Electricity and Energy Storage

- Electricity storage on a large scale has become a major focus of attention as intermittent renewable energy has become more prevalent.

- Pumped storage is well established. Other megawatt-scale technologies are being developed. These can provide dispatchable capacity as required by demand.

- The storage to complement intermittent renewables if they are to replace base-load capacity must be able to meet demand over many days, not simply hours.

- At household level, behind the meter, battery storage is being promoted to complement solar PV installation. It reduces demand on the grid during evening peaks especially.

The rapid increase in many parts of the world of generating capacity by intermittent renewable energy sources, notably wind and solar, has led to a strong incentive to develop energy storage for electricity on a large scale. Due to the (desired or imposed) growing annual share of electrical energy originating from renewable technologies subject to naturally-fluctuating power flows (like solar PV and wind), characterised by relatively low load factors, the combined installed capacities of those technologies in the future are expected to be much larger than typical/conventional electrical peak power demand.*

* “The regrettable habit in some circles to blindly use the word 'power' as a synonym of 'electricity' must be avoided in the context of storage. 'Power' is charged into or discharged from a storage device, but it is 'energy' that is stored.” – Projected Costs of Generating Electricity 2020, International Energy Agency & Nuclear Energy Agency.

The extent to which electricity storage can be developed will determine the extent to which those intermittent renewable sources can displace dispatchable sources, taking surplus power on occasions and bridging intermittency gaps. There are questions of scale – power and energy capacity – which are indicated below in particular cases. Also some stored energy usually needs to be available as electricity over days and weeks, though there is plenty of scope for short-term storage over minutes and hours. Cost-effectiveness is key so both value and cost must be clearly determined to compare different electrical storage technologies in a variety of applications and services.

Electricity cannot itself be stored on any scale, but it can be converted to other forms of energy which can be stored and later reconverted to electricity on demand. Storage systems for electricity include battery, flywheel, compressed air, and pumped hydro storage. Any systems are limited in the total amount of energy they can store. Their energy capacity is expressed in megawatt-hours (MWh), and the power, or maximum output at a given time, is expressed in megawatts of electric power (MW or MWe). Electricity storage systems may be designed to provide ancillary services to a transmission system including frequency control, and this is the chief role of grid-scale batteries today.

Of course, very effective storage of energy is achieved in fossil fuels and nuclear fuel, before electricity is generated from them. While the focus here is on storage after generation, particularly from intermittent renewable sources, any proper consideration of the question needs also to encompass nuclear fuel for power generation as a more economical option with relatively little materials requirement.

Pumped storage involves pumping water uphill to a reservoir from which it can be released on demand to generate hydroelectricity. The efficiency of the double process is about 70%. Pumped storage comprised 95% of the world’s large-scale electricity storage in mid-2016, and 72% of the storage capacity added in 2014. Pumped hydro has the advantage of being long-term if required. Battery storage, however, is being deployed widely. More than 6 GW of grid-scale battery storage was added in 2021, reaching close to 16 GW connected to electricity networks at the end of that year, according to the International Energy Agency (IEA). Building-scale power storage emerged in 2014 as a defining energy technology trend. This market has grown by 50% year-on-year, with lithium-ion batteries prominent but redox flow cell batteries show promise. Such storage may be to reduce demand on the grid, as back-up, or for price arbitrage. In 2015 battery storage costs were around $400/kWh of contained energy, and 1.6 GW was installed or planned. The cost dropped to $141/kWh in 2021 before rising to $151/kWh (in 2022 prices) according to Bloomberg NEF’s annual battery price survey.

Pumped storage projects and equipment have a long lifetime – nominally 50 years but potentially more, compared with batteries – 8 to 15 years. Pumped hydro storage is best suited for providing peak-load power for a system comprising mostly fossil fuel and/or nuclear generation. It is not so well-suited to filling in for intermittent, unscheduled and unpredictable generation.

A World Energy Council report in January 2016 projected a significant drop in cost for the majority of energy storage technologies as from 2015 to 2030. Battery technologies showed the greatest reduction in cost, followed by sensible thermal, latent thermal and supercapacitors. Battery technologies showed a reduction from a range of €100-700/MWh in 2015 to €50-190/MWh in 2030 – a reduction of over 70% in the upper cost limit in the next 15 years. Sodium sulfur, lead acid and lithium-ion technologies lead the way according to WEC. The report models storage related to both wind and solar plants, assessing the resultant levelised cost of storage (LCOS) in particular plants. It notes that the load factor and the average discharge time at rated power is an important determinant of the LCOS, with the cycle frequency becoming a secondary parameter. For solar-related storage the application case was daily storage, with six-hour discharge time at rated power. For wind-related storage the application case was for two-day storage with 24 hours discharge at rated power. In the former case the most competitive storage technology had LCOS of €50-200/MWh. In the latter case, levelised costs were higher and sensitive to the number of discharge cycles per year, and “few technologies appeared attractive."

Following a two-year study by the California Public Utilities Commission, the state in 2010 passed legislation requiring 1325 MWe of electricity storage (excluding large-scale pumped storage) by 2024. In 2013 it brought forward the deadline to 2020, then having 35 MW total. The legislation specifies power, not storage capacity (MWh), suggesting that the main purpose is frequency control. The stated purpose of the legislation is to increase grid reliability by providing dispatchable power from an increasing proportion of solar and wind inputs, replace spinning reserve, provide frequency control and reduce peak capacity requirements (peak shaving). The storage systems can be connected with either transmission or distribution systems, or be behind the meter. The main focus is on battery energy storage systems (BESS). Energy arbitrage may enhance revenue, buying off-peak and selling for peak demand. Southern California Edison in 2014 announced plans for 260 MW of electricity storage to offset the closure of the 2150 MWe San Onofre nuclear plant. While 1.3 GW in the context of the state’s 50 GW demand will not provide much dispatchable power, it was a major incentive for the utilities.

Oregon followed California, and in 2015 set a requirement for larger utilities (PGE and PacifiCorp) to procure at least 5 MWh of storage by 2020, and PGE proposed 39 GW in several locations, costing $50 to $100 million. In June 2017 Massachusetts issued a target of 200 MWh storage by 2020. In November 2017 New York resolved to set a storage target for 2030.

In the USA, there is some 22 GW of pumped storage capacity and 550 gigawatt-hours of energy storage across the country, according to the Office of Energy Efficiency & Renewable Energy. In 2022, large-scale battery storage capacity in the USA reached 9.1 GW and 25 GWh. The Energy Information Administration projects this to reach 30.0 GW by the end of 2025.

Early in 2016 the UK’s National Grid got a strong response to a tender for 200 MW enhanced frequency response (EFR). It offered four-year contracts for capacity able to provide 100% active power output in a second or less of registering a frequency deviation. Some 888 MW of battery capacity was offered, 150 MW of interconnection, 100 MW of demand-side response and 50 MW of flywheel capacity. All but three involved battery storage. In August the winning bids were announced – the eight chosen tenders being from 10 MW to 49 MW (totalling 201 MW) and costing £66 million in total. The winning bids ranged from £7 to £12 per MW of EFR/h, with an average of £9.44/MW of EFR/h. Batteries are also expected to become the main choice for firm frequency response, slightly slower than EFR.

