Nuclear Power in Finland

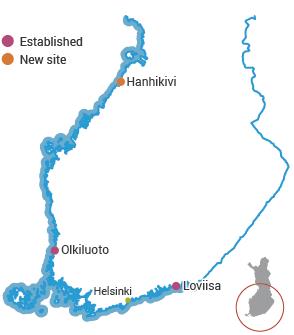

- Finland has five operating nuclear reactors providing about one third of its electricity.

- Provisions for radioactive waste disposal are well-advanced.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2024): 81.9 TWh

Generation mix: nuclear 32.6 TWh (40%); wind 19.4TWh (24%); hydro 14.3 TWh (17%); biofuels & waste 11.0 TWh (13%); coal 2.3 TWh (3%); solar 1.2 TWh; natural gas 0.7 TWh; oil 0.2 TWh.

Import/export balance: 3.2 TWh net import (8.7 TWh imports; 5.5 TWh exports)

Total consumption: 76.2 TWh

Per capita consumption: c. 13,600 kWh in 2024

Source: International Energy Agency and The World Bank. Data for year 2024.

Per capita electricity consumption in Finland has grown strongly from about 5800 kWh/yr in 1974 to about 13,600 kWh/yr in 2024.

The majority of fossil fuel is imported. Coal is imported from Russia and Poland; all of the gas consumed comes from Russia. Overall the country imports nearly half of the energy it consumes, the majority of which is from Russia.

In June 2019, the government announced a new energy policy with the objective of achieving carbon neutrality by 2035. The policy proposes a complete phase-out of coal power by May 2029. The policy set out plans to commission two nuclear power reactors, and supported operating lifetime extensions for existing reactors. Plans for new reactors have since been cancelled (see below).

The country is part of the deregulated Nordic electricity system which faces shortages, especially in any dry years, when hydroelectric generation is curtailed. Over 2009-2011 some two-thirds of imported electricity came from Russia, but this has decreased considerably since the completion of the Fenno-Skan 2800 MW HVDC link with Sweden.

Since the 1930s energy-intensive industry has invested in large-scale energy production in Finland, rather than leaving it entirely to specialized utilities. More recently energy-intensive companies have seen joint ownership of electricity production with power sold at cost price to shareholders as an important means of protection against the increasing prices and volatility of liberalized electricity markets. This so-called Mankala model is also effective in risk-sharing. It is distinctive of Finland in relation to capital-intensive nuclear capacity. For more information see page on Financing Nuclear Energy.

A windfall profits tax on nuclear and hydro capacity built before 2004 was introduced in December 2013. All generators receive free CO2 emission allowances, and those not emitting CO2 can sell them. In the case of nuclear and hydro (but not wind and biomass) this is deemed a windfall profit, and will be taxed to raise about €50 million per year. Fortum and TVO have protested.

Nuclear power industry

Finland's reactors are among the world's most efficient, with an average lifetime capacity factor of over 90%a and average capacity factor over the last ten years of almost 95%. Two boiling water reactors supplied by the Swedish company Asea Atomb are operated by Teollisuuden Voima Oy (TVO)c; two modified Russian pressurized water reactors (VVER) with Western containment and control systems are operated by Fortum Corporationd; and an EPR supplied by Areva and Siemens is operated by TVO.

Finnish reactors are remarkable in the extent to which they have been uprated since they were built. TVO's Olkiluoto 1&2 started up in 1978-80 at 660 MWe net; by 2010 they were rated at 880 MWe net each (one-third more) and their planned operating lifetime had been extended to 60 years, subject to safety evaluation every decade. TVO now proposes progressively to uprate them further to 1000 MWe each. A 25 MWe uprate of Olkiluoto 1 over May-June 2010 was part of this, and involved replacement of low-pressure turbines. A similar uprate of unit 2 was undertaken over May-June 2011. With uprates, TVO aims “always to have 40 years of remaining technical lifetime”. In January 2017 TVO applied for 20-year operating licence renewal for both units, which was approved by the Finnish government in September 2018.

In October 2023 TVO commenced an environmental impact assessment (EIA) to investigate the possibility of further extending the operating lifetimes of Olkiluoto 1&2 beyond 60 years by at least 10 years. An 80 MWe uprate for each of the two reactors is also being considered.

In October 2025, the European Investment Bank agreed a €90 million loan to support upgrades to automation and control systems at Olkiluoto 1&2. Earlier in October the Ministry of Economic Affairs and Employment issued its decision that TVO’s 2024 EIA for lifetime extension and uprates meets legislative requirements.

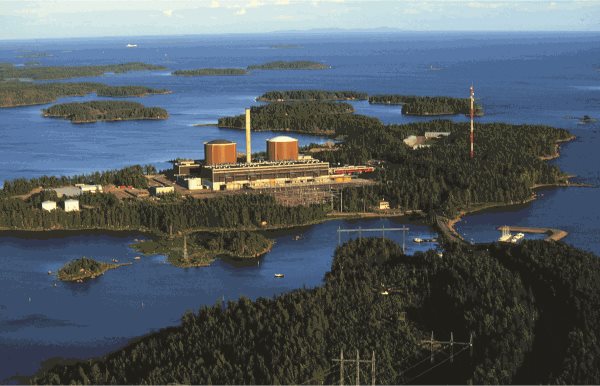

Loviisa (Image: Fortum)

Fortum's two VVER-440 reactors at Loviisa have been uprated 18% from their design capacity of 420 net (465 MWe gross) in 1977-80 to 507 MWe net (531 MWe gross). A 20-year operating licence extension was granted by the Radiation and Nuclear Safety Authority (STUK) in mid-2007, taking them to 2027 and 2030. This was confirmed by STUK in February 2017. In 2008, Areva and Siemens commenced a renewal project to install modern digital instrumentation and control systems at the plant, expected to take six years, but Fortum terminated this in 2014 and transferred the work to Rolls-Royce, which completed it in 2018.

