Nuclear Power in Russia

- Russia is moving steadily forward with plans for an expanded role of nuclear energy, including development of new reactor technology.

- It is committed to closing the fuel cycle, and sees fast reactors as key to this.

- Exports of nuclear goods and services are a major Russian policy and economic objective. Over 20 nuclear power reactors are confirmed or planned for export construction. Foreign orders totalled $133 billion in late 2017.

- Russia is a world leader in fast neutron reactor technology and is consolidating this through its Proryv ('Breakthrough') project.

Reactors

Construction

Shutdown

Operable nuclear power capacity

Electricity sector

Total generation (in 2021): 1159 TWh

Generation mix: natural gas 514 TWh (44%); nuclear 223 TWh (19%); hydro 216 TWh (19%); coal 187 TWh (16%); oil 8.5 TWh (7%); biofuels & waste 4.0 TWh; wind 3.3 TWh; solar 2.2 TWh.

Import/export balance: 21.3 TWh net export (1.6 TWh imports; 22.9 TWh exports)

Total consumption: 808 TWh

Per capita consumption: c. 5600 kWh

Source: International Energy Agency and The World Bank. Data for year 2021.

Russia is one of the few countries without a populist energy policy favouring wind and solar generation; the priority is unashamedly nuclear.

In the early 2010s, Russia's electricity supply, formerly centrally controlled by RAO Unified Energy System (UES)*, faced a number of acute constraints. First, demand rose strongly to 2010 after more than a decade of stagnation; secondly some 50 GWe of generating plant (more than a quarter of it) in the European part was approcahing the end of its design lifetime; and thirdly Gazprom cut back on the very high level of natural gas supplies for electricity generation because of the profits it could make exporting the gas to the West (over 30% of EU gas comes from Russia).

* In Russia, 'energy' mostly implies electricity.

UES's gas-fired plants burn about 60% of the gas marketed in Russia by Gazprom, and plans were to halve this by 2020. (Also, by 2020, the Western Siberian gas fields were expected to be so depleted that they would supply only one-tenth of current Russian output, compared with nearly three-quarters in about 2010.) Also there are major regional grid constraints so that a significant proportion of the capacity of some plants cannot be used. Some non-nuclear generators have been privatised, e.g. OGK-4 (E.ON Russia) is 76% owned by E.ON, and OGK-5 (Enel Russia) is 56% owned by Enel. Other OGKs are owned by Inter RAO or Gazprom. Some TGK companies (also supplying heat) are private, others such as TGK-3 or Mosenergo are owned by Gazprom.

* In Russia, 'energy' mostly implies electricity.

In November 2009, the government's Energy Strategy 2030 was published, projecting investments for the next two decades. It envisaged a possible doubling of generation capacity from 225 GWe in 2008 to 355-445 GWe in 2030. A revised scheme in mid-2010 projected 1288 TWh demand in 2020 and 1553 TWh in 2030, requiring 78 GWe of new plant by 2020 and total 178 GWe new build by 2030, including 43.4 GWe nuclear. The scheme envisaged decommissioning 67.7 GWe of capacity by 2030, including 16.5 GWe of nuclear plant (about 70% of present capacity). New investment by 2030 of RUR 9800 billion in power plants and RUR 10,200 billion in transmission would be required. In mid-2010 the projected annual electricity demand growth to 2020 was put at 2.2%. In mid-2013, UES projected 1.9% pa. Retail electricity prices are relatively low – for households in 2010, about 9 c/kWh compared with the EU median of 18.5 cents.

Rosenergoatom is the sole nuclear utility, following consolidation in 2001. In 2009 nuclear production was 163.3 TWh (83.7 TWh from VVER, 79.6 TWh from RBMK and other). It then increased slowly to over 200 TWh in 2018. Before this, nuclear electricity output had risen strongly due simply to better performance of the nuclear plants, with capacity factors leaping from 56% to 76% 1998-2003 and then on to 80.2% in 2009. Rosenergoatom aimed for 90% capacity factor by 2015. In 2006 Rosatom announced a target of nuclear providing 23% of electricity by 2020 and 25% by 2030, but 2007 and 2009 plans approved by the government scaled this back significantly (see Building nuclear capacity below).

In July 2012 the Energy Ministry (Minenergo) published draft plans to commission 83 GWe of new capacity by 2020, including 10 GWe nuclear to total 30.5 GWe producing 238 TWh/yr. A year later Minenergo reduced the projection to 28.26 GWe in 2019. Total investment envisaged was RUR 8230 billion, including RUR 4950 billion on upgrading power plants, RUR 3280 billion on new grid capacity and RUR 1320 billion on nuclear.

In May 2015 the Ministry of Economic Development announced a “very significant" delay in commissioning new nuclear power plants due to “a current energy surplus”. Commissioning of two new Leningrad units and two new Novovoronezh units was delayed by one year, and construction of Smolensk II was postponed for six years. In September 2015 Rosatom said it expected to commission 15 further reactors of 18.6 GWe by 2030, reaching 44 GWe then (so presumably no retirements).

In parallel with this Russia is greatly increasing its hydro-electric capacity, aiming to increase by 60% to 2020 and double it by 2030. RusHydro OGK's 3 GWe Boguchanskaya plant in Siberia is being developed in collaboration with Rusal, for aluminium smelting. The aim is to have almost half of Russia's electricity from nuclear and hydro by 2030.

Earlier plans, set out in the government's Energy Strategy 2030, published in November 2009, envisaged a doubling of generation capacity from 225 GWe in 2008 to 355-445 GWe in 2030. A revised scheme in mid-2010 projected 1288 TWh demand in 2020 and 1553 TWh in 2030, requiring 78 GWe of new plant by 2020 and total 178 GWe new build by 2030, including 43.4 GWe nuclear. The scheme envisaged decommissioning 67.7 GWe of capacity by 2030, including 16.5 GWe of nuclear plant.

Present nuclear capacity

Power reactors in operation

| Reactor | Type V=PWR |

MWe net, each |

Commercial operation |

Licensed to, or scheduled close |

| Akademik Lomonosov 1 | KLT-40S | 32 | 05/20 | 2029 |

|---|---|---|---|---|

| Akademik Lomonosov 2 | KLT-40S | 32 | 05/20 | 2029 |

| Balakovo 1 | V-320 | 950 | 5/86 | 2045 |

| Balakovo 2 | V-320 | 950 | 1/88 | 2043 |

| Balakovo 3 | V-320 | 950 | 4/89 | 2048 |

| Balakovo 4 | V-320 | 950 | 12/93 | 2053 |

| Beloyarsk 3 | BN-600 (FBR) | 560 | 11/81 | 2030 |

| Beloyarsk 4 | BN-800 (FBR) | 820 | 10/16 | 2056 |

| Bilibino 2-4 | EGP-6 (LWGR) | 3 x 11 | 12/74-1/77 | Dec 2021; unit 2: 2025 |

| Kalinin 1 | V-338 | 950 | 6/85 | 2045 |

| Kalinin 2 | V-338 | 950 | 3/87 | 2047 |

| Kalinin 3 | V-320 | 950 | 11/2005 | 2065 |

| Kalinin 4 | V-320 | 950 | 9/2012 | 2072 |

| Kola 1 | V-230 | 411 | 12/73 | 2033 |

| Kola 2 | V-230 | 411 | 2/75 | 2034 |

| Kola 3 | V-213 | 411 | 12/84 | 2027 |

| Kola 4 | V-213 | 411 | 12/84 | 2029 |

| Kursk 3 | RBMK | 925 | 3/84 | 2029 |

| Kursk 4 | RBMK | 925 | 2/86 | 2031 |

| Leningrad 3 | RBMK | 925 | 6/80 | 2025 |

| Leningrad 4 | RBMK | 925 | 8/81 | 2026 |

| Leningrad II-1 | V-491 | 1101 | 10/2018 | 2078 |

| Leningrad II-2 | V-491 | 1101 | 03/2021 | 2079 |

| Novovoronezh 4 | V-179 | 385 | 3/73 | 2032 |

| Novovoronezh 5 | V-187 | 950 | 2/81 | 2035 potential |

| Novovoronezh II-1* | V-392M | 1100 | 10/2018 | 2077 |

| Novovoronezh II-2* | V-392M | 1101 | 03/2021 | 2077 |

| Rostov 1 | V-320 | 989 | 3/2001 | 2031 |

| Rostov 2 | V-320 | 950 | 10/2010 | 2040 |

| Rostov 3 | V-320 | 950 | 9/2015 | 2045 |

| Rostov 4 | V-320 | 979 | 9/2018 | 2048 |

| Smolensk 1 | RBMK | 925 | 9/83 | 2028 |

| Smolensk 2 | RBMK | 925 | 7/85 | 2030 |

| Smolensk 3 | RBMK | 925 | 1/90 | 2034 |

| Total: 36 | 26,802 MWe | |||

V-320 is the base model of what is generically VVER-1000; V-230 and V-213 are generically VVER-440; V-179 & V-187 are prototypes. Rostov was formerly sometimes known as Volgodonsk. Most closure dates are from January 2015 'roadmap' unless licence extension indicates later date. Many reactors have been uprated but current net capacities are mostly unknown.

* Novovoronezh II-1&2 are sometimes referred to as Novovoronezh 6&7.