In the UK storage is treated as generation for licensing purposes, but on connection to a distribution network it has to comply with two different connection and charging methodologies, with one half connecting as demand and the other as generation. A single storage connection methodology is proposed, and the Department for Business, Energy & Industrial Strategy and energy regulator Ofgem are aiming to define ’electricity storage’ in legal and regulatory terms so as to expedite deployment. The Electricity Storage Network, an industry body, supports the move.

On demand response, the UK government said providers should have easier access to a range of markets so they can compete fairly with large generators, including the balancing market, ancillary services, and the capacity market. There is concern over whether storage and demand response providers should be able to access the same length capacity market contracts as new diesel generators. In this area the response needs to be over hours, and batteries are less economical.

In November 2016 the European Commission acknowledged energy storage as a key flexibility instrument required in the future. It proposed a new definition of electricity storage to include “deferring an amount of the electricity that was generated to the moment of use, either as final energy or converted into another energy carrier” such as gas. This brought power-to-gas (P2G) concepts within the regulatory definition of energy storage so that excess power from intermittent renewables can by electrolysis be turned into hydrogen which can be added to the normal gas distribution network (up to 20%, though much less allowed in most countries), or sold directly. Electrolysers could thus be providing ancillary grid services for which they are paid. The redefinition of P2G from simply a load to storage has implications for both electricity grids and reducing CO2 arising from gas. P2G electrolysers can be seen as part of the grid, not simply end users.

ITM Power, which develops electrolysers for P2G systems, proposes to build a number of hydrogen refuelling stations for fuel cell cars in the UK, with these having some grid balancing function. In March 2017 it had four in operation, with hydrogen production timed to absorb excess power from the grid. The UK government wants 65 hydrogen refuelling stations by 2020. Each has 200 to 250 kW capacity, so a number of them are needed to be able to bid for enhanced frequency response (minimum 3 MW).

Polymer electrolyte membrane (PEM) electrolysers are now available at about €1 million per MW, with smaller footprint and more rapid response than alternatives, enabling grid balancing and energy storage. Some 4.7 TWh of renewable electricity was curtailed in Germany in 2015.

Hydrogen storage at scale and its long-range transmission is envisaged as being by conversion to ammonia, which in practical terms is more energy-dense.

See Energy Storage Association website or European Association for Storage of Energy (EASE) for further information.

Pumped hydroelectric storage

In some places pumped storage is used to even out the daily generating load by pumping water to a high storage dam during off-peak hours and weekends, using the excess base-load capacity from low-cost coal or nuclear sources. During peak hours this water can be released through the turbines to a lower reservoir for hydro-electric generation, converting the potential energy into electricity. Reversible pump-turbine/motor-generator assemblies can act as both pumps and turbines*. Pumped storage systems can be effective in meeting peak demand changes due to rapid ramp-up or ramp-down, and profitable due to the differential between peak and off-peak wholesale prices. The main issue apart from water and altitude is round-trip efficiency, which is around 70%, so for every MWh of input only 0.7 MWh is recovered. In addition, relatively few places have scope for pumped storage dams close to where the power is needed.

* Francis turbines are widely-used for pumped storage but have a hydraulic head limit of about 600 m.

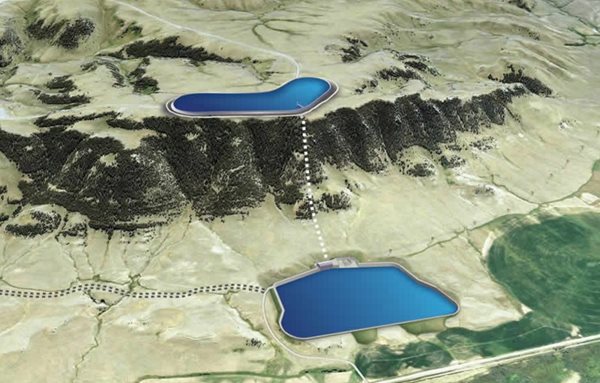

Most pumped storage capacity is associated with established hydro-electric dams on rivers, where water is pumped back to a high storage dam. Such dammed hydro schemes can be complemented by off-river pumped hydro. This requires pairs of small reservoirs in hilly terrain and joined by a pipe with pump and turbine.

This schematic of the Gordon Butte project is typical of off-river pumped storage (Gordon Butte)

The International Hydropower Association has a tracking tool, which maps the locations and power capacity for existing and planned pumped storage projects.

Pumped storage has been used since the 1920s and today about 160 GW pumped storage is installed worldwide, including 31 GW in the USA, 53 GW in Europe and Scandinavia, 27 GW in Japan and 23 GW in China. This amounts to some 500 GWh able to be stored – about 95% of the world’s large-scale electricity storage in mid-2016, and 72% of that capacity which was added in 2014. IRENA reports that 96 TWh was used from pumped storage in 2015. The International Energy Agency's World Energy Outlook 2016 projects 27 GW of pumped storage capacity being added by 2040, mainly in China, the USA and Europe. However, as outlined in World Energy Outlook 2020, the geographical limitations of suitable pumped storage sites mean that other options, such as battery storage and thermal storage, are being explored.

For off-river pumped hydro the paired reservoirs normally need to have an altitude difference of at least 300 metres. Abandoned underground mines have some potential as sites. In Spain’s Leon region Navaleo plans a pumped hydro system in a former coal mine with a 710 m head and 548 MW output, feeding 1 TWh per year back into the grid. The project is anticipated to be commissioned in 2024.

Unlike wind and solar inputs to a grid system, hydro generation is synchronous and therefore provides ancillary services in the transmission network such as frequency control and provision of reactive power. A pumped storage project typically has 6 to 20 hours of hydraulic reservoir storage for operation, compared with much less for batteries. Pumped storage systems are typically over 100 MWh stored energy.

Pumped hydro storage is best suited for providing peak-load power for a system comprising mostly fossil fuel and/or nuclear generation at low cost. It is much less suited to filling in for intermittent, unscheduled generation such as wind, where surplus power availability is irregular and unpredictable.

The largest pumped storage facility is in Virginia, USA, with 3 GW capacity and 30 GWh of stored energy. However, useful facilities can be quite small. They also do not need to be supplementary to major hydroelectric schemes, but can use any difference in elevation between upper and lower reservoirs of over 100 metres if not too far apart. In Okinawa seawater is pumped to a cliff-top reservoir. In Australia a disused underground mine was considered for a lower reservoir. Israel plans the 344 MW Kokhav Hayarden two-reservoir system.

In Montana, USA, the $1 billion, 4 x 100 MW Gordon Butte Pumped Storage Hydro Project in the central part of the state will use excess power from the state’s 665 MWe of wind turbines, though this is less predictable than off-peak power designed to supply base-load. Absaroka Energy will build the elevated reservoir on a mesa 312 metres above the lower reservoir from 2018. It expects to supply 1300 GWh per year to supplement wind, with ancillary services.