In August 2020, Fortum began the environmental impact assessment required to operate the two units beyond their existing licences. In March 2022, following about €300 million of investment in the two reactors over the previous five years, the utility applied to the government for permission to extend their operating lifetimes to 2050. In February 2023, the Finnish government approved Fortum’s licence extension request for an additional 20-year term, extending the operation of Loviisa 1&2 until the end of 2050.

Fifth unit, Olkiluoto 3

Following an application made in November 2000 by TVO, in May 2002 Finland's parliament voted 107-92 to approve building a fifth nuclear power reactor, to be in operation about 2009. The vote was seen as very significant in that it was the first such decision to build a new nuclear unit in Western Europe for more than a decade. A similar proposal had been rejected in 1993, but the political climate throughout Europe had since become much more favourable to nuclear energy.

TVO's application for a new reactor was based primarily on economic criteria (lowest kWh cost, lowest sensitivity to fuel price increases)f, but it noted the considerable energy security and emissions savings benefits. Government support for the proposal was based mainly on climate policy, while its detractors supported a massive increase in natural gas use (from Russia) for electricity generation.

The site of the new unit was decided in October 2003 to be at TVO's Olkiluoto plant in the southwest, with two nuclear reactors already in operation there.

Following the submission of tenders by three vendorsg, in October 2003, TVO announced that Framatome ANP's 1600 MWe European Pressurized Water Reactor (EPR) was the preferred reactor on the basis of operating cost. Siemens was contracted to provide the turbines and generators. TVO signed a €3.2 billion turnkey contract with Areva NP and Siemens for an EPR unit in December 2003, with commercial operation expected in mid-2009. Meanwhile bids to TVO from its various owners for shares of the 1600 MWe expected net output totalled 2000 MWe.

Construction started May 2005 but delays have been encountered, particularly on the reactor section. Siemens and its subcontractor supplied the turbine section much quicker. The most recent delays to the plant's schedule have centred on the reactor instrumentation and control (I&C) system, which gained approval from STUK in April 2014 after four years of what Areva described as "exchanges" between the constructor and TVO. In April 2016 TVO applied for a 20-year operating licence. The 130,000-page application to the Finnish Ministry of Employment and the Economy includes information on technical and operational safety principles, arrangement for nuclear waste management, and details of TVO's expertise and financial position. The Finnish government granted the operating licence in March 2019.

Earlier, in March 2018, a settlement was agreed to end the long-running dispute over cost and schedule overruns at Olikiluoto 3 in which Areva and Siemens would pay €450 million in compensation to TVO.

Prior to the agreement, the parties looked to the International Chamber of Commerce (ICC) in Stockholm to settle the question of who should pay for cost overruns. The Areva-Siemens consortium was claiming €3.52 billion against TVO in relation to the delay and cost overruns of the project. The claim included payments delayed by TVO under the construction contract, and penalty interest totalling about €1.45 billion and €135 million in alleged loss of profit. TVO counterclaimed costs and losses of €2.6 billion to the end of 2018, having revised its loss figure from €1.8 billion to the end of 2014.

The agreement stated that the supplier companies were entitled to an "incentive payment" of €150 million "upon timely completion" of the project. At that time the schedule was for grid connection in December 2018, and commercial operation in May 2019 – some 10 years behind schedule. In the event that the supplier consortium failed to complete the project by end-2019, it would be liable to pay further penalties to TVO, up to €400 million, depending on the length of the delay.

In June 2018, it was announced that commercial operation had been delayed to September 2019, and in November that was put off to January 2020. In April 2019, the target date was pushed back again to March 2020, and in July 2019, it was moved to July 2020. In February 2020, grid connection was expected in November 2020, with commercial operation in March 2021. In April 2020 TVO announced that fuel loading would not go ahead as planned in June 2020 due to disruption as a result of measures taken to prevent the spread of coronavirus. In August 2020, fuel loading was delayed to March 2021, with grid connection expected in October of the same year. Fuel loading commenced on 29 March 2021. In August 2021 it was announced that commercial operation was delayed by three months to June 2022, to allow for further inspections and work on the turbine. On 21 December 2021 the reactor achieved first criticality. First grid connection was in March 2022 but regular electricity production only commenced in mid-April 2023, following an extended phase of test production during which some 3300 tests were conducted and more than 9000 test reports collated. During this period, in October 2022 TVO announced that damage was discovered in the impellers of all four of the feedwater pumps. In December 2022 TVO announced that electricity production had recommenced for a final trial run.

TVO issued an acceptance certificate to the Areva-Siemens consortium for Olkiluoto 3 soon after the commencement of regular electricity production on 16 April.

TVO completed final takeover of the Olkiluoto 3 EPR on 20 June 2025 following two years of commercial operation and a successful second annual outage.

New nuclear capacity

Sixth and seventh units

In June 2007, a new consortium of 67 industrial and energy companies announced plans to establish a joint venture company – Fennovoima Oyi, initially led by E.On (with 34%) – to construct a new nuclear power plant in Finland. The indigenous companies comprise a cooperative, Voimaosakeyhtiö SF, which owns 66% of the shares in Fennovoima and is effectively a holding company.

In January 2009, Fennovoima submitted its application to the government for a decision-in-principle, which was granted in May 2010. The company presented three site alternatives but, later in 2009, withdrew Loviisa and in October 2011 decided upon one of two prospective northern sites: Pyhäjoki municipality, rather than Simo which was close to Outokumpu's Tornio steelworks, the largest electricity consumer in Finland. Both are government-defined development areas on the west coast. The Environment Ministry has approved land-use plans and the plant will be built on the Hanhikivi peninsula on the coast of Bothnian Bay, near Pyhäjoki. There is room for a second reactor, but no plans for one. The Hanhikivi 1 plant was to be up to 1700 MWe and supply district heating as a by-product. In 2012 E.On decided to leave the project, which reduced its potential to 1000-1300 MWej.

