China's Nuclear Fuel Cycle

- China has become self-sufficient in most aspects of the fuel cycle.

- China aims to produce one-third of its uranium domestically, obtain one-third through foreign equity in mines and joint ventures overseas, and to purchase one-third on the open market.

- China's two major enrichment plants were built under agreements with Russia but much current capacity is indigenous.

- China’s R&D investment in nuclear technologies is very significant, particularly in high-temperature gas-cooled and molten salt-cooled reactors.

China has stated it intends to become self-sufficient not just in nuclear power plant capacity, but also in the production of fuel for those plants. However, the country still relies to some extent on foreign suppliers for all stages of the fuel cycle, from uranium mining through fabrication and reprocessing, but mostly for uranium supply. As China rapidly increases its number of reactors, it has also initiated a number of domestic projects, often in cooperation with foreign suppliers, to meet its nuclear fuel needs.

The national policy is to obtain about one-third of uranium supply domestically, one-third from Chinese equity in foreign mines, and one-third on the open market. Increasingly, other stages of the fuel cycle will be indigenous. Uranium demand in 2023 is expected to be over 11,000 tU rising to over 40,000 tU by 2040.

China National Nuclear Corporation (CNNC) maintains a strong monopoly on the nuclear fuel cycle in China, notably the front end, forcing China General Nuclear Power (CGN) to work around this, principally with international ventures, some involving large capital outlays.

CNNC is also the main operator in the fuel cycle back end, evidenced by a series of agreements with Areva (now Orano) for a reprocessing plant. That in November 2015 was part of a wider agreement in relation to all aspects of the fuel cycle, and foreshadowing an intention at the time to take equity in Areva NC, in connection with evolving agreements to build a reprocessing plant based on Areva technology.

Following Areva’s restructuring, a new framework agreement between what is now Orano and CNNC was signed in February 2017, covering “the whole industrial chain of the nuclear fuel cycle.” In particular it supports plans for construction of a reprocessing plant in China. The commitmment was reaffirmed in January 2018 through the signing of an MoU.

As well as a long-standing close relationship with France, China has a bilateral nuclear cooperation agreement (‘123 agreement’) with the USA from 1985 which was renewed in 2015. This is a prerequisite for nuclear trade in plant and materials that involves the USA.

Domestic uranium resources and mining

CNNC is the only current supplier of domestic uranium. CGN has responded energetically to this situation through its subsidiary China Guangdong Nuclear Uranium Resources Co Ltd (CGN-URC) as described below.

China now claims to be “a uranium-rich country” on the basis of some two million tonnes of uranium. As of January 2021, identified recoverable resources totalled 223,900 tU to $130/kg, of which 107,600 were reasonably assured.

By international standards, China's ores are low-grade and production has been inefficient, due in part to the remote, mountain location of deposits. In 2022 uranium production was an estimated 1700 tU.

The nuclear power companies are not depending on the national goal of sourcing one-third of uranium domestically, and are ramping up international arrangements to obtain fuel.

Operating uranium mines in China

| Minea | Province | Type | Nominal capacity tonnes U/yr |

Started |

| Yining | Xinjiang | In-situ leach (ISL) | 850 | 1993 |

|---|---|---|---|---|

| Lantian | Shaanxi | Underground, heap leach | 0 | 1993 |

| Fuzhou | Jiangxi | Underground, mill | 350 | 1966 |

| Chongyi | Jiangxi | Underground, heap leach | 0 | 1979 |

| Shaoguan | Guangdong | Underground, heap leach | 200 | 2008 |

| Tongliao | Inner Mongolia | ISL | 200 | 2015 |

| Total | 1600 |

Xinjiang's Yili basin in the far west of China, in which the Yining (or Kujiltai) ISL mine sits, is contiguous with the Ili uranium province in Kazakhstan, though the geology is apparently different. The Fuzhou mine in the southeastern Jiangxi province is in a volcanic hydrothermal deposit, as is Qinglong in Liaoning. The other mines are in granitic deposits. Source: Red Book 2022.

China National Uranium Corporation (CNUC or CUC), a subsidiary of CNNC, operates these mines.

CGN subsidiary China Guangdong Nuclear Uranium Resources Co Ltd (CGN-URC) was set up in 2006 to be responsible for CGN's fuel supply, and in particular to undertake uranium exploration and mining, uranium trade, and management of fuel processing for CGN. It is pursuing the second stage of a planned three-stage development, with diversification of supplies and integration of front-end services. A third stage will involve new technology as well as consolidation of its role as viable supplier. It aims to free up international trade and bring about better logistics.

CGN-URC has been undertaking uranium exploration in Xinjiang Uygur autonomous region, and also in Guangdong, via CGN-URC Guangdong Uranium Ltd. In May 2011 CGN-URC announced that it was developing two 500 tU/yr mines on these deposits, to operate from 2013, but this venture appears to have stalled.

Mineral exploration

CNNC's Geological Survey Bureau and the Beijing Research Institute of Uranium Geology are the key organizations involved with a massive increase in exploration effort since 2000, focused on sandstone deposits amenable to ISL in the Xinjiang and Inner Mongolia regions, and the granite and volcanic metallogenic belts in southern China, including the Xiangshen uranium orefield.

In northern China, the exploration is focused on previously discovered mineralization spanning the Yili, Turpan-Hami, Junggar and Tarim basins of Xinjiang Autonomous Region, and the Erdos/Ordos, Erlian, Songliao, Badanjili and Bayingebi basins of Inner Mongolia. The Ordos basin itself covers over 250,000 sq. km of Shaanxui, Shanxi, Gansu and Inner Mongolia and contains major coal units as well as commercial gas reservoirs and some oil. It starts just north on Xi’an in Shaanxi province and extends nearly to Baotou near the Mongolian border. By 2012 this had become the premier uranium region of China, right across its north. In 2008 significant deposits were discovered in the Yili basin of Xinjiang, including J3, and then in the Ordos basin Nalinggou, Darong and (in 2012) Daying were discovered. Daying is expected to become China’s largest uranium resource and in late 2014 was being described by the Geological Survey Bureau as ‘world class’. Also in the Erlian basin the Bayanwula deposit, a roll front deposit with biogenic origins, was identified. In the Songliao basin in the east of Inner Mongolia the Qianjiadian deposit was identified, and in 2017 CNNC announced "a breakthrough in sandstone-type uranium ore exploration," and expects a new orebody – with an overall length of more than 10 km – to develop into a large uranium deposit.

CNNC Inner Mongolia Mining Industry LLC based in Baotou is responsible for overseeing natural uranium geological prospecting, scientific research and project management in the middle and western parts of Inner Mongolia. Its Mining Business Division is focused mainly evaluating the Nalinggou and Bayanwula projects by the end of 2015. The Division is also setting up regional headquarters in Inner Mongolia, Jiangxi, Guangdong and Xinjiang.

Some northern uranium mineralization is interbedded with coal deposits, giving rise to concerns about mining efficiently, and about the amount of radioactivity in coal as burned in some northern power stations. The Daying uranium deposit in Inner Mongolia is evidently in this category, with separate layers of coal and uranium ore in sandstone palaeochannels extending over many kilometres. The coal resource is major.

In March 2013 CNNC signed an agreement with China Petroleum & Chemical Corp. (SINOPEC) to set up the joint venture of CNNC and SINOPEC Uranium Resources Co. Ltd to accelerate the exploration for uranium resources, starting with the Chaideng area of Inner Mongolia. The Chaideng prospecting region of Dongsheng Coal Field is in the northeast of the Ordos Basin.

In August 2014 CNNC signed an agreement with Shenhua Group to recover uranium from a mine near Ordos city. In March 2016 it signed a broader strategic agreement. Shenhua is the largest coal mining company in China.

The Dongsheng group of uranium deposits is located in south-central Inner Mongolia, about 100 km south of Baotou and on the northern edge of the Ordos Basin. Uranium ore bodies are mostly in area of 200 sq. km hosted by fluvial sandstones in the Zhiluo Formation as a regional redox front, and to a lesser degree within the Yan'an Formation, which has coal-bearing strata. Individual tabular and roll-front ore bodies are several tens to one hundred metres long, up to 20 m thick, and have average ore grades of 0.02 to 0.05%U. They plunge from 75 to 185 m deep, following the dip of the Zhiluo formation.

International uranium sources

Increasingly, uranium is imported from Kazakhstan, Uzbekistan, Canada, Namibia, Niger and Australia. International sources are both from Chinese equity in mines and uranium bought on the open market.

Chinese equity in uranium mines in other countries

| Company | Country | Mine | Equity % | Start production with China equity |

| CNUC | Niger | Azelik | 37.2 + 24.8 ZXJOY | 2010 but now closed |

| Niger | Imouraren | 25+, more pending | On hold | |

| Namibia | Langer Heinrich | 25 | 2014 | |

| Namibia | Rössing | 68.6 | 2019 | |

| CGN-URC | Namibia | Husab | 100 | 2016 |

| Kazakhstan | Irkol & Semizbai | 49 | 2008, 2009 | |

| Kazakhstan | Central Mynkuduk | 49 | 2021 |

Alashankou bonded uranium warehouse

CNUC is constructing a warehouse in Xinjiang on the Kazakhstan-China border, designed to become a major uranium trading hub in the future. At the end of 2021, CNUC announced it had completed construction of phase 1, bringing the storage capacity of the warehouse to 3000 tU. Phase 2, which CNUC aims to complete by the end of 2023, will significantly expand the facility’s capacity to 20,000 tU.

