Russia's Nuclear Fuel Cycle

- A significant increase in uranium mine production is planned.

- There is increasing international involvement in parts of Russia's fuel cycle.

- A major Russian political and economic objective is to increase exports, particularly for front-end fuel cycle services through Tenex, as well as nuclear power plants.

Russia uses about 5500 tonnes of natural uranium per year.

There is high-level concern about the development of new uranium deposits, and a Federal Council meeting in April 2015 agreed to continue the federal financing of exploration and estimation works in Vitimsky Uranium Region in Buryatia. It also agreed to financing construction of the engineering infrastructure of Mine No. 6 of Priargunsky Industrial Mining and Chemical Union (PIMCU). The following month the Council approved key support measures including the introduction of a zero rate for mining tax and property tax; simplification of the system of granting subsoil use rights; inclusion of the Economic Development of the Far East and Trans-Baikal up to 2018 policy in the Federal Target Program; and the development of infrastructure in Krasnokamensk.

In June 2015 Rosgeologia signed a number of agreements to expedite mineral exploration in Russia, including one with Rosatom. It was established in July 2011 by presidential decree and consists of 38 enterprises located in 30 regions across Russia, but uranium is a minor part of its interests.

Uranium resources and mining

Russia has substantial economic resources of uranium, with about 9% of world reasonably assured resources plus inferred resources up to $130/kg – 505,900 tonnes U (2014 Red Book). Rosatom reported ARMZ resources as 517,000 tU in September 2015, mostly requiring underground mining. Historic uranium exploration expenditure is reported to have been about $4 billion. The Federal Natural Resources Management Agency (Rosnedra) reported that Russian uranium reserves grew by 15% in 2009, particularly through exploration in the Urals and Kalmykia Republic, north of the Caspian Sea.

Uranium production has varied from 2870 to 3560 tU/yr since 2004, and in recent years has been supplemented by that from Uranium One Kazakh operations, giving 7629 tU in 2012. In 2006 there were three mining projects in Russia, since then others have been under construction and more projected, as described below. Cost of production in remote areas such as Elkon is said to be US$ 60-90/kg. Spending on new ARMZ domestic projects in 2013 was RUR 253.5 million, though in November 2013 all Rosatom investment in mining expansion was put on hold due to low uranium prices.

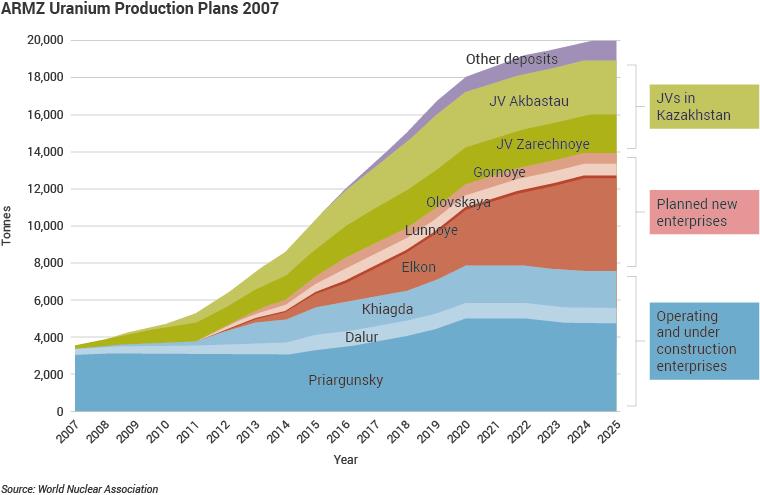

Plans announced in 2006 for 28,600 t/yr U3O8 output by 2020, 18,000t of this from Russia* and the balance from Kazakhstan, Ukraine, Uzbekistan and Mongolia have since taken shape, though difficulties in starting new Siberian mines makes the 18,000 t target unlikely. Three uranium mining joint ventures were established in Kazakhstan with the intention of providing 6000 tU/yr for Russia from 2007: JV Karatau, JV Zarechnoye and JV Akbastau (see below and Kazakhstan paper).

* See details for April 2008 ARMZ plans. In 2007 TVEL applied for the Istochnoye, Kolichkanskoye, Dybrynskoye, Namarusskoye and Koretkondinskoye deposits with 30,000 tU in proved and probable reserves close to the Khiagda mine in Buryatia.

From foreign projects: Zarechnoye 1000 t, Southern Zarechnoye 1000 t, Akbastau 3000 t (all in Kazakhstan); Aktau (Uzbekistan) 500 t, Novo-Konstantinovskoye (Ukraine) 2500 t. In addition Russia would like to participate in development of Erdes deposit in Mongolia (500t) as well as in Northern Kazakhstan deposits Semizbai (Akmolonsk Region) and Kosachinoye.

*(this chart is now slightly out of date but still gives a general picture)

AtomRedMetZoloto (ARMZ) is the state-owned company which took over Tenex and TVEL uranium exploration and mining assets in 2007-08, as a subsidiary of Atomenergoprom (79.5% owned). It inherited 19 projects with a total uranium resource of about 400,000 tonnes, of which 340,000 tonnes are in Elkonskiy uranium region and 60,000 tonnes in Streltsovskiy and Vitimskiy regions. The rights to all these resources had been transferred from Rosnedra, the Federal Agency for Subsoil Use under the Ministry of Natural Resources and Environment.

JSC ARMZ Uranium Holding Company (as it is now known) became the mining division of Rosatom in 2008, responsible for all Russian uranium mine assets and also Russian shares in foreign joint ventures. In 2008, 78.6% of JSC Priargunsky, all of JSC Khiagda and 97.85% of JSC Dalur was transferred to ARMZ. In March 2009 the Federal Financial Markets Service of Russia registered RUR 16.4 billion of additional shares in ARMZ placed through a closed subscription to pay for uranium mining assets, on top of a RUR 4 billion issued in mid 2008 to pay for the acquisition of Priargunsky, Khiagda and Dalur. In November 2009 SC Rosatom paid a further RUR 33 billion for ARMZ shares, increasing its equity to 76.1%.

In 2009 and 2010 ARMZ took a 51% share in Canadian-based Uranium One Inc, paying for this with $610 million in cash and by exchange of assets in Kazakhstan: 50% of JVs Akbastau, Karatau and Zarechnoye, mining the Budenovskoye and Zarechnoye deposits. (An independent financial advisor put the value of ARMZ's stakes in the Akbastau and Zarechnoye JVs at $907.5 million.) Uranium One has substantial production capacity in Kazakhstan, including now those two mines with Karatau, Akdala, South Inkai and Kharasan, as well as small prospects in USA and Australia (sold in 2015). In 2013 ARMZ completed the purchase of outstanding shares in Uranium One Inc, and it became a full subsidiary of ARMZ. JSC Uranium One Group (U1 Group) is from December 2016 a 78.4% owned subsidiary of Atomenergoprom and apparently separate from ARMZ.

Following this, late in 2013 Rosatom established Uranium One Holding NV (U1H) as its global growth platform for all international uranium mining assets belonging to Russia, with headquarters in Amsterdam. It lists assets in Kazakhstan, USA and Tanzania, as well as owning and managing Rosatom’s stake in Uranium One Inc. In 2013 it accounted for 5086 tU production at average cash cost of $16/lb U3O8, and reported 229,453 tU measured, indicated and inferred resources (attributable share). In 2014 it produced 4857 tU and listed resources of 177,000 tU. The company plans to extend its interests into rare earths. Its ‘strategic partner’ is JSC NAC Kazatomprom.

ARMZ remains responsible for uranium mining in Russia. At the end of 2013 it was 82.75% owned by Rosatom and 17.25% TVEL. Exploration expenditure has nearly doubled in two years to about US$ 52 million in 2008. In 2013 the government approved an exploration budget of RUR 14 billion ($450 million) through to 2020, principally in the Far East and Northern Siberia. Deposits suitable for ISL mining will be sought in the Transurals, Transbaikal and Kalmykyia. Other work will be in the Urals, Siberian, Far East Federal Districts (Zauralsky, Streltsovsky, Vitimsky and Vostochno-Zabaikalsky, and Elkonsky ore regions).

Rosgeologia, the Russian state-run geological exploration services company set up in 2011, has identified "promising" uranium deposits in the North-West Federal District of Russia following completion of a survey of the Kuol-Panayarvinskaya area on the border of the Murmansk region and the Republic of Karelia. It signed an agreement with Rosatom in 2015 to focus on uranium.

CJSC Rusburmash (RBM) is the exploration subsidiary of ARMZ. VNIPIPT is the subsidiary responsible for R&D and engineering of mining and processing plants.

In December 2010 ARMZ made a $1.16 billion takeover bid for Australia's Mantra Resources Ltd with a prospective Mkuju River project in southern Tanzania, which was expected in production about 2013 at 1400 tU/yr, but is now deferred. This is now under U1H.

Domestic mining

In 2009 the government accepted Rosatom’s proposal for ARMZ and Elkonsky Mining and Metallurgical Combine to set up the “open-type joint stock company” EGMK-Project. The state’s contribution through Rosatom to the EGMK-Project authorized capital will be RUR 2.657 billion, including RUR 2.391 billion in 2009 and RUR 0.266 billion in 2010. EGMK-Project is being set up to draw up the project and design documentation for Elkonsky Mining and Metallurgical Combine (see below).

The Russian Federation’s main uranium deposits are in four districts:

- The Trans-Ural district in the Kurgan region between Chelyabinsk and Omsk, with the Dalur ISL mine.

- Streltsovskiy district in the Transbaikal or Chita region of SE Siberia near the Chinese and Mongolian borders, served by Krasnokamensk and with major underground mines.