Fennovoima in December 2013 signed a plant supply contract with Rusatom Overseas for an AES-2006 power plant with VVER-1200/V-491 reactor. Another agreement between Voimaosakeyhtiö SF (the holding company for indigenous and EU shareholders) and Rosatom established that Rosatom would take a 34% share of Fennovoima and help to arrange finance beyond that. In November, most of the indigenous shareholders had committed to ongoing participation in the project, reserving half of the plant’s output. At the end of February 2014 Voimaosakeyhtiö committed to proceeding with the project, with 44 shareholders involved. The largest local stakeholder is Outokumpu, with 12.5%, and together they were committed to 50.2% of the plant at that stage. In March RAOS Voima Oy, a subsidiary of Rosatom, took up its 34% equity in Fennovoima.

Fennovoima, with a new board, confirmed the investment in April 2014, having said that when the plant starts operating (then estimated to be in 2024), the price of electricity for shareholders would be less than €50/MWh (5 cents/kWh), including all production costs, depreciation, finance costs and waste management. Building cost was then estimated at €6 billion. A third contract was with TVEL for fuel supply to Fennovoima – first core and ten years' reloads.

In March 2014 Fennovoima applied to the government to change the design of the plant from the original 1600 MWe class approved in principle in 2010 to a 1200 MWe VVER. The government agreed to this in September, conditional upon at least 60% of the company's shareholders being Finnish or owned by parties domiciled in the European Union or a member of the European Free Trade Association when the company applied for a construction licence, and parliament approved the project in December 2014. STUK’s appraisal was positive, subject to Fennovoima building up nuclear safety expertise to support its application in mid-2015 for a construction licence. At the end of June 2015 Fennovoima submitted its Hanhikivi construction licence application to the Ministry of Employment and Economy, with more than 60% purported EU equity. Early in August Finnish ownership was confirmed as 65.1%. The ministry said that it expected to take at least two years to process the application. In September 2017 Fennovoima announced that it expected to receive the construction licence in 2019.

Voimaosakeyhtiö SF wanted to build local equity in the project to 66% as originally intended, and was negotiating with potential new owners. By November 2014 it had reached about 55% Finnish equity, and early in August 2015 Fortum agreed to take a 6.6% stake in the project, and the project management company SRV took 1.8%. In addition, Outokumpu agreed to increase its share from 12.3 to 14.1%. This made a total of 65.1% Finnish equity, well above the government requirement, and accounting for nearly all the Voimaosakeyhtiö SF holding company share.*

* Subject to sorting out equity in a Russian hydro project, Fortum said in December 2014 that it would like to take up to 15% equity in Fennovoima, but nothing eventuated by the end of June 2015 government deadline. Then Croatia’s Migrit Solarna Energija suddenly agreed to take a 9% stake in Voimaosakeyhtiö SF for €158 million, “to be financed in cooperation with credit institutions.” The main such institution was the Vienna branch of Russia’s Sperbank, which did not impress the government, and it was rejected.

In October 2014 Rusatom Overseas and Russia’s Atomproekt at St Petersburg signed an agreement to develop design documentation for the project, which would allow Fennovoima to apply for the construction licence. Construction was due to start in 2018, after site works from 2015 to the end of 2017. Major excavation started in January 2016. The Russian company Titan-2 will be general contractor to build the plant, and a low-speed Arabelle turbine from Alstom Atomenergomash is specified. SRV will be project manager for Titan-2 and Rusatom Overseas. By May 2017, 381 companies had registered as subcontractors for the project, 92% of them based in Finland.

In June 2016 the Regional State Administrative Agency of Northern Finland granted an environmental permit for the project. The permit covers all matters regarding the activities and emissions during the operation of the plant, back-up power production and the cooling water outlet structures. In addition, the agency granted the company a water permit for the seawater intake and use as cooling water, and allowed Fennovoima to start construction work on the cooling water outlet structures. Atomstroyexport quotes the power as 1250 MWe gross, due to the cold water and use of the low-speed Arabelle turbine.

Fennoivoima’s share of the capital cost will be financed about 25% by equity contributions and the balance by a loan, which Rosatom is responsible for arranging. The capital cost of the plant is estimated to be €7 to 7.5 billion including financing. In January 2015 Russia’s cabinet announced approval of RUR 150 billion (€2 billion) finance from its sovereign wealth fund for the project, mostly as a loan guaranteed by export credit agencies. Russia expects revenues to the federal budget of more than double that over the life of the plant.

In December 2018 Rosatom told the company that first power would be in 2028 due to delays in documentation with STUK, and construction start was likely in 2021. In October 2019 Japan Steel Works' Muroran plant started forging the generator rotor for the plant, under contract to RAOS Project, a Rosatom subsidiary. It will then be sent to the GE Steam Power facility in Belfort, France, to be machined. The 240-tonne rotor will be 8 metres long and 2 metres wide.

Fennovoima had expected to apply for a construction licence in 2022, with commercial operation in 2029, but in February 2022 the company said that the "Russian invasion of Ukraine, and the countermeasures by EU and western countries as a consequence, pose a major risk for the Hanhikivi 1 project." The country's Minister for Economic Affairs said that he would not be granting a construction permit under the current circumstances. Later that month the Finnish city of Vantaa announced it had instructed its municipal energy company Vantaan Energia to pull out of the project, and in May 2022 Fennovoima announced it was terminating the EPC contract with Rosatom's RAOS Project subsidiary.