CNNC initiatives abroad

With the prospective need to import much more uranium, China Nuclear International Uranium Corporation (SinoU) was set up by CNNC to acquire equity in uranium resources internationally. It set up the Azelik mine in Niger and has agreed to buy a 10% share of Areva’s Imouraren project there for €200 million. It is now consolidated into CNUC.

In January 2014 it bought a 25% stake in Paladin’s Langer Heinrich mine in Namibia for $190 million, entitling it to that share of output. In November 2018, it bought Rio Tinto’s majority stake (68.6%) in Namibia’s Rössing mine.

It has investigated prospects in Kazakhstan, Uzbekistan, Mongolia, Namibia, Algeria and Zimbabwe. Canada and South Africa are also seen as potential suppliers for SinoU. About 2007 it bought a share (49%?) in the Zhalpak mine in Kazakhstan, and a joint venture with Kazatomprom was set up to develop it.

Sinosteel Corporation holds minor equity in explorer PepinNini Minerals Ltd in Australia and has 60% of a joint venture with PepinNini to develop a uranium deposit in South Australia. Sinosteel is also involved with exploration on Quebec and Krygystan.

In 2010 CNNC contracted with Cameco for 8865 tU through to 2025.

In March 2009, CNNC International, a 70% subsidiary of CNNC Overseas Uranium Holding Ltd and through it, of CNUC, agreed on a $25 million takeover of Western Prospector Group Ltd which controlled the Gurvanbulag deposit in Mongolia, very close to the Chinese border. Western Prospector and its Mongolian subsidiary, Emeelt Mines, undertook a definitive feasibility study which showed that the project was barely economic, on the basis of 6900 tU reserves averaging 0.137% U. With radiometric sorting the head grade would be 0.152%U and the mine could produce 700 tU/yr for nine years. Mine development cost would be about $280 million. In June 2012 CNNC Mongolia Project Co announced an agreement with the Mongolian government's Nuclear Energy Agency (NEA) to develop Gurvanbulag, following three years of feasibility studies and preparation. In August 2014 CNNC said that the government had approved its recent feasibility study, and negotiations towards a joint venture company with NEA continued. In November 2015 CNNC International reported that all exploration work was complete and that it awaited a mining licence. It then expected to form a project JV with the government, which would hold 51% leaving CNNC International Ltd. with 49% of the project.

CNNC has been searching for uranium in Jordan.

CGN initiatives abroad

CGN subsidiary China Guangdong Nuclear Uranium Resources Co Ltd (CGN-URC) set up in 2006 has uranium imports and investment in overseas sources of supply as part of its remit. It has been active in securing foreign supplies of uranium.

In September 2007, two agreements were signed in Beijing between Kazatomprom and CGN on Chinese participation in Kazakh uranium mining joint ventures and on reciprocal Kazatomprom investment in China's nuclear power industry. These came in the context of an earlier strategic cooperation agreement and one on uranium supply and fuel fabrication. This is a major strategic arrangement for both companies, with Kazatomprom to become a major uranium and nuclear fuel supplier to CGN. A framework strategic cooperation agreement was then signed with CNNC. A CGN subsidiary, Sino-Kazakhstan Uranium Resources Investment Co, has invested in two Kazakh uranium mines: Irkol and Semizbai, while CNNC is investing in another: Zhalpak. In April 2015 CGN Mining Co Ltd purchased the Sino-Kazakh shares, so it now holds 49% of the Semizbai-U JV.

In November 2010 CGN signed a long-term contract with Kazatomprom for 24,200 tonnes of uranium through to 2020. In May 2014 CGN contracted with Uzbekistan’s Navoi Mining & Metallurgy for $800 million worth of uranium to 2021. In 2013 Uzbekistan exported 1,663 tonnes of uranium (U3O8?) to China.

In November 2007 CGN signed an agreement with Areva to take a 24.5% equity stake in its UraMin subsidiary (now Areva Resources Southern Africa), and for China to take half the output, but this did not proceed.*

* Uramin was proposing mines in Namibia, South Africa and Central African Republic. In October 2008, Areva announced that a further 24.5% would be taken up by other 'Chinese sovereign funds', though it would remain the operator. China also agreed to buy more than half of the uranium from UraMin over the lifetime of the three deposits – the total quantity involved was to be over 40,000 tU to 2022. However, production from those mines, Trekkopje, Ryst Kuil and Bakouma respectively has not yet materialized, and at the end of 2009 Areva’s reported 100% equity in the company, with no Chinese equity.

CGN-URC has embarked upon a 50-50 joint venture with Uzbekistan's Goskomgeo focused on black shales the Sino-Uz Uranium Resources Co Ltd (or Uz-China Uran LLC), in particular the Boztau uranium exploration project in the Central Kyzylkum desert of the Navoi region of Uzbekistan. Over 2011-13 CGN-URC was to develop technology for the separate production of uranium and vanadium from these black shale deposits with a view to commencing production from 2014. In May 2014 Goskomgeo said CGN-URC planned to start mining in 2014, with production being sold to China.

In 2012 CGN-URC, through a Hong Kong subsidiary Taurus Minerals (60% CGN, 40% China-Africa Development Fund), took over Kalahari Minerals PLC and then Extract Resources Ltd, giving it ownership of the massive Husab project in Namibia, with 137,700 tU measured and indicated resources and a further 50,000 tU inferred resources at Rossing South. The cost was about $2.2 billion. Swakop Uranium is the development company owned by Taurus, except for a 10% share held by the government’s Epangelo Minerals. Mine development commenced in April 2013, production commenced at the end of 2016, ramping up to 5500 tU/yr. In July 2014 CGN Global Uranium Ltd (CGU) was incorporated in the UK to sell Husab uranium on the world market, though most production will be for CGN.

In 2015 CGN paid C$82.2 million for a nearly 20% stake in Fission Uranium Corp, making it the first direct Chinese investment in a Canadian uranium developer. An offtake agreement will entitle CGN to up to 35% of Patterson Lake South production at a 5% discount on prevailing spot market prices.

In mid-2010, CGN signed a framework agreement with Cameco under which the two companies would negotiate long-term uranium purchase agreements and potential joint development of uranium resources. In November the Cameco sale of 11,200 tonnes of uranium through to 2025 was confirmed. Then, in November 2010, CGNPC signed a $3.5 billion, ten-year contract with Areva for supply of 20,000 tonnes of uranium.

Alternative sources of uranium

In 2007 CNNC commissioned Sparton Resources of Canada with the Beijing No.5 Testing Institute to undertake advanced trials on leaching uranium from coal ash out of the Xiaolongtang power station in Yunnan province, in the southwest. The Lincang ash contains 160-180 ppm U – above the cut-off level for some uranium mines. The power station ash heap contains over 1700 tU, with annual arisings of 106 tU. Two other nearby power stations burn lignite from the same mine. A joint venture company Yunnan Sparton New Environ Tech Consulting Co. Ltd. (SNET), 60% owned by Sparton, has been set up to operate the secondary recovery programs. No results were evident by mid-2011, or since.

Nuclear fuel industrial parks

Two industrial parks for nuclear fuel are planned – a northern one in Hebei near Beijing, and one in the south, probably Guangdong province. They will each include uranium conversion, enrichment, and fabrication facilities to support China's goal to become the centre of Asian nuclear fuel preparation and manufacturing. Also, sales of Hualong reactors are envisaged as being with a supply of fuel. About CNY 80 billion is being invested in the two parks.

In May 2013 CGN and CNNC announced that their new China Nuclear Fuel Element Co (CNFEC) joint venture would build a CNY 45 billion ($7.33 billion) complex in Daying Industrial Park at Zishan town in Heshan and Jiangmen city, Guangdong province. This nuclear fuel industrial park was to be established during the 12th Five-Year Plan and be fully operational by 2020. However, in July 2013 the plan was abruptly stalled. The 200 ha park was to involve 1000 tU/yr fuel fabrication as well as a conversion plant (14,000 t/yr) and an enrichment plant, close to CGN’s Taishan power plant.

The plan is being implemented at Cangzhou in Hebei province – the North Park – and a new site being sought in Guangdong – the South Park.

Conversion

Information on China’s conversion capacity is uncertain. The World Nuclear Association's (WNA's) 2019 edition of The Nuclear Fuel Report has 9965 tU/yr as reference case requirements for 2020, rising to 13,201 tU/yr in 2022 and 24,710 tU/yr in 2030.

Conversion requirements are of the same order. A conversion plant at Lanzhou in Gansu province of about 1000 tU/yr started operation in 1980 but may now be closed. A 5000 t/yr plant is reported there, operating at about 80% capacity, and a 9000 t/yr one is reported as under construction and due on line in 2017 or 2018.

