Economics of Nuclear Power

- Nuclear power is cost-competitive with other forms of electricity generation, except where there is direct access to low-cost fossil fuels.

- Fuel costs for nuclear plants are a minor proportion of total generating costs, though capital costs are greater than those for coal-fired plants and much greater than those for gas-fired plants.

- System costs for nuclear power (as well as coal and gas-fired generation) are very much lower than for intermittent renewables.

- Providing incentives for long-term, high-capital investment in deregulated markets driven by short-term price signals presents a challenge in securing a diversified and reliable electricity supply system.

- In assessing the economics of nuclear power, decommissioning and waste disposal costs are fully taken into account.

- Nuclear power plant construction is typical of large infrastructure projects around the world, whose costs and delivery challenges tend to be under-estimated.

For information on financing specifically, please see information page on Financing Nuclear Energy.

Assessing the relative costs of new generating plants utilizing different technologies is a complex matter and the results depend crucially on location. Coal is, and will probably remain, economically attractive in countries such as China and India, as long as carbon emissions are cost-free or not fully costed. Gas is also competitive for base-load power in many places, particularly using combined-cycle plants.

Nuclear power plants are expensive to build but relatively cheap to run. In many places, nuclear energy is competitive with fossil fuels as a means of electricity generation. Waste disposal and decommissioning costs are usually fully included in the operating costs. If the social, health and environmental costs of fossil fuels are also taken into account, the competitiveness of nuclear power is improved.

The basic economics metric for any generating plant is the levelized cost of electricity (LCOE). It is the total cost to build and operate a power plant over its lifetime divided by the total electricity output dispatched from the plant over that period, hence typically cost per megawatt hour. It takes into account the financing costs of the capital component (not just the 'overnight' cost).

On a levelized (i.e. lifetime) basis, nuclear power is an economic source of electricity generation, combining the advantages of security, reliability and very low greenhouse gas emissions. Existing plants function well with a high degree of predictability. The operating cost of these plants is lower than almost all fossil fuel competitors, with a very low risk of operating cost inflation. Plants are now expected to operate for 60 years and even longer in the future. The main economic risks to existing plants lie in the impacts of subsidized intermittent renewable and low-cost gas-fired generation. The political risk of higher, specifically-nuclear, taxation adds to these risks.

World Nuclear Association published Nuclear Power Economics and Project Structuring in early 2017. The report noted that the economics of new nuclear plants are heavily influenced by their capital cost, which accounts for at least 60% of their LCOE. Interest charges and the construction period are important variables for determining the overall cost of capital. Once a nuclear plant has been constructed, the production cost of electricity is low and predictably stable.

In deregulated wholesale electricity markets the economic justification for any capital investment has been decreasing while the actual need increases due to the ageing of existing plants. The IEA points out that at the turn of the century one-third of investment in electricity flowed into deregulated markets exposed to wholesale price uncertainty, whilst two-thirds went into regulated markets with some assurance of return on capital. By 2014 only 10% of investment was directed into deregulated markets. This has prompted urgent reviews by governments concerned about medium-term energy security. All operating nuclear power plants were built by governments or regulated utilities where long-term revenue and cost recovery was virtually certain. Some of these plants, especially in the UK and USA, now find themselves in a deregulated market environment.

Regulated and government utilities make investments in generation assets, spend money on power plant fuel and operation, and make decisions about retiring existing assets. These decisions are based on long-term planning processes focused on ensuring reliable operation while minimizing total costs over the long-term. In a deregulated market a merchant generator depends on the inherently short-term and often volatile market for its revenue, putting the operator at risk; and the developer of a new plant faces considerable uncertainty due to greater completion risk. Government support is needed to mitigate these risks and make new projects bankable.

A further economic aspect is the system cost of making the supply from any source meet actual demand from the grid. The system cost is minimal with dispatchable sources such as nuclear, but becomes a factor for intermittent renewables whose output depends on occasional wind or solar inputs. If the share of such renewables increases above a nominal proportion of the total then system costs escalate significantly and readily exceed the actual generation cost from those sources. This is modelled in a 2019 OECD Nuclear Energy Agency study and very evident in Germany, and is an important consideration beyond the LCOE in comparing sources (see section below on Other costs).

Assessing the costs of nuclear power

The economics of nuclear power involves consideration of several aspects:

- Capital costs, which include the cost of site preparation, construction, manufacture, commissioning and financing a nuclear power plant. Building a large-scale nuclear reactor takes thousands of workers, huge amounts of steel and concrete, thousands of components, and several systems to provide electricity, cooling, ventilation, information, control and communication. To compare different power generation technologies the capital costs must be expressed in terms of the generating capacity of the plant (for example as dollars per kilowatt). Capital costs may be calculated with the financing costs included or excluded. If financing costs are included then the capital costs change materially for nuclear in relation to construction time of the plant and with the interest rate and/or mode of financing employed.

- Plant operating costs, which include the costs of fuel, operation and maintenance (O&M), and a provision for funding the costs of decommissioning the plant and treating and disposing of used fuel and wastes. Operating costs may be divided into ‘fixed costs’ that are incurred whether or not the plant is generating electricity and ‘variable costs’, which vary in relation to the output. Normally these costs are expressed relative to a unit of electricity (for example, cents per kilowatt hour) to allow a consistent comparison with other energy technologies. To calculate the operating cost of a plant over its whole lifetime (including the costs of decommissioning and used fuel and waste management), we must estimate the ‘levelized’ cost at present value. The levelized cost of energy (LCOE) represents the price that the electricity must fetch if the project is to break even (after taking account of all lifetime costs, inflation and the opportunity cost of capital through the application of a discount rate).

- External costs to society from the operation, which in the case of nuclear power is usually assumed to be zero, but could include the costs of dealing with a serious accident that are beyond the insurance limit and in practice need to be picked up by the government. The regulations that control nuclear power typically require the plant operator to make a provision for disposing of any waste, thus these costs are ‘internalized’ as part of operating costs (and are not external). Electricity generation from fossil fuels is not regulated in the same way, and therefore the operators of such thermal power plants do not yet internalize the costs of greenhouse gas emission or of other gases and particulates released into the atmosphere. Including these external costs in the calculation for alternatives improves the economic competitiveness of new nuclear plants and other low-carbon sources of electricity.

- Other costs such as system costs and nuclear-specific taxes.

Each of these aspects is considered below.

Capital costs

Costs are incurred prior to construction, during design and licensing, and while the plant is under construction, and include expenditure on the equipment, engineering and labour, as well as the cost of financing the investment.