A pilot project in Galdorf, Germany connects wind turbines, via an underground penstock, to a pumped storage power station. It comprises 13.6 MWe of wind turbines and 16 MWe of hydro capacity from pumped storage.

Battery energy storage systems

Batteries store and release energy electrochemically. The requirements for battery storage are high energy density, high power, long life (charge-discharge cycles), high round-trip efficiency, safety, and competitive cost. Other variables are discharge duration and charge rate. Various compromises are made among these criteria, underlining the limitations of battery energy storage systems (BESS) compared with dispatchable generation sources. The question of energy return on energy invested (EROI) also arises, which acutely relates to how long a battery is in service and how its round-trip efficiency holds up over that period.

Batteries require a power conversion system (PCS) including inverter to link into a normal AC system. This adds about 15% to the basic battery cost.

Various megawatt-scale projects have proved that batteries are well-suited to smoothing the variability of power from wind and solar systems over minutes and even hours, for short-duration integration of these renewables into a grid. They also showed that batteries can respond more quickly and accurately than conventional resources such as spinning reserves and peaking plants. As a result, large battery arrays are becoming the stabilization technology of choice for short-duration renewables integration. This is a function of power, not primarily energy storage. The demand for it is much lower than for energy storage – the California ISO estimated its peak frequency regulation demand for 2022 at just over 2000 MW from all sources.

Some battery installations replace spinning reserve for short-duration back-up, so operate as virtual synchronous machines using grid forming inverters.

Smart grids Much discussion of battery storage is in connection with smart grids. A smart grid is a power grid which optimizes power supply by using information on both supply and demand. It does this with networked control functions of devices with communication capabilities such as smart meters.

Lithium-ion batteries in 2015 accounted for 51% of newly-announced energy storage system (ESS) capacity and 86% of deployed ESS power capacity. An estimated 1,653 MW of new ESS capacity was announced around the world in 2015, with just over one-third coming from North America. Lithium-ion batteries are the most popular technology for distributed energy storage systems (Navigant Research). Lithium-ion batteries have a 95% round trip direct current efficiency, falling to 85% when the current is converted to alternating current for the grid. They have a 2000-4000 cycle and 10-20 year lifespan, depending on use.

In the World Energy Outlook 2022, the IEA identifed lithium-ion batteries as the fastest growing storage technology in the world. In its Net Zero Emissions by 2050 Scenario (NZE), battery storage capacity is projected to reach 778 GW by 2030 and 3860 GW by 2050, from 27 GW in 2021.

At household level, behind the meter*, battery storage is being promoted. There is obvious compatibility between solar PV and batteries, due to them being DC. In Germany, where solar PV has an average 10.7% capacity factor, 41% of new solar PV installations in 2015 were equipped with back-up battery storage, compared with 14% in 2014. In 2020 that figure reached 70%, with Germany’s residential storage market representing around 2.3 GWh of installed capacity. This increase, in both household and grid-connected PV systems, is encouraged by the KfW Development Bank, which arranges low-interest government loans and payback assistance covering up to 25% of the required investment outlays. KfW requires that sufficient PV electricity be used for onsite consumption and storage so that no more than half of the output reaches the transmission network. In this way, it is claimed that 1.7 to 2.5 times the usual solar capacity can be tolerated by the grid without overloading.

* Household and small business PV is not part of the distribution system but is essentially domestic to the premises, with much generated power used there and some possibly exported to the system through the meter which originally measured power drawn from the grid to be charged for.

Over one-third of the 1.5 GW ‘battery storage’ in 2015 was lithium-ion batteries, and 22% was sodium-sulfur batteries. The International Renewable Energy Agency (IRENA) estimates that the world needs 150 GW of battery storage to meet IRENA's desired target of 45% of power generated from renewable sources by 2030. In the UK about 2 GW is required for rapid frequency control in a 45 GWe system, and National Grid spends £160 to £170 million per year on this. In Germany, installed utility-scale battery storage increased from about 225 MW in 2017 to 750 MW in 2021.

A large BESS is a 40 MW/20 MWh Toshiba lithium-ion system at the Tohoku Electric Power Company’s Nishi-Sendai substation in Japan, commissioned early in 2015, and San Diego Gas & Electric has a 30 MW/120 MWh lithium-ion BESS in Escondido, California. Also STEAG Energy Services has started a 90 MW lithium-ion storage program in Germany (see below), and Edison is setting up a 100 MW facility in Long Beach, California.

In South Australia a Tesla 100 MW/129 MWh lithium-ion system was installed next to Neoen’s 309 MWe Hornsdale wind farm near Jamestown – the Hornsdale Power Reserve (HPR). About 70 MW of the capacity is contracted to the state government to provide grid stability and system security, including frequency control ancillary services (FCAS) through Tesla's Autobidder platform in timeframes of six seconds to five minutes. The other 30 MW of capacity has three hours of storage, and is used as load shifting by Neoen for the adjacent wind farm. It has proved capable of very rapid response for FCAS, supplying up to 8 MW for about 4 seconds before slower contracted FCAS cut in when frequency dropped below 49.8 Hz. In 2020 the project was expanded by 50 MW/64.5 MWh for A$79 million so that it now provides about half the virtual inertia required in the state for FCAS.

There are several types of lithium-ion battery, some with high energy density and fast charging to suit motor vehicles (EVs), others such as lithium iron phosphate (LiFePO4, abbreviated as LFP), are heavier, less energy-dense and with longer cycle life. Concepts for long-duration storage include repurposing used EV batteries – second-life batteries.

Sodium-sulfur (NaS) batteries have been used for 25 years and are well established, though expensive. They also need to operate at about 300°C, which means some electricity consumption when idle. PG&E’s 2 MW/14 MWh Vaca-Dixon NaS BESS system cost about $11 million ($5500/kW, compared with about $200/kW which PG&E estimated to be break-even cost in 2015). Service life is about 4500 cycles. Round-trip efficiency in an 18-month trial was 75%. A 9.0 MW/20 MWh NaS unit was built as part of a hybrid system by Hitachi for EWE at Varel in Lower Saxony, North Germany and commissioned in 2018. (A 7.5 MW/2.5 MWh lithium-ion battery is the quick-response part of the system, the whole plant costing €24 million.) A 5.8 MWh NaS system was commissioned for BASF at Antwerp in 2021.

Redox flow cell batteries (RFBs) developed in the 1970s have two liquid electrolytes separated by a membrane to give positive and negative half-cells, each with an electrode, usually carbon. The voltage differential is between 0.5 and 1.6 volts in aqueous systems. They are charged and discharged by a reversible reduction-oxidation reaction across the membrane. During the charging process, ions are oxidised at the positive electrode (electron release) and reduced at the negative electrode (electron uptake). This means that the electrons move from the active material (electrolyte) of the positive electrode to the active material of the negative electrode. When discharging, the process reverses and energy is released. The active materials are redox pairs, i.e. chemical compounds that can absorb and release electrons.