Another conversion plant at Diwopu, Jiuquan, near Yumen in northwest Gansu province, is run by CNNC 404 company and is about 500 tU/yr.

China Nuclear Fuel Corp is building a plant at Hengyang in Hunan province. UxC quotes this as 3000 tU/yr, with construction permit issued in October 2014 and operation expected in 2018. The head of Kazatomprom visited this in mid-2016.

New conversion capacity was proposed with the new China Nuclear Fuel Element Co (CNFEC) plant at Daying Industrial Park in Heshan and Jiangmen city, Guangdong province. It was quoted at 14,000 t/yr by 2020 but plans for this location were cancelled in July 2013. The new location of the complex is Cangzhou in Hebei province in the north, due to commence production in 2018 and ramp up to full capacity after 2020. However, the Guangdong government wants to revive the original project and CNNC is looking for a southern site for part of the capacity.

Ux Consulting comments that if all these plans are realized by 2030, China will have a total conversion capacity about 31,000 tU/year, which can match an enrichment capacity about 23 million SWU/year, sufficient to feed about 180 GWe of PWR capacity.

Enrichment and enriched uranium imports

In 2010 China needed 3600 tU and 2.5 million SWU of enrichment. The WNA Nuclear Fuel Report has demand in 2020 at 15,000 tU (natural) and about 8 million SWU. Enrichment requirements rise to about 13 million SWU in 2025 and 19.6 million SWU in 2030. All enrichment capacity is inland, in Shaanxi and Gansu provinces. China aims for a fully independent enrichment capability including R&D, engineering, manufacturing and operating.

A Russian centrifuge enrichment plant at Hanzhun/Hanzhong, SE Shaanxi province, was set up under 1992, 1993 and 1996 agreements between Minatom/Tenex and CNEIC covering a total 1.5 million SWU/yr capacity in China at two sites. The first two modules at Hanzhun came into operation in 1997-2000, giving 0.5 million SWU/yr as phases 1 & 2 of the agreements. In November 2007, Tenex undertook to build a further 0.5 million SWU/yr of capacity at Hanzhun, completing the 1990s agreements in relation to the Hanzhun plant. This was commissioned ahead of schedule in mid-2011 and has operated reliably since.

A north expansion project at Hanzhun was then built over 2012-14, with 1.2 million SWU/yr capacity using indigenous technology.

The full agreement for the main $1 billion Hanzhun plant was signed in May 2008 between Tenex (Techsnabexport) and China Nuclear Energy Industry Corporation. The site, or at least two phases of it, is under IAEA safeguards. Up to 2001 China was a major customer for Russian 6th generation centrifuges, and more of these were supplied in 2009-10 for Hanzhun, under phase 4 of the agreement.

The Lanzhou enrichment plant in Gansu province to the west started in 1964 for military use and operated commercially 1980 to 1997 using Soviet-era diffusion technology. A Russian centrifuge plant of 500,000 SWU/yr started operation there in 2001 as phase 3 of the above agreements and it replaced the diffusion capacity. Subsequent expansion is based on indigenous centrifuge technology, about 2.5 million SWU of which was operating in mid-2015. Two 0.5 million SWU units (CEP 2&3) and one 1.2 million SWU unit (CEP 4) comprise the indigenous additional capacity. CEP 4 is due to start full commercial operation in 2016.

Another and larger diffusion enrichment plant, Plant 814, operated at Heping, Sichuan province, from 1975 to 1987 for military purposes. It was indigenously built, about 200-250,000 SWU/yr capacity, but its continued operational status and purpose is uncertain, possibly including fuel for naval reactors. It appears to have been upgraded about 2006. A new 0.8 million SWU/yr centrifuge plant was then built at Emeishan nearby, operating from about 2013. A second 0.8 million SWU/yr plant is under construction there.

China Uranium Enrichment Capacity

| Plant | Province | Annual capacity (million SWU) 2015 |

Projected capacity 2020 |

| Hanzhun | Shaanxi | 2.2 | 2.2 |

| Lanzhou | Gansu | 3.56 | 6.52 |

| Heping 814 | Sichuan | 0.4 (uncertain) | 0.4 |

| Emeishan | Sichuan | 0.8 (part built) | 1.6 - 2.4 |

| Estimated total | 5.7 - 7.0 | 10.7 - 12.0 |

Sources: World Nuclear Association Nuclear Fuel Report, September 2015; Harvard Kennedy School study, August 2015 .

UxC estimates 2015 capacity at 4.5 million SWU.

China has developed its own centrifuge technology at Lanzhou, and the first domestically-produced centrifuge was commissioned there in February 2013. An estimated 4.1 million SWU capacity has been built using indigenous Chinese centrifuge technology.

Further enrichment capacity was planned with the new China Nuclear Fuel Element Co (CNFEC) plant at Daying Industrial Park in Heshan city, Guangdong province. It was quoted at 7 million SWU/yr by 2020. However plans for this location were cancelled in July 2013. The new location of the complex is Cangzhou in Hebei province in the north. It is due to commence production in 2018 and ramp up to full capacity after 2020. The Guangdong government wants to revive the original project, and a southern site is being sought.

CGN-URC contracts fuel fabrication services from CNEIC on behalf of its operational power generation companies. There has been some minor export of enrichment services, and in April 2014 a new initiative was reported, and export delivery of 1 million SWU was estimated for 2014 (unconfirmed).

Enriched uranium

Much of the enriched uranium for China's reactors has come from outside the country, and some still does so in connection with early fuel loads for foreign-sourced reactors.

A contract with Urenco supplied 30% of the enrichment for Daya Bay from Europe.

Under the May 2008 enrichment agreement Tenex is to supply (from Russia) 6 million SWU as low-enriched uranium product from 2010 to 2021 for the first four AP1000 reactors, this apparently being related to completion of the Hanzhun enrichment plant. It is expected to involve $5 to 7 billion of LEU and possibly more. Enriched uranium for the first four AP1000 reactors is being supplied by Tenex from Russia, under the 2008 agreement.

Fuel fabrication

CNNC is responsible for fuel fabrication in China, utilising some technology transferred from Areva, Westinghouse and TVEL. Fuel fabrication plants are inland, in Sichuan and Inner Mongolia. Demand in 2013 was about 1300 tU in fabricated fuel, and by 2020 this will rise to about 1800 tU – though precise levels fluctuate due to demand for initial core loads in new reactors.

Fuel Fabrication in and for China

| Location | Company | Type of fuel | Capacity |

| Yibin, Sichuan | Jianzhong Nuclear Fuel, China Nuclear Fuel South | PWR VVER |

800 t/yr 100 t/yr |

| Baotou, Inner Mongolia | China Nuclear Fuel North | PHWR PWR |

200 t/yr 200 t/yr total 800 t/yr by 2020 |

| Baotou, Inner Mongolia | CNNC Baotou Nuclear Fuel Company Ltd | AP1000, CAP etc |

800 t/yr |

| Baotou, Inner Mongolia | INET? | HTR | 300,000 fuel pebbles |

| Oskomen, Kazakhstan | Ulba-FA (CGN & Kazatomprom) | PWR | 200 t/yr |

CNNC's main PWR fuel fabrication plant at Yibin, Sichuan province, was set up in 1982 (though based on a 1965 military plant) to supply Qinshan 1. It is operated by CNNC subsidiary China Jianzhong Nuclear Fuel (JNF), with its subsidiary China Nuclear Fuel South, and by October 2008 was producing fuel assemblies with 400 tU/yr. It reached 800 tU/yr of PWR fuel and 100 tU/yr VVER fuel* by the end of 2013 and plans indicate at least 1000 tU/yr by 2020. It supplies Qinshan, Tianwan, Fuqing, Ningde, Hongyanhe and Yangjiang and is contracted to produce Hualong One fuel for Fuqing 5&6. It has started producing the locally-designed CF3 fuel assemblies, with the first loaded in Qinshan II-2 CNP-600 in mid-2014. It has certified Kazakhstan's Ulba Metallurgical Plant as a source of pellets. After proving at Qinshan, in 2019 full-scale production of CF3 fuel for Hualong reactors began.

* VVER fuel fabrication at Yibin began in 2009, using technology transferred from TVEL under the fuel supply contract for Tianwan. (First core and three reloads for Tianwan 1&2 were from Novosibirsk Chemical Concentrate Plant in Russia – 638 fuel assemblies, under the main contract.) By August 2010, Yibin had produced 54 VVER-1000 fuel assemblies which were being loaded into Tianwan 1&2. In November 2010, TVEL contracted with Jiangsu Nuclear Power Corporation (JNPC) and the China Nuclear Energy Industry Corporation (CNEIC) to supply six fuel reloads for Tianwan 1, and the technology for fuel to be produced at Yibin thereafter, for about US$ 500 million. TVEL certified the plant to manufacture the new TVS-2M fuel for Tianwan in April 2014. The two units run on 18-month refueling cycles.