Russia's first nuclear power plant, and the first in the world to produce electricity in 1954, was the 5 MWe Obninsk reactor. Russia's first two commercial-scale nuclear power plants started up in 1963-64, then in 1971-73 the first of today's production models were commissioned. By the mid-1980s Russia had 25 power reactors in operation, but the nuclear industry was beset by problems. The Chernobyl accident led to a resolution of these, as outlined in the Appendix of the information page on Russia's Nuclear Fuel Cycle.

Rosenergoatom is the only Russian utility operating nuclear power plants. Its nuclear plants have the status of branches. It was established in 1992 and was reconstituted as a utility in 2001, as a division of Rosatom.

Between the 1986 Chernobyl accident and the mid-1990s, only one nuclear power station was commissioned in Russia, the four-unit Balakovo, with unit 3 being added to Smolensk. Economic reforms following the collapse of the Soviet Union meant an acute shortage of funds for nuclear developments, and a number of projects were stalled. But by the late 1990s exports of reactors to Iran, China and India were negotiated and Russia's stalled domestic construction programme was revived as far as funds allowed.

Around 2000, nuclear construction revived and Rostov 1 (also known as Volgodonsk 1), the first of the delayed units, started up in 2001, joining 21 GWe already on the grid. It was followed by Kalinin 3 in 2004, Rostov 2 in 2010 and Kalinin 4 in 2011.

By 2006 the government's resolve to develop nuclear power had firmed and there were projections of adding 2-3 GWe per year to 2030 in Russia as well as exporting plants to meet world demand for some 300 GWe of new nuclear capacity in that timeframe. Early in 2016 Rosatom said that Russia’s GDP gained three roubles for every one rouble invested in building nuclear power plants domestically, as well as enhanced “socio-economic development of the country as a whole.”

Earlier in 2017 the CEO of Rosatom said that the government would end state support for the construction of new nuclear units in 2020, and so Rosatom must learn to earn money on its own, primarily via commercial nuclear energy projects in the international market. He said that Rosatom had come from being a consortium of unprofitable, separately-run businesses a decade ago to a vertically-integrated state corporation with improved strategies and financial performance, thanks in part to a "large-scale" programme of state funding. “In this situation … we must learn how to earn money independently,” especially in the world market. “Optimisation of the management system should become the main theme of 2017.”

In February 2010 the government approved the federal target programme designed to bring a new technology platform for the nuclear power industry based on fast reactors. In June 2010 the government approved plans for 173 GWe of new generating capacity by 2030, 43.4 GWe of this being nuclear. However, by January 2015 this domestic 2030 nuclear target had halved. Nevertheless Rosatom said that it had reduced the cost of electricity production at nuclear power plants by 36% over 2011 to 2017.

Rosatom's long-term strategy up to 2050 involves moving to inherently safe nuclear plants using fast reactors with a closed fuel cycle, especially under the Proryv ('Breakthrough') project. It envisages nuclear providing 45-50% of electricity at that time, with the share rising to 70-80% by the end of the century. The ultimate aim of the closed fuel cycle is to eliminate the production of radioactive waste from power generation.

Apart from adding capacity, utilisation of existing plants has improved markedly since 2000. In the 1990s capacity factors averaged around 60%, but they have steadily improved since and are now above 80%.

Life extension, uprates and completing construction

Most reactors are being licensed for lifetime extension. Half of Russia's nuclear generation in 2015 came from units which had been upgraded for long-term operation and were operating beyond their initial design lifetimes (around 30 years), mostly with 15-year extensions initially. Twenty four of 34 reactors operating in 2015 had been upgraded with lifetime extension, adding 3 GWe of generating capacity. Of the other ten, five were being upgraded and five were relatively new anyway.

Generally, Russian reactors were originally licensed for 30 years from first power. Since 2000, licence extensions have been issued for 29 units totalling 21GWe: Beloyarsk 3, Novovoronezh 3-5, Kola 1-4, Kalinin 1&2, Balakovo 1-3 Rostov 1, Kursk 1-4, Leningrad 1-4, Smolensk 1-3, and Bilibino 1-4. Novovoronezh 4, Kola 1&2, Rostov 1 and Bilibino 2-4 have have been granted second licence extensions.

Generally the VVER-440 units have got 15-year operating lifetime extensions. (Kola 1&2 VVER-440 units are V-230 models which the EU has paid to shut down early in countries outside Russia. Novovoronezh 4, a V-179, is a predecessor to these.) The reactor pressure vessels of some older reactors have undergone thermal annealing to reduce acquired brittleness. Kola 1&2 were upgraded for operating lifetime extension to 60 years – 2033 & 2034. Kola 3&4 licence extensions to 2027 and 2029 (45 years) have been confirmed after upgrading work. Novovoronezh 4 is now licensed to operate until 2032.

Most VVER-1000 units are expected to have 30-year operating licence extensions. In 2015 Balakovo 1 was upgraded to extend its operating lifetime to 60 years, followed by the same for unit 2 in 2017, and unit 3 in 2019. Unit 1 was the first large VVER reactor to undergo thermal annealing of the pressure vessel. Kalinin 2 is expected to have a 30-year operating licence extension by 2025.

In 2006 Rosatom said it was considering 15-year lifetime extensions and uprating of all its operating RBMK reactors, and ten had licence extensions by mid-2016. Following significant design modifications made after the Chernobyl accident, as well as extensive refurbishment including replacement of fuel channels, a 45-year lifetime is seen as realistic for most of the 1000 MWe units. In 2020 they provided 31% of Russia's nuclear-generated electricity.

For older RBMK units, service lifetime performance recovery (LPR) operations involve correcting deformation of the graphite stack. After dismantling the pressure tubes, longitudinal cutting of a limited number of graphite columns returns the graphite stack geometry to a condition that meets the initial design requirements. The procedure will give each of these older reactors at least three years' extra operation, and may then be repeated. Leningrad 1 was the first reactor to undergo this over 2012-13, followed by the Kursk units, and then Smolensk.

Most reactors are being uprated. The July 2012 Energy Ministry draft plan envisaged increasing the power of VVER-440 units to 107%, that of RBMKs to 105% and VVER-1000 units to 104-110% (revised to 107-110% in 2013).

In May 2015 Rosenergoatom said it had completed uprating all VVER-1000 reactors to 104% of rated power, and was starting to take them to 107% using advanced TVS-2M fuel design, starting with Balakovo 4. Earlier, uprating of 5% for VVER-440 (but 7% for Kola 4) had been achieved, and in 2015, Kola 3 went to 107%. The overall cost was less than RUR 3 billion ($60.5 million), according to Rosenergoatom. The cost of this was earlier put at US$ 200 per kilowatt, compared with $2400/kW for construction of Rostov 2. Rosatom said that at the end of 2016 all 11 VVER-1000 units were operating at 104% of their original capacity with Rostechnadzor approval.

Rosenergoatom has been investigating further uprates of VVER-1000 units to 107-110% of original capacity, using Balakovo 4 as a pilot plant to 2014. The cost of further uprates beyond 104% is expected to be up to $570/kW, depending on what needs to be replaced – the turbine generators being the main items. For the V-320 units, pilot commercial operation at 104% power is carried out over three fuel campaigns, with the reactor and other system parameters being monitored and relevant data collected. After this period, a cumulative 104% power operation report is produced for each plant. Rostechnadzor will then assess safety and possibly license commercial operation at the higher power level.

Rosenergoatom is considering the introduction of a 24-month fuel cycle at new nuclear power units. Previously, VVER-1000 reactors operated for 12 months without refuelling and from 2008 they were all converted to an 18-month fuel cycle. VVER-440s still use a 12-month cycle. To achieve 24 months in new units, the design of VVERs will need to be changed and fuel enrichment would need to be increased from 4-4.5% U-235 to 6-7% in the VVER-TOI design.

The R&D Institute of Power Engineering was preparing plans for 5% uprating of the later Leningrad, Kursk and Smolensk RBMK units. For Leningrad 2-4, fuel enriched to average 3% instead of 2.4% would allow a 5% increase in power, and Rostechnadzor authorized trials in unit 2 of the new fuel. Following this it was to consider authorizing a 5% uprate for long-term operation. However, Rosenergoatom in May 2012 flagged problems with ageing of the graphite moderator, most acute at Leningrad 1, questioned proceeding with uprates of older units, and said it would consider derating individual units where problems such as pressure tube distortion were apparent due to graphite swelling. Leningrad 1 would be derated to 80% to prolong its operating life, and work to restore its graphite stack and extend its service life was completed late in 2013. Similar work would then be done on all first-generation RBMKs, since these are so important economically to Rosenergoatom. However, future RBMK operation might possibly be at reduced capacity of 80% across all units. The successful repair of Leningrad 1 removed the pressure for accelerated replacement of old RBMK units. In December 2018 Leningrad 1 was shut down, followed by unit 2 in November 2020.

Individual operating power plants

Balakovo: Rostechnadzor approved a 4% increase in power from all four Balakovo V-320 reactors and major overhauls were undertaken from 2012. Balakovo 1 was upgraded at a cost of RUR 9 billion over nine years, and in December 2015 Rostechnadzor gave it a 30-year operating lifetime extension, the first Russian unit to achieve this. Rosatom has done the same for the other three units, all of which are uprated to 104% with 18-month refuel cycle. All four Balakovo units are set for a 60-year operating lifetime. Three test assemblies of REMIX fuel were loaded into Balakovo 3 in June 2016. In September 2021 TVEL announced that the trial of the REMIX fuel over five years had been successful. The assemblies will be examined in more detail in about 2023 once cooled and less radioactive.

