for the "timely launch" of new nuclear power projects on the east coast and for feasibility studies for the construction of inland plants. It said that efforts should be focused on promoting the use of large pressurized water reactors (including the AP1000 and CAP1400 designs), high temperature gas-cooled reactors (HTRs) and fast reactors. It also said that research should be conducted to "improve the nuclear fuel cycle system” including reprocessing of used fuel.

In the 13th Five-Year Plan from 2016, six to eight nuclear reactors were to be approved each year. Non-fossil primary energy provision should reach 15% by 2020 and 20% by 2030 (from 9.8% in 2013). The action plan aim was for 62% of primary energy to come from coal in 2020, down from 72.5% in 2007. This was achieved in 2018, though largely through substitution for natural gas.

In June 2015 China submitted its Intended Nationally Determined Contribution (INDC) to climate change mitigation and adaptation for 2020 to 2030 to the UN. This pledge included increasing the share of non-fossil fuels in primary energy consumption to about 20% and restraining carbon emissions in 2030 to double of those in 2005 (after being 158% of the 2005 level in 2015 and 182% in 2020). Annual average new nuclear capacity 2005 to 2020 is 3.4 GWe/yr, from 2020 to 2030 it is 9.0 GWe/yr.

Nuclear power

Nuclear power has an important role, especially in the coastal areas remote from the coalfields and where the economy is developing rapidly. Generally, nuclear plants can be built close to centres of demand, whereas suitable wind sites are remote from demand. Moves to build nuclear power commenced in 1970 and about 2005 the industry moved into a rapid development phase, in the 11th Five-Year Plan.

Technology has been drawn from France, Canada and Russia, with local development based largely on the French element. The latest technology acquisition has been from the USA (via Westinghouse, owned by Japan's Toshiba) and France. The State Nuclear Power Technology Corporation (SNPTC) made the Westinghouse AP1000 the main basis of technology development in the immediate future, particularly evident in the local development of CAP1400 based on it, and more immediately the CAP1000.

This has led to a determined policy of exporting nuclear technology, based on China’s development of the CAP1400 reactor with Chinese intellectual property rights and backed by full fuel cycle capability. In 2015 the Hualong One reactor became the main export product. The policy is being pursued at a high level politically, as one of 16 key national science & technology projects, utilising China's economic and diplomatic influence, and led by the initiative of CGN commercially, with SNPTC and more recently CNNC in support.

Workers bringing Ling Ao Phase II unit 1 to first criticality in July 2010 (CGN)

Prior to 2008, the government had planned to increase nuclear generating capacity to 40 GWe by 2020 (out of a total 1000 GWe planned), with a further 18 GWe nuclear being under construction then. Projections for nuclear power then increased to 70-80 GWe by 2020, 200 GWe by 2030 and 400-500 GWe by 2050. In April 2015 CNEA said that by 2030 per capita annual electricity consumption would be 5500 kWh, and installed nuclear capacity would be 160 GWe, providing 10% of electricity (with coal 64.6%). By 2050, per capita consumption would be 8500 kWh, and installed nuclear capacity 240 GWe providing 15% of electricity (coal 50.5%).

National policy moved from ‘moderate development’ of nuclear power to ‘positive development’ in 2004, and in 2011-12 to ‘steady development with safety’. See further comment under Post-Fukushima Review below. The nuclear capacity target for 2020 became 58 GWe in operation and 30 GWe under construction, though the China Electricity Council in 2019 said that 53 GWe in operation was more likely.

In December 2011 the National Energy Administration (NEA) said that China would make nuclear energy the foundation of its power-generation system in the next "10 to 20 years", adding as much as 300 GWe of nuclear capacity over that period. In September 2013 SNPTC estimated that 4-6 new units per year would be needed to 2015 then 6-8 units during the 13th Five-Year Plan period (2016-2020)*, increasing to 10 units each year after 2020. The NEA confirmed that China could manufacture eight full sets of reactor equipment per year, and in 2014 it announced that China was aiming for world leadership in nuclear technology.

* The 13th Five-Year Plan formalized in March 2016 included the following nuclear projects and aims:

- Complete four AP1000 units at Sanmen and Haiyang.

- Build demonstration Hualong One reactors at Fuqing and Fangchenggang.

- Start building the demonstration CAP1400 reactor at Rongcheng (Shidaowan).

- Accelerate building Tianwan Phase III (units 5&6).

- Start building a new coastal power plant.

- Active preparatory work for inland nuclear power plants.

- Reach target of 58 GWe nuclear operational by end of 2020, plus 30 GWe under construction then.

- Accelerate and push for building demonstration and large commercial reprocessing plants.

- Strengthen the fuel security system.

In July 2013 the National Development and Reform Commission (NDRC) set a wholesale power price of CNY 0.43 per kWh (7 US cents/kWh) for all new nuclear power projects, to promote the healthy development of nuclear power and guide investment into the sector. The price is to be kept relatively stable but will be adjusted with technology advances and market factors, though many consider it not high enough to be profitable. It was reported that the price for power from Sanmen might be about 5% higher, but in 2019 it was CNY 0.42/kWh. Haiyang was selling power for CNY 0.414/kWh and Taishan CNY 0.435/kWh in 2019.

Nuclear power is already competitive, and wholesale price to grid has been less than power form coal plants with flue gas desulfurization, though the basic coal-fired cost is put at CNY 0.3/kWh*. In March 2015 a new round of electricity market reform was launched, to prioritize clean power generation, and this allowed nuclear power companies to negotiate prices with customers.

* Wind cost to grid is CNY 0.49 - 0.61 per kWh, depending on region (and FIT, now CNY 0.54 per kWh), solar is CNY 0.9 (desert) to 1.3 (east). CGN Power reported that in 2015 Hongyanhe grid tariff was CNY 0.4142/kWh, and Ningde CNY 0.43/kWh.

In October 2018 the NDRC's Energy Research Institute said that China's nuclear generating capacity must increase to 554 GWe by 2050 if the country is to play its part in limiting the global temperature rise to below 1.5 °C. The share of nuclear power in the country's energy mix would thus increase from 4% to 28% over this period. The study said that assuming an all-in cost of CNY 20,000 (approximately $3000) per kW of capacity in large plants, an investment of more than CNY 8.7 trillion ($1.3 trillion) would be required. Based on capacity additions over the past few years, the total investment demand to 2050 was considered to be feasible.

Hong Kong supply

Hong Kong gets much of its power from mainland China, in particular about 70% of the output from Daya Bay's 1888 MWe net nuclear capacity is sent there. A 2014 agreement increases this to 80%. The Hong Kong government plans to close down its coal-fired plants, and by 2020 to get 50% of its power from mainland nuclear (now 23%), 40% from gas locally (now 22%) and 3% from renewables. Another option, with less import dependence, is to increase domestic generation from gas to 60%, and maintain mainland nuclear at 20%.

Hong Kong utility China Light & Power (CLP) has equity in CGN's Daya Bay (25%) power plant, and was until 2013 negotiating a possible 17% share in Yangjiang. After considering equity in a further CGN nuclear plant, in October 2016 CLP Holdings Ltd successfully bid for a 17% share in Yangjiang Nuclear Power Co Ltd, in response to a CGN general invitation to tender.

Since 1994 Hong Kong has been getting up to one-third of its power from Daya Bay output, and this contract now runs to 2034. According to CLP data, nuclear power cost HK 47 c/kWh in November 2013, compared with 27 cents for coal and 68 cents for gas, which provides the main opportunity to increase supply. CLP supplies about 80% of Hong Kong’s power.

Regulation and safety

The National Nuclear Safety Administration (NNSA) was set up in 1984 under the China Atomic Energy Authority (CAEA) and is the licensing and regulatory body which also maintains international agreements regarding safety and non-proliferation safeguards. While it already reported to the State Council directly, in January 2011 the State Council Research Office (SCRO) recommended: "The NNSA should be an entity directly under the State Council Bureau, making it an independent regulatory body with authority," although its international roles would continue to be through the CAEA. It is administered by the Ministry of Environmental Protection (MEP), and the head of NNSA has the rank of Vice Minister of MEP. (The CAEA plans new capacity and approves feasibility studies for new plants – see also SCRO report below.) In relation to the AP1000, the NNSA works closely with the US Nuclear Regulatory Commission.