In December 2022 the Dispute Review Board (DRB) determined that Fennovoima's decision to terminate the engineering, procurement and construction contract with Rosatom for the Hanhikivi plant was unlawful. Fennovoima said that the DRB's recommendation was "neither final, nor binding, as both parties submitted notices of dissatisfaction shortly after it was issued" and that it had since initiated international arbitration proceedings against RAOS Project.

TVO's 2008 application for a decision in principle to construct a 1000-1800 MWe PWR or BWR unit as Olkiluoto 4 was granted in May 2010. TVO was looking at building another EPR (of about 1650 MWe), but was also considering Toshiba's version of the ABWR (approximately 1650 MWe), GE Hitachi's ESBWR (approximately 1650 MWe), Mitsubishi's EU-APWR (approximately 1650 MWe) and the slightly smaller Korean APR-1400 (approximately 1450 MWe) – all these net capacity figures, from TVO3. In March 2012 TVO formally requested bids and received five in January 2013.

TVO initially expected to have the unit on line about 2020, but in 2014 it applied for a five-year extension of the government approval, due to the delay with Olkiluoto 3. It would then need to submit a construction licence application by mid-2020. However, the extension was not granted, and the company had only until June 2015 to apply for a construction licence, after deciding upon the technology and preparing engineering plans. TVO decided not to proceed, since “the delay of the start-up of Olkiluoto 3 plant unit … [makes it] impossible to make significant Olkiluoto 4 related decisions necessary for the construction licence application within the current period of validity of the decision-in-principle." “Olkiluoto 4 is important for us and therefore we will be prepared to apply for a new decision-in-principle." In June 2015 TVO shareholders resolved not to proceed with plans for unit 4.

Finland's cancelled nuclear power reactors

| Reactor | Type | MWe gross | Construction start | Commercial operation |

| Hanhikivi 1 | VVER-1200/V-491 | 1170 | Cancelled | |

|---|---|---|---|---|

| Olkiluoto 4 | EPR, ABWR, ESBWR, EU-APWR or APR1400 | 1550-1830 | Cancelled |

Government approvals

In March 2007, TVO and Fortum commenced environmental impact assessments (EIA) for new nuclear power units at the Olkiluoto and Loviisa sites respectively. This is the first phase of licensing a new nuclear plant. It is followed by a decision in principle (by parliament), construction licence, then operating licence.

After two days of intense debate, Finland's parliament in July 2010 approved construction of the TVO Olkiluoto 4 reactor by 120 votes to 72, and one Fennovoima reactor by 121 to 71. It also voted 159 to 35 to increase the planned capacity of the Posiva waste repository (see section on Used fuel disposal below).

Fortum's application for a decision-in-principle on the construction of a new unit at Loviisa was rejected by the government in April 2010k.

In February 2014 a new intergovernmental agreement with Russia was signed to enable Rosatom to supply a reactor unit for Fennovoima's Hanhikivi project. A key feature of the agreement was that it resolved issues related to liability for damages from nuclear accidents. Finland is party to the OECD-sponsored Paris Convention on nuclear liability as amended in 2004, while Russia adheres to the IAEA-sponsored Vienna Convention. The 2014 agreement stipulates that both international treaties are reciprocally applicable between Finland and Russia. In effect the agreement thus substitutes for the 1988 Joint Protocol relating to both conventions, which Russia has not ratified.

Small modular reactors

The VTT Technical Research Centre of Finland is studying the potential use of small modular reactors (SMRs) for both district heating and electricity generation. District heating is used widely in Finland but is fuelled predominantly by coal, which is to be phased out by 2029.

In 2023 Finnish SMR developer Steady Energy signed letters of intent with energy companies Helen and Kuopion Energia. Steady Energy’s LDR-50 SMR has been in development at VTT since 2020. The LDR-50 is a PWR with a thermal capacity of 50 MW and is designed to operate at low temperatures (150 °C) and pressure (10 bar). In November 2025, Helen identified three potential Helsinki sites – Vuosaari and Salmisaari power plant areas and the Norrberget area in western Östersundom – for further assessment of a small nuclear heat plant.

Earlier in May 2025 Steady Energy announced plans to build a full-scale pilot facility for the LDR-50 at the former Salmisaari B coal power plant in Helsinki, under a lease agreement with Helen. The €15-20 million demonstration project, which would use electric heating instead of nuclear fuel, aims to validate the reactor’s passive safety systems ahead of commercial deployment.

In July 2025, Fortum and GE Vernova Hitachi Nuclear Energy agreed early works covering prelicensing and site adaptation for potential BWRX‑300 deployment in Finland and Sweden.

Fuel cycle

Fuel supply

TVO has bought uranium from Canada, Australia and Africa, had it converted to UF6 in Canada and France, and enriched in Russia. Fuel fabrication has been in Germany, Sweden and Spain.

Fortum predecessor company IVOl contracted for a complete fuel supply service from Russia for the Loviisa plantm. In November 2022 Fortum signed an agreement with Westinghouse for the design, approval and delivery of a new type of fuel to the Loviisa plant. The agreement built on the collaboration supplying fuel to Loviisa from 2001 to 2007, during which Westinghouse delivered nearly 750 VVER-440 fuel assemblies. The first batch of fuel assemblies were delivered in September 2024.

Uranium mining

There have been no uranium mines in Finland, but Areva Resources Finland has applied for a uranium mining claim at Ranua, just south of Rovaniemi in Lapland. Earlier applications for uranium exploration licences in southern Finland were refused in 2007.