Beloyarsk: Beloyarsk 3 BN-600 fast neutron reactor in Zarechny municipality of Sverdlovsk region was upgraded for a 15-year operating lifetime extension, to 2025, and is now licensed to 2030 with ongoing upgrading work aimed at taking it to 2040. In 30 years of operation to late 2011, it produced 114 TWh with capacity factor of 76%. Due to progressive modification, its fuel burn-up has increased from 7% (design value) to 11.4%. It provides heat for Zarechny town as well as electricity from three 200 MWe turbine generators.

The Beloyarsk 4 BN-800 fast neutron reactor was delayed by lack of funds following construction start in 2006 and after first criticality in June 2014 it came online with grid connection in December 2015. Its three steam generators drive a single turbine generator. It entered commercial operation at the end of October 2016. Total cost of construction was reported as RUR 145.6 billion ($2.3 billion). Despite being a test bed for new fuels, it produced 13.7 TWh in its first 36 months.

Beloyarsk 5 as a BN-1200 plant was included in the Regional Energy Planning Scheme in November 2013 and confirmed in the government decree in August 2016.

(Further details on Beloyarsk 4&5 is in the Transition to Fast Reactors and Reactor Technology subsections below.)

Bilibino: Unit 1 was shut down in 2018; units 2-4 were to be shut down in December 2021 after the floating nuclear power plant at Pevek was online, but in 2019 unit 2 was given a licence extension to 2025. As of March 2022 it was unclear whether units 3&4 were still operating. Decommissioning of unit 1 commenced in January 2019. The units are EGP-6 light water graphite-moderated reactors.

Kalinin: Unit 1 had a major overhaul in 2012 for licence extension and power uprate, and Kalinin 2 followed to 2016. Unit 3 was officially approved for this in June 2019. Kalinin 1 was undergoing tests at 104% in 2013 and in mid-2014 it was granted a ten-year licence extension, to mid-2025. Kalinin 2 licence extension to 2038 was granted in November 2017. All four Kalinin units are set for a 60-year operating lifetime.

Kalinin 4 is a V-320 unit built by Nizhny-Novgorod Atomenergopoekt. Rostechnadzor approved an operating licence in October 2011, it started up in November, was grid-connected in December and attained full commercial operation in September 2012. It uses major components originally supplied for Belene in Bulgaria. Final cost was RUR 7 billion ($220 million) under budget – about 10%. Silmash (Power Machines) upgraded the turbine generator of units 3&4 to increase their gross power to 1100 MWe in 2016.

Preparing Kalinin 4 for startup (Rosatom)

Kola: Safety analyses for Kola 3&4, which are later-model VVER-440 reactors, have allowed for at least 15-year life extension from 2011 and 2014 respectively, and significant upratings, despite low power demand in the Murmansk region and Karelia which means they are not fully utilised. In 2010, intended life extension was announced for Kola 3 (15 years). Kola 4 has been uprated to 107% using improved fuel assemblies on a six-year cycle and run on pilot basis but is not yet fully licensed at this level. In October 2014 Rostechnadzor granted a 25-year licence extension for unit 4, taking it to 2029. In May 2016 unit 3 was being prepared for operation at 107%.

In November 2013 the Regional Energy Planning Scheme suggested the early V-230 units 1&2 might continue to operate until two new VVER-TOI units are commissioned, likely to be 2025 and 2030 respectively. Having had one 15-year extension to their operating licences, in mid-2014 Rosenergoatom proposed that Kola 1&2 might have a second operating lifetime extension, taking them to 60 years operation (2033, 2034). It was claimed that further work could bring them to contemporary standards. Annealing of the unit 2 reactor vessel was undertaken in 2016, with the service life extended to the end of 2029. Work to extend the operating period of unit 1 to 60 years started in 2016, and in July 2018 it was granted a licence extension to 2033. It was reconnected to the grid in December 2018 after a 250-day shutdown, including annealing of the reactor vessel. Further work was undertaken on unit 2 in 2019 during a 268-day outage, including the introduction of new active and passive safety systems, enhancement of the seismic stability of reactor equipment, and replacement of radiation monitoring, control, reactor protection and diagnostic systems. Previous annealing of units 1&2 had been undertaken in 1989, followed by further major works over 1991 to 2005, costing $718 million. Some $96 million of this was from international sources including neighbouring countries.

The Kola reactors will be the first VVERs to run on reprocessed uranium (RepU) as a matter of course.

Kursk: Having had a licence extension to 2016, Kursk 1 was the first RBMK unit to be licensed for pilot operation with 5% uprate (reported to 1020 MWe net) but units 2&4 were also operating at this level late in 2011. In February 2012 Rosatom said it would invest a further RUR 30 billion ($1.1 billion) in upgrading Kursk 2-4 and extending their operating lives – RUR 5.0, 11.9 & 13.7 billion respectively.

On units 1&2 work on the graphite moderator stack was undertaken to avoid the deformation experienced in Leningrad 1. Unit 2 was returned to service in February 2014 after its ‘lifetime performance restoration program’. Following inspection, further work was postponed for unit 1, and was then completed in April 2016. Kursk 4 was issued a 15-year licence extension to December 2030 after RUR 13 billion in upgrade work over ten years. Kursk 1 was shut down in December 2021 after 45 years in operation. Units 2-4 are each set for 45-year operating lifetimes.

Kursk 5 – an upgraded RBMK design – was more than 70% built before the project was terminated. Rosatom was keen to see it completed and in January 2007 the Duma's energy committee recommended that the government fund its completion by 2010. However, funds were not forthcoming and the economic case for completion was doubtful, so in February 2012 Rosatom abandoned the project. Instead, major announcements were made regarding Kursk II (see below).

Leningrad: In 2010, intended life extension was announced for Leningrad 4 (15 years), and it underwent a RUR 17 billion refurbishment over 2008-11, including replacement of generator stator. The upgrading investment in all four Leningrad RBMK units totalled RUR 48 billion ($1.6 billion) to early 2012. Leningrad unit 1 was shut down in May 2012 due to deformation of the graphite moderator, and after a RUR 5 billion ($146 million) restoration of the graphite stack as the pioneer lifetime performance recovery (LPR) procedure it was restarted in November 2013. The same work was undertaken on unit 2 in 2014, and second stage lifetime performance recovery (LPR) work on unit 1 was planned for 2015. In 2016 Rosenergoatom planned to replace 150 pressure tubes in unit 2 and 50 in unit 1. All four Leningrad units were set for a 45-year operating lifetime, though unit 1 was closed 44 years after the first VVER-1200 came online at the same site.

Unit 1 was finally shut down in December 2018, followed by unit 2 in November 2020. Units 3&4 will be shut down in 2025/2026. Both VVER-1200 units of phase II of the project are in operation, and two more are planned.

Novovoronezh: Units 3&4 gained 15-year licence extensions to 2016 and 2017, then unit 4 was given a further 15-year licence extension, using parts from the shutdown unit 3. They were the first VVER-440 units to have their operational life extended by annealing the reactor pressure vessels. In 2018 the emergency core cooling system of unit 4 was supplemented so that a drop in primary circuit pressure will automatically release water with boric acid into the core.

A plan for refurbishment, upgrade and life extension of Novovoronezh 5 was announced in mid-2009, this being a prototype of the second-generation VVER-1000 design. The initial estimate was RUR 1.66 billion ($52 million) but this eventually became RUR 14 billion ($450 million). The 12 months of work from September 2010 included the total replacement of the reactor control system and 80% of electrical equipment, and fitting upgraded safety systems, in particular, those of emergency core cooling and feedwater, and emergency power supply. Rosatom projects its operating lifetime being extended to 2035. In 2011 it gained a five-year licence extension, and in 2015 it was licensed for a further 10 years, to 2025.

Unit 6 (also referred to as Novovoronezh II-1), the first of a new generation of 1200 MWe class reactors, was grid-connected in August 2016 after about eight years' construction, and unit 7 (unit II-2) was grid-connected in April 2019.

Rostov: In September 2009 Rostechnadzor approved an operating licence for Rostov 2; it started up in January 2010, was grid connected in March, and entered commercial operation in October 2010. It was approved for 104% of nominal power in October 2012, to about 1075 MWe gross, and in 2016 its fuel cycle was being extended to 18 months.

Rostov 3&4 are effectively new V-320 units. Unit 3 construction restarted in September 2009. It started up and was grid connected in December 2014, reached full power in July 2015, and entered commercial operation in September 2015. In December Rostechnadzor approved a power increase to 104% of the rated level. Unit 4 construction started in June 2010. It started up late in 2017, was grid connected in February 2018 and entered commercial operation in September 2018. See also following section.

Smolensk: Early in 2012 Rosatom announced a RUR 45 billion ($1.5 billion) programme to upgrade and extend the operating lifetime of Smolensk 1-3 RBMK units. At the same time, construction of Smolensk II would get underway, with the first VVER unit to come online by 2024 (now 2027). In 2012 Smolensk 1 was licensed to December 2022, a ten-year extension after refurbishment. Upgrading unit 2 was undertaken from 2013, and included replacement of fuel channels and upgrading the reactor control and protection system and radiation monitoring system, as well as reinforcing the building structure. Unit 3 upgrade was implemented to March 2019, though it was already operating above 1000 MWe gross. All three Smolensk units are set for a 45-year operating lifetime. Rostechnadzor issued a 15-year licence extension for unit 3 in December 2019, with units 1&2 having already achieved the same.