The NNSA has been working closely with the US Nuclear Regulatory Commission (NRC) in relation to the AP1000, and has adopted some parallel regulations. This, with a high level of IAEA and OECD involvement, gives the NNSA strong international credibility.

The Ministry of Environmental Protection (MEP) is directly under the State Council and is responsible for radiological monitoring and radioactive waste management and for administration of the NNSA.

A utility proposing a new plant submits feasibility studies to the CAEA, siting proposals to the NNSA and environmental studies to MEP itself. Nuclear power plant licences issued by the NNSA progress from siting approval, then construction permit, fuel loading permit, to operating licence.

The NNSA is responsible for licensing all nuclear reactors and other facilities, safety inspections and reviews of them, operational regulations, licensing transport of nuclear materials, waste management, and radiation protection including sources and NORM. It licenses staff of nuclear manufacturers through to reactor operators. The NNSA certifies companies for design, manufacture, installation and non-destructive inspection of civilian nuclear safety equipment, and imported equipment. It is responsible for radiological protection and for environmental impact assessment of nuclear projects, in collaboration with the Ministry of Environmental Protection (MEP). The 2003 Law on Prevention and Control of Radioactive Pollution is supplemented by a number of regulations issued since 1986 with the authority of State Council.

In September 2025 China adopted the updated Atomic Energy Law, which entered into force in January 2026.

The NNSA is responsible for safeguards materials accounting throughout the fuel cycle, and communicates with the International Atomic Energy Agency (IAEA) in this regard.

In 2013 the CAEA signed a cooperation agreement with the OECD’s Nuclear Energy Agency (NEA), confirming China as a ‘key partner’ with the OECD. In May 2014 the NNSA signed an agreement on the regulation of nuclear power and radiation safety with the OECD NEA. This is to share experience on the effective regulation and oversight of nuclear safety, as well as best practice in licensing and oversight of civil nuclear facilities.

China has shown unprecedented eagerness to achieve the world's best standards in nuclear safety (as also in civil aviation). It requested and hosted 12 Operational Safety Review Team (OSART) missions from IAEA teams to October 2011, and each plant generally has one external safety review each year, either OSART, WANO peer review, or CNEA peer review (with the Research Institute for Nuclear Power Operations, RINPO). In December 2013 the NNSA with its Japanese and South Korean counterparts agreed to form a network to cooperate on nuclear safety and quickly exchange information in nuclear emergencies. The NNSA is also part of the ASEAN+3 Forum on Nuclear Safety.

Following the Fukushima accident in Japan in March 2011, the government suspended its approval process pending a review of lessons which might be learned from it, particularly regarding siting of reactors with plant layout, and control of radiation release. Safety checks of operating plants were undertaken immediately, and a review of those under construction was completed in October 2011. Resumption of approvals for further new plants was suspended until a new nuclear safety plan was accepted and State Council approval given in October 2012 (see also Post-Fukushima review below).

Following the Fukushima accident, concern regarding possible river pollution and depletion during droughts (due to evaporative cooling towers) meant many years of delay for the inland AP1000 plants which were due to start construction in 2011.

SCRO report on nuclear investment and safety

In January 2011 a report from the State Council Research Office (SCRO), which makes independent policy recommendations to the State Council on strategic matters, was published. While approving the enormous progress made on many fronts, it cautioned concerning provincial and corporate enthusiasm for new nuclear power plants and said that the 2020 target should be restricted to 70 GWe of new plant actually operating so as to avoid placing undue demand on quality control issues in the supply chain. Another 30 GWe could be under construction. It emphasized that the priority needed to be resolutely on Generation-III technology, notably the AP1000 and derivatives.3

SCRO said that China should limit the number of Generation II reactors built, notably CPR-1000. It noted the 100-fold increase in probabilistic safety brought by Generation III, and that future reactor generations would continue the trend.

SCRO drew attention to another factor potentially affecting safety – the nuclear power workforce. While staff can be technically trained in four to eight years, "safety culture takes longer" at the operational level. This issue is magnified in the regulatory regime, where salaries are lower than in industry, and workforce numbers remain relatively low. SCRO said that most countries employ 30-40 regulatory staff per reactor in their fleet, but the National Nuclear Safety Administration (NNSA) had only 1000 staff – a figure that must more than quadruple by 2020. The SCRO recommended: "The NNSA should be an entity directly under the State Council Bureau, making it an independent regulatory body with authority."

Post-Fukushima review

Immediately following the Fukushima accident in March 2011, the State Council announced on March 16 that it would suspend approvals for new nuclear power stations and conduct comprehensive safety checks of all nuclear projects, including those under construction (with an immediate halt required on any not satisfactory). It also suspended work on four approved units due to start construction in 2011*. About 34 reactors were already approved by the central government of which 26 were being built. The Shidaowan HTR, though ready for first concrete, was also delayed. After three months the inspections of operating plants had been completed, and those on plants under construction were completed by October (though construction had continued).

* Fuqing 4-6, Yangjiang 4. Fuqing 4 and Yangjiang 4 started construction late in 2012

In 2012 a new safety plan for nuclear power was approved by State Council, and full incorporation of International Atomic Energy Agency (IAEA) safety standards became explicit. In an unprecedented move to improve the transparency of nuclear regulation the government then formally solicited public comments on its nuclear safety plan which must ensure that no ‘serious incident’ (INES Level 3) or greater occurs at any reactor. (So far in China no nuclear incident has been over INES level 2.) The plan involved significant expenditure across all of the country’s facilities. In October 2012 approvals for new plants recommenced. The nuclear capacity target for 2020 became 58 GWe in operation and 30 GWe under construction.

The State Council in 2012 approved the "12th 5-year Plan for Nuclear Safety and Radioactive Pollution Prevention and Vision for 2020", compiled by the Ministry of Environment. It suggested that China would need to spend RMB 80 billion ($13 billion) on improving nuclear safety at 41 operating and under construction reactors by 2015. "China has multiple types of nuclear reactors, multiple technologies and multiple standards of safety, which makes them hard to manage," it said, adding that the operation and construction of nuclear reactors must improve. The bottom line of safety requirements is that radioactive releases should never cause “unacceptable effects on the environment or the public”, and that advanced nuclear technology should “practically eliminate the possibility of release of significant quantities of radioactive substances from nuclear power units” built from 2016.

A series of research and development (R&D) projects was launched by the NEA in February 2012 to improve safety-related technology and the country’s emergency response capabilities at indigenous nuclear power plants in the event of an extreme disaster beyond design basis. The 13 R&D projects were conducted by CNNC, CGN and the Institute of Nuclear and New Energy Technology (INET) at Tsinghua University. They include the development of passive emergency power supply and cooling water systems, development of passive containment heat removal systems, developing hydrogen control devices, measures for the prevention and mitigation of used fuel accidents, and analysing the impact of multiple simultaneous external events and response measures. The outcome of this by 2014 was to bring the safety of CPR-1000 reactors up to “internationally recognized levels” required for Generation III reactors.

In 2014, the five major nuclear power utilities including CNNC and CGN signed the Cooperation Framework Agreement on Mutual Aid for Nuclear Accident Emergency Among Groups, undertaking to establish and improve the emergency response mechanism and cooperation between adjoining nuclear power plants belonging to different groups, in case of a serious nuclear accident.

International review of NNSA and MEP

In July 2010 a 22-strong IAEA team from 15 countries carried out a two-week Integrated Regulatory Review Service (IRRS) mission to review of China's regulatory framework for nuclear safety. The IAEA made a number of recommendations but said that the review had provided "confidence in the effectiveness of the Chinese safety regulatory system and the future safety of the vast expanding nuclear industry."