- The Vitimsky district in Buryatia about 570 km northwest of Krasnokamensk, with the Khiagda ISL mine.

- The more recently discovered remote Elkon district in the Sakha Republic (Yakutia) some 1200 km north-northeast of the Chita region.

Present production by ARMZ is principally from the Streltsovskiy district, where major uranium deposits were discovered in 1967, leading to large-scale mining, originally with few environmental controls. These are volcanogenic caldera-related deposits. Krasnokamensk is the main town serving the mines.

In 2008 ARMZ said that it intended to triple production to 10,300 tU per year by 2015, with some help from Cameco, Mitsui and local investors. ARMZ planned to invest RUR 203 billion (US$ 6.1billion) in the development of uranium mining in Russia in 2008-2015. It aimed for 20,000 tU per year by 2024. Total cost was projected at RUR 67 billion ($2 billion), mostly at Priargunsky, with RUR 4.8 billion ($144 million) there by end of 2009 including a new $30 million, 500 tonne per day sulfuric acid plant commissioned in 2009, replacing a 1976 acid plant.

Russian uranium mining

| Production centre | Region | First production | Orebody | Known resources: tU | Capacity: tU/yr |

|---|---|---|---|---|---|

| Priargunsky | Transbaikal/Chita | 1968 | volcanic | 95,700 @ 0.16% | 3000 |

| Dalur | Trans-Ural/Kurgan | 2004 | sandstone | 7,400 @ 0.04% | 700 |

| Khiagda | Buryatia, Vitimsky | 2010 | sandstone | 29,900 @ 0.05% | 1000 |

| Gornoye | Transbaikal/Chita | deferred | granite, vein | 3,200 @ 0.20% | 300 |

| Olovskaya | Transbaikal/Chita | deferred | volcanic | 8,210 @ 0.072% | 600 |

| Elkon | Yakutia/Sakha | (2020) | metasomatite | 303,600 @ 0.15% | 5000 |

| Lunnoye | Yakutia/Sakha | (2016?) | polymetallic | 800 | 100 with gold |

Source: 2016 ‘Red Book’ except Olovskaya and Lunnoye.

Russian uranium production, tonnes U

| Production centre | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|

| Priargunsky | 2011 | 2133 | 1970 | 1977 | 1873 | 1631 | 1456 | 1300 | 1240 |

| Dalur | 529 | 562 | 578 | 590 | 591 | 592 | 858 | 595 | 585 |

| Khiagda | 332 | 440 | 442 | 488 | 540 | 693 | 590 | 1016 | 1021 |

| Total | 2872 | 3135 | 2990 | 3055 | 3004 | 2916 | 2904 | 2911 | 2846 |

Trans-Ural, Kurgan region

A modest level of production is from Dalur in the Trans-Ural Kurgan region. This is a low-cost ($40/kg) acid in situ leach (ISL) operation in sandstones. About 1350 km east of Moscow, Uksyanskoye is the town supporting the Dalur mine. ARMZ’s 2008 plan had production at Dalur by acid ISL increasing from 350 to 800 tU/yr by 2019 (expanding from the Dalmatovskoye field in the Zauralsk uranium district to Khokhlovskoye in the Shumikhinsky district, then Dobrovolnoye in the Zverinogolovsky district). In 2014 JSC Dalur completed further exploration of the Khokhlovskoye deposit and increased its resources from 4700 to 5500 tonnes. A mill upgrade was started in 2016. More than half of 2016 production was from the Ust-Uksyansky part of Dalmatovskoye field.

In 2016 geological exploration at the Dobrovolnoye deposit was advanced, and a permit for development was received in June 2017, allowing construction of the pilot plant, which commenced in 2020. Its reserves are quoted as 7067 tU. After pilot operation to 2021, commercial operation is expected to maintain Dalur production at 700 tU per year to about 2025 after Dalmatovskoye and Khokhlovskoye are exhausted, reaching full capacity in 2031.

Transbaikal Chita region, Streltsovskiy district

Here, several underground mines operated by JSC Priargunsky Industrial Mining and Chemical Union (PIMCU – 85% ARMZ) supply low-grade ore to a central mill near Krasnokamensk. PIMCU was established in 1968, and produces some other metals than uranium. Since 2008 it has been an ARMZ subsidiary. Historical production from Priargunsky is reported to be 140,000 tU (some from open cut mines) and 2011 known resources (RAR + IR) are quoted as 115,000 tU at 0.159%U. In 2013 ‘reserves’ were quoted by ARMZ at 108,700 tonnes. Production is up to about 3000 tU/yr, about one-tenth of it from heap leaching. In 2015 production was 1977 tU and costs were reduced by 11%, so that it hoped to break even in mid-2016.

The company has six underground mines, most of them operating: Mine #1, Mine #2, Glubokiy Mine, Shakhta 6R, Mine #8 with extraction from Maly Tulukui deposit, and Mine #6 (see below). ARMZ’s 2008 plan called for Priargunsky's production to be expanded from 3000 to 5000 tU/yr by 2020.

Mine #1 production rate was increased in 2016. It is on the opposite side of the Oktyabriski settlement from mine #2 and about 2 km from it.

Mine #2 was making a loss in 2013 due to market conditions, so it was closed in order to concentrate on bringing mine #8 to full production. Stoping operations resumed in February 2015, with production target 130 tU for the year, from average grade 0.15%. It is now known as section 2 of mine #8. Some production has been exported to France, Sweden and Spain.

Mine #8 began producing in 2011, towards phase 1 target capacity of 400 t/yr by the end of 2014. The total cost of development is expected to be RUR 4.8 billion (RUR 3.5 billion for phase 1). Production was increased 22% in 2016.

Mine #6 will access the Argunskoye and Zherlovoye deposits which comprise 35% of the Streltsovskoye reserves of 40,900 tU, with much higher grade (0.3%U) than the rest. Production cost from mine #6 is projected at $90/kgU. Future plans for Priargunsky are focused on development of mine #6, official construction of which commenced in 2018.

Development began in 2009 for stage 1 production from 2015 to reach full capacity in 2019, but this was put on hold in 2013. In March 2015 ARMZ said it hoped to find co-investors in the project, and federal funds might be forthcoming. Then in June 2015 Rosatom’s Investment Committee decided to finance the development. In August 2016 ARMZ said that RUR 27 billion was required to enable 2022 commissioning. In March 2018 a new financing arrangement was announced to the extent of RUR 18.5 billion, with Priargunsky to own 51% of the project and ARMZ 49% directly. Most of the project financing – RUR 16.1 billion – would be from China National Nuclear Corporation (CNNC), with the balance of RUR 2.5 billion from a new Russia-China Investment Fund for Regional Development (RCIF) “as a first step in widening cooperation” with China. According to the Russian Gazette (quoted by Platts Nuclear Fuel), CNNC’s investment would give it a 49% stake in the joint venture, entitling it to that proportion of annual production. Construction recommenced in March 2018, aiming for first production in 2023, ramping up to full capacity of 1800 tU/yr by 2026. Rosatom reported that the Mine #6 development project is supervised by the government of Zabaikalsky Krai.

Mine #4. Mining the Tulukuy pit of Mine #4 ceased in 1991 due to low grades, but now low-cost block-type underground leaching is ready to be employed in the pit bottom to recover the remaining 6000 tU. Following this the pit will be filled with low-grade ore for heap leaching.

A re-evaluation of reserves in 2012 suggested that mineable resources apart from Mine #6 amounted to only 32,000 tU. Mine #8 resources were quoted at 12,800 tU in December 2012. In 2014 PIMCU, as part of the Kaldera project, identified four promising areas over 100 sq km in the Streltsovskoye ore field, with resources estimated at 80,000 tU, and they will be explored over 2015-17.

In 2014 PIMCU completed an upgrade of its sulfuric acid plant to take daily production from 400 to 500 tonnes, for use in both the conventional mill and in underground and heap leaching. Also the mill (hydrometallurgical plant) process was improved.

There is a legacy environmental problem at Priargunsky arising from 30 waste rock and low-grade ore dumps as well as tailings. Rehabilitation of waste rock dumps and open pits is proceeding and low-grade ores are being heap leached. Dams and intercepting wells below the tailings dams with hydrogeological monitoring and wastewater treatment is addressing water pollution. Final rehabilitation of the impacted areas will occur after final closure takes place. In 2016 ARMZ announced a new heap leaching initiative for very low-grade ores stockpiled on the surface, to produce 50 to 63 tU/yr.

In 2006 Priargunsky won a tender to develop Argunskoye and Zherlovoye deposits in the Chita region with about 40,000 tU reserves. Dolmatovsk and Khokhlovsk have also been identified as new mines to be developed (location uncertain).

Development of Olovskoye and Gornoye deposits* in the Transbaikal region near Priargunsky towards Khiagda would add 900 tU/yr production for RUR 135 billion ($5.7 billion). Measured resources together are 12,200 tU and inferred resources 1600 tU, all at 0.072% average (JORC-compliant). In 2007 newly-formed ARMZ set up two companies to undertake this, and possibly attract some foreign investment:

- Gornoye Uranium Mining Company (UDK Gornoye) to develop the Gornoye and Berezovoye mines in the Krasnochikoysky and Uletovsky districts in Chita, with underground mining and some heap leach (ore grade 0.226%U) originally to produce 300 tU/yr from 2014, but now anticipating up to 1000 tU/yr from 2025.

- Olovskaya Mining & Chemical Company to develop the Olovskoye deposits in the Chernyshevsk district of Chita region with underground, open cut and heap leach to produce 600 tU/yr from 2016.

The 2016 Red Book noted that UDK Gornoye was undertaking pilot mining project design for the Berezovoye deposit.