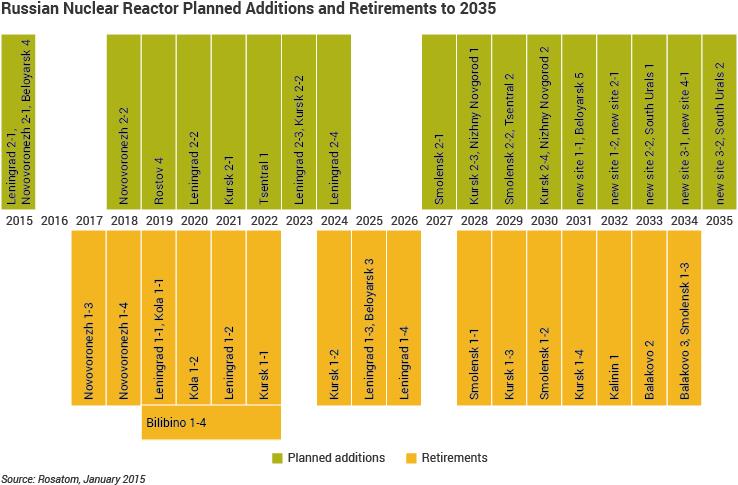

Retiring old units

The January 2015 Rosenergoatom plan envisaged retiring nine units by 2023 – four VVERs (Kola 1&2, Novovoronezh 3&4), three RBMKs (Leningrad 1&2 and Kursk 1) and the four small Bilibino EGPs. Novovoronezh 3 was shut down in December 2016, Leningrad 1 in December 2018, Leningrad 2 in November 2020, and Kursk 1 in December 2021.

Three more RBMK units (Kursk 2, Leningrad 3&4) and the Beloyarsk 3 BN-600 reactor are due to retire by 2027.

Building new nuclear capacity

Rosatom's initial proposal for a rapid expansion of nuclear capacity was based on the cost effectiveness of completing the 9 GWe of then (c2002) partially built plant. To get the funds, Minatom offered Gazprom the opportunity to invest in some of the partly completed nuclear plants. The rationale was that the $7.3 billion required for the whole 10 GWe (including the just-completed Rostov 1) would be quickly recouped from gas exports if the new nuclear plant reduced the need to burn that gas domestically.

In September 2006 Rosatom announced a target of nuclear providing 23% of electricity by 2020, thus commissioning two 1200 MWe plants per year from 2011 to 2014 and then three per year until 2020 – adding some 31 GWe and giving some 44 GWe of nuclear capacity in 2020. The Minister of Finance strongly supported the program to increase nuclear share from 15.6% to 18.6% of total in 2020, hence improving energy security as well as promoting exports of nuclear power technology. After 2015 all funding would be from Rosatom revenues.

In September 2007 an ambitious federal target program (FTP) to 2020 was released, working up to over 4 GWe per year new additions from 2016, but noting that from 2012 to 2020 only two 1200 MWe units per year were within the "financial capacity of the federal task program". In February 2008, under the broader Master Plan for Electric Energy Facilities to 2020, the earlier FTP to 2020 was endorsed with little change except that an extra five VVER-1200 units were added as "maximum scenario" or "extra" in the last few years to 2020. As well as the 4800 MWe capacity then under construction, a further 12,000 MWe was planned for completion mostly by 2016, and then a lot more by 2020. Several new sites were involved. Also the new 300 MWe units were listed as being VBER-300 PWR types.

Kursk 5 RBMK was in the FTP to 2009 but construction was halted in 2012, when about 70% complete, and it is mothballed. (see above)

By April 2009 plans were radically scaled back, due both to reduced electricity demand growth and financial constraints. By July 2012, 30.5 GWe nuclear was projected for 2020. This was confirmed in a January 2015 ‘roadmap’, with an average of one reactor per year commissioned to 2025, including the first three TOI units and excluding the Baltic plant. The ‘roadmap’ excluded smaller and experimental units. But net additions to 2020 were only 6 GWe, taking the target to 31 GWe then.

More significantly, in about 2008 the Ministry of Industry and Energy (MIE) and Rosatom were charged with promptly developing an action plan to attract investment into power generation. It was envisaged that by 2020 much generation would be privatized and competitive, while the state would control natural monopoly functions such as the grid.

In March 2011 the State Duma’s energy committee recommended construction of Kursk II with standard VVER-TOI reactors and updating FTP plans to have units 1&2 put online in 2020 and 2023. It said that unit 1 must be in service by the time the first RBMK unit of phase I is closed, to ensure adequate supply to Moscow.

The FTP is based on VVER technology at least to the 2030s. But it highlights the goal of moving to fast neutron reactors and closed fuel cycle, for which in 2010 Rosatom proposed two options, outlined below in the Transition to Fast Reactors section. In stage 1 of the second option, which was adopted, a 100 MWe lead-bismuth-cooled fast reactor was to be built, though this has now been dropped, and in stage 2 over 2015-2020 a pilot demonstration power facility (PDPF) 300 MWe lead-cooled BREST reactor and a multi-purpose fast neutron research reactor (MBIR) are to be built.

In 2009 Siemens announced that it would withdraw from Areva and forge a link with Rosatom. A memorandum of understanding then confirmed the intent to set up a joint venture with Rosatom as majority shareholder, developing Russian VVER designs, building new nuclear power plants, and upgrading existing nuclear plants. This was hailed by Mr Putin as a long-term strategic partnership. However, finalising the agreement was delayed pending Siemens disengaging from Areva, and in September 2011 Siemens announced that it would not proceed. In any case most of Siemens intellectual property remained with Areva, so it would have had little to contribute to Rosatom/Atomenergoprom.

In October 2014 Rosatom resolved in principle to develop small and medium power reactors, though initially they are not expected to compare economically with larger units. In May 2014 Rosenergoatom was completing comparative assessment of VVER-600 from Gidropress and VBER-600 from OKBM designs. In 2016 the VVER-600 was ordered to be built at Kola initially.

In August 2016 a government decree set out plans to build 11 new reactors beyond Kursk and those then under construction by 2030, as part of the Unified Energy System of Russia. It brought forward the dates for the first two BN-1200 reactors.

In June 2022 Strana Rosatom said that the government has set a goal to bring the share of nuclear power in electricity supply to 25%. Rosenergoatom said that would be challenging because some 10 units are due to shut down by 2030. In order to offset these retirements, Rosenergoatom has said it would need to increase efficiency at operating units. Among other measures, it aims to transfer all VVER-1200 power units to an 18-month fuel cycle by 2024.

A general plan to 2035 has received preliminary government approval, listing specific sites and units to be prioritized:

- Kursk-II: units 1–4 (VVER-TOI)

- Leningrad-II: units 3&4 (VVER-1200)

- Smolensk-II: units 1&2 (VVER-TOI)

- Baimsky GOK: four modernized floating nuclear units (RITM-200)

- Small unit in Yakutia: unit 1 (RITM-200)

- ODEK in Seversk: BREST-OD-300 fast reactor

- Kola-II: unit 1 with (VVER-S or VVER-600)

- Beloyarsk: unit 5 (BN-1200M fast reactor)

See also subsections: Transition to Fast Reactors, and Fast reactors in the Reactor Technology section below.

Power Reactors Under Construction

| Reactor | Reactor type | MWe gross | Construction start | Start or commercial operation |

| BREST-OD-300 | BREST-300 | 300 | 06/2021 | 2026 |

|---|---|---|---|---|

| Kursk II-1 | VVER-TOI/V-510 | 1255 | 04/18 | 2025 |

| Kursk II-2 | VVER-TOI/V-510 | 1255 | 04/19 | 2025? |

| Leningrad II-3 | VVER V-491 | 1188 | 03/24 | 2030 |

| Subtotal of 4 under construction | 3998 MWe gross | |||

(The MBIR research reactor is also under construction, at Dimitrovgrad.)

Baltic 1 a VVER-1200/V-491, commenced construction in Kaliningrad in Russia in February 2012. Construction was suspended in July 2013, and in 2017 the RPV made for Baltic 1 was sent to be used in Ostrovets 2 in Belarus. The unit is shown as under construction in PRIS, but was removed from the WNA's database in November 2020.

Power Reactors Planned and Officially Proposed

| Reactor | Reactor type | MWe gross | Construction start | Start or commercial operation |

| BREST-OD-300 | BREST-300 | 300 | 06/2021 | 2026 |

|---|---|---|---|---|

| Kursk II-1 | VVER-TOI/V-510 | 1255 | 04/18 | 2025 |

| Kursk II-2 | VVER-TOI/V-510 | 1255 | 04/19 | 2025? |

| Leningrad II-3 | VVER V-491 | 1188 | 03/24 | 2030 |

| Subtotal of 4 under construction | 3998 MWe gross | |||

VVER-1200 is the reactor portion of the AES-2006 nuclear power plant, or for planned units beyond Leningrad II it will be VVER-TOI plant with VVER 1200/V-510 reactor. Rostov was also known as Volgodonsk, and construction of units 3&4 actually began in 1983 but was suspended indefinitely with relatively little work done. South Urals was to be BN-800, and now is to be BN-1200.