CNNC set up a second civil fuel fabrication plant run by China North Nuclear Fuel Co Ltd (CNNFC) at Baotou, Inner Mongolia, in 1998, based on a military plant there dating from 1956. This has become a major R&D base, producing the most types of fuel. It fabricates fuel assemblies for Qinshan's CANDU PHWRs (200 tU/yr) and 200 tU/yr for older PWRs. Areva has assisted the plant to qualify for production of modern fuel. In 2012 the plant became the Northern Branch of China Nuclear Fuel Element Co Ltd., or simply China Nuclear Northern, though the original company name continued being used. The plant is ramping up from 400 tU/yr to 800 tU/yr production over 2013 to 2020 for PWR and PHWR fuel.

In 2008 SNPTC agreed with both fuel companies (Jianzhong and Northern) to set up CNNC Baotou Nuclear Fuel Company Ltd to make fuel assemblies for China's AP1000 reactors (first cores and some re-loads of the initial units are supplied by Westinghouse). In January 2011 a $35 million contract was signed with Westinghouse "to design, manufacture and install fuel fabrication equipment that will enable China to manufacture fuel" for AP1000 units. This production line was commissioned in 2015, at 400 tU/yr for phase 1. Phase 2, also 400 tU/yr, was completed in October 2016 and commissioned in June 2017. CNNC signed a contract with Sanmen Nuclear Power Company in January 2017 to provide refuelling components for the second, third and fourth operating cycles of units 1&2 of the Sanmen plant. Early in 2016 a prototype fuel assembly for the CAP1400 was produced. In 2015, now as a subsidiary of SPI, SNPTC declared a strong interest in pellet and fuel manufacturing for its AP and CAP reactors, with associated R&D.

A new fuel production line at Baotou to make the 9% enriched fuel spheres for the Shidaowan HTR-PM high temperature reactors in Shandong province was completed in May 2015 at a cost of almost CNY 300 million. It started production in March 2016, ramping up to a capacity of 300,000 fuel pebbles per year. By July 2017 it had produced 200,000, transitioning to full commercial operation. NNSA licensed the project in February 2013. It is based on a trial production line developed by INET at Tsinghua University to produce 100,000 spherical fuel elements per year, and INET is involved in the new plant. (In March 2011 a contract was signed with SGL Group in Germany for supply of 500,000 machined graphite spheres for HTR-PM fuel load by the end of 2013.) Qualification irradiation tests of fuel elements were completed in December 2014 at the High Flux Reactor at Petten in the Netherlands.

In May 2013 CNNC and CGN announced that they would build a new China Nuclear Fuel Element Co (CNFEC) plant at Daying Industrial Park in Heshan and Jiangmen city, Guangdong province, and it would have 1000 tU/yr capacity by 2020. Construction was due to start in 2013, but in July the plan for this location was abruptly cancelled. Some of this capacity is likely to be built at Cangzhou in Hebei province. The CNY 45 billion industrial park was also to involve a conversion plant and an enrichment plant.

CGN in joint venture with Kazatomprom is building the 200 t/yr Ulba-FA fuel fabrication plant in Kazakhstan to produce AFA 3G fuel assemblies for its French-designed reactors. CGN-URC holds 49% of the Ulba-FA JV.

In order meet its goal of being self-sufficient in nuclear fuel supply, additional fuel production capacity will be required. However, the EPR fuel for Taishan being supplied to CGN by Framatome, comprising the two first cores and 17 reloads, will be fabricated in France.

Also the VVER fuel for Tianwan 3&4 is being supplied by Russia’s TVEL until 2025, and it will help to equip the Yibin plant to produce from then, under a $1 billion contract with Jiangsu Nuclear Power Corporation (JNPC) and the China Nuclear Energy Industry Corporation (CNEIC).* In 2019 TVEL was also contracted to supply fuel for Tianwan 7&8 and Xudapu 3&4. In 2018 TVEL and CNEIC were considering joint construction of a VVER fuel fabrication plant in Ukraine.

* TVEL's TVS-2M fuel offers the possibility of an extended 18-month operating cycle and is used in Russia's Balakovo and Rostov power plants. After pilot operations using six TVS-2M assemblies at Tianwan 1, the design was licensed in China, and Tianwan 1&2 were converted to 18-month operating cycles from 2014. Units 3&4 are to run on the fuel from their first core loadings onwards.

CGN-URC contracts fuel fabrication services from CNFSC and CNFNC, and retails these to its operational power generation companies.

CNNC and Areva have set up a 50-50 joint venture to produce and market zirconium alloy tubes for nuclear fuel assemblies. The joint venture, CNNC Areva Shanghai Tubing Co. (CAST), started production at the end of 2012, and was expected to ramp up from 300 km of tubes per year to 1500 km in 2015, supplying both Yibin and Baotou fuel fabrication plants. A further agreement in 2013 may extend this JV to producing the zircaloy itself, at 600 t/yr by 2017.

Fuel cycles

A standard 18-month fuel cycle is the normal routine for Daya Bay, Ling Ao, and early M310 to CPR-1000 reactors. This has average burn-up of 43 GWd/t, with maximum of 50 GWd/t. An Advanced Fuel Management cycle using fuel with gadolinium burnable poison is implemented at Ling Ao phase II, Hongyanhe, Ningde, and Yangjiang, giving average 50 GWd/t and maximum 57 GWd/t through to CPR-1000+.

Moving to recycling fuel in PWRs is the next step, though with limited advantage compared with longer-term goal of using fast neutron reactors with MOX and advanced reprocessing. This will be electrometallurgical reprocessing (pyroprocessing) coupled with some sort of partitioning.

Reprocessing, recycling

Establishing significant reprocessing capacity is seen as vital both for management of domestic used fuel and as a service export in connection with selling reactors overseas.

Late in 2015 CNNC said it estimated that 23,500 tonnes of used fuel will have been discharged from reactors by 2030 and 15,000 tonnes of that would be in dry cask storage. When 50 GWe is operating, up to 2000 t used fuel will be discharged each year.

Most of the civil back-end facilities are currently at the Lanzhou Nuclear Fuel Complex in Gansu province. This is repurposed from Jiuquan Atomic Energy Complex, originally a military facility with a plutonium production reactor operating 1975-84. Also, a formerly military enrichment plant is there, now a significant civil facility.

CNNC Ruineng Technology Co Ltd was set up by CNNC in November 2011 to industrialize used fuel reprocessing technology and mixed oxide (MOX) fuel production to close the fuel cycle. This would involve both local initiatives and the planned Areva/Orano plant. Ruineng will also be responsible for storage and management of used fuel.

A pilot reprocessing plant using the Purex process was constructed from 2006 at Lanzhou Nuclear Fuel Complex in Gansu province. It completed hot commissioning in 2010 to reprocess about 50 tonnes of used fuel over 2013-15. It is reported to have about 36 t/yr capacity subsequently.

A demonstration fuel reprocessing plant, with a capacity of 200 tonnes of used fuel per year, is being built in Gansu Nuclear Technology Industrial Park at Jinta in Gansu province by CNNC Longrui Technology Company, which was set up in March 2015. It is expected to start operation in 2025. A second 200 t/yr plant started construction about the end of 2020. They are both close to the demonstration MOX plant under construction since 2018 and form the main infrastructure for the two CFR-600 fast reactors (see Mixed oxide fuel section below).

A large (800 t/yr) commercial reprocessing plant is planned to follow and begin operation about 2025, using the Purex process to recover uranium and plutonium from fuel with burn-up up to 55 GWd/t. Actinides and fission products will become waste which would be vitrified. It is unclear how this relates to successive agreements with Orano. A second 800 t/yr plant was to follow.

The planned Areva (now Orano) reprocessing plant has been a long-running saga since 2007, with no clear outcome yet evident.*

* In November 2007, when Areva and CNNC signed an agreement to assess the feasibility of a reprocessing plant for used fuel and a mixed oxide (MOX) fuel fabrication plant in China, representing an investment estimated then of €15 billion. The 800 t/yr reprocessing plant was then envisaged to be in Jinta county, north of Jiayuguan in Gansu province, employing proven French technology and operated by Areva. Design, construction and commissioning was expected to take ten years from 2010. In November 2010, an industrial agreement on this was signed, which Areva said was "the final step towards a commercial contract" for the project. In April 2013 a further agreement was signed with Areva, setting out the technical specifications for the 800 t/yr plant. Then in March 2014 another agreement on the matter was signed, to continue planning the project and completing a business case for it.

In June 2015 a further agreement "formalizes the end of technical discussions, defines the schedule for commercial negotiations and confirms the willingness of both groups to finalize the negotiations in the shortest possible timeframe," according to Areva. In September CNNC said that it was selecting a site and that construction was expected to start in 2020 to be completed in 2030. China Nuclear Power Engineering Corporation (CNPE) was seeking seismic studies of coastal sites for the plant on behalf of CNNC Ruineng Technology Co Ltd. In November 2015 another Areva-CNNC agreement was signed for the 800 t/yr plant, referencing Orano’s La Hague plant and envisaging a cost of CNY 100 billion ($15.7 billion). CNNC would be responsible for building the plant but with Areva NC (now Orano) responsible for technical aspects.