* 2006 plans were for 2000t/yr at new prospects in Chita Region and Buryatia (Gornoye, Berezovoye, Olovskoye, Talakanskoye properties etc.), plus some 3000t at new deposits.

Buryatia, Vitimsky district

JSC Khiagda's operations are at Vitimsky in Buryatia about 570 km northwest of Krasnokamensk, serving Priargunsky's operations in Chita region, and 140 km north of Chita city. They are starting from a low base – in 2010 production from the Khiagdinskoye ore field was 135 tU, rising to 440 tU in 2013 (fully utilising the pilot plant) and targeting 1000 tU/yr from 2018 with a new plant. These are a low-cost (US$ 70/kgU) acid in situ leach (ISL) operations in sandstones, and comprise the only ISL mine in the world in permafrost. Groundwater temperature is 1-4°C, giving viscosity problems, especially when winter air temperature is -40°C. The main uranium mineralisation is a phosphate, requiring oxidant addition to the acid solution. In the Khiagdinskoye field itself there are eight palaeochannel deposits over 15 x 8 km, at depths of 90 to 280 metres (average 170 m). Single orebodies are up to 4 km long and 15 to 400 m wide, 1 to 20 m thick.

JSC Khiagda has resources of 55,000 tU amenable to ISL mining, with resource potential estimated by Rosatom of 350,000 tU, giving a mine life of over 50 years. In 2015 ‘reserves’ were quoted by ARMZ at 39,300 tonnes U. The 2008 ARMZ plan envisaged production from JSC Khiagda's project increasing to 1800 tU/yr by 2019, but in 2013 the higher target was postponed. The 2018 plan is now 1000 tonnes. In 2014 JSC Khiagda continued construction of the main production facility and on the sulfuric acid plant, the first stage of which was commissioned in September 2015. Its final design capacity is 110,000 t/yr.

JSC Khiagda is currently mining uranium from the Khiagdin and Istochnoy deposits of the Khiagda ore field. Preparatory work for mining operations at the Vershinny deposit is under way. In May 2018, JSC Khiagda announced that engineering and geological surveys ahead of the construction of mining facilities was under way at Kolichikan and Dybryn deposits. The other two fields in the immediate vicinity are Namaru and Tetrakhskoye. All these deposits occur over an area about 50 x 20 km. There are also plans to install plant for extracting rare earth oxides (REO) as by-product. The nearest towns are Romanovka, 133 km north of Chita, and Bagdarin.

Sakha/Yakutia, Elkon district

ARMZ’s long-term hope is development of the massive Elkon project with several mines in the Sakha Republic (Yakutia) some 1200 km north-northeast of the Chita region. The Elkon project is in a mountainous region with difficult climate conditions and little infrastructure, making it a challenging undertaking. Production from metasomatite deposits is planned to ramp up to 5000 tU/yr over ten years, for RUR 90.5 billion ($3 billion), and 2020 start up was envisaged, but this is now "after 2030". Elkon is set to become Russia's largest uranium mining complex, based on resources of over 270,000 tU (or 357,000 tU quoted by Rosatom in 2015). It will involve underground mining, radiometric sorting, milling, processing and uranium concentrate production of up to 5000 tU/yr.

Elkon Mining and Metallurgical Combine (EMMC) was set up by ARMZ to develop the substantial Elkonsky deposits. The Elkon MMC project involves the JSC Development Corporation of South Yakutia and aims to attract outside funding to develop infrastructure and mining in a public-private partnership, with ARMZ holding 51%. Foreign equity including from Japan, South Korea and India is envisaged, and in March a joint venture arrangement with India was announced. The Elkon MMC developments are to become “the locomotive of the economic development of the entire region”, building the infrastructure, electricity transmission lines, roads and railways, as well as industrial facilities, from 2010. Of 15 proposed construction sites, three have been tentatively selected: at the mouth of Anbar River, Diksi Village and Ust-Uga Village. The building of four small floating co-generation plants to supply heat and electricity to northern regions of Yakutia is linked with the Elkon project in southern Yakutia.

There are eight deposits in the Elkon project with resources of 320,000 tU* (RAR + IR) at average 0.146%U, with gold by-product: Elkon, Elkon Plateau, Kurung, Neprokhodimoye, Druzhnoye (southern deposits), as well as Yuzhnaya, Severnaya, Zona Interesnaya and Lunnoye (see below). In mid-2010 ARMZ released JORC-compliant resource figures for the five southern deposits: 71,300 tU as measured and indicated resources, and 158,500 tU as inferred resources, averaging 0.143%U. ARMZ pointed out that the resource assessment against international standards will increase the investment attractiveness of EMMC. However, in September 2011 ARMZ said that production costs would be US$ 120-130/kgU, which would be insufficient in the current market, and costs would need to be cut by 15-20%.

* 257,800 tU of this was in the five southern deposits. The 2011 Red Book gives 271,000 tU resources for Elkon, or 319,000 tU in situ.

First production from EMMC was expected in 2015 ramping up to 1000 tU/yr in 2018, 2000 tU/yr in 2020 and 5000 tU/yr by 2024 based on the southern deposits as well as Severnoye and Zona Interesnoye. This schedule has slipped by at least ten years. Also, it is remote, and mining will be underground, incurring significant development costs. ARMZ and EMMC are seeking local government (Sakha) support for construction of main roads and railways to access the Elkon area, and make investment there more attractive.

JSC Lunnoye was set up by ARMZ at the same time as EMMC to develop a small deposit jointly by ARMZ (50.1%) and a gold mining company Zoloto Seligdara as a pilot project to gain practical experience in the region in a polymetallic orebody. Lunnoye is expected in full production in 2016, reaching 100 tU/yr. It has reserves of 800 tU and 13 t gold, and is managed by Zoloto Seligdara. ARMZ in mid 2011 expressed impatience with the rate of development.

Further mine prospects

The Federal Subsoil Resources Management Agency (Rosnedra) was transferring about 100,000 tonnes of uranium resources to miners, notably ARMZ, in 2009-10, and 14 projects, mainly small to medium deposits, were prepared for licensing then. They are located mainly in the Chita (Streltsovskiy district), Trans-Ural (Zauralskiy district) and Buryatia (Vitimskiy district) uranium regions.

The projects prepared for licensing include:

- Chita Oblast – Zherlovskoye, Pyatiletnee, Dalnee and Durulguevskoye.

- Republic of Buratiya – Talakanskoye, Vitlausskoye, Imskoye, Tetrakhskoye, and Dzhilindinskoye.

- Kurgan Oblast – Dobrovolnoye (now licensed).

- Khabarovsk Krai – Lastochka.

- Republic of Tyva – Ust-Uyuk and Onkazhinskoye.

- Republic of Khakassia – Primorskoye.

All together these projects have 76,600 tonnes of reasonably assured and inferred resources, plus 106,000 tonnes of less-certain 'undiscovered' resources.

Rosnedra published a list of deposits in the Republic of Karelia, Irkutsk Region and the Leningrad Region to be offered for tender in 2009. In particular, Tyumenskiy in Mamsko-Chuiskiy District of Irkutsk Region was to be offered for development, followed by Shotkusskaya ploshchad in Lodeinopolsky District of Leningrad Region. In Karelia Salminskaya ploshchad in Pitkyaranskiy District and the Karku deposit were offered. None of these 2009 offerings had reasonably assured or inferred resources quoted, only 'undiscovered' resources in Russia's P1 to P3 categories and it appears that none were taken up. In 2016 the Karelia Ministry of Natural Resources and Ecology acknowledged only one uranium deposit “of no commercial interest” at Srednyaya Padma (Medvezhegorsk District) and announced that no mining was planned.

Foreign and private equity in uranium mining

In October 2006 Japan's Mitsui & Co with Tenex agreed to undertake a feasibility study for a uranium mine in eastern Russia to supply Japan. First production from the Yuzhnaya mine in Sakha Republic (Yakutia) is envisaged for 2009. Mitsui had an option to take 25% of the project, and was funding $6 million of the feasibility study. Construction of the Yuzhnaya mine was estimated to cost US$ 245 million, with production reaching 1000 tU/yr by 2015. This would represent the first foreign ownership of a Russian uranium mine. However, according to the 2016 Red Book, Yuzhnaya now appears to be part of the Elkon project (see above).

Following from previous deals with Tenex, in November 2007 Cameco signed an agreement with ARMZ. The two companies are to create joint ventures to explore for and mine uranium in both Russia and Canada, starting with identified deposits in northwestern Russia and the Canadian provinces of Saskatchewan and Nunavut.

In addition to ARMZ, private companies may also participate in tenders for mining the smaller and remote uranium deposits being prepared for licensing in Russia. ARMZ is open to relevant investment projects with strategic partners, and Lunnoye deposit is an example where a private company Zoloto Seligdara is partnering with ARMZ.

Mine rehabilitation

Some RUR 340 million (US$10m) is being allocated in the federal budget to rehabilitate the former Almaz mine in Lermontov, Stavropol Territory, in particular Mine 1 on Beshtau Mountain and Mine 2 on Byk Mountain, as well as reclamation of the tailings dump and industrial site of the hydrometallurgical plant. The work will be undertaken by Rosatom organizations under Rostechnadzor. In 2008, rehabilitation of Lermontovsky tailings was included in a federal target program, and over RUR 360 million was allocated for the purpose.

Secondary supplies

Some uranium also comes from reprocessing used fuel from VVER-440, fast neutron and submarine reactors - some 2500 tonnes of uranium has so far been recycled into RBMK reactors.