In 2016 a further IRRS mission was invited and a 14-strong team from the IAEA reviewed the China situation with many more reactors online and under construction. An interim report said that most of the recommendations made during the 2010 mission had been implemented but that "further work is needed in areas such as managing long-term operation of nuclear power plants and waste management." Also: "The team recommended that China should continue its progress towards adopting the draft Nuclear Safety Act, which sets out fundamental safety principles [and which] should ensure the independence of MEP/NNSA as a regulatory body.”

Reactor technology

China has set the following points as key elements of its nuclear energy policy:

- PWRs will be the mainstream but not sole reactor type.

- Nuclear fuel assemblies are fabricated and supplied indigenously.

- Domestic manufacturing of plant and equipment will be maximized, with self-reliance in design and project management.

- International cooperation is nevertheless encouraged.

The technology base for future reactors remains officially undefined, though two designs are currently predominant in construction plans: CAP1000 and Hualong One, after plans for more CPR-1000 units were scaled back post-Fukushima. Beyond them, high-temperature gas-cooled reactors and fast reactors appear to be the main priorities.

A major struggle between the established China National Nuclear Corporation (CNNC) pushing for indigenous technology and the small but well-connected State Nuclear Power Technology Corp (SNPTC) favouring imported technology was won by SNPTC about 2004. In particular, SNPTC proposed use of indigenized 1000+ MWe plants with advanced third-generation technology, arising from Westinghouse AP1000 designs at Sanmen and Haiyang (see section below on Embarking upon Generation III plants). Westinghouse has agreed to transfer technology to SNPTC over the first four AP1000 units so that SNPTC can build the following ones on its own. In 2014 SNPTC signed a further agreement with Westinghouse to deepen cooperation in relation to AP1000 and CAP1400 technology globally and “establish a mutually beneficial and complementary partnership”. In November 2018 successors of the two companies – State Power Investment Corporation (SPIC) and Westinghouse (under new ownership) – signed a further cooperation agreement.

In February 2006, the State Council announced that the large advanced PWR was one of two high priority projects for the next 15 years, depending on "Sino-foreign cooperation, in order to master international advanced technology on nuclear power and develop a Chinese third-generation large PWR".4 In September 2006, the head of the China Atomic Energy Authority said that he expected large numbers of third-generation PWR reactors derived from foreign technology to be built from about 2016, after experience is gained with the initial AP1000 units.

This trend was given impetus by the reappraisal of safety following the Fukushima accident.

EPR

Two EPR reactors have been built at Taishan, and two more are planned (see section below on Embarking upon Generation III plants). Areva says the reactors are 4590 MWt, with net power 1660 MWe.

In October 2008, Areva and CGN (then: CGNPC) announced establishment of an engineering joint venture as a technology transfer vehicle for development of the EPR and possibly other PWR plants in China and later abroad. The Wecan JV, 55% CGN subsidiary China Nuclear Power Engineering Co. and 45% Areva, was set up in December 2009 and based in Shenzhen, though by mid-2011 the CGN share was held by China Nuclear Power Technology Research Institute (CNPRI), another subsidiary. Overseas projects involving CGN appear now to hold the only potential for expanding the role of Areva’s EPR technology involving China.

AP1000, CAP1000

The Westinghouse AP1000 was to be the main basis of China's move to Generation III technology, and involved a major technology transfer agreement. It is a 1250 MWe gross reactor with two coolant loops. Four AP1000 reactors were completed at Sanmen and Haiyang in 2018, for CNNC and China Power Investment Corp (CPI) respectively. Six more at three sites were firmly planned after them, at Sanmen, Haiyang and Lufeng (for CGN), and at least 30 more were proposed to follow. A State Council Research Office report in January 2011 emphasized that these should have priority over alternative designs such as CPR-1000, and this position strengthened following the Fukushima accident.

The reactors are built from modules fabricated adjacent to each site. The timeline is 50 months from first concrete to fuel loading, then six months to grid connection for the first four units, with this expected to reduce significantly for the following units. In October 2009, SNPTC and CNNC signed an agreement to co-develop and refine the AP1000 design, and this position strengthened following the Fukushima accident. (See also section below on Embarking upon Generation III plants).

CNEA estimated in May 2013 that the construction cost for two AP1000 units at Sanmen would be CNY 40.1 billion ($6.12 billion), or 16,000 yuan/kW installed ($2440/kW), instead of CNY 32.4 billion earlier estimated. This is about 19% higher than the latest estimate for the CPR-1000 (CNY 13,400/kW, $2045/kW), but likely to drop to about that level with series construction and greater localization as envisaged. Grid purchase price is expected to exceed CNY 0.45/kWh at present costs, and drop to the standard CNY 0.43/kWh with series build and reduced capital cost.

Plans for future AP1000 units will now be CAP1000, which is a local standardization of the design, transitional to the CAP1400. It is said to have reduced cost and improved operation and maintenance attributes. The base design, commenced in 2008, is complete, the detailed design, started in April 2010, was due by June 2013*. Early in 2012 SNPTC had organized SNERDI (nuclear island and general designer) and SNPDRI (for conventional island) to localize the design for both inland and coastal sites, for Xianning, Pengze and Taohuajiang. The demonstration CAP1000 plant is under construction at Haiyang (units 3&4). Localization is 80%.

* Differences from the AP1000 include conforming to Chinese design standard GB6429, construction management, supply chain technical requirements, post-Fukushima modification, and module design.

Alstom signed an agreement in July 2013 with Dongfang Electric Corporation for turbine and generator packages for CAP1000 projects to be based on Alstom’s Arabelle technology.

CAP1400

Westinghouse announced in 2008 that it was working with SNPTC and Shanghai Nuclear Engineering Research & Design Institute (SNERDI) to develop jointly a passively safe 1400-1500 MWe design from the AP1000/CAP1000, for large-scale deployment, though SNPTC would have full intellectual property rights for any derivatives over 1350 MWe. SNPTC initially called it the Large Advanced Passive PWR Nuclear Power Plant (LPP or APWR). It is one of 16 Key National Projects in China. This development with SNERDI opens the possibility of China itself exporting the new larger units with Westinghouse's cooperation. In April 2016 the IAEA presented SNERDI with its positive evaluation report from the generic reactor safety review process undertaken over nine months. The CAP1400 is also known as 'Guohe No. 1'.

In December 2009, the State Nuclear Plant Demonstration Company – a 55-45% joint venture company by SNPTC and China Huaneng Group – was set up to build and operate an initial demonstration unit of the larger two-loop design, the CAP1400, at Huaneng's Shidaowan site at Rongcheng. The new company signed a set of agreements with SNERDI and the State Nuclear Power Engineering Company (SNPEC) in November 2010 to proceed with the project. It will have 193 fuel assemblies, MOX capability, 50 GWd/t burn-up and improved steam generators. Seismic rating is 300 gal. Dongfang Electric is to design and build the turbine generator under contract to SNPTC.

The basic design was approved by the National Energy Administration (NEA) in January 2014. Site works were completed in April 2014, with final NNSA approvals in September, following a 17-month review. In December 2014 SNPTC said it was ready to pour first concrete but awaited State Council permission, then in April 2015 construction of the turbine hall started. In November 2015 SNPTC said that construction would start in March 2016, the delay being to ensure that the AP1000 primary coolant pump issues were resolved. Construction of unit 1 started in about June 2019 and unit 2 in April 2020. Westinghouse provided technical consulting services to SNPTC for the design. Over 90% of the components are indigenous. Construction cost is expected to be CNY 15,751/kWe ($2450/kWe) and power cost CNY 0.403/kWh for the first unit and dropping to CNY 0.38/kWh (5.9 ¢/kWh) subsequently. A 2014 government figure is CNY 42.3 billion ($6.5 billion) for the first two units. SPIC officially launched the Guohe One project in September 2020 after the first two units were already under construction. Unit 1 entered commercial operation at the end of 2024.