Early in 2010, Talvivaara Mining Company Plc announced that it planned to recover 350 tU/yr as a by-product of nickel and zinc production from suphidic black shales (schists) using bacterial heap leaching at Sotkamo in northeastern Finland, over 46 years through its Talvivaara Sotkamo Ltd. The uranium resource is 26,000 tU. In April 2010, Talvivaara applied to the Ministry of Employment and Economy for a license to extract uranium as a by-product, in accordance with the Nuclear Energy Act. The company signed an agreement with Cameco early in 2011 to build a €45 million plant for uranium recovery, using solvent extraction. Cameco would take all Sotkamo uranium production to 2027, this agreement being approved by the European Commission in November 2011. In January 2012 STUK advised the government that uranium recovery could be done with minimal radiation release, and the European Commission expressed a positive view of the uranium recovery project. Accordingly, the process was licensed by the Council of State in May 2012, but this was revoked in December 2013 by the Supreme Administrative Court. The Council of State had not reconsidered the matter to August 2015. In April 2014 the Regional State Administrative Agency for Northern Finland licensed uranium recovery from ore mined in the Kuusilampi open pit.

The heap leach pads at Sotkamo cover 210 ha and after 18 months the ore (0.002%U) would be moved to a secondary pad for 36 months. The pregnant liquor (20 ppm U) would be first stripped of copper and zinc, then the uranium can be recovered. Hitherto a lot of uranium has remained in the waste stream and has accumulated at the bottoms of nearby lakes, giving rise to concern. However, as announced in 2015, the company “faced various difficulties since the commissioning of the mine in 2008 and 2009,” these being both operational and environmental, including a gypsum pond leakage which resulted in legal proceedings against management.

In October 2013, Talvivaara announced that its liquidity position was poor and constraining development. It and Talvivaara Sotkamo applied for corporate reorganization in November. This created some uncertainty for Cameco regarding timing of production startup and length of the ramp-up period. It had then invested a total of $70 million in the uranium extraction process, and construction of that plant was about 98% completed. In November 2014 Talvivaara Sotkamo was declared bankrupt and operations ceased.

In August 2015 the Ministry of Employment and Economy said that a new state-owned company would purchase the business and assets of Talvivaara Sotkamo from Talvivaara in order to revive mining from September and secure long-term investment in the mine. This was a subsidiary of state-owned Terrafame Group Oy, and in mid-August the transfer to Terrafame Mining Oy (now Terrafame Oy) was accomplished. In November 2016 it was considering starting uranium recovery, subject to approval from STUK and a new licence from the Council of State.

In October 2017 the company applied for a permit to recover uranium as a by-product. The company estimated that if granted, uranium recovery could begin towards the end of 2019, with about €75 million having already been invested in plant and only another €10 miilion required. In December 2017 STUK granted permission to conduct laboratory-scale solvent extraction of rare elements and uranium to learn about the process. In February 2020 the government granted the permit for uranium recovery.

Talvivaara Mining Co Plc is indirectly a shareholder in the Fennovoima project, and in March 2012 increased its stake in it from 10 MWe to 60 MWe (3.3%) by purchasing shares in two regional power companies which are part of Voimaosakeyhtioe, the holding company that owns 66% of the project.

In December 2022 Terrafame announced plans to start recovering natural uranium as a byproduct of zinc and nickel production at its Sotkamo mine by the summer of 2024. An already-built uranium recovery plant would be prepared for operational use, with preparation cost requiring €20 million of investment. The recovery plant is estimated to operate at full capacity by 2026 and is expected to produce about 200 tonnes of uranium per year from an ore concentration of approximately 17 mg/kg. Terrafame said that recovery of the uranium would increase its annual net sales by around €25 million.

Waste management

Originally the intention was to export spent fuel if possible, and if not, to reprocess it, but by the 1980s the policy had become deep geological disposal of used fuel as such. The power companies are responsible for safe radioactive waste management including storage of used fuel, and licence renewal is conditional upon demonstrating this.

Finland's nuclear waste management program was initiated in 1983, soon after the four reactors started commercial operation. The 1987 Nuclear Energy Act had final disposal as an option, and set up the nuclear waste management fund under the Ministry of Trade and Industryn. The 1994 amendment of the Act stipulates that wastes should be handled wholly in the country (the prior arrangement with Russia for Loviisa used fuel finished in 1996o). Posiva Oy was then set up as a TVO - Fortum joint venture company. Reactor decommissioning is the responsibility of the two power companies separately, and plans are updated every five years. Responsibility for nuclear wastes remains with the power companies until its final disposal.

At the end of 2014, €2.38 billion had been accumulated in the State Nuclear Waste Management Fund from charges on generated electricity, which account for about 10% of nuclear electricity production costs. The charges are set annually by the government according to the assessed liabilities for each company, and also cover decommissioning. The payments each March relate to the previous year. The Ministry of Employment and Economy said that the fund, after the 2013 payments of about €83 million and 2014 payments of €91 million are made, will be sufficient to cover all costs for disposing of the amount of nuclear waste and spent fuel now in Finland as well as decommissioning of the operating reactors. The total estimated cost of €3.3 billion for all nuclear wastes includes used fuel repository operation to 2120 (€2.4 billion) and decommissioning €200 million. The 2015 payments total €91 million, and the return on the fund’s investments is about €25.5 million per year.

At Olkiluoto a surface pool storage for spent fuel has been in operation since 1987. This KPA facility has 1270 tonne capacity and is designed to hold used fuel for about 50 years, pending deep geological disposal. The KPA facility was extended over 2011-2014.

At Loviisa, expanded interim storage pools required by expiry of the Russian arrangement to take back used fuel were commissioned in 2000.

TVO and Fortum are responsible for the management and disposal of their low- and intermediate-level operational waste. An underground repository at Olkiluoto for low- and intermediate-level operational waste has been in operation since 1992. It is designed to be expanded to take eventual decommissioning waste. A similar facility at Loviisa was commissioned in 1997. The depth of these is about 100 metres.

In March 2023 the low and intermediate-level waste disposal facility at Loviisa was granted a new operating licence to 2090.