A coastal site in Jiangsu province was suggested, so that used fuel could be transported on ships (rather than a 3000 km road or rail trip inland to Gansu, though public and local government support there is strong). In July 2016 Lianyungang city in Jiangsu was mentioned as likely for the 3km2 site, close to the Tianwan nuclear power plant, but in August public protests caused local government to back away from the proposal. A final contract had been envisaged in 2017 with construction from 2020, possibly including a MOX plant.

Associated with the reprocessing plant, the site would also have a used fuel storage facility with the capacity to hold 3000 tonnes initally and possibly 6000 tonnes eventually. An associated high-level liquid waste vitrification facility is also planned.

It is estimated that another 800 t/yr reprocessing plant will be required every ten years to match nuclear growth.

Technology for recycling uranium recovered from used nuclear fuel from Chinese PWRs for use in the Qinshan Phase III Candu units is being developed (see section below on Recycled uranium in PHWRs; thorium in PHWRs).

Mixed oxide fuel

A small experimental mixed oxide (MOX) fuel plant was built in 2008, giving experience at 500 kg/yr.

In October 2010, GDF Suez Belgian subsidiary Tractabel, with Belgonucleaire and the nuclear research centre SCK-CEN signed an agreement with CNNC to build a pilot mixed oxide (MOX) fuel fabrication plant in China. Belgium has experience in MOX fuel development and production dating back to 1960, including 20 years of industrial MOX production at Belgonucleaire's 35 tonne per year Dessel plant from 1986 to 2006 (see section on Fuel cycle in the information page on Nuclear Power in Belgium). MOX has been in use in Belgium's nuclear power plants since 1995.

CNNC’s Gansu Nuclear Technology Industrial Park is building a 20t/yr demonstration MOX plant associated with the initial 200 t/yr demonstration reprocessing plant under construction. The MOX plant started construction in 2018 and is expected to be commissioned about 2025. This is to support the fuel needs of the two CFR-600 fast reactors.

Fuel for the Xiapu 1 CFR-600 fast reactor will be HEU from Russia, but Xiapu 2 may run on domestically-produced MOX. Fuel for the BN-800 reactors (referred to as Chinese Demonstration Fast Reactors – see section below on Fast neutron reactors) earlier planned to be built at Sanming would have been MOX pellets, initially made in Russia.

China Institute of Atomic Energy (CIAE) earlier envisaged two 40 t/yr MOX fabrication plants in operation from about 2018. A 50 t/yr MOX reprocessing plant is under consideration for operation by 2030. This may be part of the Areva NC (Orano) reprocessing plant contract.

Waste management

When China started to develop nuclear power, a closed fuel cycle strategy was also formulated and declared at an International Atomic Energy Agency conference in 1987. The used fuel activities involve: at-reactor storage; away-from-reactor storage; and reprocessing. CNNC has drafted a state regulation on civil used fuel treatment as the basis for a long-term government programme. There is a levy of CNY 2.6 cents/kWh from the fifth year of commercial operation of each reactor, to pay for used fuel management, reprocessing, and the eventual disposal of separated HLW.

Based on expected installed capacity of 50 GWe by 2020, the annual used fuel arisings will amount to about 1300 tonnes at that stage, the cumulative total being about 14,000 tonnes then. The two Qinshan Phase III CANDU units, with lower burn-up, will discharge 176 tonnes of used fuel annually.

Storage of used fuel and disposal of HLW

A centralized used fuel storage facility has been built at Lanzhou Nuclear Fuel Complex, 25 km northeast of Lanzhou in central Gansu province. The initial stage of that project has a storage capacity of 550 tons and could be expanded to 1300 tonnes. Used fuel from Daya Bay is shipped there. However, most used fuel is stored at reactor sites, in ponds. It or an intermediate-level waste repository there is 10-20 m underground. The only dry storage operating is at Qinshan, and this is being expanded.

CNNC Everclean Co Ltd is responsible for used fuel transport from nuclear power plant sites to Lanzhou Nuclear Fuel Complex, and storage there. Some used fuel – over 100 fuel assemblies per year – is transported 3700 km by road from Daya Bay to Gansu province for storage. According to the State Administration for Science, Technology and National Defense Industry (SASTIND), this quantity needs to increase to 600 assemblies per year. In June 2018 CNNC Everclean contracted with Holtec International to supply its HI-STAR 100MB casks by 2020. In 2016 it had bought four NAC-STC casks for high-burnup fuel, and in January 2018 Spain's ENSA also supplied a cask.

CGN plans a demonstration programme of regional storage centres close to its power plants, and the first is at Daya Bay, using Orano’s NUHOMS dry storage system. These will dispatch used fuel by train to the eventual reprocessing plant in the west of the country.

Following reprocessing, separated high-level waste will be vitrified, encapsulated and put into a geological repository some 500 metres deep. Site selection and evaluation has been under way since 1986, focused on three candidate locations in the Beishan area of the Gobi desert in Gansu province. All are in granite. The site for the Beishan underground research laboratory 400-560 metres deep was announced by the NNSA in September 2019.

In June 2021, under the 14th Five-Year Plan, construction of the underground laboratory started, with a view to 50 years of operation after seven years' construction. It is to have 2.39 million square metres of gross floor space, with 13.4 km of tunnels. Estimated cost is CNY 2.7 billion ($420 million). The Beijing Research Institute of Uranium Geology (BRIUG) is leading the project.

In the light of research here, the final repository would be constructed from 2040 with demonstration disposal. Acceptance of high-level waste into a national repository is anticipated from 2050. All this is taking place under the 2006 R&D Guidelines for Geological Disposal jointly published by China Atomic Energy Authority, Ministry of Science &Technology, and Ministry of Environmental Protection. The International Atomic Energy Agency has also been advising on the project since 1999.

In mid-2014 construction started on a vitrification plant for HLW in Sichuan, where 800 m3 of liquid waste was reported to be stored already. It was commissioned in August 2021 and uses German technology and plant from Karlsruhe Institute of Technology. It is entirely for military waste, but the technology may be usable later for civil waste.

The regulatory authorities of high-level radioactive waste disposal projects are Ministry of Environmental Protection (MEP) and the National Nuclear Safety Administration (NNSA). The China Atomic Energy Agency (CAEA) is in charge of the project control and financial management. CNNC deals with implementation, and four CNNC subsidiaries are key players: Beijing Research Institute of Uranium Geology (BRIUG) handles site investigation and evaluation, engineered barrier study and performance analyses, with the China Institute of Atomic Energy (CIAE) undertaking radionuclide migration studies. The China Institute for Radiation Protection (CIRP) is responsible for safety assessment, and the China Nuclear Power Engineering Company (CNPE) works on engineering design.

Low- and intermediate-level waste

Industrial scale disposal of low- and intermediate-level waste (LILW) is at three sites: near Yumen, northwest Gansu province; at the Beilong repository in Gunagdong province near the Daya Bay nuclear plant; and at Feifengshan, Sichuan province. Two of these are run by CNNC Everclean Co, the other by a CGN subsidiary. These are the first three of five planned regional LILW disposal facilities.

China LILW disposal sites

| Site name | Location | Operator | Storage capacity planned | Storage capacity actual | Functions |

|---|---|---|---|---|---|

| Xibei Center, Northwest | Gansu province (CNNC 404 plant) | CNNC Everclean Co. | 200,000 m3 | 20,000 m3 | Includes waste from local military facilities. |

| Beilong Center | Guangdong province | Guangdong Daya Bay Nuclear Power Environmental Protection Co. | 80,000 m3 |

8800 m3 |

5 km away from Daya Bay. Dedicated to waste from Daya Bay and Ling Ao units. |

| Feifeng Mountain | Sichuan province | CNNC Everclean Co. | 180,000 m3 | 20,000 m3 | As a testing facility. |

Decommissioning

The China Institute of Atomic Energy (CIEA) 15 MWt HWRR-II heavy water research reactor that started up in 1958 was shut down at the end of 2007 and decommissioned.

Heavy manufacturing industrial parks

Two significant industrial parks focused on nuclear manufacturing were announced in 2010 and are being set up.

The first is a nuclear technology base near Nanjing in Jiangsu province, known as the Nanjing Jiangning district Binjiang Development Zone, and part of the China Nuclear Binjiang Production Base inaugurated in 2003 which includes a research facility for nuclear-grade concrete. China Huaxing Nuclear Construction Company (HXCC) committed to build this on the banks of the Yangtze River about 300 km west of Shanghai, in three phases to 2015. Nanjing is a transport hub, and the overall 51 square kilometre development zone will be served by a new river port including a bulk cargo terminal and 12 deep-water piers.

The zone will feature as its centrepiece a $146 million factory for pre-assembled structural and equipment modules for CPR-1000 and Westinghouse AP1000 reactors. The modules, weighing up to nearly 1000 tonnes each in the case of AP1000, can then be taken by barge to construction sites. Currently AP1000 modules are made by Shandong Nuclear Power Equipment Manufacturing Co. which has the capacity to support construction of two reactors per year. HXCC is the main civil engineering contractor for China Guangdong Group.