SPIC is promoting the Guohe One brand for export and is discussing potential partnerships with countries including Turkey and South Africa. In May 2016 SNERDI said that the successful IAEA generic reactor safety review would help, “laying a solid foundation for the CAP1400 to participate in international competition at a higher level." After Rongcheng, SNPTC envisaged further CAP1400 projects for Liaoning, Shandong, Fujian, Guangdong and Guangxi provinces.

CAP1400 may be followed by a larger, three-loop CAP1700 design if the passive cooling system can be scaled to that level. Agreements with Westinghouse stipulate that SNPTC will own the intellectual property rights. SNPEC is doing the engineering under a team from SNERDI, the Shandong Electric Power Engineering Consulting Institute (SEPECI), and the State Nuclear Power Equipment Manufacturing Company (SNPEMC), which will make the components.

CNP-1000, also CNP-600, CNP-300, SNP350 (ACP300, ACP600, ACP1000)

CNNC had been working with Westinghouse and Framatome (now Areva) at SNERDI since the early 1990s to develop a Chinese standard three-loop PWR design, the CNP-1000. This is developed from the single-loop Qinshan CNP-300 unit, a 966 MWt, 310 MWe gross, 300 MWe net reactor (uprated by potential 50 MWe in April 2019) with 30-year design operating lifetime (and 20-year extension in 2021). This was then scaled up to the two-loop CNP-600 units, also at Qinshan, with high (60 GWd/t) burn-up, 18-month refuelling cycle and 20 more (but shorter) fuel assemblies than the French-origin M310 units at Daya Bay and Ling Ao.b In 1997, the Nuclear Power Institute of China (NPIC) at Chengdu became involved in the reactor design and, early in 2007, SNERDI was reassigned to concentrate on the AP1000 programme.

CNNC was keen to create its own brand of advanced second-generation reactor with full intellectual property rights, and wanted to build two initial CNP-1000 plants at Fangjiashan, adjacent to Qinshan near Shanghai, under the 11th Economic Plan, though the design probably would not have been ready. In early 2007, the CNP-1000 development was put on hold, though this aborted export plans then for two CNP-1000 units to Pakistan. CPR-1000 reactors, designated M310+ by CNNC, were built at Fangjiashan.

Further CNP-600 units were built at Qinshan and Changjiang, Hainan. CNNC says they are free of French intellectual property rights. CNNC is also developing the design to the ACP600 which it calls a third-generation design and expected to be built on Hainan or in the northwest Gansu province and exported.c It will have double containment, 18-24 month refuelling cycle, 121 fuel assemblies (as CNP-600), digital I&C, and 60-year operating lifetime, but slightly less power – 605 MWe instead of 650 MWe gross.

In October 2011 CNNC announced that its independently-developed ACP1000 (or CP1000) was entering the engineering design stage, initially for Fuqing units 5&6, with 1100 MWe nominal power and load-following capability. It has 177 fuel assemblies 3.66 m long. In May 2013 CNNC finished a preliminary safety analysis report, and was working on construction design in order to be ready for construction by the end of the year. CNNC expected to start building the first in 2014, at Fuqing, with 85% local content, and the second there in 2015. In April 2013 it announced an export agreement for an ACP1000, for Pakistan. CNNC asserts full intellectual property rights for the CNP series of reactors, which have evolved to the ACP series. However, when the National Energy Administration ordered a rationalization of CNNC’s and CGN’s 1000 MWe class designs, the ACP1000 morphed into the Hualong One or HPR1000 – though CNNC still sometimes describes its version of this as the ACP1000. Meanwhile the IAEA approved the ACP1000 design in its generic reactor safety review process in December 2014, though the IAEA points out that this does not “constitute any kind of design certification.”

Two new 300 MWe CNP-300 PWR units have been built at Chasma in Pakistan by the China Zhongyuan Engineering Corporation. They are similar to those already commissioned at that site in 2000 and 2011, and similar to Qinshan 1 – China's first indigenously-designed (by SNERDI) nuclear power plant.

The SNP350 is SNERDI's development of the CNP-300, upgraded in many respects to meet latest performance, economy, and safety requirements. It is 1035 MWt, 350 MWe gross, with a design operating lifetime of 60 years and digital I&C systems. In series its cost is expected to be $4000/kW. If built by CNNC it may be designated CNP350.

CNNC was seeking to sell the CNP-300 to Belarus and in Africa, and these will probably now become ACP300 or SNP/CNP350.

ACP100 small modular PWR

A ‘key project’ in the 12th Five-Year Plan was CNNC’s multi-purpose small modular reactor, the ACP100, or LingLong One. The preliminary design was completed in 2014, based on the larger ACP (and CNP) units and a preliminary safety analysis report (PSAR) has been completed. The basic design was completed early in 2016, and CNNC said that the NDRC approved the ACP100S design for marine use late in 2016. The design took four years and was funded to CNY 700 million. In April 2016 the IAEA presented CNNC with its report from the generic reactor safety review process undertaken over ten months. In 2016 CNNC subsidiary China Nuclear Power Engineering Corp (CNPE) submitted an expression of interest to the UK government based on its ACP100+ design. By 2030 CNNC expects the ACP100 to be standardized as an advanced SMR, with large-scale construction.

It has passive safety features and will normally be installed underground. Seismic tolerance is 300 Gal. It has 57 fuel assemblies 2.15m tall and integral steam generators (320ºC input), so that the whole steam supply system is produced and shipped as a single reactor module. It has passive cooling for decay heat removal. Its 385 MWt produces about 125 MWe, and power plants comprising two to six of these are envisaged, with 60-year design life and 24-month refuelling. Or each module can supply 1000 GJ/hr, giving 12,000 m3/day desalination (with MED). Industrial and district heat uses are also envisaged, as is floating nuclear power plant (FNPP) application. See further in Floating nuclear power plants section below.

CNNC New Energy Corporation (CNNC-CNEC), a joint venture of CNNC (51%) and China Guodian Corp, was planning to build two ACP100 units in Putian county, Zhangzhou city, at the south of Fujian province, near Xiamen and not far from Fuqing, as a demonstration plant. This would be the CNY 5 billion ($788 million) phase 1 of a larger project. Construction time was expected to be 36-40 months for the two ACP100 units. CNNC applied for NDRC approval, but early in 2017 the site for first ACP100 units was changed to Changjiang, on Hainan, with a larger reactor to be built at Putian. In May 2017 CNNC said it was ready to build the first unit at Changjiang. Preliminary work began in July 2019 and full construction has begun, but no official announcement has been made. 58 months construction is expected.

A second proposal was approved for two further CNNC-CNEC units at Zhangzhou-Gulei, but this is suspended by local government opposition.

The Linglong One Demonstration Project* involves a joint venture of three companies: CNNC as owner and operator, Nuclear Power Institute of China (NPIC) as the reactor designer, and China Nuclear Power Engineering Group being responsible for plant construction. CNNC-CNEC signed a second ACP100 agreement with Hengfeng county, Shangrao city in Jiangxi province, and a third with Ningdu county, Ganzhou city in Jiangxi province in July 2013 for another ACP100 project costing CNY 16 billion. Further inland units are planned in Hunan and Jilin provinces, and CNNC has signed ACP100 development agreements also with Zhejiang and Heilongjiang provinces. Export potential is considered high, with full intellectual property rights. CNNC-CNEC will construct major parts of the reactors in Bashan, Jilin province. For the demonstration plant, the reactor vessel is from Shanghai Boiler Co, the steam generators from a CNNC subsidiary and other reactor internals from Dongfang.

* Hainan Changjiang Multi-Purpose Small Modular Reactor Technical Demonstration Project is its full name.

In August 2023 CNNC announced the installation of the integrated reactor core module for the Linglong One Demonstration Project. In September 2025 it announced that containment integrity testing had been completed, and in October cold functional tests were completed. In December 2025 the steam turbine test was completed, with commissioning expected in the first half of 2026.