Vanadium redox flow batteries (VRFB or V-flow) use the multiple oxidation states of vanadium to store and release charge. They suit large stationary applications, with long life (approx. 15,000 cycles, or 'infinite'), full discharge, and low cost per kWh compared with lithium-ion when cycled daily or more frequently. V-flow batteries become more cost-effective the longer the storage duration – often about four hours – and the larger the power and energy needs. The crossover economic scale is said to be about 400 kWh capacity, beyond which they are more economic than lithium-ion. Also they operate at ambient temperature, so are less prone to fires than lithium-ion. On cost and scale, VRFBs have major grid and industry applications – up to GWh projects rather than MWh ones.

With RFBs energy and power can be scaled separately. The power determines the cell size or the number of cells, and the energy is determined by the amount of the energy storage medium. Modules are up to 250 kW and may be assembled up to 100 MW. This allows redox flow batteries to be better adapted to particular requirements than other technologies. In theory, there is no limit to the amount of energy, and often the specific investment costs decrease with an increase in the energy/power ratio, as the energy storage medium usually has comparatively low costs.

A model 'peaker' plant in China has 100 MWe solar PV with a 100 MW/500 MWh VRFB.

A general finding from the PG&E trial was that if batteries are to be used for energy arbitrage, they should be co-located with the wind or solar farms – often remote from the main load centre. However, if they are to be used for frequency regulation, they are better located close to the urban or industrial load centres. Since the frequency control revenue stream is much better than arbitrage, utilities will normally prefer downtown rather than remote locations for assets they own.

Lithium-ion battery costs have dropped by two-thirds between 2000 and 2015, to about $700/kWh, driven by the vehicle market and a further halving of cost is predicted to 2025.

According to Bloomberg NEF’s annual battery price survey, prices dropped to $141/kWh in 2021 before rising to $151/kWh (in 2022 prices). Power conversion system (PCS) costs have not dropped at the same rate, and in 2015 added about 15% to battery cost for non-vehicle applications. In 2020 PCS costs were $73/kWh.

| Lithium-ion battery materials |

|

As the use of lithium-ion batteries has increased, and the future projections have increased even more, attention has turned to the sources of materials. Lithium is a fairly common element, the majority of mined lithium (about three-quarters) is used for batteries. Most supply comes from Australia, China and South America. See also companion information page on Lithium. Electrode materials of lithium-ion batteries are also in demand, notably cobalt, nickel, manganese and graphite. Graphite is mostly produced in China – 79% of production in 2021 (0.82 million tonnes). Cobalt is mostly mined in the Democratic Republic of the Congo (DRC) – 120,000 tonnes in 2021, followed by Australia (5600 t), Canada (4300 t), China (2200 t), and Philippines (4500 t). Resources are mainly in DRC and Australia. Nickel is produced in many countries, with the resources well spread. Recycling of these materials from old batteries is expensive. |

Lithium-ion batteries may be categorized by the chemistry of their cathodes. The different combination of minerals gives rise to significantly different battery characteristics:

- Lithium nickel cobalt aluminium oxide (NCA) battery – specific energy range (200-250 Wh/kg), high specific power, lifetime 1000 to 1500 full cycles. Favoured in some premium EVs (e.g. Tesla), but more expensive than other chemistries.

- Lithium nickel manganese cobalt oxide (NMC) battery – specific energy range (140-200 Wh/kg), lifetime 1000-2000 full cycles. Most common battery used in electric and plug-in hybrid electric vehicles. Lower energy density than NCA, but longer lifetimes.

- Lithium iron phosphate (LFP) battery – specific energy range (90-140 Wh/kg), lifetime 2000 full cycles. Low specific energy a limitation for use in long-range EVs. Could be favoured for stationary energy storage applications, or vehicles where size and weight of battery are less important. Reported to be less prone to thermal runaway and fires.

- Lithium manganese oxide (LMO) battery – specific energy range (100-140 Wh/kg), lifetime 1000-1500 cycles. Cobalt-free chemistry seen as an advantage. Used in electric bikes and some commercial vehicles.

Supercapacitors

A capacitor stores energy by means of a static charge as opposed to an electrochemical reaction. Supercapacitors are very large and are used for energy storage undergoing frequent charge and discharge cycles at high current and short duration. They have evolved, and cross into battery technology by using special electrodes and electrolyte. They operate at 2.5-2.7 volts and charge in under ten seconds. Discharge is under 60 seconds, and the voltage drops off progressively. The specific energy of supercapacitors ranges up to 30Wh/kg, very much less than a lithium-ion battery.

Rotating synchronous stabilisers

To compensate for the lack of synchronous inertia in generating plant when there is high dependence on wind and solar sources, synchronous condensers (syncons), also known as rotating stabilisers, may be added to the system. They are used for frequency and voltage control where grid stability needs to be enhanced due to a high proportion of variable renewable input. They provide reliable synchronous inertia and can help stabilize frequency deviations by generating and absorbing reactive power. These are not energy storage in the normal sense, and are described in the information page on Renewable Energy and Electricity.

Battery systems worldwide

Europe

Total installed non-hydro storage capacity in Europe reached 2.7 GWh at the end of 2018 and and between 2.8 and 3.3 GWh in 2022. This includes household systems, which comprise more than one-third of 2019-20 additions. EDF plans to have 10 GW of battery storage across Europe by 2035. In March 2020 Total launched a 25 MW/25 MWh lithium-ion battery project at Mardyck near Dunkirk, to be “the largest in France”.

The first of STEAG's six planned 15 MW lithium-ion units in a €100 million, 90 MW programme was energised in June 2016 at its Lünen coal-fired site in Germany. To qualify for commercial operation, the batteries need to respond to automated calls within 30 seconds and be capable of feed-in for a minimum of 30 minutes.

In Germany, RWE has invested €6 million in a 7.8 MW/7 MWh lithium-ion battery system at its Herdecke power station site near Dortmund, where the utility operates a pumped storage plant. It has operated since 2018.

In Germany, a 10 MW/10.8 MWh lithium-ion battery storage system was commissioned in 2015 at Feldheim, Brandenburg. It has 3360 lithium-ion modules from LG Chem in South Korea. The €13 million battery unit stores power generated by a local 72 MW wind farm and was built to stabilise the grid of TSO 50Hertz Transmission. It also participates in the weekly tendering for primary control reserve.

RWE plans a 45 MW lithium-ion battery at its Lingen and a 72 MW one at its Werne Gerstein power plants by end of 2022, mainly for FCAS. Siemens plans a 200 MW/200 MWh battery at Wunsiedel in Bavaria for energy storage and peak management.

Dutch utility Eneco and Mitsubishi, as EnspireME, have installed a 48 MW/50 MWh lithium-ion battery in Jardelund, northern Germany. The battery is to supply primary reserve to the grid and enhance grid stability in a region with many wind turbines and grid congestion problems.

German operators of battery systems which are bid into the primary control reserve market on a weekly basis are reported to have received an average price of €17.8/MWh over 18 months to November 2016.