Costs prior to construction start are rarely considered but can be significant, particularly those related to licensing. Regulator fees are typically c. $60 million per reactor per countrya, and costs payable by a vendor to support the licensing process are c. $180-240 million per design per countryb.

The overnight cost is the capital cost exclusive of financing charges accruing during the construction period. The overnight cost includes engineering, procurement and construction (EPC) costs, owners' costs (land, cooling infrastructure, associated buildings, site works, switchyards, project management, licences, etc.) and various contingencies. About 80% of the overnight cost relates to EPC costs, with about 70% of these consisting of direct costs (physical plant equipment with labour and materials to assemble them) and 30% indirect costs (supervisory engineering and support labour costs with some materials). The remaining 20% of the overnight cost is for contingencies and owners’ costs (essentially the cost of testing systems and training staff).

Construction/investment cost is the capital cost inclusive of all capital cost elements (i.e. overnight cost, cost escalation and financing charges). The construction cost is expressed in the same units as overnight cost and is useful for identifying the total cost of construction and for determining the effects of construction delays. In general the construction costs of nuclear power plants are significantly higher than for coal- or gas-fired plants because of the need to use special materials, and to incorporate sophisticated safety features and backup control equipment. These contribute much of the nuclear generation cost, but once the plant is built the plant operating costs are minor.

Financing cost is the interest charge on debt, dictated by the construction period and interest rate applicable.

The construction time of a nuclear power plant is usually taken as the duration between the pouring of the first 'nuclear concrete' and grid connection. Long construction periods will push up financing costs, and in the past they have done so very significantly. Among electricity generation technologies, the cost of finance is particularly important for the overall economics of nuclear power plants due to the profile of the capital expenditure. Nuclear power plants are more complex than other large-scale power generation plants, and so are more capital-intensive and may take longer to construct. Typically a nuclear power plant will take over five years to construct whereas natural gas-fired plants are frequently built in about two years. Once in operation, the high capital costs of nuclear construction are offset by low and stable variable costs, but the need to finance the upfront construction costs presents a challenge.

The cost of capital is typically a key component of the overall capital cost of nuclear power projects. Over a long construction period, during which there are no revenue streams from the project, the interest on funds borrowed can compound into very significant amounts. In a business plan, the cost of capital is often calculated at various discount rates to discover whether capital expenditure can be recovered. If the cost of capital is high then the capital expenditure rises disproportionately and may undermine the viability of the project.

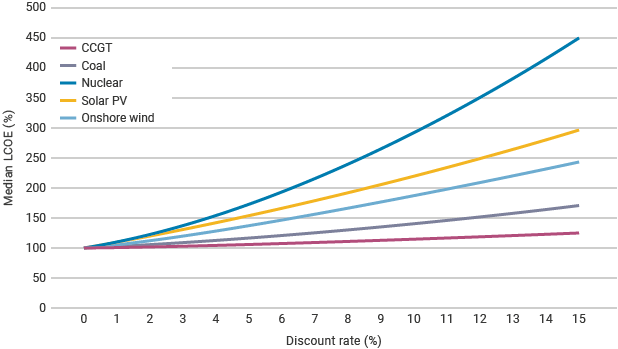

Figure 1: Effect of discount rate on levelized cost of electricity (LCOE) for different technologies (source: OECD Nuclear Energy Agency)

The 2020 edition of the World Nuclear Association's World Nuclear Supply Chain report tabulated two breakdowns in capital costs, by activity and in terms of labour, goods and materials:

| Design, architecture, engineering and licensing | 5% |

| Project engineering, procurement and construction management | 7% |

| Construction and installation works: | |

| Nuclear island | 28% |

| Conventional island | 15% |

| Balance of plant | 18% |

| Site development and civil works | 20% |

| Transportation | 2% |

| Commissioning and first fuel loading | 5% |

| Total | 100% |

| Equipment | |

| Nuclear steam supply system | 12% |

| Electrical and generating equipment | 12% |

| Mechanical equipment | 16% |

| Instrumentation and control system (including software) | 8% |

| Construction materials | 12% |

| Labour onsite | 25% |

| Project management services | 10% |

| Other services | 2% |

| First fuel load | 3% |

| Total | 100% |

Capital cost escalation

With relatively few nuclear plants constructed in North America and Western Europe over the past two decades, the amount of information on the costs of building modern nuclear plants in these regions is somewhat limited. The shift to Generation III reactors has added further uncertainty. Other non-nuclear generation technologies also show variation, as do major infrastructure projects such as roads and bridges, depending upon where they are built. However, the variation is particularly crucial for electricity generation as its economics depend so much on minimizing capital investment cost, which must be passed onto consumers, in contrast to roads, bridges and dams which are usually less complex.

The OECD Nuclear Energy Agency’s (NEA's) calculation of the overnight cost for a nuclear power plant built in the OECD rose from about $1900/kWe at the end of the 1990s to $3850/kWe in 2009. In the 2020 edition of the Projected Costs of Generating Electricity joint report by the International Energy Agency (IEA) and the NEA, the overnight costs ranged from $2157/kWe in South Korea to $6920/kWe in Slovakia. For China, the figure was $2500/kWe. LCOE figures assuming an 85% capacity factor ranged from $27/MWh in Russia to $61/MWh in Japan at a 3% discount rate, from $42/MWh (Russia) to $102/MWh (Slovakia) at a 7% discount rate, and from $57/MWh (Russia) to $146/MWh (Slovakia) at a 10% discount rate.

The 2020 edition of Projected Costs of Generating Electricity makes the important point regarding LCOE: “At a 3% discount rate, nuclear is the lowest cost option for all countries. However, consistent with the fact that nuclear technologies are capital intensive relative to natural gas or coal, the cost of nuclear rises relatively quickly as the discount rate is raised. As a result, at a 7% discount rate the median value of nuclear is close to the median value for coal [but lower than the gas in CCGTs], and at a 10% discount rate the median value for nuclear is higher than that of either CCGT or coal. These results include a carbon cost of $30/tonne, as well as regional variations in assumed fuel costs.”

The US Energy Information Administration (EIA) calculated that, in constant 2002 values, the realized overnight cost of a nuclear power plant built in the USA grew from $1500/kWe in the early 1960s to $4000/kWe in the mid-1970s. The EIA cited increased regulatory requirements (including design changes that required plants to be backfitted with modified equipment), licensing problems, project management problems and misestimation of costs and demand as the factors contributing to the increase during the 1970s. Its 2024 report, Capital Cost and Performance Characteristic Estimates for Utility-Scale Electric Power Generating Technologies, gave an estimate for a new US nuclear plant (based on two AP1000 units) of $7821/kWe (overnight cost in 2023 values).