CAP200, CAP150, CAP50 small modular PWRs

These have SPIC/SNPTC provenance, being developed from the CAP1000 in parallel with the CAP1400 by SNERDI, using proven fuel and core design. SNPTC is focused on the CAP200 and CAP50, the latter for floating nuclear power plants and desalination.

CAP200 or LandStar-V from SNERDI is 660 MWt/220 MWe and has two external steam generators (301°C). It is pitched to replace coal plants and supply district heating, and has a design operating lifetime of 60 years. With 24-month refuelling, burn-up of 42 GWd/t is expected. The 89 fuel assemblies are the same as for the CAP1400 but shorter. It has both active and passive core cooling systems, with natural circulation effective for up to 20% power. The CAP200 will be installed in a 32 m deep underground caisson structure with a seismic design basis of 600 Gal, even in soft ground. In 2017 the first-of-a-kind cost was estimated at $5000/kW and $160/MWh, dropping to $4000/kW in series.

The earlier CAP150 design is 450 MWt/150 MWe. The design has eight integral steam generators (295°C), and is claimed to have “a more simplified system and more safety than current third generation reactors.” It is pitched for remote electricity supply and district heating, with three-year refuelling and design operating lifetime of 80 years. It has both active and passive cooling and in an accident scenario, no operator intervention is required for seven days. The seismic design basis is 300 Gal. In mid-2013 SNPTC quoted approximately $5000/kW capital cost and 9 c/kWh for the CAP150, so significantly more than the CAP1400.

A related SNERDI project is a reactor for floating nuclear power plants. This is to use the CAP50 of about 200 MWt and relatively low-temperature (250°C), so only about 40 MWe with two external steam generators and five-year refuelling. SPIC has also presented the OceanStar-V version of the CAP200, on a barge, as a floating nuclear power plant.

CPR-1000, M310+, ACPR1000

The CPR-1000 is a significantly upgraded version of the 900 MWe-class French M310 three-loop technology imported for the Daya Bay nuclear power plant in the 1980s and also built at Ling Ao. Known as the 'improved Chinese PWR' and designated Generation II+, it features digital instrumentation and control and a design life of 60 years. Its 157 fuel assemblies (3.66 m – 12 feet – long) have calculated core melt frequency of 1x10-5 and a release probability an order of magnitude lower than this.

Standard construction time is 52 months, and the claimed unit cost was under CNY 10,000 (US$ 1600) per kilowatt, though 2013 estimates put it at about $2300/kW domestically. With a capacity of 1080-1089 MWe gross (usually about 1020 MWe net), Ling Ao Phase II is the first plant to be designated as the CPR-1000 design. It cost CNY 28.5 billion, hence CNY 14,150/kW. (The Hongyanhe units, in colder water, are 1119 MWe gross, 1061 MWe net.) The CPR-1000 was being widely and quickly deployed for domestic use, with 57 likely to be built, as of end of 2010. Following the Fukushima accident, no further approvals were made.

China Guangdong Nuclear Power Corporation (CGN) led the development of the CPR-1000 and established a nearly complete domestic supply chain. However, Areva retains intellectual property rights, which constrains overseas sales since the Chinese would need agreement from Areva on a case-by-case basis.

The eight CNNC-built units derived from the M310 (Fangjiashan 1&2, Fuqing 1-4 and Tianwan 5&6) are designated M310+.

The Advanced CPR – ACPR1000 – with full Chinese intellectual property rights, was launched by CGNPC in November 2011 with some fanfare regarding its safety attributes, which comply with international requirements. CGN has been in cooperation with Dongfang Electric, Shanghai Electric, Harbin Electric, China First Heavy Industries, China Erzhong and other companies since 2009 to develop the ACPR1000, a three-loop unit with double containment and core-catcher. Yangjiang 3&4 are an intermediate CPR-1000+, with some design modifications.

CGN made the ACPR1000 available for local build on schedule from 2013 with the first at Yangjiang, units 5&6, followed by Hongyanhe 5&6 and Lufeng 1&2 (now to be CAP1000). In September 2012 Fangchenggang 3&4 was identified as the demonstration project, with construction start at the end of 2014, but meanwhile construction started on Yangjiang 5&6, which CGN said had evolved to be an ACPR1000 design. Fangchenggang 3 was to be the reference plant for CGN’s bid to build the Sinop plant in Turkey. Overnight construction cost is expected to be $2500/kW.

A further development, ACPR1000+, was envisaged for export, from 2014, but was abandoned with the rationalization to Hualong One described below, CGN's version of which is the HPR1000. It was to have a 60-year life and 300 Gal seismic capability. The conceptual design gained IAEA approval through its generic reactor safety review process in May 2013, though the IAEA points out that this does not “constitute any kind of design certification”.

In January 2012, CGN with Areva and EdF agreed on a partnership to develop a Generation III reactor based on the CPR-1000, the ACE1000 (Areva-CGN-EdF1000). Mitsubishi Heavy Industries, already designing the similar-size Atmea1 with Areva, said it will not be involved. The ACE1000 concept is reported to be evolutionary, with single but reinforced containment, active safety systems with three 100% loops (so can do maintenance on one of them outside outages). No more has been heard of this plan and it has evidently been overtaken by Hualong One.

ACPR small modular PWRs

Not to be outdone by CNNC in the small modular field, CGN has two small ACPR designs: an ACPR100 and an ACPR50S, both with passive cooling for decay heat and 60-year design life. Both have standard type fuel assemblies and fuel enriched to <5% with burnable poison giving 30 month refueling. The ACPR100 is an integral PWR, 450 MWt, 140 MWe, having 69 fuel assemblies. Reactor pressure vessel is 17m high and 4.4 m inside diameter, operating at 310°C. It is designed as a module in larger plant and would be installed underground.

The offshore ACPR50S is 200 MWt, 60 MWe with 37 fuel assemblies and four external steam generators. Reactor pressure vessel is 7.4m high and 2.5 m inside diameter, operating at 310°C. It is designed for mounting on a barge as floating nuclear power plant (FNPP) or possible submersible. The applications for these are similar to those for the ACP100. CGN announced in January 2016 that development of its reactor design has been approved by the NDRC as part of the 13th Five-Year Plan for innovative energy technologies. In November 2016 it announced that it had contracted with Dongfang Electric Corporation for the pressure vessel of a demonstration ACPR50S unit, which it said amounted to start of construction. See further in Floating nuclear power plants section below.

Hualong – HPR1000

Since 2011 several rounds of negotiations between CNNC and CGN grappled with the task of "merging" the ACP1000 and ACPR1000+ designs as ordered by the National Energy Administration (NEA) while allowing for some differences, with impetus given by the regulator. Both are three-loop designs based to some extent on the French M310, but the cores are very different: one (ACP1000) evolved from the established CPR1000, has 177 fuel assemblies 3.66 m (12 feet) long, while the ACPR1000, with four units at Hongyanhe and Yangjiang, has 157 assemblies 4.3 m (14 feet) long, so physically merging the basic designs was impractical, and in the event the ACP1000 design prevailed in the rationalization. Some features of the ACPR1000 are incorporated into the Hualong One design, at least in the CGN version, which it calls the HPR1000. The Hualong One requires about 50% more steel and concrete than the CPR1000 and costs about 31% more.

The Hualong One or HPR1000 thus has 177 fuel assemblies 3.66 m long, 18-24 month refuelling interval, equilibrium fuel load will be 72 assemblies with 4.45% enriched fuel. It has three coolant loops, double containment and active safety systems with some passive elements, and a 60-year design life. The passive systems are able to operate for 72 hours with a sufficient inventory of storage water and dedicated batteries. The CGN version delivers 3150 MWt, 1150 MWe gross, 1092 MWe net, while CNNC quotes 3050 MWt, 1170 MWe gross, 1090 MWe net. Average burn-up is 45,000 MWd/tU, thermal efficiency 36%. Seismic tolerance is 300 Gal. Instrumentation and control systems will be from Areva-Siemens, but overall 90% will be indigenous components. Target cost in China is $2800-3000/kWe, though recent estimates mention $3500/kW. CGN said in November 2015 that the series construction cost would be CNY 17,000/kWe (then $2650/kWe), compared with CNY 13,000/kWe for second-generation reactors.