In Spain Acciona commissioned a wind plant with BESS in May 2017. The Acciona plant is equipped with two Samsung lithium-ion battery systems, one providing 1 MW/390 kWh and the other producing 0.7 MW/700 kWh, connected to a 3 MW wind turbine and on the grid. Both appear to have frequency response as part of their role.

In May 2016 Fortum in Finland contracted French battery company Saft to supply a €2 million megawatt-scale lithium-ion battery energy storage system for its Suomenoja power plant as part of the largest ever BESS pilot project in the Nordic countries. It will have a nominal output of 2 MW and able to store 1 MWh of electricity, to be offered to the TSO for frequency regulation and output smoothing. It is similar to the system operating in the Aube region of France, linking two wind farms, total 18 MW. Saft has deployed over 80 MW of batteries since 2012.

In the UK, battery storage was 2.4 GW/2.6 GWh by the end of 2022. A further 20.2 GW was approved, including 33 sites of 100 MW or more. Renewables energy company RES provides 55 MW of dynamic frequency response from lithium-ion battery storage, to National Grid.

In March 2020 Finland’s Wartsila won a contract to supply two 50 MW lithium-ion batteries to EDF’s Pivot Power as it embarks upon a 2 GW storage programme for a network of grid-scale batteries for ancillary grid services and electric vehicle charging. A third 50 MW battery at Southampton is from Downing LLP. EDF Energy Renewables has a 49 MW battery storage project for National Grid at EDF Energy’s West Burton site in North Yorkshire.

UK undersecretary of state for energy Amber Rudd visits the Leighton Buzzard facility in 2014 (UK Power Networks)

In Northern Ireland, US generator AES has completed a 10 MW/5 MWh energy storage array at its Kilroot power station in Carrickfergus. The system consists of over 53,000 lithium-ion batteries arranged in 136 separate nodes with control system which responds to grid changes in under a second. It is the largest advanced energy storage system in the United Kingdom and Ireland, and the only such system at transmission scale according to AES. The company wants to build the storage array up to 100 MW, providing £8.5 million in system savings per annum “by displacing out of merit thermal back up plant and facilitating fuller integration of existing renewables,” it said.

In the UK, on the Orkney Islands, a 2 MW/500 kWh lithium-ion battery storage system is operating. This Kirkwall power station uses Mitsubishi batteries in two 12.2m shipping containers, and stores power from wind turbines.

In Somerset, Cranborne Energy Storage has a 250 kW/500 kWh Tesla Powerpack lithium-ion storage system associated with a 500 kW solar PV set-up. Tesla claims that the powerpacks can be configured to provide power and energy capacity to the grid as a standalone asset, offering frequency regulation, voltage control, and spinning reserve services. The standard Tesla Industrial Powerpack unit is 50 kW/210 kWh, with 88% round-trip efficiency.

In the UK, Statoil has commissioned the design of a 1 MWh lithium-ion battery system, Batwind, as onshore storage for the 30 MW offshore Hywind project at Peterhead, Scotland. From 2018 it is to store excess production, reduce balancing costs, and allow the project to regulate its own power supply and capture peak prices through arbitrage.

North America

In November 2016 Pacific Gas & Electricity Co (PG&E) reported on an 18-month technology demonstration project to explore the performance of battery storage systems participating in California’s electricity markets. The project began in 2014 and utilized PG&E’s 2 MW/14 MWh Vaca-Dixon and 4 MW Yerba Buena sodium-sulfur battery storage systems to provide energy and ancillary services in California Independent System Operator (CAISO) markets and controlled by CAISO in that wholesale market. The $18 million Yerba Buena BESS Pilot Project was set up by PG&E in 2013 with $3.3 million support from the California Energy Commission. Vaca-Dixon BESS is associated with a PG&E solar plant in Solano County.

The PG&E report showed that batteries were still far from cost-effective, even assuming a 20-year battery life. Used for energy arbitrage (charging when price was low and discharging when price high), the 6 MWe set-up barely covered operating expenses. The margin achieved in cost of power arbitrage was consumed by the 25% power lost between cycles due to charging and discharging inefficiencies and the energy required to keep the batteries at operating temperature (300°C). The optimum use of the BESS was confirmed as frequency regulation, with batteries maintained half-charged and ready to charge or discharge as required to compensate for mismatches between generation and load. Response time is very rapid, and hence very valuable to CAISO (or any TSO). When used entirely for frequency control the 2 MW storage netted almost $35,000 per month – better than alternative uses, but still low payback for $11 million investment. Operational control proved extremely complex. PG&E reported to the California Assembly: "With California Assembly Bill 2514 and its requirements that utilities procure 1.3 gigawatts of energy storage, California ratepayers could expect to pay billions of dollars for the deployment and operations of these resources.”

In 2017, PG&E will utilize the Yerba Buena battery for another technology demonstration involving the coordination of third-party distributed energy resources (DERs) – such as residential and commercial solar – using smart inverters and battery storage, controlled through a distributed energy resource management system (DERMS).

In August 2015 GE was contracted to build a 30 MW/20 MWh lithium ion battery storage system for Coachella Energy Storage Partners (CESP) in California, 160 km east of San Diego. The 33 MW facility was completed by ZGlobal in November 2016 and will aid grid flexibility and increase reliability on the Imperial Irrigation District network by providing solar ramping, frequency regulation, power balancing and black start capability for an adjacent gas turbine.

San Diego Gas & Electric has a 30 MW/120 MWh lithium-ion BESS in Escondido, built by AES Energy Storage and consisting of 24 containers housing 400,000 Samsung batteries in almost 20,000 modules. It will supply evening peak demand, and partly replaces the Aliso Canyon gas storage 200 km north which had to be abandoned early in 2016 due to a massive leak. (It was used for peak-load gas generation.)

SDG&E's 30MW battery storage facility in Escondido, California. (Photo: San Diego Gas & Electric)

Southern California Edison is building a 100 MW/400 MWh battery installation to commission in 2021, comprising 80,000 lithium-ion batteries in containers. Another big SCE project proposed is a 20 MW/80 MWh storage for AltaGas Pomona Energy at its San Gabriel natural gas-fired plant.

A large project is Southern California Edison’s $50 million Tehachapi 8 MW/32 MWh lithium-ion battery storage project in conjunction with a 4500 MWe wind farm, using 10,872 modules of 56 cells each from LG Chem, which can supply 8 MW over four hours. In 2016 Tesla contracted to supply a 20 MW/80 MWh lithium-ion battery storage system for Southern California Edison’s Mira Loma substation, to help meet daily peak demand.

A very large battery system has been approved for Vistra’s gas-fired Moss Landing power plant in Monterey County, California. The site comprises of 256 Tesla 3 MWh Megapack units providing 182.5 MW/730 MWh. The system is upgradeable, with the contract between Tesla and PG&E suggesting that the battery could be ramped to 1.1 GWh in the future.