Also arising from reprocessing used fuels, some 32 tonnes of reactor-grade plutonium has been accumulated for use in MOX. Added to this there is now 34 tonnes of weapons-grade plutonium from military stockpiles to be used in MOX fuel for BN-600 and BN-800 fast neutron reactors at Beloyarsk, supported by a $400 million payment from the USA. Some of this weapons plutonium may also be used in the MHR high-temperature gas-cooled reactor under development at Seversk, if this proceeds.

About 28% of the natural uranium feed sent to USEC in USA for enrichment, and contra to the LEU supplied from blended-down Russian military uranium, is being sent to Russia for domestic use. The value of this to mid 2009 was US$ 2.7 billion, according to Rosatom. See also Military Warheads as Source of Fuel paper.

Russia's uranium supply is expected to suffice for at least 80 years, or more if recycling is increased. However, from 2020 it is intended to make more use of fast neutron reactors.

Fuel Cycle Facilities: conversion & enrichment

Many of Russia's fuel cycle facilities were originally developed for military use and hence are located in former closed cities (names bracketed) in the country. In October 2015 the ministry of economic development moved to open four of these which host facilities managed by Rosatom: Novouralsk, Zelenogorsk, Seversk and Zarechny.

In 2009 the conversion and enrichment plants were taken over by the newly-established JSC Enrichment & Conversion Complex, and in 2010 this became part of TVEL, a subsidiary of Atomenergoprom.

Seversk in Western Siberia is a particular focus of new investment, with Rosatom planning to spend a total of RUR100 billion on JSC Siberian Chemical Combine (SCC, SGChE) over 2012-20 to develop its “scientific, technical and production potential in terms of nuclear technology.” SCC comprises several nuclear reactors and plants for conversion, enrichment, separation and reprocessing of uranium and separation of plutonium. In 2012 Rosatom announced that it was investing RUR 45.5 billion ($1.6 billion) in SCC at Seversk to 2017 for modernising the enrichment capacity and setting up a new conversion plant.

TVEL has decided to rationalize some of its activities at Novouralsk, setting up a scientific and production association (SPA) in 2016 to incorporate Urals Gas Centrifuges Plant (UZGT or UGCP), Novouralsk Scientific and Design Center (NSDC), Uralpribor, and Electrochemical Converters Plant (ECCP).

Conversion

Russia’s total uranium conversion capacity is about 25,000 tU/yr, but only about half of this is used as of 2013.

TVEL plans to consolidate its conversion capacity at JSC Siberian Chemical Combine (SCC) at Seversk near Tomsk, where some capacity already operates. In 2012 Rosatom said it would spend RUR 7.5 billion to set up a new conversion plant at SCC Seversk, to commence operation in 2016. The new plant is designed to have a capacity of 20,000 tU per year from 2020, including 2000 t of recycled uranium. Public hearings on the project were under way in 2014. The 2015 edition of the World Nuclear Association Nuclear Fuel Report gives capacity then as 12,500 tU.

The main operating conversion plant has been at Angarsk near Irkutsk in Siberia, with 18,700 tonnes U/yr capacity – part of TVEL's JSC Angarsk Electrolysis & Chemical Combine (AECC). In anticipation of the planned new plant at SCC Seversk however, the Angarsk conversion plant was shut down in April 2014.

TVEL also had conversion capacity at Kirovo-Chepetsky Chemical Combine (KCCC) in Glazoy, which was shut down in the 1990s. Since 2009 this has been a RosRAO site, for clean-up

The Elektrostal conversion plant, 50 km east of Moscow, has 700 tU/yr capacity for reprocessed uranium, initially that from VVER-440 fuel. It is owned by Maschinostroitelny Zavod (MSZ) whose Elemash fuel fabrication plant is there. Some conversion of Kazakh uranium has been undertaken for west European company Nukem, and all 960 tonnes of recycled uranium from Sellafield in UK, owned by German and Netherlands utilities, has been converted here. UK-owned recycled uranium has also been sent there.

Uranium enrichment

Four enrichment plants totalling 24 million kg SWU/yr of centrifuge capacity operate at Novo-Uralsk (formerly Sverdlovsk-44) near Yekaterinburg in the Urals, Zelenogorsk (formerly Krasnoyarsk-45), Seversk (formerly Tomsk-7) near Tomsk, and Angarsk near Irkutsk – the last three all in Siberia. The first two service foreign primary demand and Seversk specialises in enriching reprocessed uranium, including that from western Europe. As of early 2011, all are managed by TVEL, rather than Tenex (Techsnabexport).

| Plant | Operator | Capacity (M SWU/yr) | Special features |

| Novouralsk | JSC Urals Electrochemical Combine | 10 | Can enrich to 30% |

|---|---|---|---|

| Zelenogorsk | PA ElectroChemical Plant (ECP) | 8.7 (expanding to 12) | |

| Seversk | JSC Siberian Chemical Combine (SCC, SGChE) | 3.0 | RepU enrichment |

| Angasrk | JSC Angarsk Electrolysis & Chemical Combine | 2.6 | Tails enrichment |

| Total | 24.3 (expanding to 27.6) |

The Novouralsk (Novo-Uralsk) plant is part of the JSC Urals Electrochemical Combine (UECC) in the Sverdlovsk region. It has operated 8th generation centrifuges since 2003, and 9th generation units from 2013. The fourth cascade of 9th generation centrifuges was commissioned in August 2016. TVEL is spending RUR 42 billion on re-equipping the plant with 9th generation units by 2019. In 2016 it was operating 6th to 9th generation centrifuges. The plant can enrich to 30% U-235 (for research and BN fast reactors), the others only to 5% U-235.

The TVEL-Kazakh JV Uranium Enrichment Centre (UEC) bought a 25% share of UECC and became entitled to half its output – up to 5 million SWU/yr (see below). In April 2013 the government commission for control over foreign investments approved this sale.

UECC once claimed 48% of Russian enrichment capacity and 20% of the world’s. Rosatom in 2015 applied to the government to create a territory of priority development (TPD) in Novouralsk, a special economic zone enjoying low taxes, simplified administrative procedures and other benefits.

The Zelenogorsk plant is known as the PA Electrochemical Plant (ECP) in the Krasnoyarsk region (120 km east of that city), and has ISO 14001 environmental accreditation and ISO 9001 quality assurance system. It is starting to run 9th generation centrifuges and in 2021 commissioned its third cascade of these. In 2011 Rosatom said the plant's capacity was 8.7 million SWU/yr and it planned to increase that to 12 million SWU/yr by 2020, with a view to exporting its services. Rosatom was investing RUR 70 billion ($2.3 billion) by 2020 in developing the plant, with up to 90% of the new centrifuges installed there to make it the main enrichment plant. It is the site of a new deconversion plant (see below).

The Seversk plant is part of the JSC Siberian Chemical Combine (Sibirsky Khimichesky Kombinat – SKhK or SCC), Tomsk region, which opened in 1953. It is about 15 km from Tomsk. As well as the enrichment plant with substantial capacity for recycled uranium the site has other facilities, and several plutonium production reactors (now closed). It is starting to run 9th generations centrifuges.

Angarsk, near Irkutsk in Siberia, is part of the JSC Angarsk Electrolysis & Chemical Combine (AECC). It is the only enrichment plant located outside a 'closed' city, nor has it had any defence role, and hence it became the site of the new International Uranium Enrichment Centre (IUEC) and fuel bank. In 2014 AECC said it would retain its present capacity. In December 2014 it started to undertake enrichment of tails (depleted UF6) stored onsite up to natural UF6 levels, and expects this to continue to 2030 as a major activity.

Technology: Diffusion technology was phased out by 1992 and all plants now operate modern gas centrifuges, with fitting of 8th generation equipment now complete. New units have a service life of up to 30 years, compared with half that previously. The last 6th & 7th generation centrifuges were set up in 2005, 8th generation equipment was supplied over 2004 to 2012, and about 240,000 units per year replaced 5th generation models. (6th generation units are still produced for export to China.) Two new 9th generation cascades were commissioned in 2015 and 10th generation units were being tested in 2016.

While TVEL had taken over responsibility for manufacture, in 2016 Rosatom decided to combine the design and production of centrifuges at the Urals Gas Centrifuge Plant (UZGT or UGCP) in Novouralsk, as part of the scientific and production association (SPA) set up by TVEL. OKB-Nizhniy Novgorod and Cetrotech-SPb had been involved in design and manufacture. The first 9th generation centrifuges were supplied to UECC early in 2013 from UZGT.

Tails re-enrichment: A significant proportion of the capacity of Novouralsk and Zelenogorsk plants – some 7 M SWU/yr – was earlier taken up by enrichment of tails (depleted uranium), including for west European companies Areva and Urenco. According to WNA sources, about 10,000 to 15,000 tonnes of tails per year, with U-235 assays between 0.25% and 0.40%, has been shipped to Russia for re-enrichment to about 0.7% U-235 since 1997. The tails were stripped down to about 0.10% U-235, and remain in Russia, being considered a resource for future fast reactors. The contracts for this work for Urenco and Areva ended in 2010.

A portion of the Zelenogorsk capacity, about 4.75 M SWU/yr, was taken up with re-enrichment of tails to provide 1.5% enriched material for downblending much of the Russian HEU destined for USA. It was also the site for downblending much of the of ex-weapons uranium for sale to the USA (though all the other three plants may have contributed over the 20 years).

Seversk capacity is about 3 M SWU/yr, and some recycled uranium (from reprocessing) has been enriched here for Areva, under a 1991 ten-year contract covering about 500 tonnes UF6. (French media reports in 2009 alleging that waste from French nuclear power plants was stored at Seversk probably refer to tails from enrichment of the recycled uranium.) It is understood to be enriching the 960 tU of reprocessed uranium from Sellafield in UK, belonging to its customers in Germany and Netherlands, sent to Elektrostal in eight shipments over 2001-09.