The second is the China Haiyan Nuclear Power City, launched by CNNC at Haiyan, Zhejiang province, on the Yangtze delta about 120 km southwest of Shanghai and close to the cities of Hangzhou, Suzhou and Ningbo. As well as having the nuclear power plants in the Qinshan complex nearby, Haiyan hosts the headquarters of 18 leading Chinese nuclear equipment suppliers and branch offices of all the major Chinese nuclear design institutes and construction companies. The new China Haiyan Nuclear Power City will cover 130 square kilometers and has a 10-year budget of $175 billion, according to reports. It is expected to have four main areas of work: development of the nuclear power equipment manufacturing industry; nuclear training and education; applied nuclear science industries (medical, agricultural, radiation detection and tracing); and promotion of the nuclear industry.

The Haiyan Nuclear Power City is entitled to all the preferential benefits granted to national economic and technological zones and national hi-tech industrial zones. Enterprises in the industrial park will enjoy priority for bidding quota, bidding training, qualification guidance and specific purchasing with CNNC. The concept is based on the French equivalent in the Burgundy area, and French suppliers will be involved at Haiyan, as will CGNPC.

As well as these major industry centres there is a factory for AP1000 modules set up at Haiyang, on the coast, and another in central Hubei province to support inland AP1000 projects and later the CAP-1400 derivatives.

A further centre, the Taishan Clean Energy (Nuclear Power) Equipment Industrial Park, opened in February 2010 in the Pearl River Delta region of Guangdong province, and is expected to become a centre for nuclear power equipment manufacturing, initially supplying hardware and services to nearby nuclear power projects. The planned development will eventually cover about 45 sq km and include design, R&D and technical services. The initial 3.1 sq km phase of the park costing CNY 2 billion was followed by a second 2.4 sq km phase. Targets call for manufacturers at the park to have 45% of the nuclear equipment market in Guangdong and produce goods worth CNY 22 billion by 2020 while playing a leading role in R&D and maintenance of nuclear power equipment. The park also plans to produce CNY 20 billion in goods not related to the power industry by 2020.

Research & development

Initial Chinese nuclear R&D was military. A water-cooled graphite-moderated production reactor for military plutonium started operating in 1966, located at the Jiuquan Atomic Energy Complex some 100 km northwest of the city of Jiuquan in Gansu province, north-central China. The area is mainly desert and very remote. In the early 1980s it was decided to convert it to dual-use, and plutonium production evidently ceased in 1984. Reprocessing was onsite. Another, larger, plutonium production reactor with associated facilities was in a steep valley at Guangyuan in Sichuan province, about 1000 km south. It started up about 1975 and produced the major part of China's military plutonium through to 1991.

In November 2013 China National Nuclear Power Company, Ltd. (CNNP) joined two of the nuclear-related research programs run by the Electric Power Research Institute (EPRI) in the USA. These are the Nuclear Maintenance Application Center (NAMC), which develops technologies, systems, and guides to drive improvements in nuclear plant maintenance activities; and the Nondestructive Evaluation (NDE) program, which develops technologies and procedures to quickly, accurately, and cost-effectively inspect and characterize nuclear component condition and inform strategic decisions on whether and when to replace, repair, or continue operation. CNNP said that it “will expand its engagement with EPRI soon to become a full member in all of its nuclear research programs.” Earlier in 2013 EPRI had signed agreements with CGN and SNERDI.

Research Reactors

Apart from military facilities, China has about 19 operational research reactors, and a report by the Ministry of Environmental Protection (MEP) in June 2013 asserted their good condition and safety, along with that of the country’s power reactors.

The 125 MW light water High-Flux Engineering Test Reactor (HFETR) has been run by the (Southwest) Leshan Nuclear Power Institute of China at Jiajiang, Sichuan province, since 1979. Early in 2007, this was converted to use low-enriched uranium, with the help of the US National Nuclear Security Administration (NNSA). It is licensed to 2028. At least one of the five research reactors in Sichuan province was near the epicentre of the May 2008 earthquake.

The China Institute of Atomic Energy (CIEA) near Beijing undertakes fundamental research on nuclear science and technology and is the leading body in relation to fast neutron reactors, as well as other research reactors. Its 15 MWt HWRR-II heavy water research reactor started up in 1958 and was shut down at the end of 2007. An updated version of this was supplied to Algeria and has operated since 1992.

CIEA built the new 60 MWt China Advanced Research Reactor (CARR), a sophisticated and versatile light water tank type unit with heavy water reflector which started up in May 2010, reaching full power in March 2011, and it also built the 65 MW China Experimental Fast Reactor (CEFR) which started up in July 2010. (see subsection below on Fast neutron reactors).

In October 2010, the Belgian nuclear research centre SCK-CEN signed an agreement with the China Academy of Sciences to collaborate on the Belgian MYRRHA projectb, which China sees as a way forward in treating nuclear wastes.

Reactor and fuel cycle development

In 2008, SNPTC and Tsinghua University set up the State Research Centre for Nuclear Power Technology, focused on large-scale advanced PWR technology and to accelerate China's independent development of third-generation nuclear power.

A 200 MWt NHR-200 integral PWR design for heat and desalination has been developed by Tsinghua University's Institute of Nuclear Energy Technology (INET) near Beijing. It is developed from the 5 MW NHR-5 prototype which started up in 1989.

The NDRC is strongly supporting R&D on advanced fuel cycles, which will more effectively utilize uranium, and possibly also use thorium. The main research organizations are INET at Tsinghua University, China Institute of Atomic Energy (CIEA), also near Beijng, and the Nuclear Power Institute of China (NPIC) at Chengdu, which is the main body focused on the PHWR technology and fuel cycles. INET has been looking at a wide range of fuel cycle options including thorium, especially for the Qinshan Phase III PHWR units. NPIC has been looking at use of reprocessed uranium in Qinshan's PHWR reactors. CIAE is mainly involved with fast reactor R&D. China's R&D on fast neutron reactors started in 1964.

In November 2018 CNNC opened the new Research Centre for Nuclear Fuels and Materials in Beijing. CNNC said it marked “an important milestone in the development and production of high-performance nuclear fuels and materials, as well as high-performance nuclear reactor cores to realize the effective and efficient development of nuclear energy,” in an advanced nuclear science industrial system.

A report from NEA says that in Jiangxi a CNEC affiliate, Nuclear Construction Clean Energy Co. Ltd, has signed an agreement with Ruijin government to set up Jiangxi Ruijin Nuclear Power Preparatory Office. According to the agreement, Nuclear Construction Clean Energy Co would look for a site to construct a high temperature gas cooled reactor.

Thorium molten salt reactor programme

The China Academy of Sciences (CAS) in January 2011 launched a programme of R&D on thorium-breeding molten salt reactors (Th-MSR or TMSR), otherwise known as liquid fluoride thorium reactors (LFTRs), claiming to have the world's largest national effort on these and hoping to obtain full intellectual property rights on the technology. The unit they are building is said to be similar to the 7 MWt Oak Ridge test MSR which ran 1965-69 in the USA with U-235 then U-233 fuels. The timeline for full commercialization of TMSR technology was originally 25 years, but is reported to have been dramatically shortened, which may be reflected in increased funding.

The TMSR Research Centre was reported to have a solid-fuel MSR prototype under construction at the Shanghai Institute of Nuclear Applied Physics (SINAP, under the CAS) originally with 2015 targetted for operation, then 2020, but it may have been shelved. This is also known as the fluoride salt-cooled high-temperature reactor (FHR) in Generation IV parlance, or Advanced HTR (AHTR). A 2 MWe accelerator-driven subcritical liquid fuel prototype is also being developed at SINAP to demonstrate the thorium cycle.

In March 2016 a strategic cooperation agreement to develop accelerator-driven advanced nuclear energy systems (ADANES) was signed between China General Nuclear (CGN) and the Chinese Academy of Sciences (CAS).

SINAP has about 600 staff and 200 graduate students undertaking basic R&D on MSRs including that on molten salt manufacture and loop technology, R&D of the front end and back end of the Th-U fuel cycle, R&D of high-temperature durable materials, and R&D of safety standards and licensing. It is also establishing specifications for nuclear-grade ThF4 and ThO2 for MSRs. It has subcontracted some work on molten salt coolants to the Fangda Group. However, reports in late 2016 suggest that the availability of pure Li-7 is a constraint on progress. (See also information paper on Lithium.)

China plans for the TMSR-SF to be an energy solution for the northwest half of the country, with lower population density and little water. The application of water-free cooling in arid regions is envisaged from about 2025.

SINAP has two streams of MSR development – solid fuel (TRISO in pebbles or prisms/blocks) with once-through fuel cycle, and liquid fuel (dissolved in fluoride coolant) with reprocessing and recycle. A third stream of fast reactors to consume actinides from LWRs is planned. The aim is to develop both the thorium fuel cycle and non-electrical applications in a 20-30 year time frame.