There are also significant variations in capital costs by country, particularly between the emerging industrial economies of East Asia and the mature markets of Europe and North America. Variations have a variety of explanations, including: differential labour costs; more experience in the recent building of reactors; economies of scale from building multiple units; and streamlined licensing and project management within large civil engineering projects.

The French national audit body, the Cour des Comptes, said in 2012 that the overnight capital costs of building nuclear power plants increased over time from €1070/kWe (in 2010 prices) when the two Fessenheim PWRs were commissioned, to €2060/kWe in 2000 after Chooz B1&2 were built, and to a projected €3700/kWe for the Flamanville EPR. It can be argued that much of this escalation relates to the smaller magnitude of the programme by 2000 (compared with when the French were commissioning 4-6 new PWRs per year in the 1980s) and the resultant failure to achieve series economies. The French programme also arguably shows that industrial organization and standardization of a series of reactors allowed construction costs, construction time and operating and maintenance costs to be brought under control. The total overnight investment cost of the French PWR programme amounted to less than €85 billion at 2010 prices. When divided by the total installed capacity (63 GW), the average overnight cost is €1335/kWe. This is much in line with the costs that were then provided by the manufacturers. In 2019 EDF estimated that the cost of building six EPR2 units in France in the late 2020s would be at least €56 billion, hence around €5700/kWe. In December 2025 EDF released a revised forecasted cost for the six-reactor EPR2 programme at €72.8 billion (in 2020 values), with the first reactor at Penly targeted for commissioning in 2038. France’s Flamanville 3 EPR was connected to the grid in December 2024 at a total cost of some €23.7 billion (in 2023 euros, about €21.1 billion in 2020 values).

In several countries, notably the UK, there is a trend towards greater vendor involvement in financing projects, but with an intention to relinquish equity once the plant is running.

In China it is estimated that building two identical 1000 MWe reactors on a site can result in a 15% reduction in the cost per kW compared with that of a single reactor.

In the USA, Vogtle 3&4 (two AP1000s, 2234 MWe total) entered commercial operation in 2023 and 2024 respectively, at a total cost of about $35 billion.

A 2016 study by The Breakthrough Institute on Historical construction costs of global nuclear power reactors presented new data for overnight nuclear construction costs across seven countries. Some conclusions emerged that are in contrast to past literature. While several countries, notably the USA, show increasing costs over time, other countries show more stable costs in the longer term, and cost declines over specific periods in their technological history. One country, South Korea, experiences sustained construction cost reductions throughout its nuclear power experience. The variations in trends show that the pioneering experiences of the USA or even France are not necessarily the best or most relevant examples of nuclear cost history. These results showed that there is no single or intrinsic learning rate expected for nuclear power technology, nor any expected cost trend. How costs evolve appears to be dependent on several different factors. The large variation in cost trends and across different countries – even with similar nuclear reactor technologies – suggests that cost drivers other than learning-by-doing have dominated the experience of nuclear power construction and its costs. Factors such as utility structure, reactor size, regulatory regime, and international collaboration may have a larger effect. Therefore, drawing any strong conclusions about future nuclear power costs based on one country's experience – especially the US experience in the 1970s and 1980s – would be ill-advised.

Plant operating costs

Operating costs include the cost of fuel and of operation and maintenance (O&M). Fuel cost figures include used fuel management and final waste disposal.

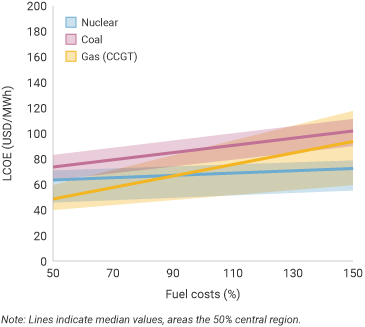

The share of fuel expenditures on total costs varies largely between technologies: whereas nuclear plants are characterized by high investment but relatively low fuel costs, this ratio is typically reversed in the case of natural gas plants.

Low fuel costs have from the outset given nuclear energy an advantage compared with coal and gas-fired plants. Uranium, however, has to be processed, enriched and fabricated into fuel elements, accounting for about half of the total fuel cost. In the assessment of the economics of nuclear power, allowances must also be made for the management of radioactive used fuel and the ultimate disposal of this used fuel or the wastes separated from it. But even with these included, the total fuel costs of a nuclear power plant in the OECD are typically about one-third to one-half of those for a coal-fired plant and between one-quarter and one-fifth of those for a gas combined-cycle plant.

The OECD-NEA has calculated that the LCOE of nuclear plants are only slightly affected by a 50% change in fuel costs (in either direction) due to their high fixed-to-variable cost ratio. Comparatively, the economics of natural gas (CCGT) and coal plants are more sensitive to changes in fuel cost, with LCOEs changing by about 7% and 4% respectively for every 10% change of fuel price.

Front end fuel cycle costs of 1 kg of uranium as UO2 fuel

| Process | Amount required x price* | Cost | Proportion of total |

| Uranium | 8.9 kg U3O8 x $94.6/kg | $842 | 51% |

|---|---|---|---|

| Conversion | 7.5 kg U x $16 | $120 | 7% |

| Enrichment | 7.3 SWU x $55 | $401 | 24% |

| Fuel fabrication | per kg | $300 | 18% |

| Total | $1663 |

* Prices are approximate and as of September 2021.

At 45,000 MWd/t burn-up this gives 360,000 kWh electricity per kg, hence fuel cost = 0.46 ¢/kWh.

Fuel costs are one area of steadily increasing efficiency and cost reduction. For instance, in the USA, fuel costs declined by 44% between 2012 and 2023 according to the Nuclear Energy Institute.

Uranium has the advantage of being a highly concentrated source of energy which is easily and cheaply transportable. The quantities needed are very much less than for coal or oil. One kilogram of natural uranium will yield about 20,000 times as much energy as the same amount of coal. It is therefore intrinsically a very portable and tradeable commodity.

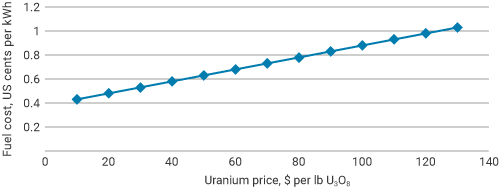

The impact of varying the uranium price in isolation is shown below in a worked example of a typical US plant, assuming no alteration in the tails assay at the enrichment plant.