The CNNC and CGN versions are very similar but not identical; they have slightly different safety systems, with CNNC emphasizing more passive safety under AP1000 influence with increased containment volume and two active safety trains, and CGN with French influence having three active safety trains. Also each organization will maintain much of its own supply chain. The new design has been variously called Hualong 1000 or HL1000 by CGN, ACP1000 by CNNC, and generically Hualong One, or HPR1000 – Hualong Pressurized Reactor 1000.

The first units are Fangchenggang 3&4 (CGN) and Fuqing 5&6 (CNNC). The 'rationalization' was helped by greater commonality in ownership of the two companies as set out in September 2012 though still not implemented a year later. Fuqing 5 started construction in May 2015, and it then emerged that the primary coolant pumps were behind schedule. Harbin Electric Company (HEC) formed a special team with CNNC to address the issue. The CGN version of the Hualong One, Fangchenggang 3&4, was to be the reference plant for the UK’s (now cancelled) Bradwell B. Fangchenggang 3 construction started in December 2015, followed by unit 4 a year later. The two units were connected to the grid in January 2023 and April 2024 respectively.

CNNC and CGN in December 2015 formed a 50-50 joint venture company – Hualong International Nuclear Power Technology Co – to market the Hualong One. The company is "committed to the continued integration and development of Hualong One as an independent third generation nuclear power technology, with the unified management of the Hualong brand, intellectual property and other related assets at home and abroad.” In some respects the Hualong was originally conceived as a reactor for export but in reality and given the difficulties of the AP1000 in recent years, notably on canned motor pumps, it has emerged as a competitor on national soil and an alternative to the CAP1000.

It appears that the CNNC ‘Hualong One’ version will be the main domestic model built with the aim of lowering the price of the reactor to equip the national fleet cheaply. After Fuqing 5&6 CNNC is building the next at Zhangzhou in Fujian province, previously an AP1000 project. This reactor design will be dedicated to the domestic market and some international markets such as Pakistan, Argentina, and possibly Eastern Europe. It is under construction in Pakistan.

The Hualong One promoted on the international market is called the HPR1000. It is based on the CGN version, with Fangchenggang as reference, and CGN is also building it as Ningde 5&6. In October 2015 CGN submitted the HPR1000 for certification of compliance with the European Utility Requirements (EUR). In March 2016 CGN signed an agreement with Skoda Praha to facilitate this. In July 2017 ten Chinese supply chain companies signed up for ongoing high-level coordination under CGN leadership for enhancing the reactor’s design, supply chain, manufacture and cost.

General Nuclear Systems (GNS), the joint venture of EDF Energy and CGN formed to progress the UK generic design approval (GDA) wrote to the UK government in October 2016 saying it was ready to start the GDA process. CGN plans to increase its efforts to sell the reactor in Central and Eastern Europe, Africa, Southeast Asia and elsewhere.

In April 2021 CNNC announced an upgraded and simplified version of the HPR1000 called Hualong Two, with plans then to begin building the first by 2024. It estimates that construction costs would fall to CNY 13,000 ($2000) per kilowatt from the current Hualong One CNY 17,000/kWe ($2600), and construction time will reduce from five years to four.

VVER

Russia's Atomstroyexport was general contractor and equipment provider for the Tianwan 1&2 AES-91 power plants using the V-428 version of the well-proven VVER-1000 reactor of 1060 MWe capacity. The reactors incorporate Finnish safety features and Siemens-Areva instrumentation and control (I&C) systems. Russia's Energoatom is responsible for maintenance from 2009. Tianwan units 3&4 are both the same version of the VVER-1000 reactor with Areva I&C systems.

In June 2018 Rosatom confirmed that it had signed a contract to build four VVER-1200 units in China – two at Tianwan (units 7&8), and two at Xudapu (units 3&4). The contract is reportedly valued at more than CNY 20 billion. China will provide finance, with Russia responsible for the nuclear island only – indicating significant localization.

Candu

From 1998 Atomic Energy of Canada Ltd (AECL) built the two-unit Qinshan Phase III plant on schedule and under budget and estimates that it could be replicated for 25% lower cost. Any replication would be on the basis of involving local engineering teams, not on a turnkey basis, but the technology is now well understood and the decades-old Candu-6 design would likely pose fewer problems for technology transfer than state-of-the-art third-generation designs from Westinghouse and Areva. (The Candu-6 units at Wolsong 2-4 in Korea had substantial local content, reaching 75% localization with unit 4.)

In September 2005, AECL signed a technology development agreement with CNNC which opened the possibility of it supplying further Candu-6 reactors and undertaking fuel cycle developments based on them. This agreement with CNNC was passed to its subsidiary, the Nuclear Power Institute of China (NPIC). From 2008 it has focused on joint development of the Advanced Fuel Cycle Candu Reactor (AFCR).

Advanced Fuel Candu Reactor

In September 2016 an agreement among SNC-Lavalin, CNNC and Shanghai Electric Group (SEC) was to set up a joint venture in mid-2017 to develop, market and build the Advanced Fuel Candu Reactor (AFCR), which will utilize used fuel from other reactors. Two design centres are envisaged, in China and Canada, to complete the AFCR technology. This could lead to construction of two AFCR units in China.

High temperature gas-cooled reactors: HTR-PM, HTR-PM 600

In February 2006, the State Council announced that the small high-temperature gas-cooled reactor (HTR) was the second of two high priority National Major Science & Technology Projects for the next 15 years. This aims at exploring co-generation options in the near-term and producing hydrogen in the long term.

The small HTR-PM (HTR Pebble-bed Modular) units with pebble bed fuel and helium coolant were to be 200 MWe reactors, similar to that then being developed in South Africa, but plans have evolved to make them twin 250 MWt (105 MWe equivalent) reactors so that they can retain the same core configuration as the prototype HTR-10. The twin units, each with a single steam generator, will drive a single 210 MWe steam turbine. Core height is 11 metres in a 25 m high, 5.7 m diameter reactor vessel, with helium at 750°C and 7 MPa producing steam at 566 °C. The engineering of the key structures, systems, and components is based on Chinese capabilities, though they include completely new technical features. Thermal efficiency of 40%, localization 75%, and 50-month construction for the first twin-unit HTR-PM was envisaged.

Each reactor will be loaded with 245,318 fuel elements, each 60 mm diameter and containing 7 g of fuel enriched to 8.5%. (The HTR-10 has 27,000 fuel elements but 17% enrichment.) Average burn-up is 90 MWd/tU. Some graphite moderator pebbles the same size are included. Pebbles are released into the top of the core one by one with the reactor operating. They are correspondingly removed from the bottom, broken ones are separated, the burn-up is measured, and spent fuel elements are screened out and transferred to storage. Reactivity control is primarily by 24 control rods, secondarily by small absorber spheres dropped by gravity through six channels alongside the control rods in the graphite side reflector.

China Huaneng Group (CHNG) is the lead organization in the consortium to build the demonstration Shidaowan HTR-PM with China Nuclear Engineering & Construction Group (CNEC/CNECC)* and Tsinghua University's INET, which is the R&D leader. Chinergy Co., a joint venture of Tsinghua and CNEC, is the main contractor for the nuclear island. Following the agreement on HTR industrialization cooperation between CNEC and Tsinghua University in 2003, the two parties signed a further agreement on commercialization of the HTR in March 2014. CNEC is responsible for the HTR technical implementation, and becomes the main investor of HTR commercial promotion at home and abroad.

* In January 2018, CNNC became a controlling shareholder in CNEC/CNECC, and the two organizations formally merged. For full details see Appendix 1 to this page, Government Structure and Ownership.