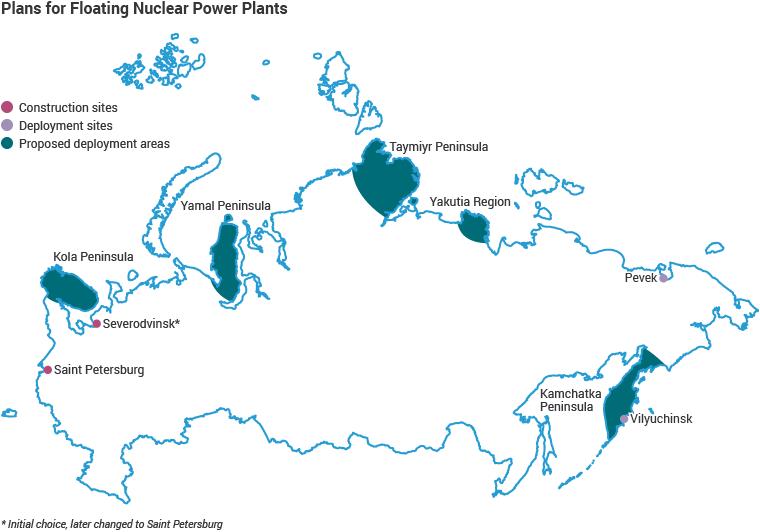

Seversk is near Tomsk, Tver is near Kalinin, Nizhegorod is a new site near Nizhniy Novgorod, 400 km east of Moscow, and Tsentral (central) is at Buisk in Kostrama region. South Ural is at Ozersk, Chelyabinsk region, 140 km west of Chelyabinsk in Sverdlovsk region. Tatarskaya is in Kamskiye Polyany in Nizhnekamsk region. Primorsk is in the far east, as is Vilyuchinsk in the Kamchatka region, and Pevek in the Chukotka Autonomous Region near Bilibino, which it will replace. Floating nuclear power or cogeneration plants are planned for Vilyuchinsk and Kamchatka, in addition to the operational plant at Pevek, Chukotka. Tver and Tsentral are considered alternatives in the short term.

Rostov 3&4 (formerly Volgodonsk)

The environmental statement and construction application were approved by Rostechnadzor in May 2009, the construction licence was granted to Energoatom in June, and construction resumed about September (it had started in 1983). First new concrete for unit 4 was in June 2010. The plant is 13.5 km from the city on the banks of Volgodonsk Tsimlyansk reservoir. Rosatom brought forward the completion dates of the two units after deciding that they would have V-320 type of VVER with improved steam generators and capacity of 1100 MWe. This is expected to save some RUR 10 billion relative to the AES-2006 technology, as it continues the construction done over 1983-86.

OMZ's Izhorskiye Zavody facility at Izhora provided the pressure vessel for unit 3. Nizhniy Novgorod Atomenergoproekt (now NIAEP-ASE) is principal contractor for units 3&4, expected to cost 130 billion (US$ 4.1 billion) according to Rosenergoatom in August 2012. Steam generators for unit 4 are from AEM-Tekhnologi at the Atommash plant, those for unit 3 from ZiO-Podolsk. Ukraine's Turboatom is providing the low-speed turbine generators for both units. Grid connection of unit 2 was in March 2010 and full commercial operation was in October. Unit 3 started up and was grid-connected in December 2014, and entered commercial operation in September 2015. Unit 4 started up in December 2017, was grid-connected five weeks later in February 2018 and entered commercial operation in September 2018. From mid-March 2018, with the completion of a new grid link, the Rostov power plant will supply Crimea, annexed by Russia in 2014.

Novovoronezh II

The principal contractor for Novovoronezh Phase II is JSC AtomEnergoProekt (Moscow), with work starting in 2007 and some involvement of NIAEP-ASE. Construction is now under the ASE group. This is the lead plant for deploying the V-392M version of the AES-2006 units. First concrete was poured for unit 1 (the 6th unit at the site) in June 2008 and for unit 2 in July 2009. Unit 1 was initially expected to be commissioned in 2015, with unit 2 following a year later, at a total cost of US$ 5 billion for 2228 MWe net (1114 MWe net each). The reactor pressure vessels are from OMZ Izhora and the advanced steam generators from ZiO-Podolsk, with 60-year operating lifetime expectancy. Turbine generators (high speed) are from Power Machines.

Atomenergoproekt told its contractors in December 2014 to accelerate work, but in May 2015 a delay of one year in commissioning both units was announced, due to low power demand. In September 2015 a pre-startup peer review was conducted for unit 1 under World Association of Nuclear Operators (WANO) auspices. Rostechnadzor issued the operating licence for unit 1 in March 2016, and fuel loading commenced.* It started up in May and was grid-connected in August 2016. Unit 2 was due to enter commercial operation in January 2019, but in February 2018 Rosenergoatom announced that it would slow construction in response to slowing demand and pressure from power consumers to reduce rate increases. Fuel loading was completed in February 2019, with grid connection in May, and commercial operation in October 2019. The plant is on one of the main hubs of the Russian grid.

In July 2020, Rosenergoatom announced that unit 1 would switch to an 18-month refuelling cycle (from 12 months) for a trial period of about three years.

* Initially only one-third of the fuel assemblies are being loaded, the remainder of the core being dummies, half of which will be replaced with fuel at each subsequent refuelling.

Leningrad II

A general contract for Leningrad phase II AES-2006 plant was signed with St Petersburg Atomenergoproekt (SPb AEP, merged with VNIPIET to become Atomproekt) in August 2007 and Rostechnadzor granted site licences in September 2007 for two units. A specific engineering, procurement and construction contract for the first two V-491 units was signed in Marchand Rostechnadzor issued a construction licence in June 2008. First concrete was poured on schedule for unit 1 in October 2008 and it was due to be commissioned in October 2013. However, a section of outer containment collapsed in 2011 and set back the schedule, as did subsequent manpower shortage, so that commissioning was then expected in 2016, following start-up at the end of 2015. Rostechnadzor granted a construction licence for the second reactor in July 2009, and first concrete was poured in April 2010. Commercial operation was due in 2018 but in May 2015 a delay of one year in commissioning both units was announced, due to low power demand. Unit 1 achieved first criticality in February 2018, and was grid connected in March, with Rostechnadzor approving commercial operation by October 2018. Rosenergoatom then announced a delay to the start of commercial operation of unit 2 to 2020. The delay was requested by energy consumers to reduce rate increases. In July 2020 Rosatom reported that first fuel asssmblies had been loaded, and the reactor was connected to the grid in October 2020. Unit 2 entered commercial operation in March 2021 following a delay due to measures to limit the spread of coronavirus. Each reactor would also provide 1.05 TJ/h (9.17 PJ/yr) of district heating. They are designed to replace the oldest two Leningrad units.

The 2008 construction contract was for $5.8 billion ($2480/kW) possibly including some infrastructure. Total project cost was estimated at $6.6 billion. In May 2015 Titan-2 became general contractor for units 1&2*, with Atomproekt remaining the general designer, and in October 2015 Titan-2 became also the principal equipment supplier. Construction is now under the ASE group which consolidates most of the entities involved.

* It was reported in September 2011 that Titan-2, a major subcontractor, took over from SPb AEP as principal construction contractor, then in February 2012 that Spetsstroy of Russia (Federal Agency for Special Construction) would do so. In December 2013 Roesenergoatom transferred the project from Spetsstroy to Atomenergoproekt Moscow as principal contractor, while SPb AEP/VNIPIET/Atomproekt remained architect general. NIAEP-ASE also bid for the general contract in October 2013. Rosatom had said in February 2012 that it did not believe that SPb AEP should perform the full range of design, construction and equipment supply roles.

A design contract for the next two units (3&4) was signed with SPb AEP in September 2008, and public consultation on these was held in Sosnovy Bor in mid-2009. An environmental review by Rostechnadzor was announced for them in January 2010 and site development licences were granted in June, then renewed in April 2013. Rosenergoatom signed a contract with VNIPIET at the end of December 2013 to develop project documentation. It expected construction licences in 2014 and construction start in 2015, but the delay to units 1&2 extends to units 3&4.

Nizhny Novgorod

The plant in Navashino District near Monakovo is eventually to comprise four AES-1200 units of 1150 MWe net and costing RUR 269 billion ($9.4 billion), the first originally planned to come online by 2019 to address a regional energy deficit. In February 2008 Rosatom appointed Nizhny-Novgorod Atomenergoproekt (NN-AEP or NIAEP) as the principal designer of the plant. Rostechnadzor issued a positive site review for units 1&2 early in 2010 and a site licence with prescription for site monitoring in January 2011. Rosatom's proposal to proceed with construction of two units was approved in November 2011. Site works started in 2012 and formal construction starts were expected soon after. This was to be the first VVER-TOI plant, with rated capacity of 1255 MWe per unit. Preliminary costing is RUR 240 billion ($7.38 billion). In the government decree of August 2016 two VVER-TOI were specified, for completion by 2030.

Tatar

A 4000 MWe nuclear plant was under construction and due on line from 1992, but construction ceased in 1990. Then a two-unit VVER-1200 plant was included in the Regional Energy Planning Scheme in November 2013. In the government decree of August 2016 a single VVER-TOI was listed for completion by 2030 at Kamskiye Polyany in Nizhnekamsk Region of Tatarstan.