The final disposal of used nuclear fuel is managed by Posiva Oy, which was set up in 1995 as a joint venture company – 60% TVO and 40% Fortum. It has well advanced plans for a deep geological repository for encapsulated used fuel at the Olkiluoto island in Eurajoki, some 400 metres down in 2 billion-year-old igneous rock.

Site selection and environmental impact assessment work was carried out following the government’s 1983 policy decision on used nuclear fuel. Four locations were investigated by Posiva in some detailp – all were technically suitable, and were covered in Posiva's environmental impact statement for the final repository. In 1999, Posiva applied for a decision in principle for the final disposal facility to be sited at Eurajoki. The decision in principle was issued by the government at the end of 2000 and ratified by Parliament by a 159 to 3 vote in May 2001. The proposal has strong local community support, and the Eurajoki Council – which had the right to veto the decision – voted 20:7 for it.

Construction on the ONKALO underground rock characterization facility commenced in 2004 at the Eurajoki site. Research to verify the site selection has been carried out at ONKALO since the beginning of its construction. This will then become the repository site, at a depth of 400-450 metres in the Olkiluoto bedrock. Posiva applied for a construction licence for the final repository for used fuel from Olkiluoto and Loviisa and the encapsulation plant in December 2012, and STUK completed its review of plans and recommended government approval in February 2015. The construction licence for both repository and encapsulation plant was granted in November 2015, albeit with only 6500 tonnes repository capacity initially. In March 2021 Posiva Oy announced the start of construction of a test disposal tunnel. The test tunnel will be used to demonstrate the processes and procedures to be used for final disposal, allowing for the issuance of an operation licence. Current plans envisage the sealing of the repository in 2120, although this depends on whether the repository accepts waste from reactors built after Olkiluoto 3 and the operational lifetimes of those reactors. The estimated total cost of final disposal of used fuel from five reactors is approximately €3 billionq.

On 30 December 2021 Posiva submitted its application to the Ministry of Economic Affairs and Employment for an operating licence for the encapsulation plant and disposal facility. The company is applying for a licence to cover the period March 2024 to the end of 2070. STUK originally planned to complete its review of the application by end of 2023, but in February 2024 requested an extension to end of 2024. In December 2025 STUK was given a further one-year extension to complete its review. STUK said Posiva “has not completed the materials necessary” for it to conduct a safety assessment.

In July 2022 excavation of the first five disposal tunnels at the Onkalo repository was completed. Construction of new disposal tunnels will continue progressively in parallel with operation. Posiva proposed that the final size of the repository should be increased from the initial capacity of 6500 tonnes of used fuel to 12,000 tonnes – large enough to accommodate waste from then proposed Olkiluoto 4 and Loviisa 3 – and STUK supported this figure. In July 2010, Parliament voted in favour of an expansion to 9000 tonnes to accommodate the used fuel from Olkiluoto 4r. Posiva claimed that it would have no space in the planned repository for fuel from Fennovoima's now-cancelled Hanhikivi project.

In March 2025, Posiva announced it had completed a demonstration of the functionality of the used fuel encapsulation plant. Also in March 2025, Posiva completed a procedure qualification test on tunnel backfill at the Onkalo repository. In June 2025, the first copper casting blank for a Finnish final disposal canister was produced at Luvata’s Pori foundry.

In December 2025, the Ministry of Employment and the Economy granted Finland’s radiation regulator a third extension to complete its assessment of Posiva’s operating licence application for the encapsulation plant and repository. STUK’s statement is now due by the end of June 2026.

Disposal will be based on the multi-barrier KBS-3 systems, developed by the Swedish Nuclear Fuel and Waste Management Company (SKB). Encapsulation will involve putting 12 fuel assemblies into a boron steel canister and enclosing this in a copper capsule. Each capsule will be placed in its own hole in the repository and backfilled with bentonite clay. The used fuel will be retrievable at every stage of the disposal process.

Earlier in June 2016 Fennovoima announced plans to build its own repository for used fuel from its now-cancelled Hanhikivi project, having failed to reach agreement with Posiva to share the Onkalo repository. It submitted its own environmental impact assessment to the Ministry of Employment and Economy. Geological studies were to be undertaken at Pyhajoki near the Hanhikivi plant and also Eurajoki, near Posiva’s Onkalo repository and the Olkiluoto plant.

Also in June 2016 Posiva launched Posiva Solutions. The new business will "focus on the marketing of the know-how accumulated from the design, research and development efforts in the final disposal of used nuclear fuel, as well as on associated consulting services". In October it signed a four-year service contract with the Czech Radioactive Waste Repository Authority (RAWRA or SURAO) to advise in the site selection process for a Czech repository, the disposal concept, and repository design. Finnish engineering company Saanio & Riekkola Oy as well as SKB International and the Geological Survey of Finland will be involved.

Public opinion

In January 2010, a TNS Gallup survey (N=1000) commissioned by Finnish Energy Industries (Energiateollisuus) showed that 48% of Finns had a positive view of nuclear power, and only 17% were negative4. The gap between the two was the widest since polling began 28 years earlier. Among women, 33% were positive and 23% negative. Among Green League supporters, 37% were negative, down from 57% five years before, and 21% were positive. The survey also found the highest ever proportion of young people aged 15-24 in favour of nuclear power, at 30%. The percentage of 15-24 year olds registering negative attitudes was likewise the lowest the surveys have ever recorded, at 10%.

A 2014 Gallup poll was reported to show that 41% were positive about nuclear power, while 24% were negative.

In relation to the new Hanhikivi plant at Pyhäjoki, when Fennovoima had started local information campaigns, 51% at Pyhäjoki were in favour of the new plant there and 38% against. In February 2012, soon after the site selection and nearly a year after the Fukushima accident, the numbers were 69% in favour and 25% against, with a steady evolution of opinion in 6 polls over the four years. Regionally the figures in Feb 2012 were 65% in favour and 30% against.