Figure 2: Effect of uranium price on fuel cost (source: World Nuclear Association)

Doubling the uranium price (say from $25 to $50 per lb U3O8) takes the fuel cost up from 0.50 to 0.62 ¢/kWh, an increase of one-quarter, and the expected cost of generation of the best US plants from 1.3 ¢/kWh to 1.42 ¢/kWh (an increase of almost 10%). So while there is some impact, it is minor, especially in comparison with the impact of gas prices on the economics of gas generating plants. In these, 90% of the marginal costs can be fuel. Only if uranium prices rise to above $100 per lb U3O8 ($260/kgU), and stay there for a prolonged period, will the impact on nuclear generating costs be considerable.

Nevertheless, for nuclear power plants operating in competitive power markets where it is impossible to pass on any fuel price increases (i.e. the utility is a price-taker), higher uranium prices will cut corporate profitability. Yet fuel costs have been relatively stable over time – the rise in the world uranium price between 2003 and 2007 added to generation costs, but conversion, enrichment and fuel fabrication costs did not follow the same trend.

For prospective new nuclear plants, the fuel component is even less significant (see below). The typical front end nuclear fuel cost is typically only 15-20% of the total, as opposed to 30-40% for operating nuclear plants.

Figure 3: Effect of fuel costs on LCOE (source: OECD Nuclear Energy Agency)

There are other possible savings. For example, if used fuel is reprocessed and the recovered plutonium and uranium is used in mixed oxide (MOX) fuel, more energy can be extracted. The costs of achieving this are large, but are offset by MOX fuel not needing enrichment and particularly by the smaller amount of high-level wastes produced at the end. Seven UO2 fuel assemblies give rise to one MOX assembly plus some vitrified high-level waste, resulting in only about 35% of the volume, mass and cost of disposal.

This 'back end' of the fuel cycle, including used fuel storage or disposal in a waste repository, contributes up to 10% of the overall costs per kWh, or less if there is direct disposal of used fuel rather than reprocessing.

Operation and maintenance (O&M) costs account for about two-thirds of the total operating cost. O&M may be divided into ‘fixed costs’, which are incurred whether or not the plant is generating electricity, and ‘variable costs’, which vary in relation to the output. Normally these costs are expressed relative to a unit of electricity (for example, cents per kilowatt hour) to allow a consistent comparison with other energy technologies.

Decommissioning costs are about 9-15% of the initial capital cost of a nuclear power plant. But when discounted over the lifetime of the plant, they contribute only a few percent to the investment cost and even less to the generation cost. In the USA they account for 0.1-0.2 ¢/kWh, which is no more than 5% of the cost of the electricity produced.

External costs

External costs are not included in the building and operation of any power plant, and are not paid by the electricity consumer, but by the community generally. The external costs are defined as those actually incurred in relation to health and the environment, and which are quantifiable but not built into the cost of the electricity.

Negative effects beyond the system itself (i.e. negative externalities) related to the provision of electricity are increasingly being recognized as significant and complicate the picture further. Negative externalities related to electricity generation – most notably the emissions of greenhouse gases and other pollutants – represent a social cost that may impact the true affordability of different electricity supply options. It is well-documented that the social and economic costs of climate change and air pollution are significant. In order to better-understand the socially optimal level of externalities (relative to production) it is imperative that the relative costs of different supply options include a reasonable estimate of their impacts on emissions and the climate.

Nuclear energy is cost-competitive based on a simple LCOE comparison, particularly at low discount rates. Its unique attributes of providing predictable, reliable supply that is low-carbon means that inclusion of system costs and negative externalities both markedly improve the relative affordability of nuclear energy.

Unlike nuclear energy, some energy sources dispose of wastes to the environment, or have health effects which are not costed into the product. These implicit subsidies, or external costs as they are generally called, are nevertheless real and usually quantifiable, and are borne by society at large. Their quantification is necessary to enable rational choices between energy sources. Nuclear energy provides for waste management, disposal and decommissioning costs in the actual cost of electricity (i.e. it has internalized them), so that external costs are minimized.

The European Commission launched a project, ExternE, in 1991 in collaboration with the US Department of Energy – the first research project of its kind "to put plausible financial figures against damage resulting from different forms of electricity production for the entire EU". The methodology considered emissions, dispersion and ultimate impact. With nuclear energy, the risk of accidents was factored in along with high estimates of radiological impacts from mine tailings (waste management and decommissioning being already within the cost to the consumer). Nuclear energy averaged 0.4 euro ¢/kWh, much the same as hydro; coal was over 4.0 ¢/kWh (4.1-7.3), gas ranged 1.3-2.3 ¢/kWh and only wind showed up better than nuclear, at 0.1-0.2 ¢/kWh average. NB these were the external costs only.

A further study commissioned by the European Commission in 2014, and carried out by the Ecofys consultancy, calculated external costs for nuclear as €18-22/MWh, including about €5/MWh for health impacts, €4/MWh for accidents and €12/MWh for so-called ‘resource depletion’, relating to the “costs to society of consumption of finite fuel resources now, rather than in the future”. Although Ecofys acknowledged that the resource depletion cost is difficult to calculate since the scarcity of a finite natural resource is already reflected in its market price, and could therefore just as well be zero, a high estimate was asserted using a questionable methodology and without taking account of the potential for recycling nuclear fuel.

Another report for the European Commission made by Professor William D’haeseleer, University of Leuven, in November 2013, estimated the cost of a potential nuclear accident to be in the range of €0.3-3.0/MWh.

Pricing of external benefits is limited at present. As fossil fuel generators begin to incur real costs associated with their impact on the climate, through carbon taxes or emissions trading regimes, the competitiveness of new nuclear plants will improve. This is particularly so where the comparison is being made with coal-fired plants, but it also applies, to a lesser extent, to gas-fired equivalents.

The likely extent of charges for carbon emissions has become an important factor in the economic evaluation of new nuclear plants, particularly in the EU where an emissions trading regime has been introduced. In early 2026 EU carbon prices were around €90/tonne of CO2.

For information on zero-emission credit (ZEC) programmes established elsewhere in the USA, see Nuclear Power in the USA.

Other costs

In order to provide reliable electricity supply, there must be reserve capacity to cover refuelling or maintenance downtime in plants which are producing most of the time, and also provision must be made for backup generation for intermittent wind and solar plants at times when they are unable to operate. Provision must also be made to transmit the electricity from where it is generated to where it is needed. The costs incurred in providing backup and transmission/distribution facilities are known as system costs.