Central/Kostroma

The 2340 MWe Tsentral (Central) nuclear power plant is to be 5-10 km northwest of Buisk Town in the Kostroma region, on the Kostroma River. It was another of those deferred but following Rosatom's October 2008 decision to proceed, it appeared that construction might start in 2013. Then a two-unit VVER-1200 plant was included in the Regional Energy Planning Scheme in November 2013, with both units to be online by 2030 and this was confirmed as VVER-TOI in August 2016. Moscow Atomenergoproekt is the architect-engineer. Rostechnadzor has approved the site and a development licence was expected by mid-2010, then a construction licence in 2012. The cost of the project and infrastructure is expected to be RUR 130 billion ($ 5 billion).

South Urals

The Yuzhnouralskaya plant near Ozersk in Chelyabinsk region has been twice deferred, and was then reported by local government to have three BN-1200 fast reactor units planned, instead of four VVER-1200. Then a two-unit BN-1200 plant was included in the Regional Energy Planning Scheme in November 2013. Plans for an initial BN-1200 unit were confirmed in August 2016, for completion by 2030. There is only enough cooling water (70 GL/yr) for two of them, and the third will depend on completion of the Suriyamskoye Reservoir.

Kola II

In January 2012 Rosenergoatom said that the replacement Kola II plant, about 10 km south of the present plant in the Murmansk region and on the shores of Lake Imandra, would be brought forward and built with two VVER-TOI units to come on line in 2020. Then a two-unit VVER-1200 plant was included in the Regional Energy Planning Scheme in November 2013; but in September 2014 Rosenergoatom was considering medium-sized units, either VVER-600 or VBER-600 for Kola. In the government decree of August 2016 a single VVER-600 was specified, for completion by 2030. In June 2021 the plant management announced that construction would start on two VVER-S-600 reactors for Kola II in 2028, with the first to be online in 2034. The ‘S’ signifies spectral shift control, with heavy water in the primary coolant.

Kursk II

It was originally envisaged that the first unit of Kursk II should be online by the time Kursk 1 closes, then envisaged in 2016. In March 2011, the State Duma’s Energy Committee recommended that the government update the general scheme of deployment of electricity generators, to have units 1 and 2 of Kursk II being commissioned in 2020 and 2023 as the lead project with VVER-TOI types, and Kursk II-1 being the reference unit for VVER-TOI. The cost envisaged is RUR 440 billion ($15 billion). Kursk I-5 capacity had been planned in the federal target programme and its abandonment left a likely base-load shortfall for UES in central Russia.

Rosatom started engineering surveys for Kursk II in 2011, and set up a task force of representatives from the nuclear industry and Kursk Region government to produce project documentation on construction of Kursk II. Site work commenced at the end of 2013, with environmental assessment. In June 2016 Rostechnadzor issued a construction licence to Rosenergoatom for unit 1, and the main site works commenced later that month. A licence for unit 2 was issued in October 2016. The total investment in building unit 1 will exceed RUR 200 billion ($3.14 billion), of which more than RUR 10 billion was allocated for 2016. Atommash supplied the reactor pressure vessels and steam generators, Power Machines the turbine generators, and Energoteks the core catcher. Construction of Kursk II-1 started in April 2018, and unit 2 in April 2019. Commissioning is expected in 2022, followed by unit 2 in 2023, matching the retirement of the first two old Kursk units.

A four-unit plant was included in the Regional Energy Planning Scheme in November 2013, units 3&4 to be on line by 2030. In June 2012 Rosatom appointed Moscow AEP as designer, and Nizhny-Novgorod AEP (NIAEP) as architect general and principal contractor.

Smolensk II

Atomenergoproekt Moscow is architect engineer for VVER-TOI units to replace old RBMK capacity at Smolensk. Roesnergoatom’s investment concept was approved in 2011. Site surveys were undertaken from June 2013, and three potential sites were shortlisted. In mid-2017 a special decree was issued for the purchase of 400 ha and for site works 6 km from Smolensk I. A four-unit VVER plant was included in the Regional Energy Planning Scheme in November 2013, with two units on line by 2025 and two by 2030. Engineering surveys were completed in November 2014 at Pyatidvorka (6 km from Smolensk I). Construction start was then deferred to 2022, with the first unit expected online in 2027. Rostechnadzor was expected to issue a site licence in September 2016. In the government decree of August 2016 two VVER-TOI units were specified, for completion by 2030.

Seversk

The first 1200 MWe unit of the Seversk AES-2006 plant 32 km northwest of Tomsk was due to start up in 2015 with the second in 2017, but has been postponed, and a decision on construction schedule was still unresolved in 2012, in the light of electricity demand. Certainly its priority is downgraded in 2013. Rosatom was ready to start construction in 2013, but awaited ministerial direction. Then a two-unit VVER-1200 plant was included in the Regional Energy Planning Scheme in November 2013, both units to be on line by 2030. The plant will also supply 7.5 PJ/yr of district heating.

Atomenrgopoekt Moscow is to build the plant at estimated cost of RUR 134 billion ($ 4.4 billion). Rostechnadzor granted a site development licence in November 2009 and a further site licence in 2011. Site work has commenced. In 2010 Seversk was put on the updated general scheme of deployment of energy facilities, with the first reactor commissioning before 2020 and the second one in 2020-2025. Seversk is the site of a major enrichment plant and former weapons facilities. A design contract for the low-speed turbine generators has been signed between Moscow AEP which is responsible for design and engineering, and Alstom Atomenergomash. This would be the first Russian plant using the low-speed turbines.

In the government decree of August 2016 a single BREST-300 fast reactor was the only unit specified, for completion by 2025 – though now delayed until 2026 (see account below).

Baltic

Separately from the February 2008 plan, Rosatom energy-trading subsidiary InterRAO UES proposed a Baltic or Baltiyskaya AES-2006 nuclear plant in Kaliningrad on the Baltic coast to generate electricity for export, and with up to 49% European equity. Private or foreign equity would be an innovation for Russia. The plant was designed to comprise two 1200 MWe VVER units, V-491 model, sited at Neman, on the Lithuanian border and costing some RUR 194 billion (in 2009 value, €4.6 billion, $6.8 billion), for 2300 MWe net. Project approval was confirmed by government decree in September 2009, following initial approval in mid-2008 as an amendment to the federal target program (FTP) of 2007. The mid-2011 business plan estimated the likely capital cost to be €6.63 to 8.15 billion.

WorleyParsons was appointed technical consultant for the project. Rosenergoatom set up a subsidiary: JSC Baltic NPP to build and commission the plant. St Petersburg Atomenergoproekt - VNIPIET (now merged as Atomproekt) is the architect engineer, Nizhniy Novgorod AEP (NIAEP) is construction manager, with Atomstroyexport (ASE). TitanStroyMontazh is engineering subcontractor. Originally AEM Petrozavodskmash was to produce the pressure vessel for unit 1 but this was assigned to AEM-Tekhnologii at the Atommash plant. OMZ's Ishorskiye Zavody will produce the pressure vessel for unit 2 and the pressurisers for both units. Alstom-Atomenergomash will supply the Arabelle low-speed turbine generators for both units – the plant will be the JV's first customer, and the Baltic plant would be the first Russian plant to use major foreign components. (LMZ high-speed turbine generators had initially been approved.)

Site work began in February 2010. Expenditure to January 2012 was RUR 7.25 billion ($241 million), and that in 2012 was expected to be RUR 7 billion. Rostechnadzor issued a construction licence for unit 1 in November 2011 and first concrete was poured on (revised) schedule in April 2012, with the base completed in December 2012. Unit 1 was planned to come on line in October 2016, after 55 months construction, supplying Rosenergoatom. Commercial operation was due in 2017. Second unit construction was planned over 2013-18, with 48 months to first power and full operation in April 2018. NIAEP-ASE suspended construction in June 2013 (see below), pending a full review of the project intended to be by mid-2014, though some work on the containment was ongoing in following months. Rosenergoatom said that in October 2013 it had spent RUR 50-60 billion ($1.2 to 1.6 billion) on the project. In 2017 the pressure vessel made for unit 1 was sent to Ostrovets in Belarus, replacing one that had suffered a mishap there.

InterRAO UES was responsible for soliciting investment (by about 2014, well after construction start) and also for electricity sales. The Baltic plant directly competes with the plan for a new unit at Visaginas near Ignalina in Lithuania and with plans for new nuclear plants in Belarus and Poland. Rosenergoatom said that the plant is deliberately placed "essentially within the EU" and is designed to be integrated with the EU grid. Most of the power (87% in the mid 2011 business plan) would be exported to Germany, Poland and Baltic states. Transmission to northern Germany would be via a new undersea cable, and in 2011 Inter RAO and Alpiq agreed to investigate an 800 MWe undersea DC link to Germany's grid. Some €1 billion in transmission infrastructure would be required. There is already some transmission capacity east through Lithuania and Belarus to the St Petersburg region if that were added to the options. The European equity would be in order to secure markets for the power. Lithuania was invited to consider the prospect, instead of building Visaginas as a Baltic states plus Poland project, but declined. However in April 2014 Rosatom said the Baltic plant was designed to “operate within the unified grid of the Baltics and North-West of Russia”. But now, due to potential isolation of the Kaliningrad Region grid*, Rosatom “has to rebuild its project completely.” In June 2015 Latvia’s SiltumElektroProjekt LLC (SEP) won a RUR 47 million, six-month contract to do a feasibility study on connecting the Baltic plant ‘interstate’.