In 2012 Rosatom announced that it was investing RUR 45.5 billion ($1.6 billion) in SCC at Seversk to 2017 for modernising the enrichment capacity and setting up a new conversion plant.

Angarsk (AECC) is the smallest of three Siberian plants, with capacity of about 2.6 million SWU/yr. In July 2011 TVEL confirmed that there were no plans to expand it. A significant focus is tails enrichment. The International Uranium Enrichment Centre (IUEC) has been set up at Angarsk (see following IUEC section).

TVEL-Kazakh JV Uranium Enrichment Centre (UEC)

In the context of a December 2006 agreement with Kazakhstan, in 2008 Kazatomprom set up a 50-50 joint venture with Techsnabexport (Tenex) for financing a 5 million SWU/yr increment to the Angarsk plant, with each party to contribute about US$ 1.6 billion and hold 50% equity. It then appeared that initial JV capacity would be about 3 million SWU/yr, with first production in 2011. However, in 2010 Rosatom announced that this would not proceed, due to surplus world capacity, but other joint venture enrichment arrangements with Kazatomprom were offered, notably up to a 49% share in Novouralsk or Zelenogorsk.

After deciding that it would be uneconomic to expand capacity at Angarsk, in March 2011 it was announced that Kazatomprom would buy a share in Urals Electrochemical Combine (UECC) which owns the Novouralsk plant through its 50% equity in the TVEL-Kazakh JV Uranium Enrichment Centre (UEC), "instead of building new capacity at AECC" at Angarsk where UEC was originally established. In mid-2011 it was reported that Kazatomprom would acquire shares in UECC either directly (30%) or in the event as a 50% shareholder in UEC with TVEL, related to the need to enrich 6000 tU/yr. Over 2012-13 UEC acquired 25% of UECC, and UEC became operational in the second half of 2013, with access to 5 million SWU/yr – about half of UECC production. The cost of the Kazatomprom share, earlier estimated by it at $500 million, was not disclosed. The first batch of enriched uranium was shipped in November 2013. UEC share of production in 2014 was 4.99 million SWU.

Deconversion

Russia's W-ECP or W-EKhZ deconversion plant is at Zelenogorsk Electrochemical Plant (ECP). The 10,000 t/yr deconversion (defluorination) plant was built by Tenex under a technology transfer agreement with Areva NC (now Orano), so that depleted uranium can be stored long-term as uranium oxide, and hydrogen fluoride is produced as a by-product. The W1-ECP plant is similar to Areva's W2 plant at Pierrelatte in France and has mainly west European equipment. It was commissioned in December 2009 and to January 2021 had processed 100,000 t depleted uranium hexafluoride. The Russian-designed phase 2 for production of anhydrous hydrogen fluoride was commissioned in December 2010. During the ten years to end of 2020, some 11,000 t of anhydrous hydrogen fluoride as well as much more hydrofluoric acid were shipped to customers. TVEL is building a second unit, W2-ECP, with equipment from Orano Projects in France. This will expand ECP’s capacity to 20,000 t/yr depleted uranium hexafluoride from 2023 and producing up to 2400 t/yr of anhydrous hydrogen fluoride.

Fuel fabrication

Fuel fabrication is undertaken by JSC TVEL, which supplies 76 nuclear reactors in Russia and 13 in other countries as well as 30 research reactors and fuel for naval and icebreaker reactors. Its operations are certified against ISO 9001 and it has about 17% of the world market for fabricated fuel. Russian fuel technology is supported by TVEL’s A.A. Bochvar High Technology Research Institute of Inorganic Materials (VNIINM).

Fuel cycles

Russia aims to maximise recycling of fissile materials from used fuel. Hence reprocessing used fuel is a basic practice, with reprocessed uranium being recycled and plutonium used in MOX, at present only for fast reactors. However, innovative developments of MOX use open up wider possibilities, and both the REMIX cycle and the Dual Component Power System are described below.

Uranium fuel fabrication

TVEL has two fuel fabrication plants with combined capacity of 2800 t/yr finished fuel:

- The huge Maschinostroitelny Zavod (MSZ) at Elektrostal 50 km east of Moscow – known as Elemash.

- Novosibirsk Chemical Concentrates Plant (NCCP) in Siberia.

TVEL's Chepetsk Mechanical Plant (CMP or ChMZ) near Glazov in Udmurtiya makes zirconium cladding and also some uranium products.

Most fuel pellets for RBMK and VVER-1000 reactors were being made at the Ulba plant at Ust Kamenogorsk in Kazakhstan, but Elemash and Novosibirsk have increased production. MSZ/Elemash produces fuel assemblies for both Russian and west European reactors using fresh and recycled uranium. It also fabricates research reactor and icebreaker fuel and in 2016 is producing the first fuel for the RITM-200 reactors in new icebreakers. VNIINM claims the fuel has greater energy density than previous icebreaker fuel.

Novosibirsk produces mainly VVER-440 & 1000 fuel, including that for initial use in China.

MSZ/Elemash is the principal exporter of fuel assemblies. Total production is about 1400 t/yr, including fuel assemblies for VVER-440, VVER-1000, RBMK-1000, BN-600 reactors, powders and fuel pellets for delivery to foreign clients. It has a contract to supply high-enriched uranium (HEU) fuel over seven years for China's first CFR600 fast reactor. The plant also produces nuclear fuel for research reactors.

TVEL is developing a uranium-erbium fuel for VVERs enriched to 5-7% for load-following and longer fuel cycles. Some RBMK fuel is already enriched over 5%.

Early in 2021 MSZ set up a new production line for fast reactor fuel, including HEU. Russia’s BN-600 reactor uses uranium fuel with three levels of enrichment: 17%, 21% and 26%. Fuel for China’s CFR600 is likely to be similar. On another production line MSZ has already provided fuel for China’s CEFR, including a 2020 reload, reported to be 64% enriched.

TVEL’s NCCP also produces pure lithium-7, and accounts for over 70% of the world supply of Li-7, both 99.95% for use in PWR cooling systems, and also now 99.99% pure. A plant upgrade in 2013 makes it possible to double the volume of Li-7 output there.

TVEL has done extensive work done on utilization of reprocessed uranium (RepU) in VVER-type reactors, and there are plans for all units of the Kola nuclear station to shift to RepU fuel. Some PWR reactors, e.g. Kalinin 2 and Balakovo 3, are using recycled uranium in TVSA fuel assemblies already.

There is no plan or provision to use MOX in light-water reactors.

TVEL owns 35% equity in the Ulba Metallurgical Plant in Kazakhstan. This has major new investment under way. It has secured both ISO 9001 and ISO 14001 accreditation. Since 1973 Ulba has produced nuclear fuel pellets from Russian-enriched uranium which are used in Russian and Ukrainian VVER and RBMK reactors. Some of this product incorporates gadolinium and erbium burnable poisons. Ulba briefly produced fuel for submarines (from 1968) and satellite reactors. Since 1985 it has been able to handle reprocessed uranium, and it has been making fuel pellets incorporating this for western reactors, supplied through TVEL.

TVEL's Moscow Composite Metal Plant designs and makes control and protection systems for nuclear power reactors.

REMIX fuel cycle

REMIX (Regenerated Mixture) fuel has been developed by the V.G. Khlopin Radium Institute for Tenex as a development of MOX to supply light water reactors. Remix fuel is produced directly from a non-separated mix of recycled uranium and plutonium from reprocessing used fuel, with a low-enriched uraniium (up to 17% U-235) make-up comprising about 20% of the mix. This gives fuel with about 1% Pu-239 and 4% U-235 which can sustain burn-up of 50 GWd/t over four years and has similar characteristics to normal LWR fuel. It is distinct from MOX in having low and incidental levels of plutonium – none is added. The spent Remix fuel after four years is about 2% Pu-239* and 1% U-235, and following about five years of cooling and then reprocessing the non-separated uranium and plutonium is recycled again after LEU addition. The waste (fission products and minor actinides) is vitrified, as today from reprocessing, and stored for geological disposal. Before vitrification it may be processed to recover valuable fission products such as isotopes Cs, Sr and Tc.

* a 68% increase, compared with 104% in MOX fuel cycle, according to Tenex.

Remix fuel can be repeatedly recycled with 100% core load in current VVER-1000 reactors and correspondingly reprocessed many times – up to five times, so that with fewer than three fuel loads in circulation a reactor could run for 60 years using the same fuel, with LEU recharge. As with normal MOX, the use of Remix fuel reduces consumption of natural uranium in VVERs by about 20% at each recycle as compared with open fuel cycle. Remix can serve as a replacement for existing reactor fuel, but in contrast to MOX there is a higher cost for fuel fabrication due to the high activity levels from U-232. Compared with UO2 fuel, the cost increment is 25-30%. The Remix cycle can be modified from the above figures according to need. The increasing concentrations of even isotopes of both elements is compensated by the fresh uranium top-up, possibly at increasing enrichment levels.

A 2019 study showed that the use of regenerated uranium in Remix fuel for VVER reactors, and therefore the U-236 isotope, also significantly increases the proportion of Pu-238 in the fuel, which prevents its diversion for non-peaceful purposes.

Remix allows all the recovered uranium and plutonium to be recycled and will give a saving in used fuel storage and disposal costs compared with the once-through fuel cycle, matched by the reprocessing cost, though this is expected to reduce. Compared with the MOX cycle, it has the virtue of not giving rise to any accumulation of reprocessed uranium (RepU) or allow any separated plutonium.