System costs are external to the building and operation of any power plant, but must be paid by the electricity consumer, usually as part of the transmission and distribution cost. From a government policy point of view they are just as significant as the actual generation cost, but are seldom factored into comparisons of different supply options, especially comparing base-load with dispersed intermittent renewables such as solar and wind. In fact the total system cost should be analysed when introducing new power generating capacity on the grid. Any new power plant likely requires changes to the grid, and hence incurs a significant cost for power supply that must be accounted for. But this cost for large plants operating continuously to meet base-load demand is very small compared with integrating intermittent renewables into the grid.

For nuclear and fossil fuel generators, system costs relate mainly to the need for reserve capacity to cover periodic outages, whether planned or unplanned. The system costs associated with intermittent renewable generation relate to their inability to generate electricity without the required weather conditions and their generally dispersed locations distant from centres of demand.

The integration of intermittent renewable supply on a preferential basis despite higher unit cost creates significant diseconomies for dispatchable supply, as is now becoming evident in Germany, Austria and Spain, compromising security of supply and escalating costs. At anything approaching a 40% share of electricity being from intermittent renewable energy, the capital cost component of power from conventional thermal generation sources increases substantially as their capacity factor decreases – the utilization effect. This has devastated the economics of some gas-fired plants in Germany, for instance.

In some countries, market design results in a market failure whereby reliable (and low carbon), but capital-intensive technologies (such as large hydro and nuclear) cannot be financed because long-term power purchase contracts are not available, meaning there is no certainty that investments can be recouped. Long-term electricity storage solutions (when/if the technology becomes available) face the same financing problem because these will also be capital-intensive.

The overall cost competitiveness of nuclear, as measured on a levelized basis (see figure below on Comparative LCOEs and System Costs in Four Countries), is much enhanced by its modest system costs. However, the impact of intermittent electricity supply on wholesale markets has a profound effect on the economics of base-load generators, including nuclear, that is not captured in the levelized cost comparisons given by the International Energy Agency (IEA) - Nuclear Energy Agency (NEA) reports. The negligible marginal operating costs of wind and solar mean that, when climatic conditions allow generation from these sources, they undercut all other electricity producers. At high levels of renewable generation, the nuclear capacity factor is reduced and the volatility of wholesale prices greatly increases whilst the average wholesale price level falls. The increased penetration of intermittent renewables thereby greatly reduces the financial viability of nuclear generation in wholesale markets where intermittent renewable energy capacity is significant. See also Electricity markets section below.

The integration of intermittent renewables with conventional base-load generation is a major challenge facing policymakers in the EU, in certain US states and elsewhere. Until this challenge is resolved, e.g. by the introduction of long-term capacity markets or power purchase agreements, then investment in base-load generation capacity in these markets is likely to remain insufficient.

A 2019 OECD Nuclear Energy Agency study, The Costs of Decarbonisation: System Costs With High Shares of Nuclear and Renewables, found that the integration of large shares of intermittent renewable electricity is a major challenge for the electricity systems of OECD countries and for dispatchable generators such as nuclear. Grid-level system costs for intermittent renewables are large ($8-$50/MWh) but depend on country, context and technology (onshore wind < offshore wind < solar PV). Nuclear system costs are $1-3/MWh.

See also paper on Electricity Transmission Grids.

Nuclear-specific taxes are levied in several EU countries. In 2014 Belgium raised some €479 million from a €0.005/kWh tax. In July 2015, Electrabel agreed to pay €130 million tax for the year 2016, alongside a fee for the operating lifetime extension of Doel 1&2 (€20 million/yr). From 2017 onwards, a formula applies for calculating tax contributions, with a minimum of €150 million per year.

In 2000 Sweden introduced a nuclear-specific tax on installed capacity, which gradually increased over time; in 2015, the tax raised about €435 million. In June 2016 the Swedish government, amid growing concerns over the continued viability of existing plants, agreed to phase out the tax on nuclear power, and it was abolished in January 2019.

In Germany, a tax was levied on nuclear fuel that required companies to pay per gram of fuel used over six years to 2016. After various court rulings, in June 2017 the Federal Constitutional Court finally ruled that the nuclear fuel tax was “formally unconstitutional and void,” which meant that the three major utilities could be reimbursed some €6.3 billion paid between 2011 and 2016 – €2.8 billion by E.On, €1.7 billion by RWE and €1.44 billion by EnBW, plus interest.

The UK imposes the Climate Change Levy, a downstream tax on energy delivered to non-domestic users in the UK introduced in 2001. Initially levied against fossil fuels and nuclear, the government removed renewables' exemption in its July 2015 Budget. In 2011 the government introduced a carbon floor price – a mechanism that has long been seen as fundamental to the economics of new UK nuclear power. The government set a minimum of £16 per tonne CO2 from 2013, rising steadily to £30 per tonne in 2020, and £70 per tonne in 2030.

See also paper on Energy subsidies and external costs.

Electricity markets

The economics of any power generation depends primarily on what each unit (kWh, MWh) costs to produce for the consumer who creates the demand for that power. This is the LCOE as outlined above. But secondly it depends on the market into which the power is sold, where the producer and grid operator run into a raft of government policies often coupled with subsidies for other sources. Such policies raise the question of what public good is served by each, and whether overall the public good is optimized. Where the outcome is not maximizing public good effectively, there is market failure.*

* This section draws heavily on the Nuclear Economics Consulting Group webpage on Market Failure.

A market can work well to achieve its stated objectives, but still result in market failure. This is often explained by externalities – negative or positive impacts of an industry – that are not reflected in the market. With electricity, the direct (private) costs of generating power at the plant do not usually include the external costs (e.g. emissions, system costs due to intermittent operation, land use, noise) nor do they account for the benefits of positive externalities (e.g. knock-on economic activity from jobs, system reliability, fuel diversity).

Electricity markets rely on direct or private costs at the plant to dispatch (i.e. turn on and turn off) generators to meet varying real-time demand for power. Those costs determine merit order of dispatch. Meeting real-time electricity demand is a difficult and challenging process. The electricity markets do this, but do not reflect the externalities of the generators participating in the market and may result in market failure. An electricity market with efficient short-term spot prices should not be expected to achieve other objectives such as lower emissions, long-term system reliability, or implementation of national policy.