The 98 MW Laurel Mountain wind farm in West Virginia employs a multi-use 32 MW/8 MWh grid-connected BESS. The plant is responsible for frequency regulation and grid stability in the PJM market as well as arbitrage. The lithium-ion batteries were made by A123 Systems, and when commissioned in 2011 it was the largest lithium-ion BESS in the world.

In December 2015 EDF Renewable Energy commissioned its first BESS project in North America, with 40 MW flexible (20 MW nameplate) capacity on the PJM grid network in Illinois to participate in the regulation and capacity markets. The lithium-ion batteries and power electronics were supplied by BYD America, and consist of 11 containerized units totaling 20 MW. The company has more than 100 MW of storage projects under development in North America.

E.ON North America is installing two 9.9 MW short-duration lithium ion battery systems for its Pyron and Inadale wind farms as Texas Waves storage projects in West Texas. The purpose is mainly for ancillary services. The project follows 10 MW Iron Horse near Tucson, Arizona, adjacent to a 2 MWe solar array.

SolarCity is using 272 Tesla Powerpacks (lithium-ion storage system) for its 13 MW/ 52 MWh Kaua’i Island solar PV project in Hawaii, to meet evening peak demand. Power is supplied to Kauai Island Utility Cooperative (KIUC) at 13.9 cents/kWh for 20 years. KIUC is also commissioning a project with a 28 MWe solar farm and 20 MW/100 MWh battery system.

Toshiba has supplied a large BESS for Hamilton, Ohio, comprising an array of 6 MW/ 2 MWh lithium-ion batteries. Lifetime of over 10,000 charge-discharge cycles is claimed.

Powin Energy and Hecate Energy are building two projects totalling 12.8 MW/52.8 MWh in Ontario, for the Independent Electricity System Operator. Powin’s Stack 140 battery array of 2 MWh will comprise the systems, at Kitchener (20 arrays) and Stratford (6 arrays).

A large utility-scale electricity storage is a 4 MW sodium-sulfur (NaS) battery system to provide improved reliability and power quality for the city of Presidio in Texas. It was energized early in 2010 to provide rapid back-up for wind capacity in the local ERCOT grid. Sodium-sulfur batteries are widely used elsewhere for similar roles.

In Anchorage, Alaska, a 2 MW/0.5 MWh battery system is complemented by a flywheel, to assist use of wind power.

Avista Corp in Washington state, northwest USA, is purchasing a 3.6 MW vanadium redox flow battery (VRFB) to load balance with renewables.

Ontario's ISO has contracted a 2 MW zinc-iron redox flow battery from ViZn Energy Systems.

East Asia

China's National Development and Reform Commission (NDRC) called for multiple 100 MW vanadium redox flow battery (VRFB) installations by the end of 2020 (as well as a 10 MW/100 MWh supercritical compressed air energy storage system, a 10 MW/1000 MJ grade flywheel energy storage array unit, 100 MW lithium-ion battery energy storage systems, and a new type of large-capacity molten salt storage device).

In September 2022 China connected 100 MW of vanadium redox flow battery (VRFB) capacity. The second phase of the project is expected to double the full capacity to 200 MW.

Rongke Power installed a 200 MW/800 MWh VRFB at Dalian, China, claiming it to be the world's largest. It is to meet peak demand, reduce curtailment from nearby wind farms, enhance grid stability. It was connected to the grid in September 2022, initially at 100 MW, but should reach 200 MW in the second phase of the project. Rongke plans 2 GW/yr factory output in the 2020s. Pu Neng in Beijing is planning large-scale production of VRFBs, and was awarded a contract in November 2017 to build a 400 MWh unit. Sumitomo supplied a 15MW/60 MWh VRFB for Hepco in Japan, commissioned in 2015.

China's VRB Energy is developing several flow cell battery projects: Qinghai province, 2 MW/10 MWh for wind integration; Hubei province, 10 MW/50 MWh PV integration growing to 100 MW/500 MWh; Lianlong province, 200 MW/800 MWh renewables integration; Jiangsu 200 MW/1000 MWh offshore wind integration.

Hokkaido Electric Power has contracted Sumitomo Electric Industries to supply a grid-scale flow battery energy storage system for a wind farm in northern Japan. This will be a 17 MW/51 MWh vanadium redox flow battery (VRFB) capable of three hours storage, due online in 2022 at Abira, with design life of 20 years. Hokkaido already operates a 15 MW/60 MWh VRFB also constructed by Sumitomo Electric, in 2015.

In November 2022 CNNC began construction of China’s first nuclear generation-supported pumped hydro storage project to be powered by the six reactors under construction at Zhangzhou. The project is expected to be completed by 2028.

Australia

In South Australia, the Hornsdale Power Reserve is a Tesla 150 MW/194 MWh lithium-ion system next to Neoen’s 309 MWe Hornsdale wind farm near Jamestown. About 70 MW of the capacity is contracted to the state government to provide grid stability and system security, including frequency control ancillary services (FCAS). Fuller details in the Battery energy storage systems section above.

In Victoria, Neoen is building the 300 MW/450 MWh Victorian Big Battery near Geelong. Neoen has a 250 MW grid services contract with the Australian Energy Market Operator (AEMO) to assist in grid stability and “unlock more renewable energy” with FCAS. Tesla has been contracted to supply and operate the system, consisting of 210 Tesla Megapacks, expected online by 2022. During initial testing at the end of July 2021, one of the Tesla Megapacks caught fire.

Neoen has built a 20 MW/34 MWh battery supplementing a 196 MWe wind farm at Stawell in Victoria, for the Bulgana Green Power Hub.

In Victoria a 30 MW/30 MWh battery supplied by Fluence is near Ballarat, and at Gannawarra near Kerang since 2018 a 25 MW/50 MWh Tesla Powerpack battery is integrated with a 50 MWe solar farm.

In South Australia a 330 MWe solar PV plant is proposed by the Lyon Group, the Riverland Solar Storage scheme at Morgan, to be backed up by a 100 MW/400 MWh battery, with cost estimate at $700 million and $300 million respectively. Near the Olympic Dam mine in the north of the state, the 120 MW solar PV plus 100 MW/200 MWh battery Kingfisher project is proposed by the Lyon Group, likely costs being $250 million and $150 million respectively.

AGL has contracted Wärtsilä to supply a 250 MW/250 MWh lithium iron phosphate (LFP) battery at Torrens Island gas-fired power plant near Adelaide for use from 2023. It may be expanded to 1000 MWh.

The 100 MW/100 MWh Playford big battery is planned in South Australia in conjunction with the Cultana 280 MWe solar PV project to serve Arrium’s Whyalla steelworks.

Australia’s first utility-scale flow battery is to be built at Neuroodla, 430 km north of Adelaide. It will be supplied by Invinity and have 2 MW/8 MWh capacity to provide evening peak supplement and ancillary services, being charged by a 6 MW solar array. Individual VRFB modules are 40 kW.

In Queensland at Wandoan South a 100 MW/150 MWh battery is being installed for Vena Energy.