* Lithuania’s revised energy policy in 2012 involves rebuilding its grid to be independent of the Russian/Belarus system and to work in with the European Network of Transmission System Operators (ENTSO) synchronous system, as well as strengthening interconnection among the three Baltic states.

Czech power utility CEZ earlier expressed interest in the project, as did Iberdrola from Spain, whose engineering subsidiary already works at Kola, Balakovo and Novovoronezh nuclear power plants. In April 2010 Enel signed a wide-ranging agreement with Inter RAO which positioned it to take up to 49% of the plant, but this did not proceed. Rosatom earlier said that the project would not be delayed even if 49% private equity or long-term sales contracts were not forthcoming.

However, in June 2013 construction was suspended due to lack of interest in the project from the Baltic states, Poland and Germany, all of whom have historical issues regarding Russia and/or Kaliningrad. Construction has remained stalled since then. In July 2015 Kaliningrad local government was talking up the prospects of an aluminium smelter to justify resuming construction of the plant. The plant was omitted from the January 2015 ‘roadmap’ to 2035. In September 2015 the first deputy director general for operations management at Rosatom said that only when long-term electricity sales contracts are negotiated and “formalized in binding documents, i.e. contracts for buying electricity produced by plant from the western side, we could speak of continuation of construction.”

NIAEP said it was investigating building some small nuclear plants in Kaliningrad instead – eight 40 MWe units such as those on floating nuclear power plants was mentioned as a possibility, and they would fit into the local energy system better, with its 500 MWe total requirement. In mid-2014 Rosenergoatom was considering a VVER-600 from Gidropress with many of the same components as the original VVER-1200, and a VBER-600 from OKBM, the latter being less developed so involving a two-year delay. A new schedule and site configuration, involving small units, was to be approved by mid-2014, but there has been no news of this. Meanwhile, manufacture and supply of equipment continued and it is being stored onsite in ten warehouses. The polar crane was delivered in August 2014. A contract for storing four steam generators for 15 months from July 2015 was let for RUR 46 million. In April 2017 it was confirmed that the RPV fabricated for Baltic 1 would be sent to Belarus for Ostovets 2. See also grid implications in Electricity Transmission Grids information page.

The 2015 Rosenergoatom annual report said: “Rosatom State Corporation has recently updated the concept for the Baltic NPP project implementation and is supposing to supply up to 100% of power outside the Kaliningrad Oblast. As part of ensuring the technical capability to supply power, several options for the power generation pattern of the Baltic NPP are being studied, taking into account future configuration of synchronization zones, and the Kaliningrad Oblast plans to prepare for an isolated mode of operation. As part of ensuring commercial conditions of supplies, the negotiations with potential buyers of electricity in the EU countries are continued. So far, several memoranda of understanding, and electricity purchase and sale agreements have been signed with major European energy holdings.”

As well as the Baltic plant, two other ventures with Rusal (see below) will apparently require private equity.

Tver

The plant at Udomlya district and 4 km from Kalinin was being designed by Nizhny-Novgorod Atomenergoproekt (NN-AEP), and in January 2010 it was announced that Rostechnadzor would conduct an environmental review of it for the first two VVER-1200 units, these being on the general scheme of electricity generators deployment to 2020. No firm dates have been given for the project, though a site development licence was expected in March 2010.

Pevek

Energoatom signed a RUR 9.98 billion purchase contract for the first floating nuclear power plant then intended for Vilyuchinsk, on the Kamchatka Peninsula in the Far East, in 2009. Keel-laying took place in May 2009 at the Baltiyskiy Zavod shipyard at St Petersburg. The 2x35 MWe plant, named Academician Lomonosov, was due to be commissioned in 2012, but the project was delayed due to shipyard insolvency. In 2012 the plant was re-assigned to Pevek in the far northeast of Siberia. The twin reactors commenced operation in December 2019, with commercial operation in May 2020. See FNPP subsection below.

Transition to fast reactors

Starting 2020-25 it is envisaged that fast neutron power reactors will play an increasing role in Russia, with substantial recycle of fuel. Fast reactors were projected as comprising some 14 GWe by 2030 and 34 GWe of capacity by 2050.

The principal scheme of innovative nuclear power for Russia based on new technology platform envisages full recycling of fuel, balancing thermal and fast reactors, so that 100 GWe of total capacity requires only about 100 tonnes of input per year, from enrichment tails, natural uranium and thorium, with minor actinides being burned. About 100 t/yr of fission product waste would go to a geological repository.

The sodium-cooled BN-series fast reactor plans are part of Rosatom's Proryv, or 'Breakthrough', project to develop fast reactors with a closed fuel cycle whose mixed oxide (MOX) fuel will be reprocessed and recycled. The BN-600 reactor at Beloyarsk has operated successfully since 1980 and is now licensed to 2020, with planned operation to 2025. The BN-800 reactor at Beloyarsk has operated since 2014, essentially as a demonstration unit for fuel and design features for the BN-1200, which is now deferred.

Recent priority in financing has been for lead-cooled fast neutron reactors with dense nitride fuel. Initially two projects were proposed – the BREST-300 lead-cooled fast reactor with associated nitride fuel fabricating/re-fabricating and spent fuel reprocessing facilities and the SVBR-100 lead-bismuth fast reactor, since dropped. Hence from the mid-2020s, fast reactors will be new designs such as BREST with a single core and no blanket assembly for plutonium production.

Fast reactors represent a technological advantage for Russia. In late 2012 Rosatom said that it plans to make available its experimental facilities for use as part of the Generation IV International Forum, including large physical test benches at Obninsk’s Institute of Physics and Power Engineering, the BOR-60 research reactor at NIIAR, and the future multifunction research reactor MBIR to be built at the NIIAR site.

While Rosatom plans to invest its own funds into FNR development through to 2025, in October 2018 it asked the government to allocate an additional RUR 200 billion ($3.05 billion) over 2019-2025 under the federal target programme for nuclear power. BREST is the focus of this, and Rosatom's long-term strategy up to 2050 involves moving to inherently safe nuclear plants using fast reactors with a closed fuel cycle and MOX or nitride fuel.

Further details of fast neutron power reactors are in the Reactor Technology section below.

Federal Target Programme: Advanced Nuclear Power Technologies 2010-2020

Rosatom put forward two fast reactor implementation options for government decision in relation to the federal target programme (FTP) 'Advanced Nuclear Power Technologies 2010-2020'. The first focused on a lead-cooled fast reactor such as BREST with its fuel cycle, and assumed mobilisation of all available resources on this project with a total funding of about RUR 140 billion (about $3.1 billion). The second multi-track option was favoured, since it involved lower risks than the first. It would result in technical designs of the Generation IV reactor and associated closed fuel cycles technologies by 2014, and a technological basis of the future innovative nuclear energy system featuring the Generation IV reactors working in closed fuel cycles by 2020. A detailed design would be developed for a multi-purpose fast neutron research reactor (MBIR) by 2014 also. This second option was designed to attract more funds apart from the federal budget allocation, was favoured by Rosatom, and was accepted.

In January 2010 the government approved the federal target programme (FTP2010) "New-generation nuclear energy technologies for the period 2010-2015 and up to 2020" designed to bring a new technology platform for the nuclear power industry based on fast neutron reactors. It anticipated RUR 110 billion to 2020 out of the federal budget, including RUR 60 billion for fast reactors, and subsequent announcements started to allocate funds among three types: BREST, SVBR (now dropped) and continuing R&D on sodium cooled types.

The FTP involved plans to build and commission a commercial complex to fabricate dense fuel, to complete construction of a pilot demonstration pyrochemical complex to fabricate BN fuel, and to test closed fuel cycle technologies. Fusion studies are included and the total R&D budget was RUR 55.7 billion, mostly from the federal budget. The FTP2010 implementation was intended to result in a 70% growth in exports of high technology equipment, works and services rendered by the Russian nuclear industry by 2020. It was also to commercialize new fast neutron reactors for Russia to build over 2020-2030. In 2012 the head of Rosatom said that the FTP was being accelerated to bring forward development and have a full range of fast reactor technologies with associated fuel cycles operating by 2020. Rosatom's R&D budget would be almost doubled by then to achieve this.

In March 2017 Rosatom and Russian Venture Company (RVC) signed an agreement to cooperate in the promotion of advanced technologies and innovative developments at Rosatom’s subsidiaries. RVC is a Russian state institution responsible for funding national innovation projects on behalf of the National Technology Initiative (NTI), established in 2014. The agreement has wide scope.

Federal target programme 2010 funding for fast neutron reactors to 2020

| Cooling | Demonstration reactor | Construction (RUR billion) | R&D (RUR billion) | Total (RUR billion) |

|---|---|---|---|---|

| Pb-Bi cooled | SVBR 100 MWe | 10.153 | 3.075 | 13.228 |

| Na cooled | (BN-600, BN-800) | 0 | 5.366 | 5.366 |

| Pb cooled | BREST 300 MWe | 15.555 | 10.143 | 25.698 |

| multiple | MBIR 150 MWt | 11.390 | 5.042 | 16.432 |

| Total: | 37.1 | 60.7 |

Source: Government decree #50, 2010. Most (RUR 9.5 billion) of the funding for SVBR was to be from "other sources" than the state budget, and it has now been dropped.