In May 2022 a survey by Kantar Public found that 60% of respondents have positive opinions about nuclear (34% completely positive and 26% broadly positive) and 11% negative.

A survey by Kantar Public in December 2022 revealed support for nuclear power in Finland at an all-time high, with 60% of respondents in favour of nuclear power and only 11% against. Of the 60% of respondents in favour of nuclear energy, 34% were 'completely' in favour while 26% said they were 'mainly' in favour. Those with 'totally' negative attitudes towards nuclear made up only 3%.

Regulation, safety & non-proliferation

Under the Nuclear Energy Act 1987 the Ministry of Economic Affairs and Employment (MEAE) is responsible for supervision of nuclear power operation and for waste disposal. The National Nuclear Waste Management Fund operates in connection with the Ministry. The MEAE represents Finland in international organizations concerned with nuclear energy.

STUK is responsible for regulation and inspection, and advising on licensing. It operates under the Council of State (effectively the government), which licenses major nuclear facilities including uranium mines. STUK is administered by the Ministry of Social Affairs and Health, and is supported by four advisory committees – on nuclear safety, radiation safety, security, and general.

Non-proliferation

Finland is a party to the Nuclear Non-Proliferation Treaty (NPT) as a non-nuclear weapons state. Its safeguards agreement under the NPT came into force in 1972 and in 1995 it came under the Euratom safeguards arrangement. In 1998, it signed the Additional Protocol in relation to its safeguards agreements with both the International Atomic Energy Agency and Euratom.

Notes & references

Notes

a. Finland's reactors had an average lifetime capacity factor to the end of December 2019 of 92.2%1 [Back]

b. In 1987, Asea merged with Brown Boveri to become ABB. In 2000, ABB's nuclear business was sold to BNFL and merged with Westinghouse (which was then a subsidiary of BNFL). [Back]

c. TVO was founded in 1969 by a number of companies to build and operate large power plants, supplying the electricity to shareholders at cost. The company is 27% owned by Fortum (see Note d below) and 57% owned by Pohjolan Voima Oy (the major shareholders of which are pulp and paper manufacturers UPM Oyj and Stora Enso Oyj). Owners take their shares of electricity at cost, any unwanted portion being sold by them into the Nordic market. This means that output is effectively contracted to each owner over the life of the plant. The private owners are mostly heavy industry with a high demand for base-load power, and hence low costs are critical for them. [Back]

d. Founded in 1998 from state-owned Imatran Voima (IVO) and listed company Neste, Fortum Corporation is a public listed energy company which is 51% owned by the Finnish government. It owns 27% of TVO (see Note c above), and 43% of Oskarshamn and 22% of Forsmark, both in Sweden. [Back]

e. Although Loviisa 1&2 have VVER-440 model V-213 reactors, the plant was extensively modified at the design stage to incorporate Western instrumentation and control systems and containment. [Back]

f. Figures published in 2000 showed that nuclear had very much higher capital costs than the alternatives – €1749/kWe including initial fuel load, which is about three times the cost of a gas plant2. But its fuel costs are much lower, and so at capacity factors above 64% it was the cheapest option. (On the basis of a capacity factor of 91% and interest rates at 5%, operating costs were put at 2.23 Euro cents per kWh (¢/kWh) for nuclear, 2.44 ¢/kWh for coal and 2.63 ¢/kWh for natural gas.) In addition, electricity costs from nuclear generation are less sensitive to fuel price rises than for gas and coal: a 50% increase in fuel prices would result in the electricity cost for nuclear rising about 6%, for coal 21% and for gas 38%. The analysis did not include costs for carbon dioxide emissions, which would make nuclear even more competitive. [Back]

g. In March 2003, tenders were submitted by three vendors for four designs:

- Framatome ANP: European Pressurised Water Reactor (EPR) of 1600 MWe capacity and the SWR-1000 (a BWR) of 1200 MWe.

- General Electric: Advanced Boiling Water Reactor (ABWR) of 1350 MWe.

- Atomstroyexport: VVER-91/99 (V-466) of 1060 MWe.

[Back]

h. For the planned Olkiluoto 4 and Northern reactors, estimates of gross capacities are given, based on the net figures supplied by the utilities as well as information from vendors. [Back]

i. Fennovoima initially consisted of stainless steel producer Outokumpu, mining and smelting company Boliden, energy utilities Rauman Energia and Katterno Group, and the Finnish subsidiary of Germany-based E.On, which was leading the project. Then in late 2007, the ownership base expanded from five to 63 as electricity consumers sought to insure against future energy cost blowouts. E.ON Kärnkraft Finland had a 34% share in Fennovoima, with the remaining 66% held by the other companies organized under Voimaosakeyhtiö SF (Power Company SF). In December 2010, six utilities and Talvivaara Mining Company became shareholders through Voimaosakeyhtiö SF, bringing the number of shareholders in Voimaosakeyhtiö SF to 67. Since then, 20 shareholders have decided not to take part in financing the nuclear power plant project and by December 2013 the number of owners of Voimaosakeyhtiö SF which would be involved in financing the project was down to 47.