Merchant generating plants rely on selling power into a commodity market which is shaped by policies including those which may favour particular sources of power regardless of their immediate and longer-term deficiencies in relation to the public good. (Generating plants in a regulated or government-owned electricity industry can deliver power essentially on a cost-plus basis, with regulators or governments able to reflect externalities in decisions.) Nuclear power plants provide a range of benefits to society that are not compensated in the commodity electricity market revenue stream. These public benefits include emission-free electricity, long-term reliable operation, system stability, system fuel diversity and fuel price hedging, as well as economic benefits from employment.

Generic approaches to fix market failure include imposing costs on negative externalities such as CO2 emissions, providing compensation to support positive externalities, and government ownership of sectors likely to experience market failure. Some US states make zero-emission credit (ZEC) payments to nuclear generation to reward the positive externalities. ZECs are similar to the production tax credits applying to wind power, though lower, but are based directly on estimated emission benefits. They mean that the value of nuclear electricity can be greater than the LCOE cost of producing it in markets strongly influenced by low gas prices and subsidies on intermittent wind generation which has market priority. Without the ZEC payments, nuclear operation may not be viable in this situation.

An analysis by the Brattle Group in 2016 showed that zero-emission credits for nuclear power could secure the economic viability of nuclear plants in competition with subsidized renewables and low-cost gas-fired plants. "The actual near-term shortfall for a distressed nuclear plant tends to be relatively modest – typically around $10/MWh, which translates to $12 to $20 per ton [approx. $13-22 per tonne] of avoided CO2, depending on the size of the shortfall and the carbon-intensity of the affected region," it said, adding: "This cost compares favorably with other carbon abatement options, the estimated social cost of carbon, and the cost of state policies designed to reduce CO2 emissions from the power sector."

The report continued: “These findings demonstrate that the retention of existing nuclear generating plants, even at a modest premium, represents a cost-effective method to avoid CO2 emissions and enable compliance with any future climate policy ... at reasonable cost. Sustaining nuclear viability in the interim will reduce near-term emissions, and is a reasonable and cost-effective insurance policy in the longer term."

The New York Public Service Commission on 1 August 2016 approved the Clean Energy Standard. The majority vote was reported to be on three main criteria: grid reliability; reducing carbon emissions; and maintaining jobs. The governor’s announcement stated: “A growing number of climate scientists have warned that if these nuclear plants were to abruptly close, carbon emissions in New York will increase by more than 31 million metric tons during the next two years, resulting in public health and other societal costs of at least $1.4 billion.”

Under New York's Clean Energy Standard (CES), zero-emission credits (ZEC) are implemented in six tranches over a period of 12 years from April 2017 to March 2029, supporting four reactors providing about 3.4 GWe. For the first two-year period nuclear generators received ZECs of $17.54/MWh, paid by the distribution utilities (and hence eventually ratepayers) but otherwise similar to the federal production tax credits applying to renewables since 1993 on an inflation-adjusted basis, though at a lower rate than its $23/MWh for wind. ZECs would escalate to $29.15/MWh over subsequent years. The ZEC programme was extended in January 2026 to 2049.

In Illinois, in December 2016 the Future Energy Jobs Bill established the Zero Emission Standard (ZES) to preserve the state’s at-risk nuclear plants. The bill provided ZECs similar to those in New York – "a tradable credit that represents the environmental attributes of one megawatt hour of energy produced from a zero emission facility" (such as the nuclear power plants which supply about 90% of the state’s zero-carbon electricity). In 2021 the Climate and Equitable Jobs Act (CEJA) expanded support by creating the Carbon Mitigation Credit (CMC) programme for additional plants. The CMC operates as a contract-for-differences mechanism; because wholesale prices have been elevated, the programme has returned net credits to ratepayers rather than costing them. Nuclear provides about 52% of Illinois’s electricity.

In the USA, the Inflation Reduction Act of 2022 introduced a production tax credit of up to 1.5 ¢/kWh for existing nuclear plants (2024-2032), and technology-neutral clean electricity credits for new plants from 2025. These were preserved by the One Big Beautiful Bill Act of 2025, which accelerated phase-outs of wind and solar credits while maintaining nuclear provisions.

Comparing the economics of different forms of electricity generation

In its Annual Energy Outlook 2025, the US EIA noted that no new nuclear capacity is projected to be built in its reference case, reflecting high capital costs estimated at $7821/kWe overnight (in 2023 values).

The 2020 edition of the OECD study on Projected Costs of Generating Electricity showed that the range for the levelized cost of electricity (LCOE) varied much more for nuclear than coal or CCGT with different discount rates, due to it being capital-intensive (see above). The nuclear LCOE is largely driven by capital costs. At a 3% discount rate, nuclear was substantially cheaper than the alternatives in all countries, at 7% it was comparable with coal and still cheaper than CCGT, at 10% it was comparable with both. At low discount rates it was much cheaper than wind and solar PV. Compared with a 0% discount rate, the LCOE for nuclear was three times as much with a 10% discount rate, while that for coal was 1.4 times and for CCGT it changed very little. Solar PV increased 2.25 times and onshore wind nearly twice at a 10% discount rate, albeit with very different capacity factors to the 85% for the three base-load options. For all technologies, a $30 per tonne carbon price was included. LCOE figures omit system costs.

Projected nuclear LCOE costs for 'nth-of-a-kind' plants completed from 2025, $/MWh

| Country | At 3% discount rate | At 7% discount rate | At 10% discount rate |

| France | 45.3 | 71.1 | 96.9 |

| Japan | 61.2 | 86.7 | 112.1 |

| South Korea | 39.4 | 53.3 | 67.2 |

| Slovakia | 57.6 | 101.8 | 146.1 |

| USA | 43.9 | 71.3 | 98.6 |

| China | 49.9 | 66.0 | 82.1 |

| Russia | 27.4 | 42.0 | 56.6 |

| India | 48.2 | 66.0 | 83.9 |

Source: OECD IEA & NEA, Projected Costs of Generating Electricity, 2020 Edition, Table 3.13a, assuming 85% capacity factor. In 2018 currency values.

OECD electricity generating costs for year 2025 onwards – 3% discount rate, $/MWh

| Country | Nuclear | Coal | Gas CCGT |

|---|---|---|---|

| France | 45.3 | - | - |

| Japan | 61.2 | 87.6 | 87.6 |

| Korea | 39.4 | 69.8 | 83.0 - 91.0 |

| Slovakia | 57.6 | - | - |

| USA | 43.9 | 75.1 - 96.3 | 40.7 |

| China | 49.9 | 70.6 | 81.5 |

| Russia | 27.4 | - | - |

| India | 48.2 | 64.7 - 94.6 | - |

Source: OECD IEA & NEA, Projected Costs of Generating Electricity, 2020 Edition, Tables 3.11a, 3.12, 3.13a, assuming 85% capacity factor. In 2018 currency values.