Thus the initial demonstration HTR-PM at Shidaowan (Shidaowan HTR-PM 1), near Weihai city, will pave the way for commercial versions with three modules each 2x250 MWt but feeding one turbine, total 655 MWe. Thermal efficiency is 43.7%. The first of the twin reactors of the demonstration HTR-PM achieved first criticality in September and the second in November 2021. The plant entered commercial operation in December 2023.

The HTR-PM 600 reactor units are likely to be built in pairs. INET expects the cost to be 15-20% more than a 600 MWe PWR and the first one to be 75% of the $6000 per kW cost of the small HTR-PM, subsequent ones about 50%. The 655 MWe size and 556 °C steam temperature mean that they can readily replace steam systems in many existing coal-fired plants.

The main HTR promotion is of the 600 MWe version, the HTR-PM 600. In April 2015 CNEC announced that its proposal for two commercial 600 MWe HTRs at Ruijin city in Jiangxi province had passed an initial feasibility review. At that time, construction was expected to start in 2017. No major utility had been named at that stage, but in July 2016 CNEC signed an agreement with CGN to set up a joint venture led by CNEC to develop HTRs domestically and overseas. It then signed a cooperation agreement with China First Heavy Industries (CFHI or YiZhong) to support the supply chain.

CNEC has done a feasibility study and commenced preliminary work on a commercial-scale HTR-PM600 at Wan’an in Fujian province, close to Ningde, according to CNEC subsidiary China Nuclear Industry Huachen Construction Co. This appears to be instead of Ruijin which is inland. Other feasibility studies for the HTR-PM600 reported by Chinergy in September 2017 are at Sanmen in Zhejiang, Xiapu in Fujian, and Bai'an in Gunagdong.

In 2016 CNEC signed agreements to develop HTRs in Saudi Arabia and Indonesia.

District heating reactors

The government has made clean-energy heating a priority, and in 2017 it issued guidance on this for northern China. The National Energy Administration’s five-year plan covering 2017-2021 highlighted clean heating technology.

CNNC, CGN and SPIC have announced concepts for low-temperature district heating reactors, all to be installed well-below ground level. Development of these acknowledges the role of heating in air pollution, particularly PM2.5 particulates, which are reported to be more than ten times higher in winter. However, the need for district heating is seasonal, and some use for the plant for the rest of the year is needed.

CGN's NHR200-I is a low-temperature district heating reactor of 200 MWt with convection circulation at 2.5 MPa in primary circuit pressure to produce steam at 127°C. Used fuel is stored around the core in the pressure vessel. Its design is described by CGN as "mature", having passed NNSA review in the 1990s. It has been developed by the Institute of Nuclear Energy Technology (INET) at Tsinghua University from the 5 MW NHR-5 prototype which started up in 1989 and heated the INET campus for three winters. In February 2018 it was announced that CGN and Tsinghua University were carrying out a feasibility study on constructing China's first district heating nuclear plant using the NHR-200 design at Daqing city in Heilongjiang province and Shenyang in Liaoning province. The NHR200-II with design and verification tests concluded in 2016 operates at 8 MPa primary circuit pressure to produce steam at over 200°C and can also be used for power generation, seawater desalination or heat for mineral processing.

SPIC’s LandStar-I is an integral pressure vessel reactor of 200 MWt with convection circulation at 9 MPa producing hot water at 110°C. Pre-feasibility studies suggested first commissioning in 2022. At SPIC’s Jiamusi demonstration project in Heilongjiang province, the two 200 MW LS-I reactors were to provide steam to a biomass plant in summer. The National Nuclear Safety Administration (NNSA) approved a preliminary environmental site assessment in August 2020 and they were expected to be in operation in 2024, but did not proceed. LandStar-V is a 600 MWt compact reactor with two external steam generators for power generation or industrial process heat. OceanStar versions are for floating nuclear power plants.

CNNC’s Yanlong District Heating Reactor-400 (DHR-400) is a low-temperature 400 MWt pool-type reactor designed to provide heat at 90°C for up to 200,000 three-bedroom apartments. The reactor prototype at CIAE achieved 168 hours of continuous heat supply in November 2017 – seen by its developers, CNNC, as the first major step towards commercialization of the design.

SPIC’s Haiyang power plant commenced supplying district heat on a commercial basis in November 2020, and by late 2021 a figure of 6.6 million tonnes of coal (13 PJ) being replaced annually was quoted. A major district heating offtake is planned for the CAP1400 under construction in Shandong, and for power plants at Qinshan, Tianwan and Hongyanhe.

Fast neutron reactors

Longer-term, fast neutron reactors (FNRs) are seen as the main technology, and CNNC expects the FNR to become predominant by mid-century. A 65 MWt fast neutron reactor – the Chinese Experimental Fast Reactor (CEFR) – near Beijing achieved criticality in July 2010, and was grid-connected a year later (but is omitted from the operating table below as being minor and experimental).5 Based on this, a 600 MWe pre-conceptual design was developed, known as the Chinese Demonstration Fast Reactor (CDFR) project 1 (and sometimes CMFR – Chinese Model Fast Reactor). The first CFR600 unit began construction in December 2017 at Xiapu in Fujian province, and began commissioning in 2023. Construction of the second unit began in December 2020. The CFR600 units are intended to be followed by a CFR1000 for commercial operation from 2030, according to the China Institute of Atomic Energy. The preliminary design of the CFR1000 was completed in July 2025. Xiapu in Fujian province is also reported to be the site for the prototype so-called travelling-wave reactor TWR-P.

In addition to CDFR project 1, in October 2009, an agreement with Russia confirmed China's intention to opt for the BN-800 technology as CDFR project 2. The first two in China were planned to start construction in 2013 at Sanming, Fujian province (see see section below on Sanming). However, despite promotion by NIAEP-Atomstroyexport the project did not proceed.

See also Fast neutron reactors subsection in the R&D section of the information paper on China's Nuclear Fuel Cycle.

Thorium molten salt reactor

A 2 MWt experimental thorium molten salt reactor (TMSR-LF1), developed by the Shanghai Institute of Applied Physics, achieved first criticality in October 2023 and reached full power in June 2024. In October 2025 the reactor achieved the first thorium-to-uranium nuclear fuel conversion in a molten salt reactor, with protactinium-233 detected after ten days of full-power operation. China aims to build a 100 MWt demonstration thorium reactor by 2035.

Floating nuclear power plants

In May 2014 the China Atomic Energy Authority (CAEA) signed an agreement with Rosatom to cooperate in construction of floating nuclear cogeneration plants (FNPPs) for China offshore islands. These would be built in China but be based on Russian technology, and possibly using Russian KLT-40S reactors – Russia’s TVEL anticipated providing fuel for them. In July 2014 Rusatom Overseas signed a further agreement, this time with CNNC New Energy, for the joint development of FNPPs – both barge-mounted and self-propelled – from 2019.

Since then however, both CNNC and CGN have announced proposals for indigenous FNPPs based on their respective small reactor designs. In February 2017 the State Administration of Science, Technology and Industry for National Defence (SASTIND) and the National Atomic Energy Agency (NEA) said that offshore FNPPs were included in the 13th five-year plans for national defence science and development of the nuclear industry, to establish relevant standards and undertake key technology research.

In July 2016 CNNC signed an agreement with China State Shipbuilding Corporation (CSSC) to develop nuclear-powered icebreakers and maritime nuclear power platforms. In August 2017 CNNC set up a company to develop, construct, operate and manage FNPPs and other vessels. China Marine Nuclear Power Development Co (CMNPD) is a joint venture among CNNP (51%), Shanghai Guosheng (Group) (20%), Jiangnan Shipbuilding (Group) (10%), Shanghai Electric Group (10%), and Zhejiang Zheneng Electric Power (9%). Jiangnan Shipbuilding near Shanghai is a subsidiary of CSSC. CNNC subsidiary China National Nuclear Power (CNNP) said that establishing the new company, capitalized at CNY 1 billion, was in accordance with the national 'Belt and Road' initiative, to help exploitation of marine resources. Desalination would be part of the role.