In March 2018 the FTP2010 was amended by the government in the light of reduced energy demand projections. It is now to concentrate on building the nitride fuel fabrication module and the first stage of the fuel re-fabrication facility which Rosatom expects to be commissioned no earlier than 2022. The BREST-300 reactor is expected to start operating in 2026.

MBIR

Design of the 150 MWt multi-purpose fast neutron research reactor (mnogotselevoy issledovatilskiy reaktor na bystrych neytronach, MBIR) was finalised in 2014 by NIKIET and the equipment contract let to Atomenergomash-Technologies. Rostechnadzor issued a site licence in 2014, a construction licence in May 2015, and construction started in September 2015 at the Research Institute of Atomic Reactors (RIAR or NIIAR) in Dimitrovgrad, as part of the Nuclear Innovation Cluster there. The total project cost was then quoted as RUR 40-41 billion, with some of this expected from investors, and completion was scheduled for 2020. However, the project was paused shortly after construction began. In November 2020 Rosatom appointed a new contractor, AO Institut Orgenergostroy, and construction resumed, with commissioning expected in 2028.

The MBIR will be a multi-loop research reactor capable of testing lead, lead-bismuth and gas coolants as well as sodium, and running on MOX fuel. Initially it will be sodium-cooled. It will be part of an international research centre at RIAR’s site and the IAEA was expected to sign an agreement on the MBIR International Research Centre in September 2016. The project is open to foreign collaboration, in connection with the IAEA INPRO programme. In April 2017 Rosatom was soliciting Japanese involvement. The MBIR will replace the BOR-60 fast research reactor. See also R&D section in the information page on Russia's Nuclear Fuel Cycle.

In January 2023 the reactor vessel for the MBIR was set in place marking the last major installation that requires the building to have an open top, with the next step being the construction of the reactor building dome.

Proryv (Breakthrough) project

The Proryv project is carried out under FTP Nuclear Power Technologies to 2020, to create a new generation of nuclear power technologies on the basis of a closed nuclear fuel cycle using fast neutron reactors. This is proceeding as a high priority in nine coordinated centres, with military focus and resolve.

The basic concepts include elimination of severe reactor accidents, closing the fuel cycle, low-activity radioactive waste, non-proliferation, reduced capital cost of fast reactors, and enabling 350 GWe of Russian nuclear capacity by the end of the century.

The nine responsibility centres include:

- Reprocessing technology and radioactive waste management for the reprocessing module (RM) of the pilot demonstration energy/power complex (PDEC or PDPC).

- Pilot production lines for onsite nuclear fuel cycle, including the fabrication/refabrication module (FRM) and the fast reactor used fuel reprocessing module (RM).

- Development of fuel elements and assemblies with mixed nitride uranium plutonium (MNUP) fuel, at Bochvar National Research Institiute (VNIINM).

- Building and operating the BREST-OD-300 reactor, at JSC NIKIET.

- Development of materials for the BN-1200 fast reactor, at JSC Afrikantov OKBM.

- Design engineering the pilot demonstration energy/power complex (PDEC or PDPC) including nitride fuel fabrication and recycling, and developing an industrial energy complex (IEC).

Most of these initiatives are more fully described in the companion page on Russia's Nuclear Fuel Cycle. BREST and BN-1200 are described below under Reactor Technology.

Aluminium and nuclear power

In 2006 the major aluminium producer SUAL (which in March 2007 became part of RUSAL) signed an agreement with Rosatom to support investment in new nuclear capacity at Kola, to power expanded aluminium smelting there from 2013. Four units totalling 1000 MWe were envisaged for Kola stage 2 underpinned by a 25-year contract with SUAL, but economic feasibility is in doubt and the project appears to have been dropped and replaced by two others.

Since 2007 Rosatom and RUSAL, now the world's largest aluminium and alumina producer, have been undertaking a feasibility study on a nuclear power generation and aluminium smelter at Primorye in Russia's far east. This proposal is taking shape as a US$ 10 billion project involving four 1000 MWe reactors and a 600,000 t/yr smelter with Atomstroyexport having a controlling share in the nuclear side. The smelter would require about one third of the output from 4 GWe, and electricity exports to China and North and South Korea are envisaged.

In October 2007 a $8 billion project was announced for the world's biggest aluminium smelter at Balakovo in the Saratov region, complete with two new nuclear reactors to power it. The 1.05 million tonne per year aluminium smelter is to be built by RUSAL and would require about 15 billion kWh/yr. The initial plan was for the existing Balakovo nuclear power plant of four 950 MWe reactors to be expanded with two more, already partly constructed* – the smelter would require a little over one-third of the output of the expanded power plant. However, in February 2010 it was reported that RUSAL proposed to build its own 2000 MWe nuclear power station, Balakovo AES2, with construction to start in 2011. The overall budget for the energy and metals complex was estimated by the Minister of Investment in the Saratov District to be about $12 billion. Land has been allotted for the project and design has commenced. Aluminium smelting is energy-intensive and requires reliable low-cost electricity to be competitive. Increasingly it is also carbon-constrained – this smelter will emit about 1.7 million tonnes of CO2 per year just from anode consumption.

* Construction of Phase II of Balakovo plant, started in 1987, was stopped in 1992. At that time, unit 5 was 60% complete and unit 6 was 15% – both VVER-1000. From mid 2000 Rosenergoatom prepared Balakovo II for construction completion. However, then Rusal decided against the plan, and in 2009 Rosatom announced freezing the project. In 2015 it called for bids to mothball the project by 2019.

RUSAL announced an agreement with the regional government which would become effective when the nuclear plant expansion is approved by Rosatom or an alternative is agreed. Balakovo units 5&6 have been listed as prospective for some time but were dropped off the 2007-08 Rosatom plan for completing 26 new power reactors by 2020 as they were low priority for UES grid supply. Balakovo is on the Volga River 800 km SE of Moscow.

Meanwhile, and relevant to these proposals, in 2011 Renova's Integrated Energy Systems (IES) Holding, Russia’s largest privately-owned power producer and supplier, agreed to sell its 141 MWe Bogoslovskaya CHP plant to RUSAL in mid-2012, along with the rights to develop a new 230 MWe combined cycle gas turbine unit at the plant, in the central region of Sverdlovsk. This deal, along with another for a supply contract from the Federal Grid Company, enables RUSAL's Bogoslovosk smelter to continue operating. These arrangements were made at presidential level, and will absolve the Bogoslovskaya smelter from paying the cross-subsidy from industrial consumers to other electricity users that is inherent in the general distribution tariff.

In 2015 RUSAL’s plans for Balakovo and Primorye smelters were on hold.

Nuclear icebreakers and merchant ship

Nuclear propulsion has proven technically and economically essential in the Russian Arctic where operating conditions are beyond the capability of conventional icebreakers. The power levels required for breaking ice up to 3 metres thick, coupled with refuelling difficulties for other types of vessel, are significant factors. The nuclear fleet has increased Arctic navigation on the Northern Sea Route (NSR) from two to ten months per year, and in the western Arctic, to year-round. In 2020 freight traffic along the NSR reached almost 33 million tonnes and is projected to reach 80 million tonnes by 2024. Greater use of the icebreaker fleet is expected with developments on the Yamal Peninsula and further east. For instance the Yamal LNG project is expected to need 200 shipping movements per year from Sabetta at the mouth of the Ob river.

The fleet is operated by Atomflot, a Rosatom division, and is commercially vital to northern mineral and oil and gas developments, as well as enabling the shortest route from Europe to East Asia. The newest icebreakers being built have a 34-metre beam, able to open a path for large ships.

The icebreaker Lenin was the world’s first nuclear-powered surface vessel (20,000 dwt) and remained in service for 30 years (1959-89), though new OK-900 reactors (2 x 159 MWt) were fitted in 1970.

It led to a series of larger icebreakers, the six 23,500 dwt Arktika-class, launched from 1975. These powerful vessels have two 171 MWt OK-900A reactors delivering 54 MW at the propellers and are used in deep Arctic waters. The Arktika was the first surface vessel to reach the North Pole, in 1977. The seventh and largest Arktika-class icebreaker – 50 Years of Victory (50 Let Pobedy) entered service in 2007. It is 25,800 dwt, 160 m long and 20m wide, and is designed to break through ice up to 2.8 metres thick. Its performance in service has been impressive.

For use in shallow waters such as estuaries and rivers, two shallow-draught Taymyr-class icebreakers of 18,260 dwt with one reactor delivering 35 MW were built in Finland and then fitted with their nuclear steam supply system in Russia. They are built to conform with international safety standards for nuclear vessels and were launched from 1989.

Larger third-generation 'universal' LK-60 icebreakers (project 22220) are being built as dual-draught (8.55 or 10.5m) wide-beam (34m) ships of 25,450 dwt or 33,540 dwt with ballast, able to handle 2.8 metres of ice, for use in the Western Arctic year-round and in the eastern Arctic in summer and autumn. In August 2012 the United Shipbuilding Corporation (USC) won the contract for the first new-generation LK-60 icebreaker, Arktika. These are powered by two RITM-200 reactors of 175 MWt each, together delivering 60 MW at the propellers via twin turbine-generators and three electric motors. They are being built by USC subsidiary Baltijsky Zavod Shipbuilding in St Petersburg.