Rosatom loaded three TVS-2M fuel assemblies each with six REMIX fuel rods into Balakovo 3 in June 2016. They remained for two fuel cycles, and a third 18-month cycle began in early 2020. These all showed good results, and Rosatom is now proceeding to pilot operation of several full-REMIX fuel assemblies. No changes in reactor design or safety measures are required. Remix fuel is also being tested in the MIR research reactor at RIAR in Dimitrovgrad.

Tenex suggests Remix being used with a form of fuel leasing from a supplier to a utility, with repeated recycle between them. Commercial application is planned for the mid-2020s.

In August 2020 Rosatom announced that Remix fuel for VVER-1000 reactors would be produced on a new production line at the Siberian Chemical Plant (SCC) at Seversk from 2023. In June 2021 TVEL commissioned equipment for the pilot fuel production line, enabling initial production of fuel assemblies by year end, using fuel pellets made at the MCC Zheleznogorsk plant. Eventually a commercial-scale Remix fuel fabrication plant is envisaged.

MOX fuel fabrication (only for fast reactors)

In late 2007 it was decided that MOX fuel production using recycled materials should be based on electrometallurgical (pyrochemical) reprocessing and vibropack dry processes for fuel fabrication, as developed at RIAR. The goals for closing the fuel cycle included minimising cost, recycle of minor actinides (for burning), excluding separated plutonium, and arrangement of all procedures in remote systems to allow for 'hot' materials. However, plans for vibropack fuels are not being pursued with any vigour.

MCC Zheleznogorsk MOX plant: A 60 t/yr commercial mixed oxide (MOX) fuel fabrication facility (MFFF) commenced operation at Zheleznogorsk (formerly Krasnoyarsk-26, 70 km northeast of Krasnoyarsk) in 2015, operated by the Mining & Chemical Combine (MCC or GKhK). This was built at a cost of some RUR 9.6 billion as part of Rosatom’s Proryv, or 'Breakthrough', project, to develop fast reactors with a closed fuel cycle whose MOX fuel will be reprocessed and recycled. It represents the first industrial-scale use of plutonium in the Russian civil fuel cycle, and is also the Russian counterpart to the US MFFF for disposition of 34 tonnes of weapons-grade plutonium.* About half the plant’s equipment was imported.

* The head of Rosatom reported to the president in September 2015: “Industrial operation has begun at a new MOX fuel (uranium-plutonium fuel) production plant, the first such plant in history. Our American partners have still not managed to finish the plant they were building. They have already spent $7.7 billion on it and, as Congress informs, they are now going to suspend the project because no one knows how much more money it will cost. We built our plant in 2.5 years at a cost of a little over $200 million, or 9.6 billion rubles. The plant is working and is now reaching industrial capacity.”

MCC’s MFFF will make 400 pelletised MOX fuel assemblies per year for the BN-800 and future BN-1200 fast reactors. The MOX can have up to 30% plutonium. The capacity is designed to be able to supply five BN-800 units or equivalent BN-1200 capacity. First production of 20 fuel assemblies for Beloyarsk 4 was in 2015, working up to full capacity in 2017. The BN-800 each year requires 1.84 tonnes of reactor-grade plutonium recovered from 190 tonnes of used VVER fuel. The first serial batch of MOX for BN-800 passed acceptance tests in December 2018. (Plutonium from used BN fuel will be used in VVER-1000 reactors.) The MFFF is built in rock tunnels at a depth of about 200 metres.

Longer-term MCC Zheleznogorsk was intending to produce MOX granules for vibropacked fuel using civil plutonium oxide, ex-weapons plutonium metal and depleted uranium. Initial capacity of 14 t/yr of granules was funded to RUR 5.1 billion (US$ 169 million then) over 2010-12. The granulated MOX is sent to RIAR Dimitrovgrad for vibropacking into FNR fuel assemblies.

In June 2011 Rosatom announced that it was investing RUR 35 billion in MCC to 2030, including particularly MOX fuel fabrication. In February 2012 the figure was put at RUR 80 billion minimum.

Mayak MOX plant: A small pelletised MOX fuel fabrication plant has operated at the Mayak plant at Ozersk since 1993, for BN-350 and BN-600 fuel (40 fuel assemblies per year), and it supplied some initial pelletised MOX fuel for BN-800 start-up, the assemblies being made by RIAR Dimitrovgrad.

Seversk MOX plant: Another MOX plant for disposing of military plutonium is planned at Seversk (Tomsk-7) in Siberia, to the same design as its US equivalent. This is for dense MOX fuel for fast reactors, and was planned for completion by the end of 2017, with RUR 5.8 billion allocated by TVEL for the equipment. (Seversk had the other two dual-purpose but basically military plutonium production reactors, totalling 2500 MWt. One of these – ADE4 – was shut down in April 2008, the other – ADE5 – in June 2008.)

RIAR Dimitrovgrad MOX plant: The Research Institute of Atomic Reactors (RIAR or NIIAR) at Dimitrovgrad, Ulyanovsk, has a small MOX fuel fabrication plant. This produces vibropacked fuel which was said to be more readily recycled. Under the federal target programme this was allocated RUR 2.95 billion (US$ 83 million) for expansion from 2012. Its main research has been on the use of military plutonium in MOX, in collaboration with France, USA and Japan. From 2014 the plant produced 106 fuel assemblies for Beloyarsk 4 BN-800, before MCC's MFFF took over this role.

Vibropacked MOX fuel (VMOX) was earlier seen as the way forward. This is made by agitating a mechanical mixture of (U,Pu)O2 granulate and uranium powder, which binds up excess oxygen and some other gases (that is, operates as a getter) and is added to the fuel mixture in proportion during agitation. The getter resolves problems arising from fuel-cladding chemical interactions. The granules are crushed (U,Pu)O2 cathode deposits from pyroprocessing. VMOX needs to be made in hot cells. It has been used in BOR-60 since 1981 (with 20-28% Pu), and tested in BN-350 and BN-600 as part of a hybrid core (with some military plutonium). This was evaluated by OKBM and Japan Nuclear Cycle Development Institute. However, its future is uncertain, and MOX fuel may revert to being conventional sintered pellets.

Dual-component power system MOX

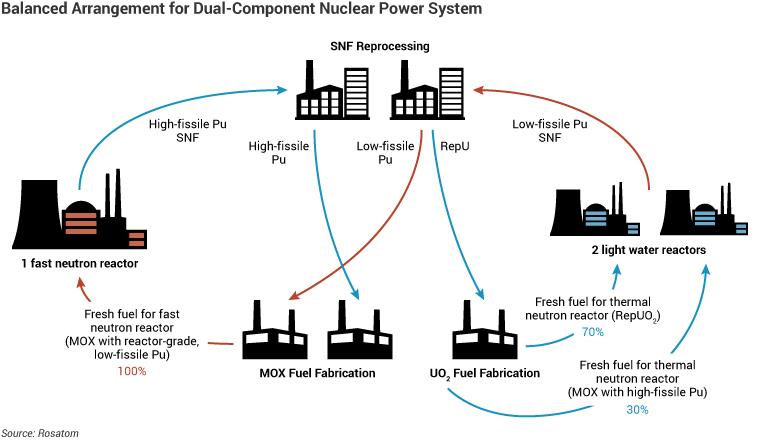

Rosatom has proposed a fuel cycle involving both thermal and fast reactors, using two kinds of MOX fuel, and envisages implementing this system when the first BN-1200 reactors are online about 2027. In 2020 the first MOX using plutonium from conventional power reactors was loaded into Beloyarsk's BN-800 reactor and later in the year another 180 such fuel assemblies will be added. By the end of 2021, the reactor will fully switch to MOX fuel.

In this fuel cycle, normal thermal reactors are the primary plutonium source, but this plutonium is reactor-grade, with about one-third even-mass number non-fissile isotopes. The plutonium is mixed with deflourinated tails from uranium enrichment (i.e. depleted uranium). Whether derived from used uranium fuel or MOX fuel, it is separated and made into MOX fuel for fast breeder reactors with not less than 1.2 breeding ratio, and the used fuel from these has a much lower proportion of even-number non-fissile plutonium isotopes.

In future this ‘clean’ or high-fissile plutonium recovered from fast reactor fuel can then made into MOX fuel for the original thermal reactors, and comprise about 30% of their fuel. The other 70% could be enriched reprocessed uranium (RepU), the depleted tails of which are also used for MOX, instead of using normal depleted uranium. Their used fuel is reprocessed to continue the dual cycle. Minor actinides are burned in the fast reactors.

One fast reactor running on 'dirty' MOX would therefore be in balance with two VVER reactors fuelled with 'clean' MOX (30% of load) and RepU oxide enriched to about 17% U-235 (70% of load) via segregated reprocessing facilities and segregated fuel fabrication.

Further details are in the information paper on Mixed Oxide Fuel.

Nitride fuel fabrication for fast reactors

Overall, RUR 17 billion is budgeted for nitride fuel development, which is mainly for the BREST-300 reactor, part of Rosatom’s Proryv or 'Breakthrough' project. Both SCC plants will be part of the Pilot Demonstration Power/Energy Complex (PDPC or PDEC) with the BREST reactor, integral to the Proryv project and approved by government decree in August 2016. The Proryv project at SCC is expected to be fully operational from 2023.

To avoid problems in reactor operation and spent fuel, nitrogen-15 is the preferred isotope. VNIINM has patented a technique for enrichment in N-15, annual demand for which is expected to be several tonnes.