In June 2018 CMNPD through CNNC published a tender for construction of a multi-purpose nuclear-powered icebreaker. The 'Linglong One' ACP-100S reactor is envisaged for power.

CGN announced in January 2016 that development of its ACPR50S reactor design has been approved by the NDRC as part of the 13th Five-Year Plan for innovative energy technologies.

CGN then signed an agreement with China National Offshore Oil Corporation (CNOOC) apparently to provide power for offshore oil and gas exploration and production, and to “push forward the organic integration of the offshore oil industry and the nuclear power industry,” according to CNOOC. Soon after, it signed an agreement with China’s largest ship design institute, China Shipbuilding Industry Corporation (CSIC) to "jointly promote cooperation on nuclear power offshore platform projects." In April 2016 CSIC confirmed that in collaboration with CGN it would build the first FNPP at the Bohai Heavy Industries shipyard in Liaoning, supplying power and desalination. (Bohai Shipyard at Huladao is the sole builder of nuclear submarines.)

In October 2018 CSIC presented a concept of a FNPP 163m x 29m displacing 29,800 tonnes with twin reactors providing 200MW total and 50 and 100 MWe, designed by China Shipbuilding Heavy Industry Co Ltd. CSIC has an in-house HHP25 nuclear reactor design derived from a submarine power plant. In early 2019 CGN tendered for construction of an "experimental ship platform" 152 metres long, 30 metres wide, with a displacement of 30,000 tonnes, dynamic positioning capabilities, and powered by two 25 MW reactors.

In November 2016 CGN announced that it had contracted with Dongfang Electric Corporation for the pressure vessel of a demonstration ACPR50S unit, which it said amounted to start of construction. There are plans for 20 more. CSIC has already designed both a FNPP concept and a submersible nuclear power plant concept.

CNNC announced in October 2015 that its subsidiary, the Nuclear Power Institute of China (NPIC), signed an agreement with UK-based Lloyd's Register to support the development of a floating nuclear power plant using the ACP100S reactor, a marine version of the ACP100. Following approval by the NDRC as part of the 13th Five-Year Plan for innovative energy technologies, CNNC said it was planning to start building its ACP100S demonstration floating nuclear plant late in 2016, for 2019 operation. In July 2016 CNNC signed an agreement with CSIC to give effect to its plans.

Embarking upon Generation III plants

In September 2004, the State Council approved plans for two units at Sanmen, followed by six units at Yangjiang (two to start with), these to be 1000 or 1500 MWe reactors pioneering Generation III nuclear technology from overseas. The Sanmen (in Zhejiang province) and Yangjiang (in Guangdong province) reactors were subject to an open bidding process for third-generation designs, with contracts to be awarded in mid-2006 – in the event, mid-2007 – putting them clearly into the 11th Five Year Plan.

Bidding process

This open bidding process underlined the extent to which China is making itself part of the world nuclear industry, and yet at first remaining somewhat ambivalent about that.

Three bids were received for the four Sanmen and Yangjiang reactors: from Westinghouse (AP1000 reactors), Areva (EPR) and Atomstroyexport (VVER-1000 model V-392). The State Nuclear Power Technology Corporation (SNPTC), directly under China's State Council, was in charge of technology selection for new plants being bid from overseas.

Some 200 experts spent over a year evaluating Generation III designs and in September 2006 most of the 34 assigned to decide voted for the AP1000. The key factors in choosing this were passive design, simplified safety system, modular construction giving more rapid build and better cost control, and smaller components allowing more ready localization.

The USA, French and Russian governments were reported to be giving firm support as finance and support arrangements were put in place. The US Export-Import bank approved $5 billion in loan guarantees for the Westinghouse bid, and the French Coface company was expected similarly to finance Areva for its bid. The US Nuclear Regulatory Commission gave approval for Westinghouse to export equipment and engineering services as well as the initial fuel load and one replacement for the four units. Bids for both two-unit plants were received in Beijing on behalf of the two customers: China General Nuclear Power Co (CGN) for Yangjiang, and China National Nuclear Corporation (CNNC) for Sanmen. Bids were for the nuclear portion of each plant only, the turbine tenders to be called for subsequently.

Bids were assessed on level of technology, the degree to which it was proven, price, local content, and technology transfer – which apparently became the major factor. Areva and Westinghouse were short-listed. However, the decision on reactor type was delayed, and came under review at the highest political level, with CNNC evidently pushing for the use of indigenous second-generation designs for both sites.

In December 2006, 22 months after the bids were submitted and after several revisions to them, the Westinghouse AP1000 reactor design was confirmed for the four units – two each at Sanmen and Yangjiang. Early in 2007, the two units planned for the Yangjiang site were switched to Haiyang in the more northerly Shandong province, making way for two EPR units Areva was in negotiations to build at Yangjiang. Later in 2007, plans for the EPRs under consideration for Yangjiang were transferred to another Guangdong site – Taishan – since there was pressure to build a lot of capacity quickly at Yangjiang.

Sanmen 1&2 and Haiyang 1&2

A framework agreement was signed at the end of February 2007 between Westinghouse and SNPTC specifying Haiyang and Sanmen for the four AP1000 units. In July 2007, Westinghouse, along with consortium partner Shaw, signed the contracts with SNPTC, Sanmen Nuclear Power Company (51% owned by CNNC), Shandong Nuclear Power Company (65% owned by CPI, for Haiyang) and China National Technical Import & Export Corporation (CNTIC) for four AP1000 reactors. Specific terms were not disclosed but the figure of $5.3 billion for the first two was widely quoted. In December 2007 the Chinese and US governments signed the intergovernmental agreement for the construction of AP1000 projects in China and technology transfer.

Sanmen site works commenced in February 2008 and full construction on Sanmen 1 – the world's first AP1000 unit – officially commenced on 19 April 2009. The reactor was initially expected to begin operation at the end of 2015 with the second less than one year later. First fuel was loaded into Sanmen 1 in April 2018, the unit was grid connected in June 2018 and entered commercial operation in September 2018. First fuel was loaded into Sanmen 2 in July 2018, the unit was grid connected in August 2018, and entered commercial operation in November 2018.

First concrete at Haiyang 1 was in September 2009, and the pressure vessel was installed in January 2012. First fuel was loaded into Haiyang 1 in June 2018, the unit was grid connected in August 2018, and entered commercial operation in October 2018. First fuel was loaded into Haiyang 2 in August 2018, the unit was grid connected in October 2018, and entered commercial operation in January 2019. China Nuclear Engineering & Construction Group (CNEC/CNECC) is building both the Sanmen and Haiyang plants. In December 2019, the two-unit Haiyang plant began providing heat to over 700,000 m2 of housing as part of the first phase of the Shandong Haiyang Nuclear Energy Heating Project. In May 2020 the project received approval to operate as the country's first large-sale cogeneration heating project, allowing it to provide heating for 30,000,000 m2 of housing.

The future of Haiyang, as envisaged by CNNC

Construction was slower than planned, the main problem being with US-made main coolant pumps (four in each reactor). These worked well in normal operation but had insufficient inertia to continue long enough for full passive safety effectiveness when not powered. Following successful tests,* the modified pumps were shipped from Curtiss-Wright to Sanmen, and the fourth was installed in unit 1 in March 2016. This is also a milestone enabling modified pumps to be supplied to seven other AP1000 units under construction in both China and the USA.

* The final performance testing verified successful pump operation during a full range of AP1000 plant operating conditions for more than 1,600 total hours, including more than 600 start-and-stop cycles. Extensive reviews and detailed post-test inspections by the NNSA confirmed performance as designed during the final testing. Curtiss-Wright conducted the testing and inspection at its Electro-Mechanical Division (EMD) facility in Cheswick, Pennsylvania, USA. SNPTC said: "This success will further accelerate China AP1000 project construction progress as well as boost advanced passive Generation III nuclear power development in China."

AP1000 construction and equipment contracts