- The TMSR-SF stream has only partial utilization of thorium, relying on some breeding as with U-238, and needing fissile uranium input as well. It is optimized for high-temperature based hybrid nuclear energy applications. SINAP aimed at a 2 MW pilot plant (to be TMSR-SF1) initially, though this has been superseded by a simulator (TMSR-SF0 or TMSR-0) with FLiNaK salt installed in June 2019 to be followed by a 10 MWt prototype (TMSR-SF1) before 2025. A 100 MWt demonstration pebble bed plant (TMSR-SF2) with open fuel cycle would follow, then a 1 GW demonstration plant (TMSR-SF3). TRISO particles will be with both low-enriched uranium and thorium, separately.

- The TMSR-LF stream is claimed to use a fully closed Th-U fuel cycle with breeding of U-233 and much better sustainability with thorium but greater technical difficulty. The TMSR-0 simulator also serves this stream. It is optimized for utilization of thorium with electrometallurgical pyroprocessing. SINAP is building a 2 MWt pilot plant (TMSR-LF1) initially, an integrated design (internal primary heat exchangers) to operate at 630-650°C. It then plans a 10 MWt experimental reactor (TMSR-LF2) by 2025, and a 100 MWt demonstration plant (TMSR-LF3) with full electrometallurgical reprocessing by about 2035, followed by a 1 GW demonstration plant.

- A TMSFR-LF fast reactor optimized for burning minor actinides is to follow.

SINAP sees molten salt fuel being superior to the TRISO fuel in effectively unlimited burnup, less waste, and lower fabricating cost, but achieving lower temperatures (600°C+) than the TRISO fuel reactors (1200°C+). Near-term goals include preparing nuclear-grade ThF4 and ThO2 and testing them in a MSR.

The TMSR-SF programme is proceeding with preliminary engineering design in cooperation with the Nuclear Power Institute of China (NPIC) and Shanghai Nuclear Engineering Research & Design Institute (SNERDI). Nickel-based alloys are being developed for structures, along with very fine-grained graphite.

Two methods of tritium stripping are being evaluated, and also tritium storage.

The 10 MWt TMSR-SF1 will have TRISO fuel in 60mm pebbles, similar to HTR-PM fuel, and deliver coolant at 650°C and low pressure. Primary coolant is FLiBe (with 99.99% Li-7) and secondary coolant is FLiNaK. Core height is 3 m, diameter 2.85 m, in a 7.8 m high and 3 m diameter pressure vessel. Residual heat removal is passive, by cavity cooling. A 20-year operating life is envisaged. The TMSR-SF0 simulator is one-third scale, with FLiNaK cooling and a 400 kW electric heater.

The 2 MWt TMSR-LF1 will use fuel enriched to under 20% U-235, have a thorium inventory of about 50 kg and conversion ratio of about 0.1. Fuel is LiF-BeF2-ZrF4-UF4 & ThF4 and FLiBe with 99.95% Li-7 would be used. Residual heat removal is passive, by air cooling. The project would start on a batch basis for offline reprocessing with some online refuelling and removal of gaseous fission products. All fuel salt would be discharged after 5-8 years for reprocessing and separation of fission products and minor actinides for storage.

The TMSR-LF stream would proceed to a continuous process of recycling salt, uranium and thorium, with online separation of fission products and minor actinides. It would work up from about 20% thorium fission to about 80% in the 2040s.

The TMSR-LF1 reactor body incorporating reactor vessel, graphite and metal internals and fuel salt loops was shipped from Shanghai Electric Nuclear Power Equipment Co at Lingang to site in Wuwei Park, Gansu province in November 2020 and installed the following month. Also in December the FLiBe cooling salt preparation plant with 150 kg/batch capacity was commissioned. It is being built by SINAP and Shanghai Construction Engineering Group. An operating licence for the reactor was issued in June 2023.

Beyond these, a 400 MWt/168 MWe liquid-fuel MSR small modular reactor is planned, with supercritical CO2 cycle in a tertiary loop at 23 MPa using Brayton cycle, after a radioactive isolation secondary loop. Various applications as well as electricity generation are envisaged. It would be loaded with 15.7 tonnes of of thorium and 2.1 tonnes of uranium (19.75% enriched), with one kilogram of uranium added daily, and have 330 GWd/t burn-up with 30% of energy from thorium. Online refuelling would enable eight years of operation before shutdown, with the graphite moderator needing attention.

The TMSR-LF150 (150 MWt, 60 MWe) producing 600-700°C in external primary heat exchangers with heat storage in the tertiary circuit may have overtaken this concept. It would have 280 GWd/t burn-up with alternative Brayton cycle or hydrogen production applications. Modules would be replaced after 10 years and fuel batch processing is also at 10 years. The fuel budget indicates starting with 1 tU and 5 tTh, adding 1.5 tU in the first ten years, then reprocess to remove 0.6 t fission products & transuranics, adding 1.7 tU in the second decade, then reprocess to remove 0.7 t fission products & transuranics, and so on. Most actinides/transuranics would be burned.

The US Department of Energy (especially Oak Ridge National Laboratory) has been collaborating with the Academy on the programme, which had a start-up budget of $350 million. Australia’s Nuclear Science & Technology Organisation (ANSTO) is also involved, along with the American Nuclear Society (ANS) on safety standards for the solid fuel TMSR, and with the American Society of Mechanical Engineers (ASME) on material processing standards.

Structural materials for MSRs must demonstrate strength at high temperatures, be radiation resistant and also withstand corrosion. Following joint research on alloys, ANSTO announced in February 2017 that NiMo-SiC alloys – prepared from nickel molybdenum metal powders with added silicon carbide particles – have superior corrosion resistance and radiation damage resistance. A number of NiMo-SiC alloy specimens containing varying amounts of silicon carbide were prepared in SINAP laboratories before being characterized at ANSTO. They possess superior mechanical properties owing to the precipitation, dispersion and solid-solution strengthening of the NiMo matrix. The strength of these alloys stems from the combination of dispersion strengthening by SiC particles, precipitation strengthening by Ni3Si and solid-solution strengthening by Mo as NiMo.

The primary reason that American researchers and the China Academy of Sciences/SINAP are working on solid fuel, salt-cooled reactor technology is that it has been seen as a realistic first step. The technical difficulty of using molten salts is significantly lower when they do not have the very high activity levels associated with them bearing the dissolved fuel and waste. The experience gained with component design, operation, and maintenance with clean salts makes it much easier then to move on and consider the use of liquid fuels, while gaining several key advantages from the ability to operate reactors at low pressure and deliver higher temperatures.

Recycled uranium in PHWRs; thorium in PHWRs

Early in 2008, CNNC subsidiary the Nuclear Power Institute of China (NPIC) signed an agreement with Atomic Energy of Canada Ltd (AECL) to undertake research on advanced fuel cycle technologies such as recycling recovered uranium from used PWR fuel and Generation IV nuclear energy systems. The initial agrement developed into a strategic agreement among AECL (now Candu Energy), the Third Qinshan Nuclear Power Company (TQNPC), China North Nuclear Fuel Corporation and NPIC in November 2008, and subsequently one in July 2014 between Candu Energy’s parent company, SNC-Lavalin, and TQNPC and China North’s parent company, CNNC.

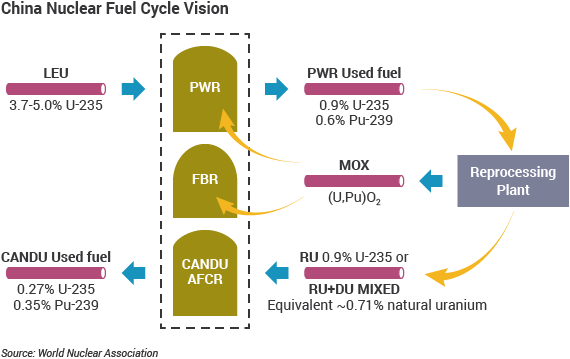

(Initially the project seemed to include DUPIC (direct use of used PWR fuel in Candu reactors), the main work on which so far has been in South Korea, but it differs in that here, plutonium is removed at the reprocessing plant for use in fast reactors – see Figure below.)

The partners jointly developed technology for recycling uranium recovered from used nuclear fuel from other Chinese reactors (PWRs) with up to 1.6% fissile content (but typically 0.9%) for use in the Qinshan Phase III Candu units. The first commercial demonstration of this was in unit 1 of Qinshan Phase III, using 12 fuel bundles with recycled uranium (RU/RepU) blended with depleted uranium (DU) to give natural uranium equivalent (NUE), similar to normal Candu fuel (0.7% U-235). It behaved the same as natural uranium fuel. Subject to supply from reprocessing plants, a full core of NUE was envisaged from 2014. Purchase of RU and DU, design and safety analysis, modification of fuel fabrication line, and licence application were planned in 2013. Full core implementation in both Candu reactors is expected in 2018.

In August 2012 a follow-on agreement among the parties (Candu Energy having taken over from AECL) focused on undertaking a detailed conceptual design of the Advanced Fuel Candu Reactor (AFCR), which is described as "a further evolution of the successful Candu 6 and Generation III Enhanced Candu 6 (EC6), optimized for use of recycled uranium and thorium fuel," or as “the fuel-flexible adaptation” of the EC6. This was directed towards "a pre-project agreement for two AFCR units in China, including site allocation and the definition of the licensing basis." Initially the two Qinshan units could be modified to become AFCRs (see above), and beyond that the first AFCR new build project is envisaged in China. One 700 MWe AFCR can be fully fuelled by the recycled uranium from four LWRs’ used fuel. Hence deployment of AFCRs will greatly reduce the task of managing used fuel and disposing of high-level wastes, and will reduce China’s fresh uranium requirements.