SCC nitride fuel plant KEU-1: In collaboration with TVEL, the Siberian Chemical Combine (SCC) at Seversk is making test batches of dense mixed nitride uranium-plutonium (MNUP) fuel for fast reactors, essentially prototype fuel for BREST. Construction of SCC’s pilot nitride fuel plant started in March 2014 with a view to commissioning in 2017-18, in time to produce fuel for the first BREST-300 reactor, which is now expected in operation about 2024. In April 2016 Atomenergomash supplied to SCC a plant for preparation of input materials for automated fabrication of MNUP fuel for fast neutron reactors.

SCC completed acceptance tests on the first ETVS nitride fuel assembly in September 2014, and it had further ones (ETVS-10 & 11) ready a year later, using parts supplied by VNIINM. In April 2015 the first ETVS nitride fuel assemblies were put into the BN-600 reactor at Beloyarsk for testing over three years, and by August 2015 there were nine ETVS there. In November 2015 the post-irradiation inspection of ETVS-1 after six-month storage to cool showed it to be in good shape. In April 2016 two more dense nitride fuel assemblies (ETVS-12 & 13) were delivered to Beloyarsk for irradiation in the BN-600 reactor. They were designed by VNIINM and made by SCC as prototypes for BREST-300 and BN-1200 reactors. In mid-2016 VNIINM produced two more pilot fuel assemblies, ETVS-14 & 15, with mixed nitride fuel for testing in the BN-600 reactor at Beloyarsk. MSZ completed acceptance tests on these in August. In December 2016 SCC announced successful post-irradiation tests on ETVS fuel assemblies, confirming their suitability for BREST. ETVS-16 to 21 were scheduled for 2017. The next series of ETVS will be of a different design. By November 2020, more than 1000 MNUP fuel rods had been produced and more than 21 fuel assemblies had been irradiated in BN-600, the latest ones each with 61 fuel rods.

SCC nitride fuel plant KEU-2: SCC started construction of a second integrated experimental facility (KEU-2) in 2016, to fabricate fuel for testing in the BN-800 reactor at Beloyarsk. A U-Pu-Np nitride fuel fabrication and recycling facility is part of the Pilot Demonstration Power Complex (PDPC; Russian acronym: ODEK) at SCC. Rosatom began installing equipment here for MNUP fuel fabrication and refabrication for the BREST-300 in 2017. The main fabrication line was expected in operation in 2020, with daily production capacity of up to 60 kg of fuel, or 120 nuclear fuel assemblies, and a total of 14.7 tonnes of fuel per year.

In October 2014 SCC announced a tender for a reprocessing plant to be completed by 2018, with VNIPIET as SCC’s preferred bidder. It included a module for processing used nuclear fuel, to examine technologies VNIINM and the VG Khlopin Radium Institute have developed. VNIINM said its experiments in 2016 had confirmed for the first time that the technology used for the reprocessing of used mixed nitride fuel enables the re-use of more than 99.9% of the actinides. The actual RUR 20 billion plant is to have a capacity of 5 t/yr used fuel from the BREST-300 and 0.5 t/yr of “rejects from electrolysis process and americium-containing burning elements.” It will commence operation about 2024, after the BREST-300 is in service. This will be part of the Pilot Demonstration Power/Energy Complex (PDPC or PDEC) with the BREST reactor.

SCC started testing three different refining technologies for the plant in 2016. The best option will be selected and used in the used fuel recycling module within PDPC. The project manager said that the refining installation “can be used as a sector-wide test-bench to deal with uranium, plutonium, and neptunium.”

Mayak nitride fuel plant: A new 14 tonne per year plant to fabricate dense mixed nitride fuel for fast neutron reactors is planned at PA Mayak, to operate from 2018. In the federal target programme to 2020, RUR 9.35 billion ($310 million) was budgeted for it. Later it may be expanded to 40 tonnes per year.

International Uranium Enrichment Centre (IUEC)

The IUEC concept was inaugurated at the end of 2006 in collaboration with Kazakhstan, and in March 2007 the International Atomic Energy Agency (IAEA) agreed to set up a working group and continue developing the proposal. In September 2007 the joint stock company Angarsk International Uranium Enrichment Centre (JSC Angarsk IUEC) was registered and a year later Rostechnadzor licensed the centre.

Late in 2008 Ukraine's Nuclear Fuel Holding Company, SC Nuclear Fuel, decided to take a 10% stake in it, matching Kazatomprom's 10%, and this was effected in October 2010. Armenia finalised its 10% share in IUEC in May 2012 (2600 shares for RUR 2.6 million). Negotiations since then have proceeded with South Africa, Vietnam, Bulgaria, UAE, Jordan, South Korea and Mongolia (in connection with Russian uranium interests there). Russia also invited India to participate in order to secure fuel for its Kudankulam plant. The aim is for Techsnabexport/TVEL eventually to hold only 51%. Each of the 26,000 IUEC shares is priced at RUR 1000.

Present equity in JSC Angarsk IUEC: TVEL 70%, Kazatomprom 10%, Ukraine State Concern Nuclear Fuel 10%, Armenia NPP 10%.

The centre is to provide assured supplies of low-enriched uranium for power reactors to new nuclear power states and those with small nuclear programmes, giving them equity in the project, but without allowing them access to the enrichment technology. Russia will maintain majority ownership. IUEC will sell both enrichment services (SWU) and enriched uranium product. Arrangements for IAEA involvement were being sorted out in 2009, and in 2010 a feasibility study commenced on IUEC investment, initially for equity in JSC Angarsk Electrolysis & Chemical Combine (AECC) so that part of its capacity supplies product to IUEC shareholders.

The existing enrichment plant at Angarsk was to feed the IUEC and accordingly was removed from the category of "national strategic installations", though it had never been part of the military programme. In February 2007 the IUEC was entered into the list of Russian nuclear facilities eligible for implementation of IAEA safeguards. The USA has expressed support for the IUEC at Angarsk. Since 2010 the facility has been under IAEA safeguards.

Development of the IUEC was envisaged in three phases:

- Use part of the existing capacity at Angarsk in cooperation with Kazatomprom and under IAEA supervision.

- Expand Angarsk capacity (perhaps double) with funding from new partners by 2017.

- Full internationalisation with involvement of many customer nations under IAEA auspices.

In 2012-13 the IUEC website said: “The JSC IUEC has been established within the Angarsk Electrolysis Chemical Complex, but it can use capacities of other three Russian combines to diversify production and optimize logistics.”

In 2016 a major customer was Ukraine’s State Concern Nuclear Fuel, which since 2012 has bought 60,000 SWU per year, proportional to its shareholding.

IUEC guaranteed LEU reserve ('fuel bank')

In November 2009 the IAEA board approved a Russian proposal to create an international guaranteed LEU reserve or 'fuel bank' of low-enriched uranium under IAEA control at the IUEC at Angarsk. This was established a year later and comprises 123 tonnes of low-enriched uranium as UF6, enriched 2.0-4.95% U-235 (with 40t of latter), available to any IAEA member state in good standing which is unable to procure fuel for political reasons. It is fully funded by Russia, held under safeguards, and the fuel will be made available to the IAEA at market rates, using a formula based on spot prices. Following an IAEA decision to allocate some of it, Rosatom will transport material to St Petersburg and transfer title to the IAEA, which will then transfer ownership to the recipient. The 120 tonnes of low-enriched uranium as UF6 is equivalent to two full fuel loads for a typical 1000 MWe reactor, and in 2010 was worth some $250 million.

This initiative complements the IAEA LEU Bank set up in Kazakhstan by making more material available to the IAEA for assurance of fuel supply to countries without their own fuel cycle facilities. The IAEA LEU Bank is located at the Ulba Metallurgical Plant (UMP) in Kazakhstan, which has 50 years of experience in handling UF6. A formal agreement with Kazakhstan to establish the legal framework was signed in August 2015, and the partnership agreement between the IAEA and UMP was signed in May 2016. Construction of the building with 600 m2 storage area started in September 2016, and the facility was formally opened at the end of August 2017. It became operational in 2019, and it awarded contracts to Orano and Kazatomprom to supply it.

Used fuel and reprocessing

Russian policy is to close the fuel cycle as far as possible and utilise recycled uranium, and also to use plutonium in MOX fuel. However, its achievements in doing this have been limited – in 2011 only about 16% of used fuel was reprocessed, this being from VVER–440s, BN-600, research reactors and naval reactors. The reprocessed uranium (RepU) is mainly used for RBMK fuel. By 2030 Rosatom hopes to fully close the fuel cycle. Commercial reprocessing started in 1977, and several projects at two sites have been under way to progress this intention:

- At Mayak Production Association in Ozersk, the RT-1 spent fuel reprocessing facility was first updated and returned to service in 2016, and will then be shut down in about 2030.

- At Mining and Chemical Combine (MCC) in Zheleznogorsk, the MOX fuel fabrication plant for fast reactors was commissioned in 2015 (see above).

- At MCC the Pilot Demonstration Centre (PDC) for used nuclear fuel reprocessing was commissioned in 2015.

- At MCC the full-scale RT-2 facility would be completed by 2025 to reprocess VVER, RBMK and BN used fuel into mixed-oxide (MOX) fuel or into REMIX – the regenerated mixture of uranium and plutonium oxides.

- At MCC Zheleznogorsk the spent fuel pool storage would be supplemented by dry storage, commissioned in 2012, and MCC will become the destination for all of Russia’s used fuel.

In 2013 used fuel arisings in Russia were:

| VVER-440 | 6 units | 87 t/yr |

| VVER-1000 | 11 units | 230 t/yr |

| RBMK | 11 units | 550 t/yr |

| EPG-6 | 4 units | 4 t/yr |

| BN-600 | 1 | 6 t/yr |

| Naval, research | 80+ | ? |

| Total | 880 t/yr |

All used fuel is stored at reactor sites for at least three years to allow decay of heat and radioactivity. High burn-up fuel requires longer before it is ready to transport. At present the used fuel from RBMK reactors and from VVER-1000 reactors is stored (mostly at reactor sites) and not reprocessed. It is expected that used fuel in storage will build up to about 40,000 tonnes by the time substantial reprocessing at MCC Zheleznogorsk gets under way about 2022. The materials from this will be burned largely in fast reactors by 2050, when none should remain.