At a 3% discount rate comparative costs are as shown above. Nuclear is comfortably cheaper than coal and gas in all countries. At a 10% discount rate (see below) nuclear is still cheaper than coal in South Korea and the USA, but is more expensive in Japan, China and India. Nuclear proves to be cheaper than gas in Korea and China, but is more expensive in Japan and the USA.

OECD electricity generating costs for year 2025 onwards – 10% discount rate, $/MWh

| Country | Nuclear | Coal | Gas CCGT |

|---|---|---|---|

| France | 96.9 | - | - |

| Japan | 112.1 | 111.3 | 97.1 |

| Korea | 67.2 | 81.0 | 90.2 - 100.4 |

| Slovakia | 146.1 | - | - |

| USA | 98.6 | 100.2 - 148.8 | 48.9 |

| China | 82.1 | 78.5 | 86.3 |

| Russia | 56.6 | - | - |

| India | 83.9 | 76.0 - 105.5 | - |

Source: OECD IEA & NEA, Projected Costs of Generating Electricity, 2020 Edition, Tables 3.11a, 3.12, 3.13a, assuming 85% capacity factor. In 2018 currency values.

Overnight capital costs for nuclear technologies in OECD countries ranged from $2157/kWe of capacity (in South Korea) to $6920/kWe (in Slovakia) in the 2020 edition of Projected Costs of Generating Electricity.

Competitiveness in the context of increasing use of power from renewable sources, which are often given preference and support by governments, is a major issue today. The most important renewable sources are intermittent by nature, which means that their supply to the electricity system does not necessarily match demand from customers. In power grids where renewable sources of generation make a significant contribution, intermittency forces other generating sources to ramp up or power down their supply at short notice. This volatility can have a large impact on non-intermittent generators’ profitability. A variety of responses to the challenge of intermittent generation are possible. Two options currently being implemented are increased conventional plant flexibility and increased grid capacity and coverage. Flexibility is seen as most applicable to gas- and coal-fired generators, but nuclear reactors, normally regarded as base-load producers, also have the ability to load-follow (e.g. by the use of ‘grey rods’ to modulate the reaction speed).

As the scale of intermittent generating capacity increases however, more significant measures will be required. The establishment and extension of capacity mechanisms, which offer payments to generators prepared to guarantee supply for defined periods, are now under serious consideration within the EU. Capacity mechanisms can in theory provide security of supply to desired levels but at a price which might be high. For example, Morgan Stanley has estimated that investors in a 800 MWe gas plant providing for intermittent generation would require payments of €80 million per year whilst Ecofys reports that a 4 GWe reserve in Germany would cost €140-240 million/year. Almost by definition, investors in conventional plants designed to operate intermittently will face low and uncertain load factors and will therefore demand significant capacity payments in return for the investment decision. In practice, until the capacity mechanism has been reliably implemented, investors are likely to withhold investment. Challenges for EU power market integration are expected to result from differences between member state capacity mechanisms.

Economic implications of particular plants

Apart from considerations of cost of electricity and the perspective of an investor or operator, there are studies on the economics of particular generating plants in their local context.

Early in 2015 a study, Economic Impacts of the R.E. Ginna Nuclear Power Plant, was prepared by the US Nuclear Energy Institute. It analyzes the impact of the 580 MWe PWR plant’s operations through the end of its 60-year operating licence in 2029. It generates an average annual economic output of over $350 million in western New York State and an impact on the U.S. economy of about $450 million per year. Ginna employs about 700 people directly, adding another 800 to 1,000 periodic jobs during reactor refueling and maintenance outages every 18 months. Annual payroll is about $100 million. Secondary employment involves another 800 jobs. Ginna is the largest taxpayer in the county. Operating at more than 95% capacity factor, it is a very reliable source of low-cost electricity. Its premature closure would be extremely costly to both state and country – far in excess of the above figures.

In June 2015 a study, Economic Impacts of the Indian Point Energy Center, was published by the US Nuclear Energy Institute, analyzing the economic benefits of Entergy’s Indian Point 2&3 reactors in New York state (1020 and 1041 MWe net). It showed that they annually generated an estimated $1.6 billion in the state and $2.5 billion across the nation as a whole. This included about $1.3 billion per year in the local counties around the plant. The facility contributed about $30 million in state and local property taxes and had an annual payroll of about $140 million for the plant’s nearly 1000 employees. The total tax benefit to the local, state and federal governments from the plant was about $340 million per year, and the plant’s direct employees supported another 5400 indirect jobs in New York state and 5300 outside it. It also made a major contribution to grid reliability and prevented the release of 8.5 million tonnes of CO2 per year. The plant was prematurely shut down 2020-2021.

Future cost competitiveness

Understanding the cost of new generating capacity and its output requires careful analysis of what is in any set of figures. There are three broad components: capital, finance, and operating costs. Capital and financing costs make up the project cost.

Calculations of relative generating costs are made using estimates of the levelized cost of electricity (LCOE) for each proposed project. The LCOE represents the price that the electricity must fetch if the project is to break even (after taking account of all lifetime costs, inflation and the opportunity cost of capital through the application of a discount rate). It is useful from an investor's point of view. But LCOE does not take account of the system costs of integrating output into a grid to meet demand, and is therefore a very poor metric for comparing dispatchable generation (coal, gas, nuclear) with intermittent renewables (wind, solar) from any policy perspective. System costs escalate greatly with increasing share of intermittent renewables.

This was partly addressed by the International Energy Agency in its World Energy Outlook 2018 by introducing value-adjusted LCOE (VALCOE), which combines LCOE with energy, flexibility and capacity values, enabling a better comparison of the overall value and competitiveness among technologies from the perspective of planners and policymakers. The VALCOE methodology has continued to be used in subsequent editions including WEO 2025. However, it still omits important aspects of system costs such as grid integration.

A 2019 report from the OECD's Nuclear Energy Agency, The Costs of Decarbonisation: System Costs with High Shares of Nuclear and Renewables, probes the system cost question more fully. It works within a very tight 50g CO2 per kWh emission constraint for electricity, as required to achieve the targets to combat climate change under the 2016 Paris Agreement. Nuclear power is the mainstay meeting base-load demand in the 98 GWe base case model system. The report points out that the variability of wind and solar PV production imposes costly adjustments on the residual system, and these system costs are currently not properly recognized in any electricity market. They are simply borne by the system in a way that makes sensible policy formulation virtually impossible.