In November 2014 an expert panel hosted by the China Nuclear Energy Association (CNEA) made a positive recommendation on the AFCR, praising the reactor's safety characteristics and saying that AFCR technology forms a synergy with China’s existing PWRs and that it is positioned to “promote the development of closed fuel cycle technologies and industrial development,” which is consistent with the overall strategy of nuclear power development in China. Immediately following this, a framework joint venture agreement between CNNC and Candu Energy was signed to build AFCR projects domestically and develop opportunities for them internationally. In September 2016 an agreement among SNC-Lavalin, CNNC and Shanghai Electric Group (SEC) was to set up a joint venture in mid-2017 to develop, market and build the AFCR, with NUE fuel. Two design centres are envisaged, in China and Canada, to complete the AFCR technology. This could lead to the construction of two AFCR units in China.

The July 2014 agreement also provides a framework for collaboration between SNC-Lavalin and CNNC on uranium mining projects in China, “and the pursuit of international project opportunities in various high-growth sectors and markets.” This was supplemented by a November 2014 MoU between Natural Resources Canada and China’s NEA.

Phase one of the earlier AECL agreement was a joint feasibility study to examine the economic feasibility of utilizing thorium in the Qinshan Phase III PHWRs. (Geologically, China is better endowed with thorium than uranium.) This involved demonstration use of eight thorium oxide fuel pins in the middle of a Canflex fuel bundle with low-enriched uranium.

In July 2009, a second phase agreement was signed among these four parties to jointly develop and demonstrate the use of thorium fuel and to study the commercial and technical feasibility of its full-scale use in CANDU units. This was supported in December 2009 by an expert panel appointed by CNNC and comprising representatives from China’s leading nuclear academic, government, industry and R&D organizations. That panel also unanimously recommended that China consider building two new CANDU units to take advantage of the design's unique capabilities in utilizing alternative fuels. Like its 2014 successor, the expert panel comprised representatives from China’s leading nuclear academic, government, industry and R&D organizations. In particular it confirmed that thorium use in the Enhanced Candu 6 reactor design is “technically practical and feasible”, and cited the design’s “enhanced safety and good economics” as reasons it could be deployed in China in the near term.

In 2017, a thorium-optimized AFCR is envisaged for deployment about 2030.

Geologically, China is better endowed with thorium than uranium.

HTR demonstration: HTR-10

A 10 MWt high-temperature gas-cooled demonstration reactor (HTR-10) was commissioned in 2000 by the Institute of Nuclear Energy Technology (INET) at Tsinghua University near Beijing. It reached full power in 2003. It has TRISO fuel particles compacted with graphite moderator into 27,000 spherical fuel elements each 60mm diameter (as a pebble bed). Each fuel element contains 5g UO2 enriched to 17%, and burn-up is 80 GWd/t. It has ten control rods in the graphite side reflector, with seven absorber ball units as secondary reactivity control, and passive heat removal. It reaches an outlet temperature of 700°C for the helium coolant at 3 MPa and may be used as a source of process heat for heavy oil recovery or coal gasification. It is similar to the South African PBMR (Pebble Bed Modular Reactor) intended for electricity generation.

In 2004, the reactor was subject to an extreme test of its safety when the helium circulator was deliberately shut off without the reactor being shut down. The temperature increased steadily, but the physics of the fuel meant that the reaction progressively diminished and eventually died away over three hours. At this stage a balance between decay heat in the core and heat dissipation through the steel reactor wall was achieved, the temperature never exceeded 1600°C, and there was no fuel failure. This was one of six safety demonstration tests conducted then.

Initially the HTR-10 has been equipped with a steam generator producing steam at 435°C coupled to a 2.5 MWe steam turbine power generation unit. However, second phase plans are for it to operate at 950°C and drive a gas turbine, as well as enabling R&D in heat application technologies. This phase will involve an international partnership with Korea Atomic Energy Research Institute (KAERI), focused particularly on hydrogen production.

Commercial HTRs: Shidaowan HTR-PM, Ruijin or Wan'an

A key R&D project is the demonstration Shidaowan HTR-PM of 210 MWe (two reactor modules, each of 250 MWt) which is being built at Shidaowan in Shandong province, driving a single steam turbine at about 40% thermal efficiency. The size was reduced to 250 MWt from earlier 458 MWt modules in order to retain the same core configuration as the prototype HTR-10 and avoid moving to an annular design like South Africa's PBMR.

Each reactor has a single steam generator with 19 elements (665 tubes) producing steam at 566°C. The fuel is 8.5% enriched (520,000 elements) giving 90 GWd/t discharge burn-up. Core outlet temperature is 750ºC for the helium, and steam temperature is 566°C. Core height is 11 metres, diameter 3 m. There are two independent reactivity control systems: the primary one is 24 control rods in the side graphite reflector, the secondary one six channels for small absorber spheres falling by gravity, also in the side reflector.

China Huaneng Group, one of China's major generators, is the lead organization in the consortium with China Nuclear Engineering & Construction Group (CNEC) and Tsinghua University's INET, which is the R&D leader. Chinergy Co. is the main contractor for the nuclear island. Projected cost is US$ 430 million, with the aim for later units being US$ 1500/kWe. The EPC contract was let in October 2008 and construction started in December 2012, with completion expected in 2017. The engineering of the key structures, systems, and components is based on Chinese capabilities, though they include completely new technical features. CNEC is the lead organization regarding HTR technology.

The HTR-PM will pave the way for larger units based on the same module. The 600 MWe Ruijin units will effectively be three HTR-PMs. INET is in charge of R&D, and is aiming to increase the size of the 250 MWt module and also utilize thorium in the fuel. The HTR programme aims at exploring co-generation options in the near-term and producing hydrogen longer-term. Eventually it is intended that a series of HTRs, possibly using Brayton cycle with helium directly driving the gas turbines, will be factory-built and widely installed throughout China. Following the agreement on HTR industrialization, cooperation between CNEC and Tsinghua University in 2003, in March 2014 a new agreement between Tsinghua University and CNEC was described by CNEC as an important milestone in HTR commercialization. CNEC is responsible for the HTR technical implementation, and becomes the main investor of HTR commercial promotion at home and abroad. In July 2016 CNEC signed an agreement with CGN to promote HTRs.

In January 2016 CNEC signed an agreement with Saudi Arabia’s King Abdullah City for Nuclear and Renewable Energy (KA-CARE) to build a high-temperature reactor in that country, based on the HTR-PM. In August 2016 CNEC signed an agreement with BATAN to develop HTRs in Indonesia.

At the end of 2014 the Nuclear Research and Consultancy Group (NRG), which operates the High Flux Reactor (HFR) at Petten in the Netherlands, completed a "multi-year qualification irradiation project" for the fuel elements produced by INET for the reactor, focused on fission gas release.

In March 2005, there was an agreement between PBMR of South Africa and Chinergy Co. of Beijing. PBMR Pty Ltd had been taking forward the HTR concept (based on earlier German work) since 1993 and was planning to build a 125 MWe demonstration plant. Chinergy Co. was drawing on the small operating HTR-10 research reactor at Tsinghua University which is the basis of the HTR-PM demonstration module which also derives from the earlier German development. The 2005 agreement was for cooperation on the demonstration projects and subsequent commercialization, since both parties believed that the inherently safe pebble bed technology built in relatively small units would eventually displace the more complex light water reactors. In March 2009, a new agreement was signed between PBMR, Chinergy and INET, but PBMR then ran out of funds.

Russia is pursuing its interest in HTR development through collaboration with China, OKBM being responsible on their side.

Fast neutron reactors

China's R&D on fast neutron reactors started in 1964.

A 65 MWt sodium-cooled fast neutron reactor – the Chinese Experimental Fast Reactor (CEFR) – at the China Institute of Atomic Energy (CIAE) near Beijing, started up in July 2010.1 It was built by Russia's OKBM Afrikantov in collaboration with OKB Gidropress, NIKIET and Kurchatov Institute. It was grid connected at 40% power (8 MWe net) in July 2011, and ramped up to full 20 MWe power in December, then passed 'official' checks in October 2012. However, it operated only 682 hours to October 2015. After its first major overhaul, the unit completed 1320 hours of low-power operation test research in 2019 and into 2020. The CIAE announced that CEFR completed its first cycle of trial operation and commissioning tests in mid-2020. It said that this provided a solid basis to proceed with the reactor’s operating phase.

It has negative temperature, power reactivity and sodium void coefficients. Its first fuel loading was UO2, reported to be high-enriched (65%), but ongoing fuel is MOX (25% Pu) with burnup of 60 GWd/t. Core outlet temperature is 530°C. It uses 260t of sodium in the two-loop primary circuit, and 48 t in secondary circuits. Steam temperature in tertiary circuits is 480°C. Coefficients of temperature reactivity and power reactivity are both negative.