In Queensland, near Lakeland, south of Cooktown, a 10.4 MW solar PV plant is to be supplemented with 1.4 MW/5.3 MWh of lithium-ion battery as edge of grid set-up, with island mode during evening peak. It will use the Conergy Hybrid Energy Storage Solution plant, and is due online in 2017. The A$42.5 million project will reduce the need for grid upgrade. BHP Billiton is involved with the project as possible prototype for remote mine sites. Other such systems are at Degrussa and Weipa mines.

In northwest Australia, a 35 MW/11.4 MWh Kokam lithium-ion battery has been operating since September 2017 on a private grid serving mines, alongside a 178 MWe gas-fired plant with slow response. It has helped with frequency control and stabilising the small grid. With the proposed addition of 60 MWe of solar capacity, a second battery is envisaged.

At Tom Price in the Pilbara a 45 MW/12 MWh battery functions as a virtual synchronous machine, replacing spinning reserve in gas turbines. A 50 MW/75 MWh Hitachi battery is also being installed. A 35 MW/12 MWh battery already operates nearby at Mount Newman.

Other countries

In Rwanda, 2.68 MWh of battery storage from Germany’s Tesvolt is contracted to provide back-up power for agricultural irrigation, off-grid, using Samsung lithium-ion cells in 4.8 kWh modules. Tesvolt claims 6000 full charge cycles with 100% depth of discharge over 30 years of service life.

Other battery technologies (than lithium-ion)

NB Vanadium flow batteries and sodium-sulfur batteries are described in the Battery energy storage systems section above.

RedFlow has a range of zinc bromide flow battery modules (ZBM) which can be installed in connection with intermittent supply and are capable of daily deep discharge and charge. They are more durable than lithium-ion type, and expected energy throughput for smaller ZBM units ranges to 44 MWh. Large-scale battery (LSB) units comprise 60 ZBM-3 batteries that deliver peak 300 kW, continuous 240 kW, at 400-800 volts and supply 660 kWh.

Eos Energy Storage in the USA uses its Znyth aqueous zinc battery with a zinc hybrid cathode, and optimised for utility grid support, providing 4 to 6 hours continuous discharge. It comprises 4 kWh units making up 250 kW/1 MWh subsystems and a 1 MW/4 MWh full system. In September 2019 Eos and Holtec International announced the formation of Hi-Power, a joint venture to mass produce aqueous zinc batteries for industrial-scale energy storage, including the storage of surplus power from Holtec's SMR-160 small modular reactors, to deliver power to the grid during peak demand.

Duke Energy is testing a hybrid ultracapacitor-battery storage system (HESS) in North Carolina, close to a 1.2 MW solar installation. The 100 kW/300 kWh battery uses aqueous hybrid ion chemistry with salt water electrolyte and synthetic cotton separator. The rapid-response ultracapacitors smooth the load fluctuations.

Lower-cost lead-acid batteries are also in widespread use at small utility scale, with banks of up to 1 MW being used to stabilise wind farm power generation. These are much cheaper than lithium-ion, some are capable of up to 4000 deep discharge cycles, and they can be fully recycled at end of life. The Ecoult UltraBattery combines a valve-regulated lead-acid (VRLA) battery with an ultracapacitor in a single cell, giving high-rate partial-state-of-charge operation with longevity and efficiency. A 250 kW/1000 kWh UltraBattery system with 1280 Ecoult batteries was commissioned in September 2011 at the PNM Prosperity Energy Storage Project at Albuquerque, New Mexico, by S&C Electric in connection with a 500 kW solar photovoltaic system, primarily for voltage regulation. Australia’s largest lead-acid battery storage system is 3 MW/1.5 MWh on King Island.

Aluminium-air batteries are not really batteries in that they cannot be recharged but need to be changed over where they are installed. But they employ an electrolyte in which aluminium ions from the anode are oxidized and energy is released. The oxygen comes through a catalyst-enhanced carbon cathode. Aluminium oxide is retained and can be recovered when the anode is replaced or the whole battery is recycled. They have a much better energy density than lithium-ion batteries, at 1.35 kWh/kg in practice, 2 kWh/kg projected, or 8 kWh/kg theoretical. Power is 200 W/kg. A 90-second battery swap is claimed for 5 kg units. The battery in some sense reverses the 14 kWh/kg input to smelting aluminium from aluminium oxide. The main components are plentiful and inexpensive. But they are high cost – $30/kW. They give a car much longer range than lithium-ion batteries. Technical problems remain, particularly removing the aluminium oxide from the anode, developing alloys for anodes, assessing aqueous alkaline against non-aqueous electrolytes, and developing cathode materials and membranes.

Stanford University and others are developing an aluminium-ion battery, claiming low cost, low flammability and high-charge storage capacity over 7500 cycles. It is rechargeable and has an aluminium anode and graphite cathode, with salt electrolyte, but produces only low voltage. Stanford’s Al-ion technology with natural graphite delivers 68.7 Wh/kg and 41 W/kg, but the Graphene Manufacturing Group (CMG) type using graphene delivers 150 Wh/kg and 7 kW/kg.

Household-scale BESS

In May 2015 Tesla announced a household battery storage unit of 7 or 10 kWh for storing electricity from renewables, using lithium-ion batteries similar to those in Tesla cars. It will deliver 2 kW and works at 350-450 volts. The Powerwall system would be sold to installers at $3000 for a 7 kWh unit or $3500 for 10 kWh, though the latter option was promptly discontinued and the former downrated to 6.4 kWh storage and 3.3 kW power. While this is clearly domestic-scale, if widely taken up it will have grid implications. Tesla claims 15 c/kWh to utilize the storage, plus the cost of that renewable energy initially, with 10-year, 3650-cycle warranty covering diminishing output to 3.8 kWh at year five, 18,000 kWh total.

In the UK, Powervault supplies diverse batteries for household use, mainly with solar PV but also with a view to savings with smart meters. Its 4 kWh lead-acid battery is the most popular product at £2900 installed, although the actual batteries need replacing every five years. A 4 kWh lithium-ion unit costs £3900 installed, and other products range from 2 to 6 kWh, costing up to £5000 installed.

In April 2017 LG Chem was offering a range of batteries in North America, both low- and high-voltage. It has 48-volt batteries with 3.3, 6.5 and 9.8 kWh, and 400-volt batteries with 7.0 and 9.8 kWh.

Domestic-level lithium-ion BESS may be subject to fire restrictions which disallow the units being attached to the walls of a dwelling.

Compressed air energy storage

Energy storage with compressed air (CAES) in geological caverns or old mines is being trialled as a relatively large-scale storage technology, using gas-fired or electric compressors, the adiabatic heat being dumped (this being the diabatic system). When released (with preheating to compensate for adiabatic cooling) it powers a gas turbine with additional fuel burn, the exhaust being used for preheating. If the adiabatic heat from compression is stored and used later for preheating, the system is adiabatic CAES (A-CAES).

CAES installations can be up to 300 MW, with overall about 70% efficiency. CAES capacity can even out the production from a wind farm or 5-10 MW of solar PV capacity and make it partly dispatchable. Two diabatic CAES systems are in operation, in Alabama (110 MW, 2860 MWh) and Germany (290 MW, 580 MWh), and others trialled or developed elsewhere in the USA.