In late 2007 it was decided that MOX fuel production using recycled materials from both light water and fast reactors should be based on electrometallurgical (pyrochemical) reprocessing. The goals for closing the fuel cycle are minimising cost, minimising waste volume, recycle of minor actinides (for burning), excluding separated plutonium, and arrangement of all procedures in remote-handled systems. This reprocessing route remains to be developed.

In August 2016 a new program for management of used fuel to 2020 was announced. It provides for transport of used fuel to Mayak at Ozersk for reprocessing, or to a central storage facility at MCC Zheleznogorsk where the reprocessing plant is due to be commissioned.

RT-1 reprocessing plant, Mayak

Used fuel from VVER-440 reactors Kola 1-4 and Rovno 1-2 in Ukraine), the BN-600 (Beloyarsk) and from naval reactors is sent to the Mayak Chemical Combine's 400 t/yr RT-1 plant (Chelyabinsk-65) at Ozersk, near Kyshtym 70 km northwest of Chelyabinsk in the Urals for reprocessing.* An upgrade of the RT-1 plant to enable it to take VVER-1000 fuel was completed in 2016, and reprocessing of fuel from Rostov began late in the year. In 2017, 20 tonnes of used VVER-1000 fuel from Balakovo is to be reprocessed.

* The original reprocessing plant at the site was hastily built in the mid-1940s, for military plutonium production in association with five producer reactors (the last shut down in 1990).

The RT-1 plant started up in 1971 and employs the Purex process. Since about 2000 the plant has been extended and modified so that it can accept a wide variety of inputs, including U-Be research reactor fuel. It had reprocessed about 5000 tonnes of used fuel to 2012 and was reported to be running at about 100 t/yr capacity, following the loss of foreign contracts. In 2015 RT-1 processed 230 tonnes of fuel, 35% more than in 2014, and its capacity is expected to reach 400 t/yr “within several years”, comprising all types from Russian designed reactors, notably VVER-1000 and RBMK. From 2017 it will also be able to reprocess uranium nitride fuel. However, after the commissioning of the RT-2 plant at MCC, it is due to be decommissioned about 2030.

About 93% of its feed to 2015 has been from Russian and Ukrainian VVER-440 reactors, about 3% from naval sources or icebreakers and 3% from the BN-600 reactor. It earlier reprocessed BN-350 used fuel. Damaged used fuel is to be reprocessed there to avoid the need for prolonged storage. In September 2015 Rosatom said that reprocessing the fuel from 201 decommissioned vessels transferred to it from the Ministry of Defence was 97% complete, and that no naval fuel remained in the Far East. Regular shipments of used submarine fuel from Andreeva Bay storage to Mayak for reprocessing commenced in mid-2017, and 22,000 naval fuel assemblies are expected to be shipped by 2024, via Murmansk.

In 2015 Mayak started reprocessing the uranium-beryllium fuel from dismantled Alfa-class submarines, as a ‘nuclear legacy project’. These unsuccessful vessels had a single reactor of 155 MWt cooled by lead-bismuth and using very highly enriched uranium – 90% enriched U-Be fuel. The experience gained with lead-bismuth eutectic is being applied in Russia’s fast reactor programme – notably BREST (since SVBR was dropped).

Recycled uranium is enriched to 2.6% U-235 by mixing RepU product from different sources and is used in all fresh RBMK fuel, while separated plutonium oxide is stored. High-level waste is vitrified and stored. There are plans to use RepU for all the Kola VVER reactors. Vitrified HLW from Ukraine’s VVER-440 used fuel is to be returned to Ukraine from 2018.

Used fuel storage capacity there is being increased from 6000 to 9000 tonnes, but will remain limited compared with Zheleznogorsk. Hence the used fuel received is usually treated fairly promptly. In 2015, 5184 RBMK used fuel assemblies were sent there from the Leningrad and Kursk plants, for storage initially.

Zheleznogorsk MCC: Pilot Demonstration Centre and RT-2 reprocessing plant

A Pilot Demonstration Centre (PDC) for several reprocessing technologies is operated by MCC at Zheleznogorsk, built at a cost of RUR 8.4 billion and completed in 2015 as a "strategic investment project". Its initial capacity with research hot cells is 10 t/yr, increasing to 100 t/yr, with later increase to 250 t/yr from 2018 as phase 2. PDC phase 2 was expected to be in full operation in 2019. It will have innovative technology including embrittlement by crystallization, and simultaneous gas, thermo and mechanical spent fuel assembly shredding. Initially it will deal with VVER-1000 fuel, later with fuel from fast reactors. It will effectively be the first stage of the large redesigned RT-2 plant at the MCC/GHK site to be operational about 2024. The cost of RepU product is expected to be some €500/kg. The PDC “can be used for demonstration of the closed nuclear fuel cycle of thermal neutron reactors running on REMIX-fuel” as well as producing MOX fuel.

The RT-2 reprocessing plant at Zheleznogorsk is now on track for completion with 700 t/yr capacity by 2025 (in addition to the 250 t/yr at PDC). Another 800 t/yr is planned by 2028. Originally it was planned to have two 1500 t/yr lines, but for some time the project was under review. Construction started in 1984 but halted in 1989 when 30-40% complete due to public opposition and lack of funds (though in 1993 it was officially reported as "under construction"). It has now been redesigned and is expected to operate from around 2025 with advanced Purex process, for both VVER-1000 and RBMK fuel, and also BN fuel. Its cost is about $2 billion, with no federal funds. The facility could form part of the new Global Nuclear Infrastructure Initiative and foreign equity in a joint stock company is being considered. (See also International Collaboration section below.)

Zheleznogorsk MCC: RBMK and VVER used fuel storage

VVER-1000 used fuel is sent to the Mining & Chemical Combine (MCC) (Gorno-Khimichesky Kombinat – GHK) at Zheleznogorsk (Krasnoyarsk-26) in Siberia for pool storage. The site is about 60 km north of Krasnoyarsk. This fuel comes from three Russian, three Ukrainian and one Bulgarian plants. A large pool storage facility was built by MCC at Zheleznogorsk in 1985 for VVER-1000 used fuel, though its 6000 tonne capacity would have been filled in 2010. The facility was fully refurbished over 2009-10, and some dry storage capacity was commissioned in 2011. In December 2009 Rostechnadzor approved pool storage expansion to 7200 tonnes and MCC sought approval to expand it to 8400 tonnes capacity to allow another 6 years input. It is now planned to expand wet storage for VVER-1000 fuel to 11,000 tonnes.

In 2012 the first stage of an 8600 tonne dry storage facility for used fuel (INF DSF-2) was commissioned at Zheleznogorsk. It was built by the E4 Group at a cost of about $500 million for the MCC/GHK. It is the largest dry storage facility in the world, holding 8129 tonnes of RBMK fuel, initially from Leningrad and Kursk power plants, followed by Smolensk. At Leningrad the fuel is cut up and put into the large containers before being shipped to MCC. RBMK fuel is not presently economic to reprocess so has been stored at reactor sites, and when transferred to MCC it is stored in hermetically sealed capsules filled with nitrogen and helium, inside a building but air-cooled.

The second stage of MCC dry storage will take VVER-1000 fuel currently in wet storage there and increase capacity to over 37,000 tonnes (26,510 t RBMK, 11,275 t VVER). MCC expects to commission it about the end of 2016. It is expected to be commissioned about the end of 2015. The original wet storage facility is to be decommissioned in 2026. Used fuel will be stored for up to 50 years, pending reprocessing. MCC has flagged the possibility of storing foreign VVER-1000 used fuel, such as that from fuel take-back arrangements linked to foreign reactor sales (initially Iran). This can be reprocessed in Russia, but the waste must be repatriated.

Bilibino's LWGR used fuel is stored at Bilibino site.

(Three decommissioned graphite-moderated reactors which principally produced military plutonium, with associated underground reprocessing plant, are also at MCC Zheleznogorsk. The huge underground complex, 200-250 m deep, was originally established in 1950 for plutonium and weapons production.)

Other reprocessing plants

At SCC Seversk a reprocessing plant for nitride fuel from BREST fast reactors is envisaged to operate from 2024, closing that fuel cycle. See above under SCC nitride fuel plant KEU-2.

In 2016 it was announced that decommissioning of the HEU downblending and mixing plant at SCC would be completed by 2022. The plant was built in 1996 at the conversion plant in order to implement the Russia-US program for blending down high-enriched uranium from Russian nuclear weapons into low-enriched uranium for export and use in US nuclear power plants. This program concluded in 2013.

Some kind of radioactive waste processing plant is under construction at the Kursk nuclear power station, according to Nikimt-Atomstroy. A completed section, fully operational by the end of 2014, would process liquid radioactive waste. The two remaining sections of the project include a processing facility for solid radioactive waste and a storage facility.

Legacy materials

Russia has a significant amount of legacy materials, some as a result of military materials production (e.g. slightly irradiated uranium), others from the civil fuel cycle (e.g. reprocessed uranium), and as a result of reviews over 2006-08 these are now recognised as potentially having significant value. The total quantity is not such as to impact the civil market; there are some technical challenges (e.g. limiting U-232 to 5 ppb in enriched RepU), and in any case Russia’s preference is to use the material domestically while making resultant expertise available internationally.