"The most important categories of system costs of VREs are increased outlays for distribution and transmission due to their small unit size and distance from load centres, balancing costs to prepare for unpredictable changes in wind speed and solar radiation and, perhaps, most importantly, technologies and costs for organising reliable supplies through the residual system during the hours when wind and sun are not fully available or not available at all." System costs rise from less than $10/MWh for 10% wind and solar to more than $50/MWh for a 75% wind/solar share, or a 50% share under some circumstances.

It is important to note that capital cost figures quoted by reactor vendors, or which are general and not site-specific, will usually just be for EPC costs. This is because owners’ costs will vary hugely, most of all according to whether a plant is greenfield or at an established site, perhaps replacing an old plant.

There are several possible sources of variation which preclude confident comparison of overnight or EPC capital costs – e.g. whether initial core load of fuel is included. Much more obvious is whether the price is for the nuclear island alone (nuclear steam supply system) or the whole plant including turbines and generators. Further differences relate to site works such as cooling towers as well as land and permitting – usually they are all owners’ costs as outlined earlier in this section. Financing costs are additional, adding typically around 30%, dependent on construction time and interest rate. Finally there is the question of whether cost figures are in current (or specified year) dollar values or in those of the year in which spending occurs.

Advanced reactors study

A peer-reviewed study in 2017, undertaken by the Energy Innovation Reform Project (EIRP), with data collection and analysis conducted by the Energy Options Network on its behalf, compiled extensive data from eight advanced nuclear companies that are actively pursuing commercialization of plants of at least 250 MWe in size. Individual reactor units ranged from 48 MWe to 1650 MWe.

At the lower end of the potential cost range, these plants could present the lowest cost generation options available, making nuclear power “effectively competitive with any other option for power generation. At the same time, this could enable a significant expansion of the nuclear footprint to the parts of the world that need clean energy the most – and can least afford to pay high price premiums for it.” The companies included in the study were Elysium Industries, GE Hitachi (using only publicly available information), Moltex Energy, NuScale Power, Terrestrial Energy, ThorCon Power, Transatomic Power (which subsequently ceased operation in 2018), and X‐energy. LCOE ranged from $36/MWh to $90/MWh, with an average of $60/MWh. A 2024 meta-analysis by Idaho National Laboratory compiled cost estimates from over 30 sources for advanced reactors, finding wide variations but suggesting that nth-of-a-kind advanced reactors could achieve competitive costs if learning rates were realized.

Advanced nuclear technologies represent a dramatic evolution from conventional reactors in terms of safety and non-proliferation, and the cost estimates from some advanced reactor companies – if they are shown to be accurate – suggest that these technologies could revolutionize the way we think about the cost, availability, and environmental consequences of energy generation.

Financing new nuclear power plants

For more detail on financing, please see the information page on Financing Nuclear Energy.

There are a range of possibilities for financing, from direct government funding with ongoing ownership, vendor financing (often with government assistance), utility financing and the Finnish Mankala model for cooperative equity. Some of the cost is usually debt financed. The models used will depend on whether the electricity market is regulated or liberalized.

Apart from centrally-planned economies, many projects have some combination of government financial incentives, private equity and long-term power purchase arrangements. The increasing involvement of reactor vendors is a recent development.

In the UK, a regulated asset base (RAB) model was adopted in 2022 for new nuclear.

Notes & references

Notes

a. Estimate based on multiple reactor vendor estimates and regulatory reports from the USA and UK, including references 1-3 below. [Back]

b. Estimated based on ratio of 1:3 to 1:4 of regulatory fees to internal support costs. Estimated ratio from multiple references including 4 below. [Back]

References

1. Office for Nuclear Regulation, Summary of the GDA issue close-out assessment of the Westinghouse Electric Company AP1000® Nuclear Reactor (March 2017)

2. Office for Nuclear Regulation, Summary of the detailed design assessment of the Electricité de France SA and AREVA NP SAS UK EPRTM nuclear reactor (December 2011)

3. Office for Nuclear Regulation, Summary of the GDA Assessment of Hitachi-GE Nuclear Energy, Ltd.’s UK ABWR Nuclear Reactor and ONR’s Decision to Issue a Design Acceptance Confirmation (December 2017)

4. Anna Bradford, US Nuclear Regulatory Commission, Counting the Costs on Advanced Reactor Reviews (October 2015)

General sources

OECD International Energy Agency and OECD Nuclear Energy Agency, Projected Costs of Generating Electricity (2010)

OECD International Energy Agency and OECD Nuclear Energy Agency, Projected Costs of Generating Electricity (2015)

OECD International Energy Agency and OECD Nuclear Energy Agency, Projected Costs of Generating Electricity (2020)

International Energy Agency, World Energy Outlook 2025

Lazard, Levelized Cost of Energy+ (LCOE+), Version 18.0 (June 2025)

OECD Nuclear Energy Agency, The Costs of Decarbonisation: System Costs with High Shares of Nuclear and Renewables (2019)

OECD Nuclear Energy Agency (2012), Nuclear Energy and Renewables: System Effects in Low-carbon Electricity Systems

US Energy Information Administration, Levelized Cost of New Generation Resources in the Annual Energy Outlook (2013)

US Energy Information Administration, Capital Cost and Performance Characteristic Estimates for Utility-Scale Electric Power Generating Technologies (January 2024)

Ecofys, Subsidies and Costs of EU Energy, Project number: DESNL14583 (November 2014)

Jessica Lovering, Arthur Yip, Ted Nordhaus, Historical construction costs of global nuclear power reactors, Energy Policy, 91, p371-382 (April 2016)

Nuclear Power Economics and Project Structuring, World Nuclear Association (January 2017)

Lion Hirth, Falko Ueckerdt and Ottmar Edenhofer, Integration Costs Revisited – An Economic Framework for Wind and Solar Variability, Renewable Energy, 74, p925-939 (2015)

Dan Yurman, Study Finds Advanced Reactors Will Have Competitive Costs, Neutron Bytes (26 July 2017)

Edward Kee, Commentary #24 – Government Support, Nuclear Economics Consulting Group (17 December 2018)

Idaho National Laboratory, Meta-Analysis of Advanced Nuclear Reactor Cost Estimations (July 2024)

Related information

Energy SubsidiesRenewable Energy and Electricity

Supply of Uranium

Nuclear Energy and Sustainable Development

Financing Nuclear Energy