Batteries have better efficiency than CAES (output as proportion of input electricity) but they cost more per unit of capacity, and CAES systems can be much larger.

Duke Energy and three other companies are developing a 1200 MW, $1.5 billion project in Utah, ancillary to a 2100 MW wind farm and other renewable sources. This is the Intermountain Energy Storage Project, using salt caverns. It is targeting 48-hour duration for discharge to bridge intermittency gaps, hence apparently over 50 GWh. The site may also store surplus solar power transmitted from Southern California. It is to be built in four 300 MW stages.

Gaelectric Energy Storage plans a 550 GWh/yr CAES project at Larne, Northern Ireland.

In the USA the Gill Ranch CAES project is being adapted to be a compressed gas energy storage (CGES) plant, with natural gas rather than air being stored under pressure. The gas is stored at about 2500 psi and 38°C. Expansion to pipeline pressure of 900 psi requires preheating to avoid liquid water and hydrate formation.

Toronto Hydro with Hydrostor has a pilot project using compressed air in bladders 55m underwater in Lake Ontario to yield 0.66 MW over one hour.

Cryogenic storage

The technology works by cooling air down to -196°C, at which point it turns to liquid for storage in insulated low-pressure tanks. Exposure to ambient temperatures causes rapid re-gasification and 700-fold expansion in volume, used to drive a turbine and create electricity without combustion. Highview Power in the UK plans a commercial-scale 50 MW/250 MWh 'liquid air' facility at a disused power plant site, based on a pilot plant in Slough and a demonstration plant near Manchester. Energy can be stored for weeks (instead of hours as for batteries) at a projected levelized cost of £110/MWh ($142/MWh) for a 10-hour, 200 MW/2 GWh system.

Thermal storage

As described in the solar thermal subsection of the WNA Renewable Energy paper, some CSP plants use molten salt to store energy overnight. Spain's 20 MWe Gemasolar claims to be the world's first near base-load CSP plant, with 63% capacity factor. Spain's 200 MWe Andasol plant also uses molten salt heat storage, as does California's 280 MWe Solana.

One molten salt reactor (MSR) developer, Moltex, has put forward a molten salt heat storage concept (GridReserve) to supplement intermittent renewables. Moltex suggests a 1000 MWe Stable Salt Reactor running continuously, diverting heat at about 600°C in periods of low demand to nitrate salt storage (as used in solar CSP plants). During periods of high demand, power output can be doubled to 2000 MWe using the stored heat for up to eight hours. It is claimed that the heat store adds only £3/MWh to the levelised cost of electricity.

Another form of heat storage is being developed in South Australia, where the 1414 Company (14D) is using molten silicon. The process can store 500 kWh in a 70 cm cube of molten silicon, about 36 times as much as Tesla’s Powerwall in much the same space. It discharges through a heat-exchange device such as a Stirling engine or a turbine and recycles the heat. A 10 MWh unit would cost about A$ 700,000. (1414 °C is the melting point of silicon.) A demonstration TESS is to be at Aurora solar energy project near Port Augusta, South Australia.

Also in Australia, a blended material called misicibility gap alloy (MGA) stores energy in the form of heat. MGA comprises small blocks of blended metals, which receive energy generated by renewables such as solar and wind that is surplus to grid demand and store it for up to a week. A cost of $35/kWh is quoted, much less than lithium-ion batteries, but it has a slower response time than batteries – 15 minutes. The heat is released to generate steam, potentially in repurposed coal-fired plants. The company MGA Thermal was spun off from the University of Newcastle and using a federal grant is building a pilot manufacturing plant. It has several systems being developed for temperatures from 200°C to 1400°C.

Another form of energy storage is ice. Ice Energy has contracts from Southern California Edison to provide 25.6 MW of thermal energy storage using its Ice Bear system, attached to large air conditioning units. This makes ice at night when power demand is low, then uses it to provide cooling during the day instead of the air conditioning compressors, thus reducing peak demand.

Hydrogen storage

In Germany Siemens has commissioned a 6 MW hydrogen storage plant using proton exchange membrane (PEM) technology to convert excess wind power to hydrogen, for use in fuel cells or added to natural gas supply. The plant in Mainz is the largest PEM installation in the world.In Ontario, Hydrogenics partnered with German utility E.ON to create a 2 MW PEM facility that came on line in August 2014, turning water into hydrogen through electrolysis.

The efficiency of electrolysis to fuel cell to electricity is around 50%.

San Diego Gas & Electric is working with Israeli GenCell to install 30 GenCell G5rx back-up fuel cells at its substations. These are hydrogen-based alkaline fuel cells with 5 kW output. They are made in Israel, and used there by Israel Electric Corporation.

In November 2022 the UK government awarded £7.7 million in funding – from the £1 billion Net Zero Innovation Portfolio – to an EDF Energy-led consortium, including the University of Bristol, UK Atomic Energy Authority (UKAEA), and Urenco Group, towards the development of a hydrogen-uranium storage solution in the UK.

Kinetic storage

Flywheels store kinetic energy and are capable of tens of thousands of recharging cycles.

Ontario’s ISO has contracted for a 2 MW flywheel storage system from NRStor Inc. Hawaiian Electric Co is installing an 80 kW/320 kWh flywheel system from Amber Kinetics for its Oahu grid, this being one module potentially of several. Normally flywheels, storing kinetic energy ready to turn back into electricity, are used for frequency control rather than energy storage, they deliver energy over a relatively short period and can each supply up to 150 kWh. Amber Kinetics claims four-hour discharge capability.

Germany’s Stornetic manufactures DuraStor units which have capacities from the tens of kilowatts up to about a megawatt. Applications range from regenerative braking for trains to wind farm ancillary services.

The principal use of flywheels is in diesel rotary uninterrupted power supply (DRUPS) set-ups, with 7-11 second ride-through synchronous function during start-up of an integrated diesel generator following mains supply failure. This gives time – e.g. 30 seconds – for normal diesel back-up to start. The flywheel is otherwise storing energy.

The US Department of Energy's Global Energy Storage database has more information.

Notes & references

Jeffrey Michel, Germany sets a new solar storage record, Energy Post, 18 July 2016

Todd Kiefer, CAISO Battery Storage Trial, Transmission & Distribution World, 21 November 2016

World's largest battery: 200 MW/800 MWh vanadium flow battery – site work ongoing, Electrek, 21 December 2017

John Petersen, CAISO Data Highlights Critical Flaws In The Evolving Renewables Plus Storage Mythology, Seeking Alpha, 6 May 2019

Redox flow batteries for renewable energy storage, Energy Storage News, 21 January 2020

Grigorii Soloveichik, ARPA-E (US Department of Energy), Ammonia as Virtual Hydrogen Carrier (November 2016)

International Energy Agency (IEA) and Nuclear Energy Agency (NEA), Projected Costs of Generating Electricity 2020

Related information

Renewable Energy and ElectricityElectricity Transmission Systems