In October 2012, E.ON announced that it would divest all its operations in Finland, including its holding in Fennovoima. Early in 2013, the 34% stake of E.ON Kärnkraft Finland was acquired by Voimaosakeyhtiö SF, meaning that Fennovoima was for a year 100%-owned by Voimaosakeyhtiö SF. [Back]

j. Fennovoima originally planned to utilize one of two designs: Areva's EPR with turbine generator from Alstom or Siemens, or Toshiba's version of the 1380 MWe ABWR. (Areva's 1290 MWe Kerena – formerly the SWR-1000, a boiling water reactor, was previously under consideration.) The two were quoted by Fennovoima as up to 1700 MWe and about 1600 MWe respectively at their sites. They were short-listed in July 2011 and commercial bids were received from Areva and Toshiba in February 2012. After receiving a construction licence, work was planned to start in 2014, with full operation envisaged by 2020. But as a result of evaluating the bids, in late February 2013 Fennovoima decided to terminate that process and proceed with direct negotiations about the 1600 MWe EU-ABWR with Toshiba.

However, at the same time Fennovoima also started work on a two-stage process to assess whether a mid-sized unit of 1000-1300 MWe would be a better option. After a preliminary assessment of alternatives, the company invited Rosatom to engage in direct negotiations, in parallel with Toshiba, concerning its 1200 MWe AES-2006 power plant. This new approach was prompted by E.On's departure from the project leaving only the direct stakeholders who will use the power. Fennovoima said it regarded mid-sized reactors from Toshiba and Rosatom as potentially suitable alternatives. In July 2013 Fennovoima said that it would focus on negotiations with Rosatom and end consideration of the Toshiba option. [Back]

k. Fortum was considering five designs, with installed capacity of 1000-1800 MWe, to go online in 2020 or 2021. The designs were: Advanced Boiling Water Reactor (ABWR) supplied by Toshiba; Economical and Simplified Boiling Water Reactor (ESBWR) supplied by GE Hitachi; AES-2006 (with 1200 MWe class VVER reactor) supplied by Atomstroyexport; Advanced Power Reactor 1400 (APR-1400) supplied by Korea Hydro & Nuclear Power (KHNP); and Areva's EPR. The application included the possibility of using the reactor to supply half of the district heating for Helsinki, 80 km away, but the pipeline would have cost up to €1.3 billion. [Back]

l. See Note d above. [Back]

m. In 1998, BNFL supplied five test assemblies that were loaded into Loviisa 1. Following the successful performance of the test assemblies, BNFL won a contract to supply half of the fuel for Loviisa and this arrangement lasted until the end of 2007. There was therefore a seven-year period where Russia was supplying half of the fuel for Loviisa. From 2008, all fuel for Loviisa has been supplied by Russia. [Back]

n. The Ministry of Trade and Industry ceased operations in December 2007 and its responsibilities transferred to the Ministry of Employment and the Economy. [Back]

o. Until 1996, used fuel from Loviisa was returned to the Mayak reprocessing complex near Chelyabinsk in Russia, under a complete fuel cycle service arrangement connected with the supply of reactors by Atomenergoexport to IVO (see Note d above). [Back]

p. Site screening studies commenced in 1983 and preliminary site investigations carried out 1986-1992. Between 1993 and 2000, detailed site investigations and environmental impact assessments were carried out at Romuvaara in Kuhmo, Kivetty in Äänekoski, Olkiluoto in Eurajoki, and Hästholmen in Loviisa. [Back]

q. The estimated €3 billion cost of final disposal assumes 50-year operational lifetimes for Loviisa 1 and 2 and 60-year lifetimes for Olkiluoto 1, 2 and 3. This would equate to about 6,500 tonnes of used fuel. This cost estimate does not include disposal of used fuel beyond these five units, although Posiva has preliminary approval to expand the repository to accept up to 12,000 tonnes of used fuel. [Back]

r. The July 2010 decision by Parliament to allow the capacity of Posiva's planned repository at Eurajoki to be increased to 9000 tonnes of used fuel will mean that the repository can accommodate all existing used fuel, along with that expected to arise from currently operational reactors, plus Olkiluoto 3 and 4.

Posiva had also applied in March 2009 for a further 3000 tonne increase in capacity for used fuel from Loviisa 3, but in April 2010 the government rejected the application to construct Loviisa 3. Meanwhile, Fennovoima was given the go-ahead for a new reactor, but currently has no final disposal route for the used fuel that its reactor would produce. Responding to Parliament's July 2010 decision to allow construction of its proposed new unit, Fennovoima stated: "Parliament requires that the Government contributes to starting assessment and negotiations during 2010 between Posiva, Posiva's owners and Fennovoima regarding the final depositing of spent nuclear fuel."3 [Back]

s. KBS stands for Kärnbränslesäkerhet, meaning 'nuclear fuel safety'. Although SKB has generally stopped referring to the term 'KBS-3', this is the method of final disposal described on its website (www.skb.se) [Back]

References

1. International Atomic Energy Agency, Power Reactor Information System (PRIS)

2. Risto Tarjanne and Sauli Rissanen, Nuclear Power: Least-Cost Option for Baseload Electricity in Finland, presented on 31 August 2000 at the 25th Annual International Symposium of the Uranium Institute (now the World Nuclear Association)

3. Application for a Decision-in-Principle concerning the Construction of a Nuclear Power Plant Unit - Olkiluoto 4, Teollisuuden Voima Oy (2008)

4. Parliament approves construction of two new nuclear power plant units, Ministry of Employment and the Economy press release (1 July 2010); Finnish nuclear program gets ready, World Nuclear News (1 July 2010)

5. Finns more positive towards nuclear, World Nuclear News (15 February 2010)

General sources

International Atomic Energy Agency, Country Nuclear Power Profiles: Finland

International Energy Agency, Electricity Information 2018

World Bank Open Data

Statistics Finland: Energy

TVO website

Fortum's nuclear power webpage

Fennovoima website

Posiva website

SKB (Swedish Nuclear Fuel and Waste Management Company) website

Timo Äikäs, Posiva Oy, Waste Disposal Techniques and Community Acceptance, presented at the Australian Academy of Technological Sciences and Engineering

Conference Nuclear Energy for Australia?, held in Sydney, Australia (July 2013)